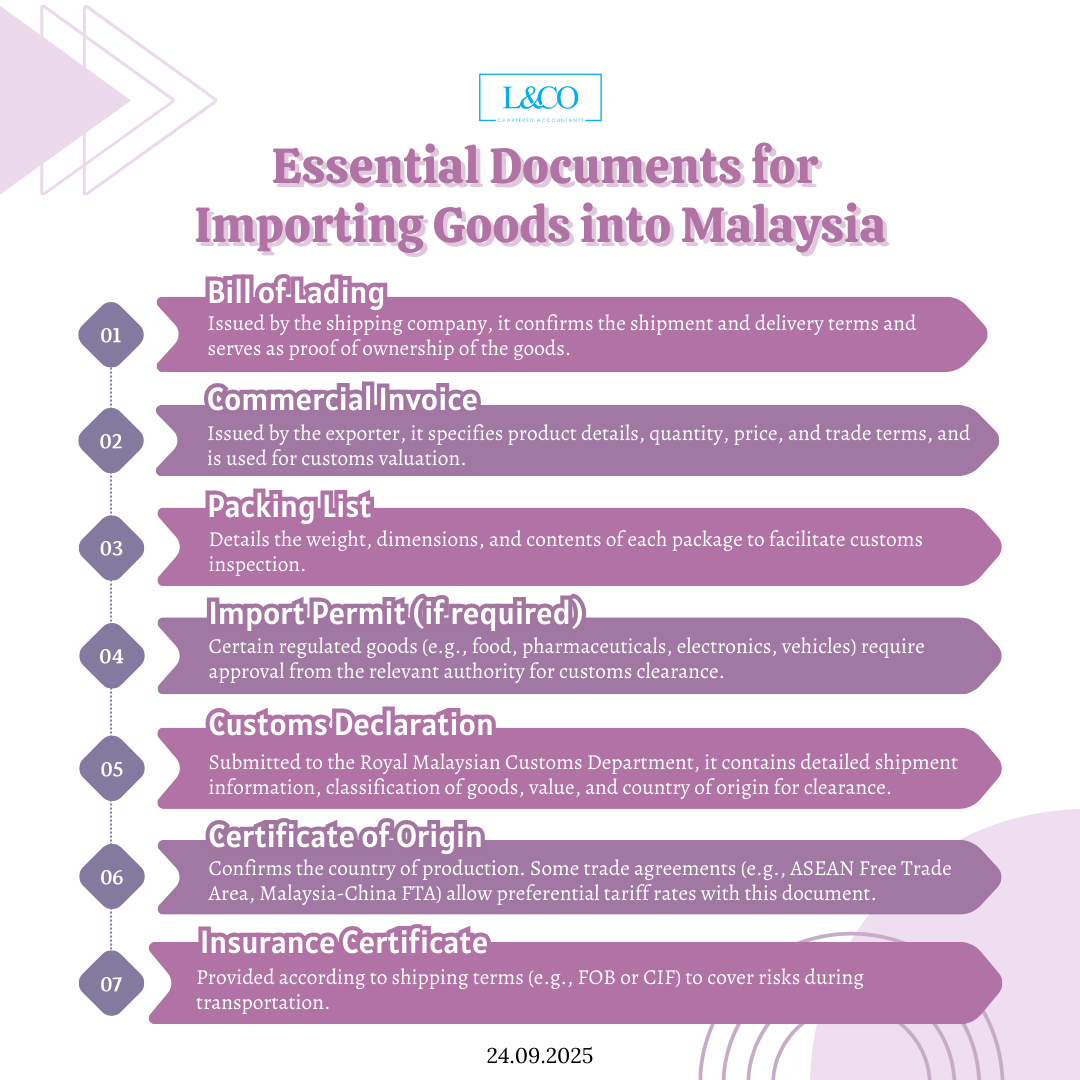

When importing goods into Malaysia, having the required documents prepared is the key to smooth customs clearance. Depending on the type of goods, different certificates or permits may be required. From the bill of lading and commercial invoice to health and safety certificates, each document plays an important role. Below is a checklist of commonly required documents to help you navigate the import process with ease.

1. Bill of Lading

- Issued by the shipping company, it confirms the shipment and delivery terms and serves as proof of ownership of the goods.

2. Commercial Invoice

- Issued by the exporter, it specifies product details, quantity, price, and trade terms, and is used for customs valuation.

3. Packing List

- Details the weight, dimensions, and contents of each package to facilitate customs inspection.

4. Import Permit (if required)

- Certain regulated goods (e.g., food, pharmaceuticals, electronics, vehicles) require approval from the relevant authority for customs clearance.

5. Customs Declaration

- Submitted to the Royal Malaysian Customs Department, it contains detailed shipment information, classification of goods, value, and country of origin for clearance.

6. Certificate of Origin

- Confirms the country of production. Some trade agreements (e.g., ASEAN Free Trade Area, Malaysia-China FTA) allow preferential tariff rates with this document.

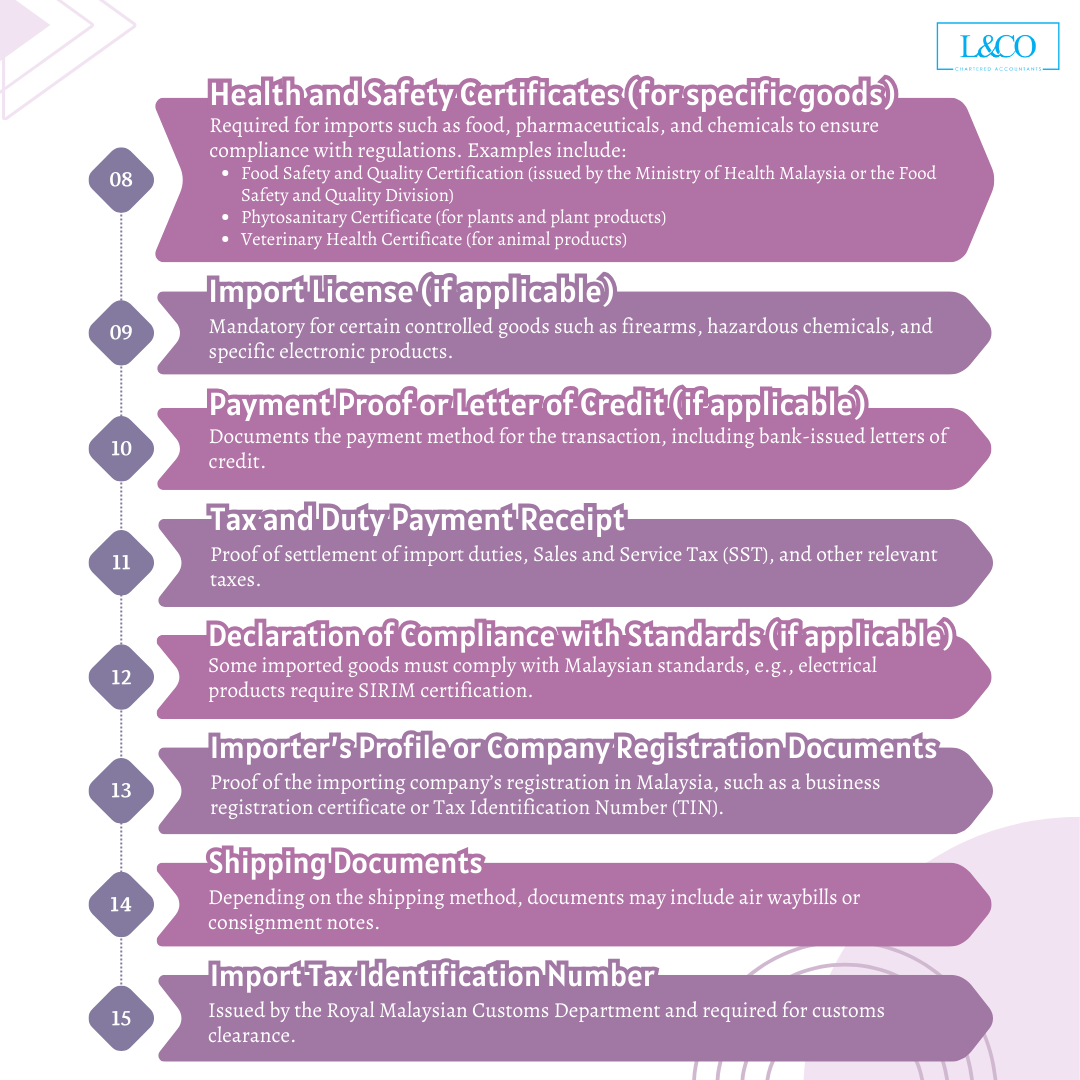

7. Health and Safety Certificates (for specific goods)

- Required for imports such as food, pharmaceuticals, and chemicals to ensure compliance with regulations. Examples include:

- Food Safety and Quality Certification (issued by the Ministry of Health Malaysia or the Food Safety and Quality Division)

- Phytosanitary Certificate (for plants and plant products)

- Veterinary Health Certificate (for animal products)

8. Import License (if applicable)

- Mandatory for certain controlled goods such as firearms, hazardous chemicals, and specific electronic products.

9. Insurance Certificate

- Provided according to shipping terms (e.g., FOB or CIF) to cover risks during transportation.

10. Payment Proof or Letter of Credit (if applicable)

- Documents the payment method for the transaction, including bank-issued letters of credit.

11. Tax and Duty Payment Receipt

- Proof of settlement of import duties, Sales and Service Tax (SST), and other relevant taxes.

12. Declaration of Compliance with Standards (if applicable)

- Some imported goods must comply with Malaysian standards, e.g., electrical products require SIRIM certification.

13. Importer’s Profile or Company Registration Documents

- Proof of the importing company’s registration in Malaysia, such as a business registration certificate or Tax Identification Number (TIN).

14. Shipping Documents

- Depending on the shipping method, documents may include air waybills or consignment notes.

15. Import Tax Identification Number

- Issued by the Royal Malaysian Customs Department and required for customs clearance.

**Last Updated on 25.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)