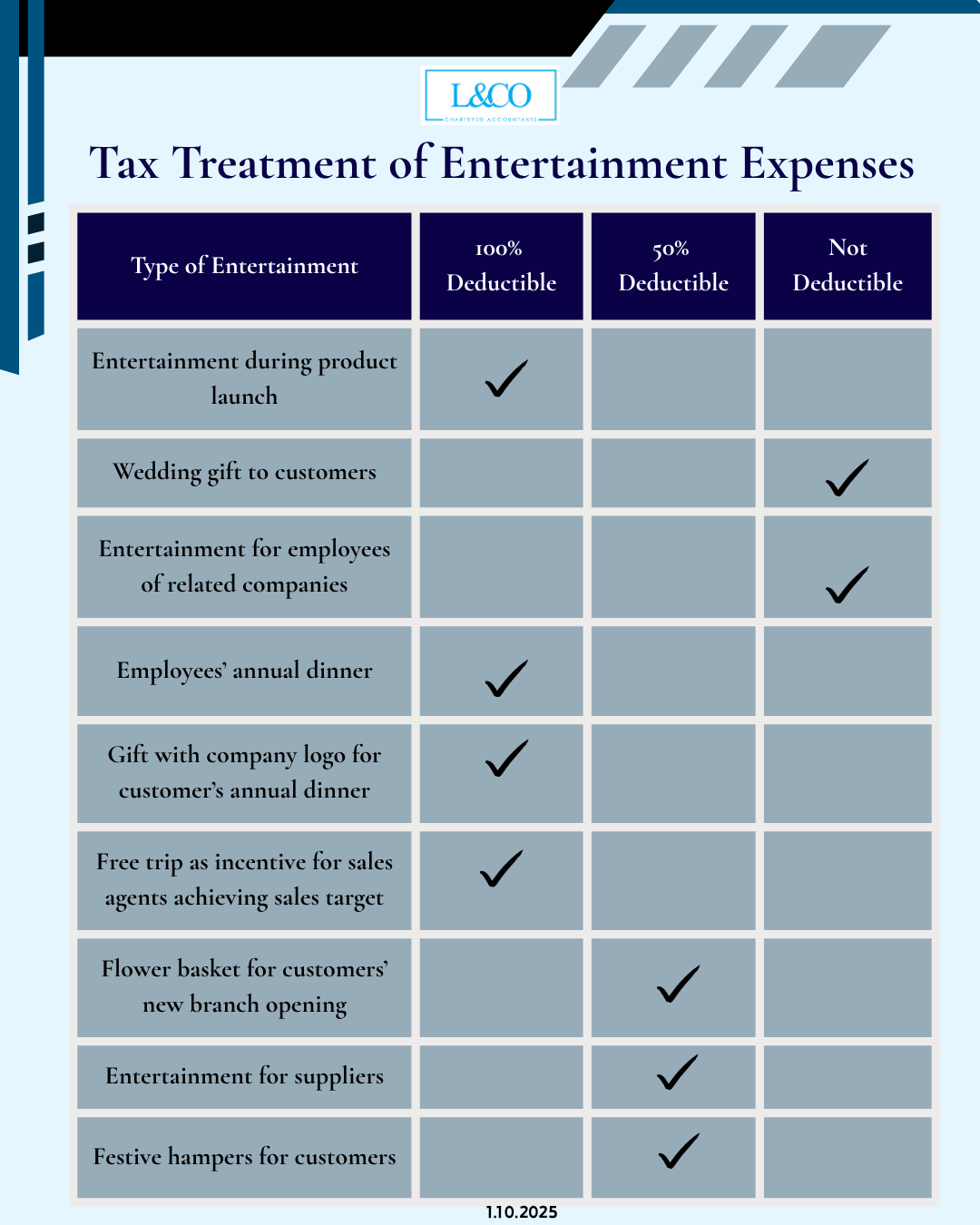

According to Income Tax Act 1967, Section 39(1)(l) and LHDN Public Ruling No. 3/2008 & 4/2015:

Not all entertainment expenses are deductible.

-In general, entertainment expenses are only 50% deductible.

-Only specific items clearly stated in the legislation are allowed 100% deduction.

-Expenses unrelated to business or of a private nature are not deductible.

Tax Treatment of Entertainment Expenses:

1.Entertainment during company’s new product launch (for potential or existing customers) → 100% Deductible

2.Wedding gift to customers → Not Deductible

3.Entertainment for employees of related companies → Not Deductible

4.Employees’ annual dinner → 100% Deductible

5.Gifts with company logo (e.g. customer annual dinner door gift) → 100% Deductible

6.Free trip as incentive (e.g. for sales agents achieving targets) → 100% Deductible

7.Flower basket for customer’s new branch opening → 50% Deductible

8.Entertainment for suppliers → 50% Deductible

9.Festive hampers for customers → 50% Deductible

**Data updated on 1.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)