How to correct errors in a submitted tax return?

You can still make amendments—whether it’s before or after the submission deadline!

Overreported? Underreported? Missed something? There’s a solution for every case!

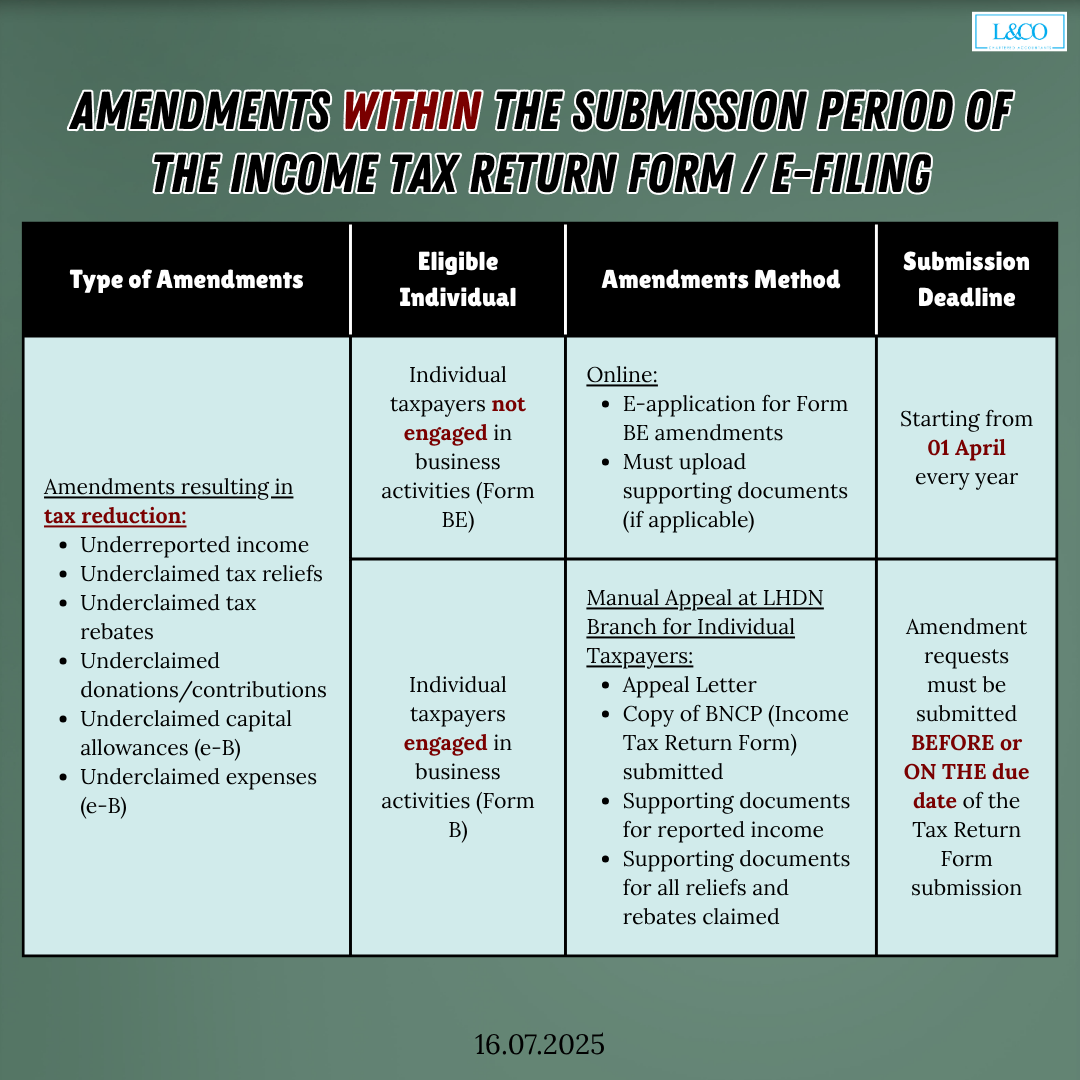

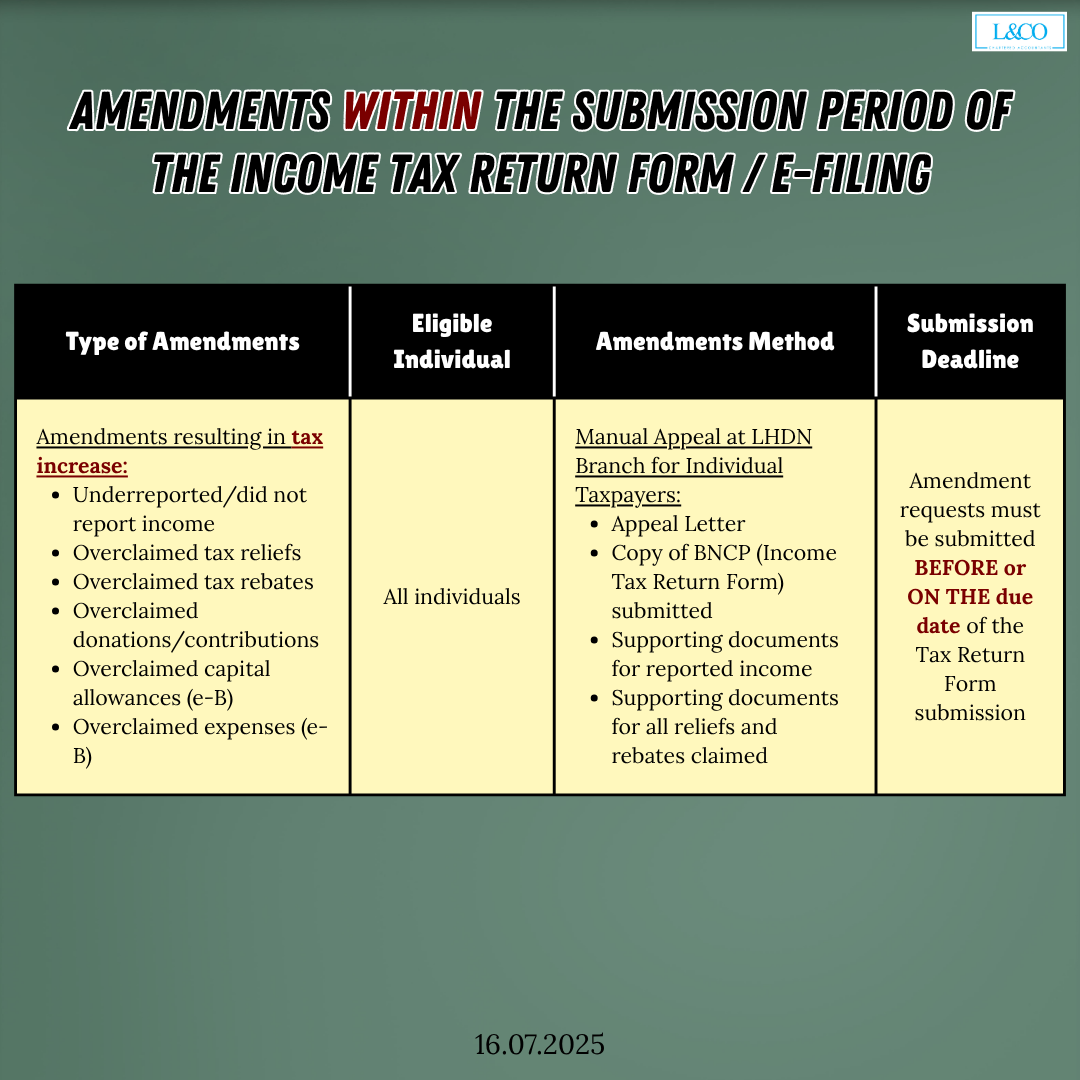

Amendments WITHIN the Submission Period of the Income Tax Return Form / e-Filing

Eligible Individuals:

- All individual taxpayers

- Individuals with no business income (Form BE)

- Individuals with business income (Form B)

Types of Amendments Allowed:

- Overreported income

- Underreported: tax reliefs, tax refunds, donations, capital allowances (e-B), and other expenses

Submission Methods:

Form BE (No Business Income):

- Online submission via e-Permohonan Pindaan BE

- Supporting documents required

- Available from 1 April every year

Form B (With Business Income) and Others:

- Manual submission to the IRB branch

- Required documents: Amendment request letter, Completed BNCP form copy, Proof of income, Supporting documents for all relevant reliefs and refunds

- Deadline: On or before the official tax filing deadline

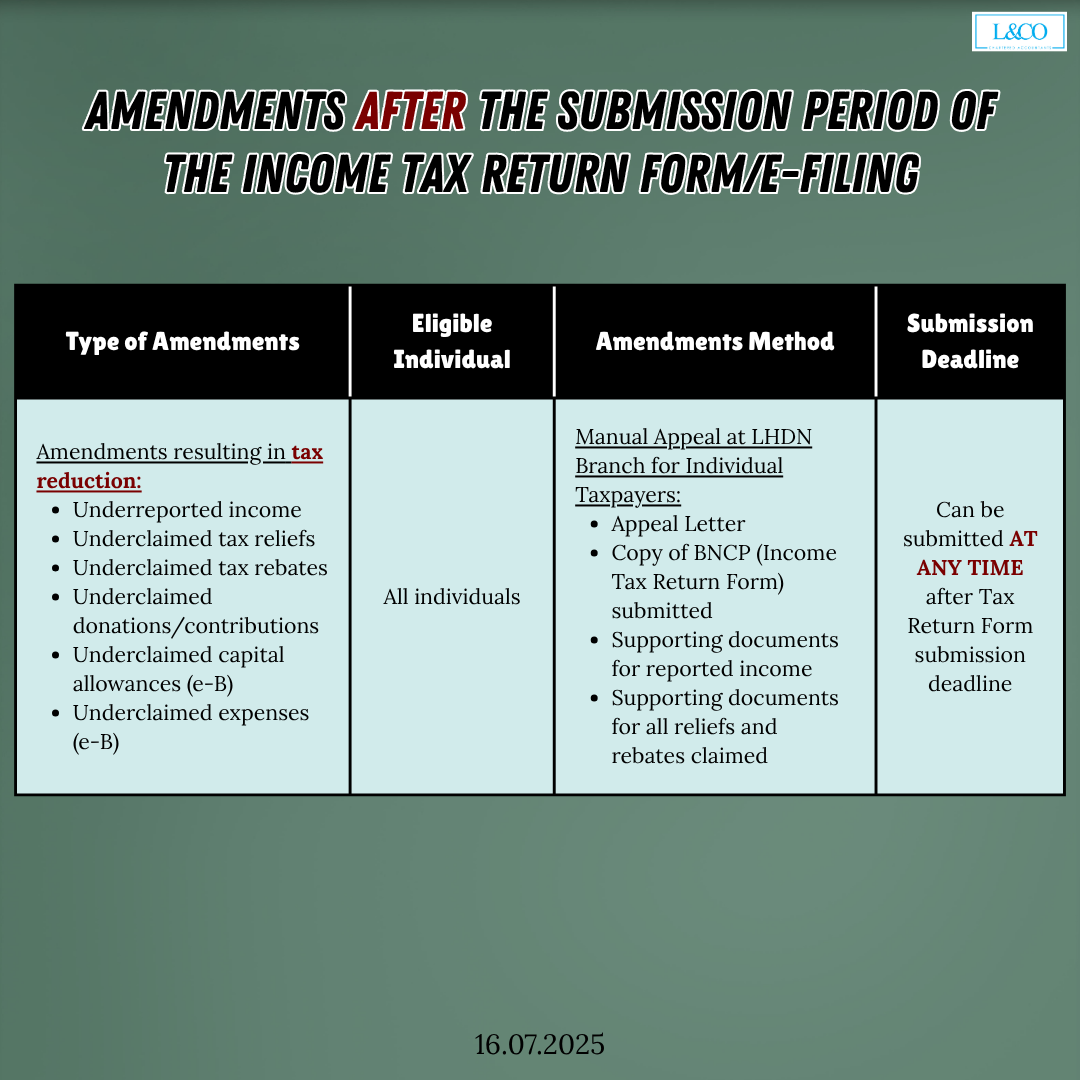

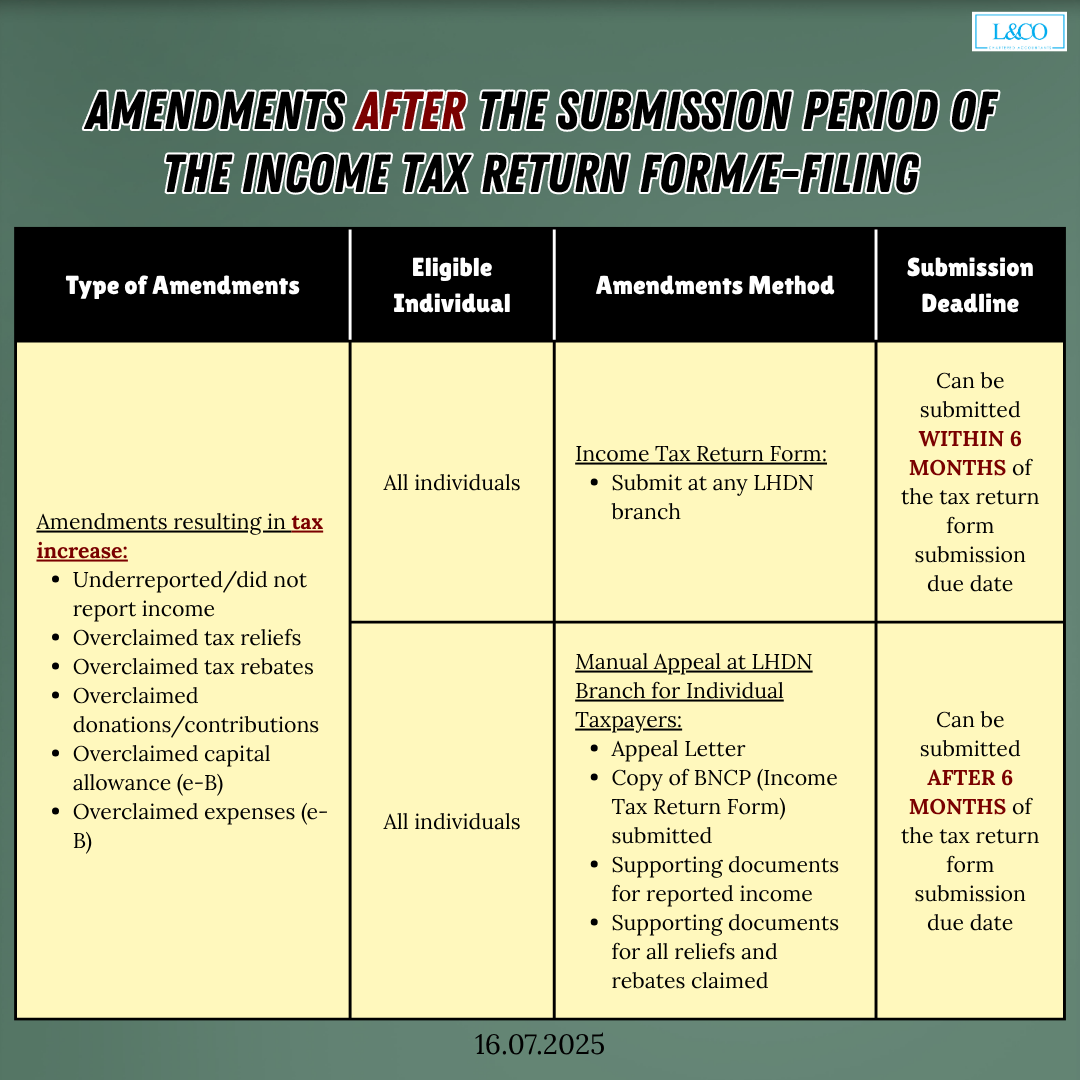

Amendments after the submission period of the Income Tax Return Form/e-filing

1. Corrections That Reduce Tax Payable

e.g., overreported income, underclaimed reliefs/donations/expenses

- Eligible for all individual taxpayers

- Manual submission to the IRB branch

- No deadline — can be submitted any time after the filing due date

- Same supporting documents required as above

2. Corrections That Increase Tax Payable

e.g., underreported income, excessive claims on refunds/donations/expenses

- Submit revised tax return within 6 months from the tax filing deadline

- After 6 months, manual submission is required with complete supporting documents

- Same documentation applies: Amendment request letter, Completed BNCP copy, Proof of income, Documents supporting claimed reliefs and expenses

**Last Updated on 16.07.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)