LHDN is going to implement e-invoice policy in 2024! Companies with an annual turnover of over RM 100 million will be the first batch to compulsory implement it!

The implementation of e-invoice aims to improve the efficiency of business operation and prevent tax leakage. The government will actively study relevant information on the implementation of e-invoice in various countries, in order to ensure an effective rollout.

【Announced by LHDN on July 2023】

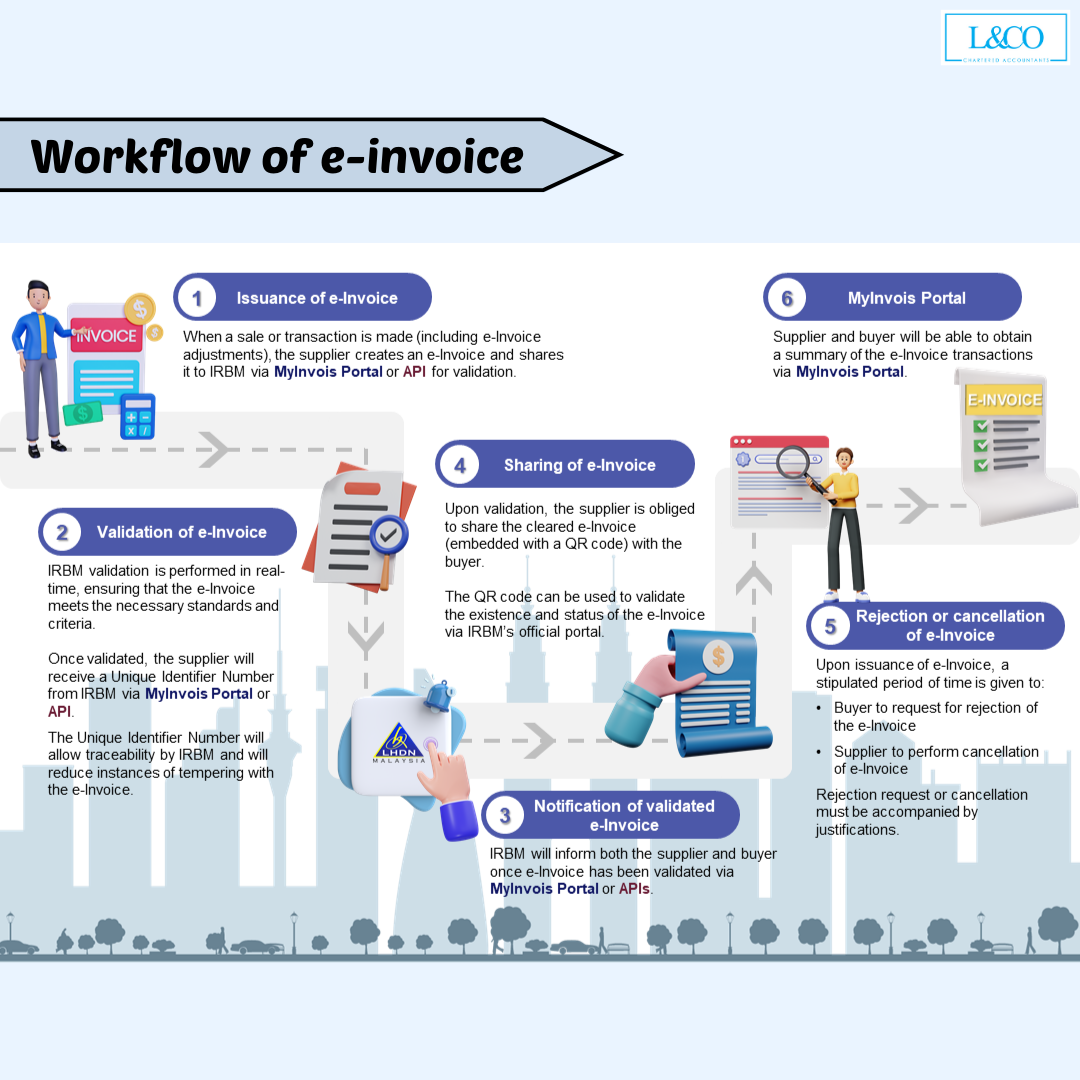

- Issuance of e-invoice

- Validation of e-invoice

- Notification of validated e-invoice

- Sharing of e-invoice

- Rejection or cancellation of e-invoice

- Check e-invoice via MyInvois Portal

The implementation of e-invoice will be done in stage:

1. Stage 1: August 2024

Companies with a turnover of RM100 million and above

2. Stage 2: January 2025

Companies with a turnover of RM25 million and above

3. Stage 3: July 2025

Companies with a turnover of RM500K and above

4. Stage 4: January 2026

Companies with a turnover of RM150K to RM500K

4. Micro SMEs earning below RM150,000 annually exempted from e-invoicing

*Updated in February 2025

Implementation is compulsory for all mentioned companies in each stage. At present, the government only implements it for B2B, and it will start to implement for B2C after B2B run smoothly.

When it comes to e-invoice, you must think of “invoices in pdf format”

FAQs of e-Invoice - General Question

“e-Invoice” refers to the electronic method of recording every transaction. With a full-scale implementation of electronic invoicing, there will no longer be a need to retain physical receipts, and all the transaction records will have a backup in the LHDN database. When taxpayers file their annual tax returns, eligible expenses will be automatically reconciled in the system, eliminating the need for taxpayers to enter them manually.

To improve tax efficiency and transparency, which can reduce tax evasion and fraud.

According to Budget 2024, the Prime Minister has proposed that the first phase of mandatory e-invoicing will commence in August 2024, with the goal of fully implementing the e-invoicing policy by July 2025, which is 18 months ahead of the earlier projections.

According to the announcement in February 2025, Phase 4 of the e-Invoice implementation will begin in January 2026, and businesses with an annual sales turnover of less than RM150,000 will be exempted from implementing e-Invoice.

Regardless of whether it’s B2B, B2C, or B2G, e-invoice is required, and the entities involved include:

- Association;

- Body of persons;

- Branch;

- Business trust;

- Co-operative societies;

- Corporations;

- Limited liability partnership;

- Partnership;

- Property trust fund;

- Property trust;

- Real estate investment trust;

- Representative office and regional office;

- Trust body; and

- Unit trust.

All industries are required to implement e-invoicing, and there are no exemptions for any specific industry at this moment.

- Automotive

- Aviation

- Luxury goods and jewellery

- Construction

- Wholesalers and retailers of construction materials

- Licensed betting and gaming

- Payment to agents /dealers/distributors

The main purpose of e-invoice is for buyers to claim tax relief. Buyers must request e-invoice from sellers if the transaction is eligible for tax relief. Hence, the details required on e-invoice are more detailed than a normal invoice, which include buyers’ TIN number, IC number and others.

If the expenses is not for tax relief (e.g. daily expenses), then the buyer is not required to request e-invoice

A self-billed e-invoice is issued by the buyer rather than the seller. Usually, a self-billed e-invoice is used when the buyer has a better understanding of the details of the transaction. This invoice can be served as a proof of the buyer’s expenditures.

- Payments to agents, dealers, distributors, etc.

- Goods sold or services provided by foreign suppliers

- Profit distributions (e.g. dividend distributions)

- e-commerce (details not yet available)

- Payments to all betting and gaming winners (in casinos or from gaming machines)

- Purchase of goods or services from non-sellers

In relation to certain B2C transactions where e-Invoices are not required by the buyers to support the said transactions for tax purposes, sellers will be allowed to issue a normal receipt or invoice in accordance with the current practices adopted by sellers. At the end of the month, sellers would be required to aggregate the normal receipts or invoices issued to end consumers and issue a consolidated e-Invoice to support the transactions made with end consumers.

No, an e-invoice refers to an invoice that is prepared, issued, and can generate documents that the LHDN system can automatically interpret in an electronic format.

- Documents that meet the criteria include: XML, JSON.

- Documents that do not meet the criteria include: PDF, DOC, JPG, etc.

Invoice: A commercial document that itemises and records a transaction between a Supplier and Buyer, including issuance of self-billed e-Invoice to document an expense.

Credit Note: A credit note is issued by Suppliers to correct errors, apply discounts, or account for returns in a previously issued e-Invoice with the purpose of reducing the value of the original e-Invoice. This is used in situations where the reduction of the original e-Invoice does not involve return of monies to the Buyer;

Debit Note: A debit note is issued to indicate additional charges on a previously issued e-Invoice;

Refund Note: A refund e-Invoice is a document issued by a Supplier to confirm the refund of the Buyer’s payment. This is used in situations where there is a return of monies to the Buyer.

A TIN number is a person’s tax number, refer to the link for details: Tax Identification Number (TIN)

No, e-invoices are necessary for all transactions, whether they are within the country or involve international trade, including import and export activities.

Yes, the supplier will be able to create e-Invoice in draft or proforma. e-Invoice will only be accepted for tax purposes once the validation is successful.

For any queries regarding the e-Invoice implementation in Malaysia, kindly send an email to myinvois@hasil.gov.my

The QR code will only contain a link to the validated e-Invoice. Hence, any device (e.g., mobile camera, QR code scanner application) capable of scanning a QR code will be able to scan the QR code.

Compared with traditional invoices, e-invoice is easier to keep and find. Via MyInvois portal, sellers and buyers can easily find a copy of their verified e-invoices here.

FAQs of e-Invoice - Sellers

The implementation of e-Invoice not only provides seamless experience to taxpayers, but also improves business efficiency and increases tax compliance.

| MyInvois Portal | API Connection | |

| Billing Method |

|

Sellers need to upload invoices via API connection after the invoices is ready (generated through seller’s own ERP system) |

| Invoice Sharing | Available in PDF, XML, JSON, CSV format in both sellers & buyers’ tax account | Through QR code on the e-invoices |

| Cost | Low | High |

| Key Feature | e-Invoice easily keep as it availables in both sellers & buyers tax account | Allows sellers to create invoices with the company’s current accounting system and upload them via the API interface for LHDN to review and certify in a single step. |

| Ideal Users |

|

|

LHDN is expected to fully implement e-invoicing in July 2025 (brought forward in Budget 2024). This means that, by that time, regardless of the industry and the size of the business, e-invoicing will be mandatory for all.

All sellers are required to implement e-invoice, but the LHDN allows buyers to issue a normal bill/receipt/invoice in accordance with the current practices adopted by sellers to the buyers who don’t request e-invoice for tax deduction purposes. Then, sellers need to aggregate all the normal invoice and issues a consolidated e-invoice at the end of the month

During the transitional period, all taxpayers will be allowed to provide either normal bill / receipt / invoice (as per current business practice) or validated e-Invoice to substantiate a transaction for tax purposes until full implementation has been in place.

No, it is only needed if the buyer has an SST registration number

Yes. For tax resident, e-invoice needs either TIN or IC number, but for non-tax resident, TIN number is a must.

Suppliers are required to obtain buyer’s details from the foreign buyers for the purposes of e-Invoice issuance.

In relation to TIN to be input in the e-Invoice, supplier may use “EI00000000020” for foreign buyers without TIN.

Yes, the seller can issue a self-billed e-invoice after obtaining customs clearance.

After verification of e-invoice, the follows will be received:

- The validated e-invoice

- Date and time of validation

- Validation link

- Unique Identifier Number (UIN)

Yes, a refund note e-invoice is required for return of monies to buyers, except when the payment is made wrongly by buyers, overpayment by buyers or return of security deposits.

FAQs of e-Invoice - Implementation

LHDN offers two electronic invoice transmission mechanisms:

- The MyInvois web portal managed by LHDN.

- Application Programming Interface (API).

MyInvois is a LHDN platform specially designed for taxpayers to generate / submit e-invoice for LHDN verification. Although it costs lower, it is only suitable for sellers with small transaction amounts.

e-Invoices submitted through MyInvois system are eligible for both sellers and buyers to download through their tax account. The e-invoice will be available in these formats:

- XML/JSON (eligible for 1 or few invoices download)

- Metadata

- CSV

- Grid

API allows sellers to connect their own ERP system to LHDN and easily transmit high-volume transactions for LHDN verification.

API allows sellers to connect their own ERP system to LHDN and easily transmit high-volume transactions for LHDN verification. However, API requires upfront investment in technology and adjustments.

There are three methods of API:

- Direct integration of taxpayers’ Enterprise Resource Planning (ERP) system with MyInvois System

- Through Peppol service providers

- Through non-Peppol technology providers

- First, after a transaction is made, the seller will issue an e-invoice.

- This e-invoice must be sent for LHDN verification via MyInvois portal or API connection.

- Once the seller receives notification from LHDN, he can then share the e-invoice to the buyer.

- If problems occur, the buyer needs to inform sellers to retrieve the e-invoice within 72 hours and upload again the correct e-invoice.

- Then, once the correct e-invoice is verified by LHDN, this e-invoice will be saved in LHDN’s database.

- Both buyers and sellers can now get the e-invoices data via their tax account (for MyInvois portal users) or via their accounting system (for API users).

There are 55 important data that split into 9 section needed in e-invoice, which include:

- Parties:

- Supplier’s Name

- Buyer’s Name

- Supplier’s Details:

- TIN

- Registration / IC / Passport Number

- SST Registration Number [Mandatory for SST registrant]

- Tourism Tax Registration Number [Mandatory for tourism tax registrant]

- MSIC Code

- Business Activity Description

- Buyer’s Details:

- TIN

- Registration / IC / Passport Number

- SST Registration Number [Mandatory for SST registrant]

- Address:

- Supplier & Buyer’s Address

- Contact Number:

- Supplier & Buyer’s Contact Number

- Invoice Details:

- Version

- Type

- Code/Number

- Original e-Invoice Reference Number (where applicable)

- Date & Time

- Date and Time of Validation

- Supplier’s Digital Signature

- Invoice Currency Code

- Currency Exchange Rate (where applicable)

- Frequency of Billing [Optional]

- Billing Period [Optional]

- Unique ID Number

- Products / Services:

- Classification

- Description

- Unit Price

- Tax Type

- Tax Rate

- Tax Amount

- Tax Exemption Details [Mandatory if tax exemption is applicable]

- Amount Exempted from Tax [Mandatory if tax exemption is applicable]

- Subtotal

- Total Excluding Tax

- Total Including Tax

- Quantity [Optional]

- Measurement [Optional]

- Discount Rate [Optional]

- Discount Amount [Optional]

- Payment Info

- Payment Mode [Optional]

- Supplier’s Bank Account Number [Optional]

- Payment Terms [Optional]

- Payment Amount [Optional]

- Payment Date [Optional]

- Payment Reference Number [Optional]

- Bill Reference Number [Optional]

Among the 9 major sections of information above, only the following terms are required to get from buyers:

- Buyer’s name

- Buyer TIN/Buyer ID number

- Buyer’s address

- Buyer’s contact phone number

- Buyer’s email

- Buyer SST registration number (if applicable)

Yes, there is a 72-hour timeframe for the e-Invoice to be cancelled by the seller. Seller can only cancel the e-invoice and upload the correct e-invoice, no amendment allowed.

Cancellation after 72 hours is not allowed. If seller wants to make amendment after 72 hours, he has to issue a new e-invoice (i.e. debit note, credit note or refund note e-invoice) to contra it, then, prepare and upload the new, complete e-invoice.

No, there is no time limit for this.

LHDN adopts a high standard of data security protection system. The authorities will assess the information required to validate e-invoice and protect against all data. Data protection regulations are also monitored and improved.

Yes, e-invoices need to be submitted to the LHDN MyInvois portal in XML and JSON formats.

Within 7 days of the end of the month.

FAQs of e-Invoice - Buyers / Taxpayers

Yes, e-invoice is required as proof if the transaction needs to be claimed for personal income tax relief.

You need to request an e-invoice from the seller.

Yes.

If you need to claim for tax relief, you need the e-invoice.

- When the expenses is eligible for tax relief

- When the expenses is for business use

Yes, so that buyers may easily view the e-invoice details via Myinvois app

For employee claims, it is acceptable to either issue the e-invoice to company or to the employee himself.

(201706002678 & AF 002133)

(201706002678 & AF 002133)