| 1) |

Claim all possible tax deduction |

|

Tax deductions reduce your taxable income. Your total deductions are subtracted from your taxable income in order to determine your total taxable income for the year. Make full use of the available tax reliefs will save you more taxes. |

|

|

|

Please be reminded to keep good tax records for future tax audit conducted by Inland Revenue Board Malaysia (IRBM). |

|

|

| 2) |

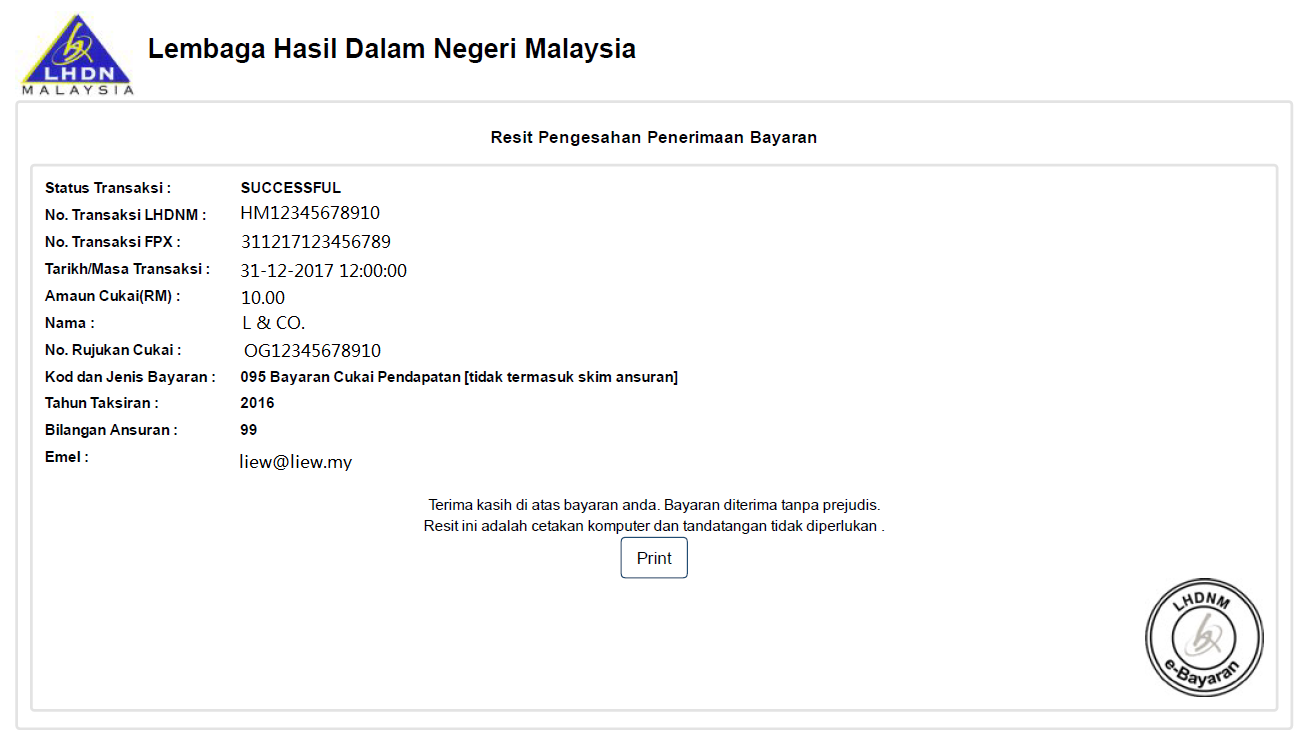

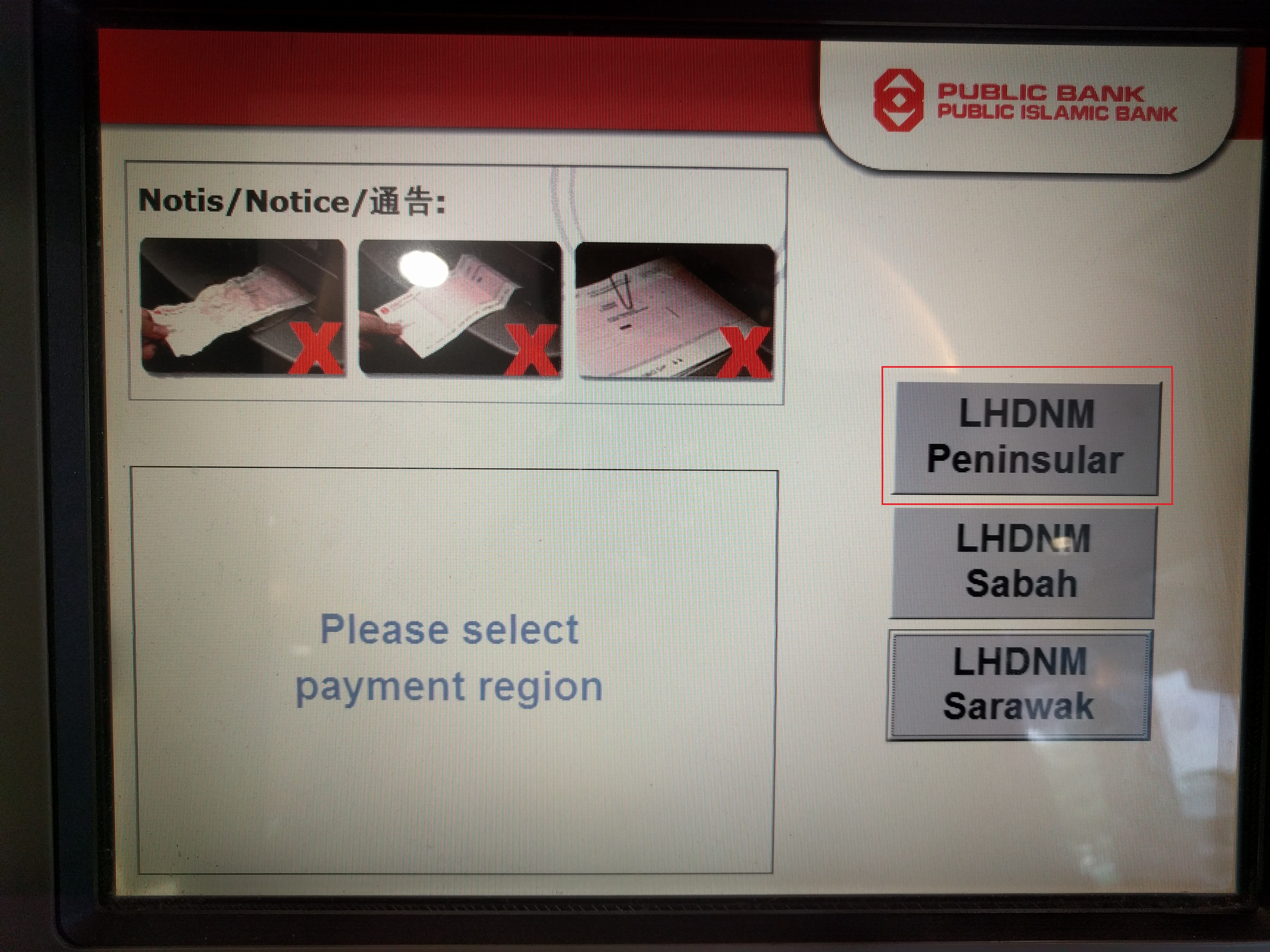

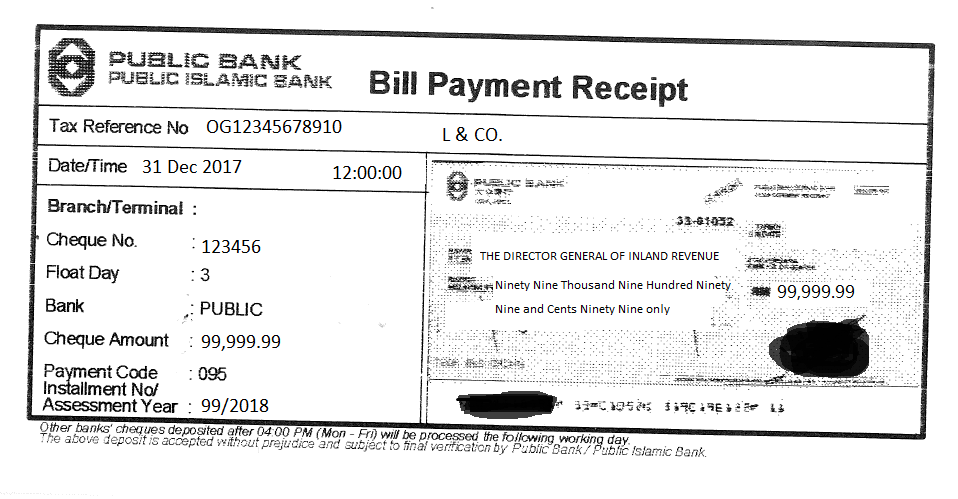

Submit and pay income tax on time |

|

Failure to submit or pay income tax on time may results in heavy tax penalty. Always submit and pay income tax on time and keep relevant records is responsibility of a good tax payer. |

|

|

| 3) |

Follow Income Tax Act |

|

Inland Revenue Board Malaysia (IRBM) is responsible for the collection and overall administration of direct taxes under the following Acts: |

|

- Income Tax Act 1967

- Petroleum (Income Tax) Act 1967

- Real Property Gains Tax Act 1976

- Promotion of Investments Act 1986

- Stamp Act 1949

- Labuan Business Activity Tax Act 1990

|

|

Thus, it is undoubtedly that you will face lesser troubles if you submit your income tax by following the above Acts. IRBM is also issuing public ruling to provide relevant guidance for the public. |

|

|

| 4) |

Apply for tax incentive |

|

There are various tax incentives offered by the government which could further reduce a company’s tax liability. The Income Tax Act 1967 provides incentives in categories such as reinvestment allowance, approved service projects, international procurement centres, regional distribution centers, biotechnology and approved businesses. Further, there are also various tax incentives provided under the Promotion of Investment Act 1986, such as investment tax allowance, infrastructure allowance and pioneer status companies. |

|

|

| 5) |

Seek the advice of tax consultant |

|

In most cases, using a tax agent or accountant won’t just save you a lot of time, it will also improve your tax refund or net payable. We are experts in tax and constantly stay up-to-date with changes in tax legislation. We may find you are entitled to deductions you are unaware of or even an offset you didn’t know existed. |

|

|

|

The best part is our tax fee is reasonable and is claimable as a deduction on next year’s tax return. |

|

|

| 6) |

Be charitable |

|

Donating to charity is always a good thing but what makes it even better is that the amount you donate is deductible on your tax return. After you make a donation, please ask for an official receipt and keep it properly. At tax time, enter the total amount into the charity donations section of your tax return. |

|

|

|

One thing about donations we should clear up: Your donations do not come straight back on to your tax refund. The amount is subtracted from your taxable income, which means you will get a percentage back. |

|

|

| 7) |

Earn Tax-free income |

|

Some income is not subject to income tax. By earning more tax-free/net-tax income, a taxpayer can lower their tax liability. You could do this by depositing money with licensed bank, investing in bonds, investing in share market, and taking advantage of certain employees’ benefits such as childcare allowance. |

|

|

| 8) |

Reduce your tax rate |

|

The highest tax rate of a company or limited liability partnership (LLP) is 24%, if your individual income tax rate is higher than 24%, it will be more tax efficient to tax the business income under Company/LLP. |

|

|

|

On the other hand, if your individual tax rate is lower than 24%, you may want to swift the business income to be taxed under individual through payment of directors’ fees, remuneration and etc. |

(201706002678 & AF 002133)

(201706002678 & AF 002133)