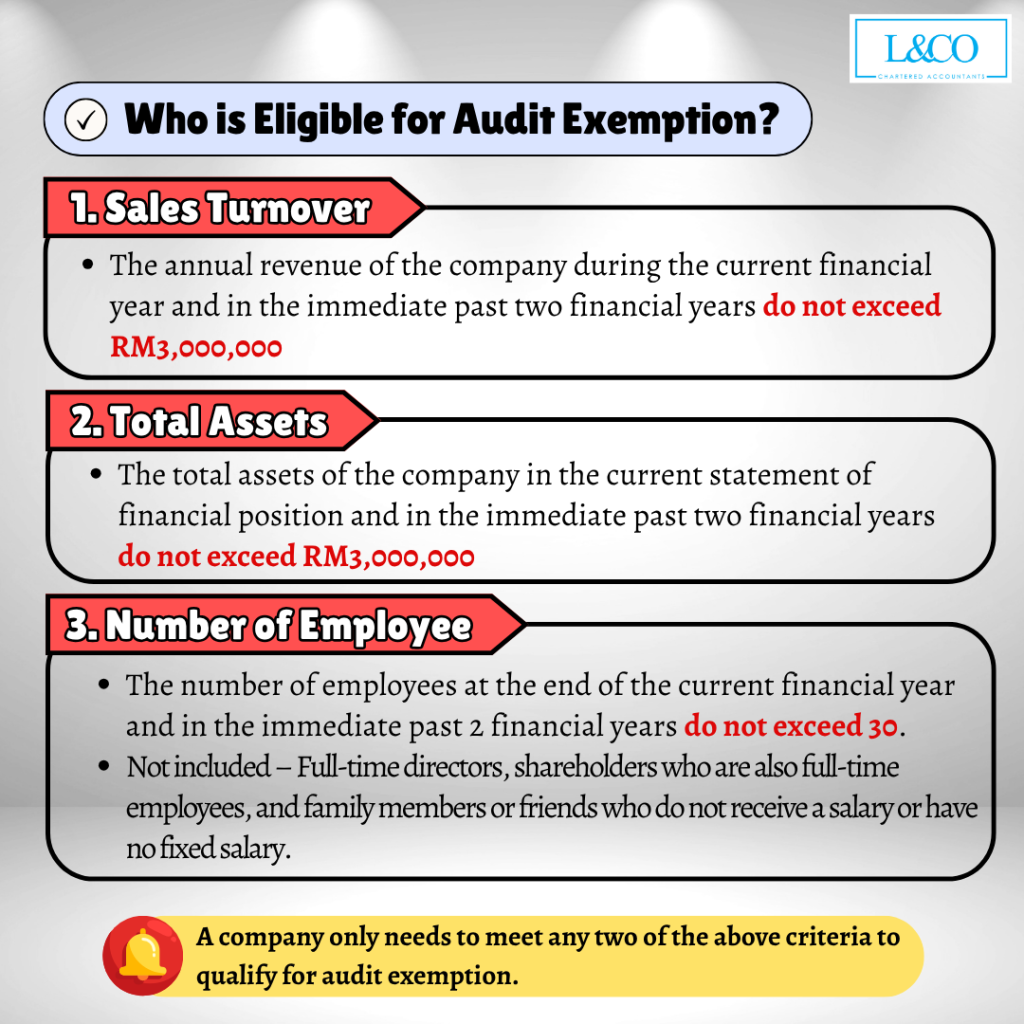

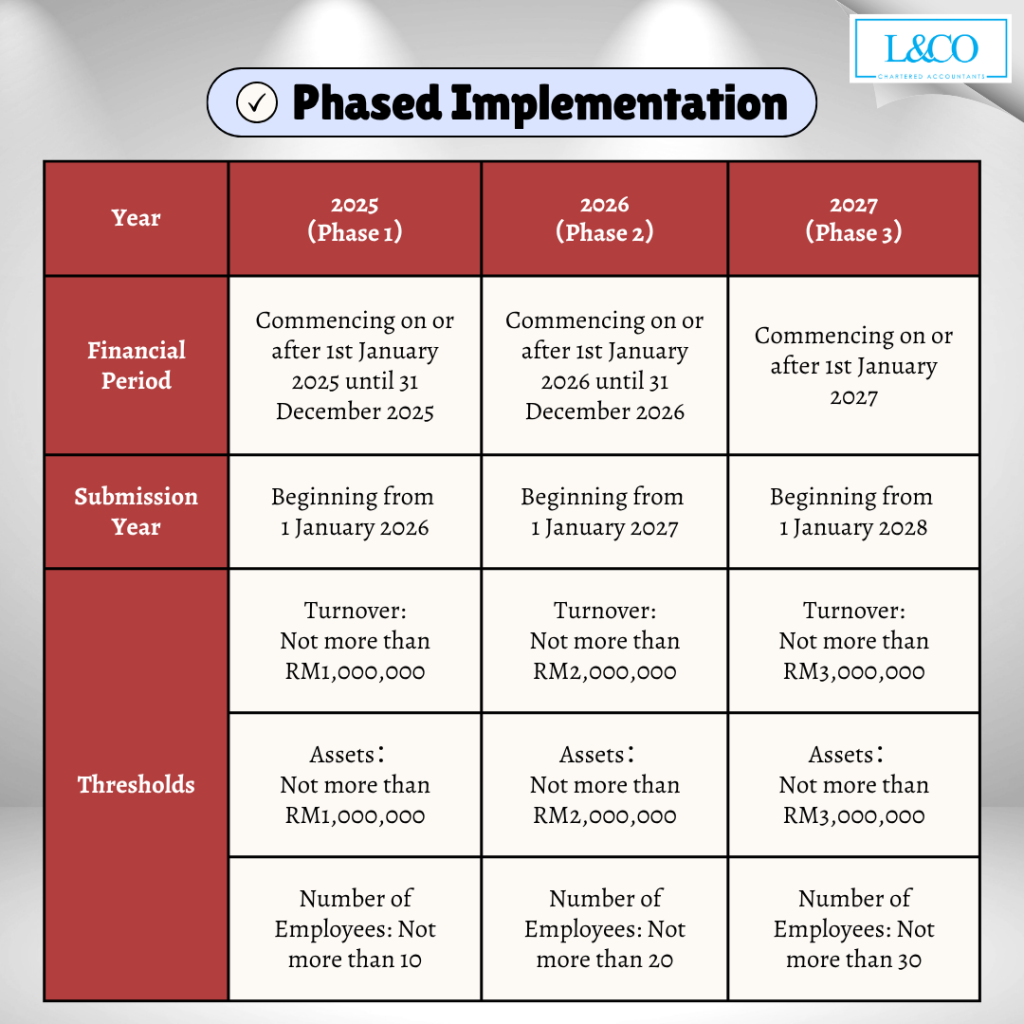

Good news! Eligible Malaysian SMEs can apply to be exempted from the annual statutory audit, easing operational burdens!

FAQs

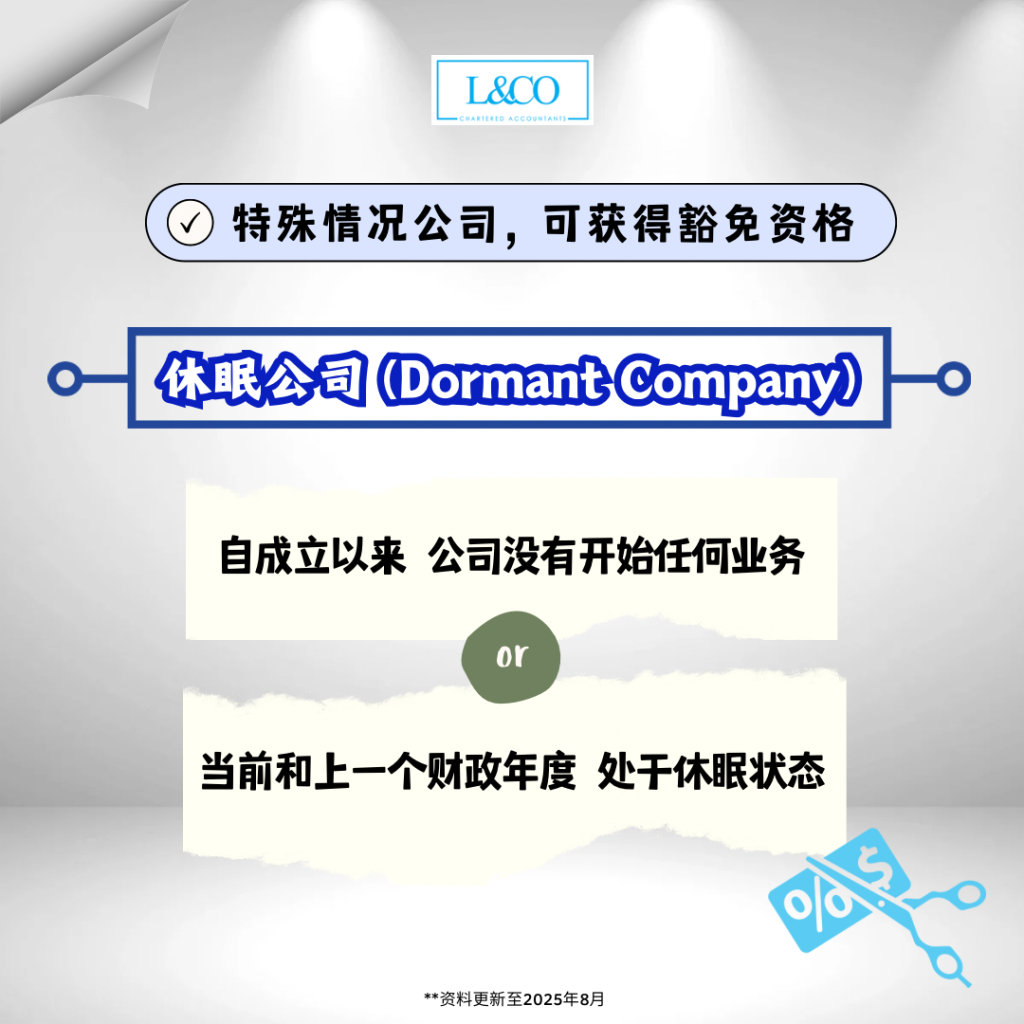

Dormant Company

- The company has not commenced any business since its incorporation.

- The company is dormant in both the current and previous financial years.

- Exempted Private Companies

- Public or Listed Companies

- Subsidiaries of Public Companies

- Foreign Companies

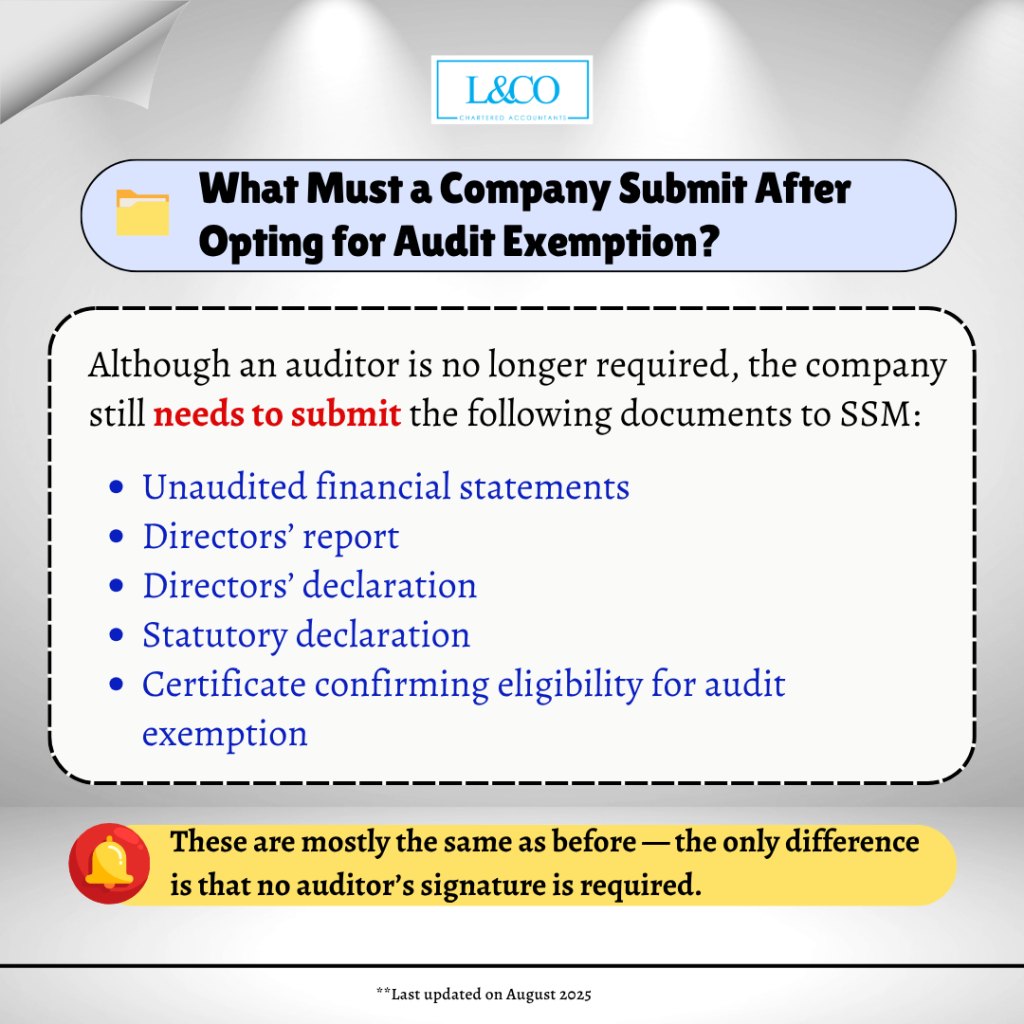

- Unaudited financial statements

- Directors’ report

- Directors’ declaration

- Statutory declaration

- Certificate confirming eligibility for audit exemption

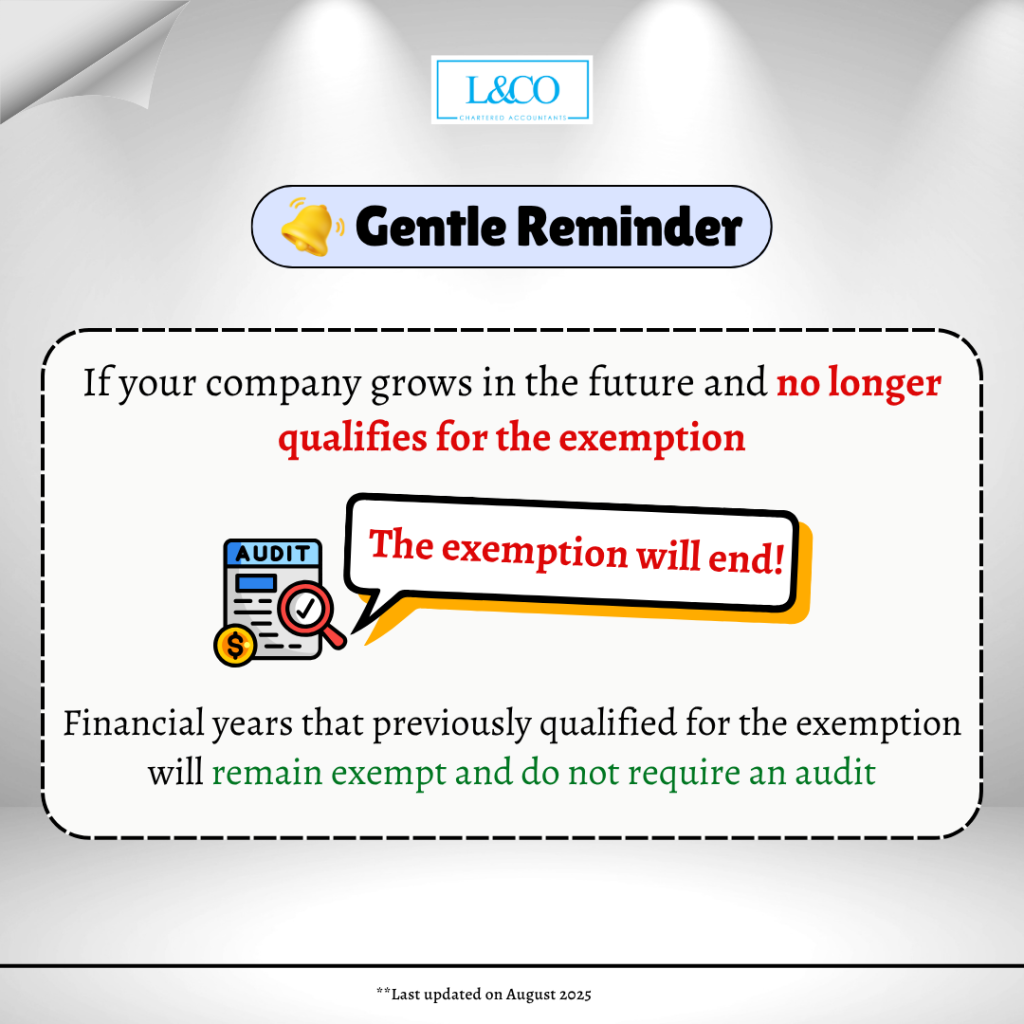

If your company grows in the future and no longer qualifies for the exemption, the exemption will end!

Financial years that previously qualified for the exemption will remain exempt and do not require an audit.

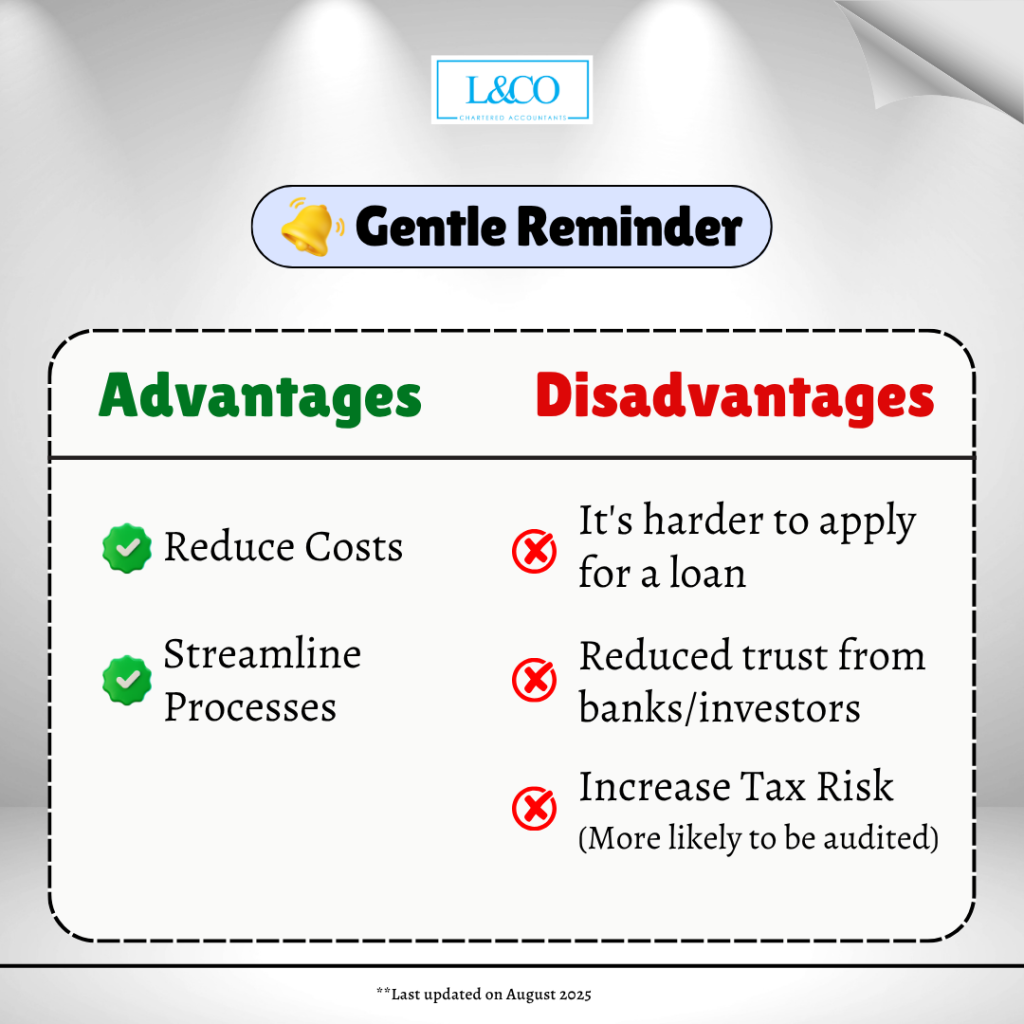

Advantages

- Reduce Costs

- Streamline Processes

Disadvantages

- It’s harder to apply for a loan

- Reduced trust from banks/investors

- Increase Tax Risk (More likely to be audited)

**Last Updated on 05.08.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)