Malaysia has officially implemented the Flexible Work Arrangement (AKF).

Both public servants and private sector employees can now adopt flexible hours, locations, and work-from-home options.

Want to know how to apply legally and enjoy available tax incentives?

Learn more today to make your business more agile and efficient.

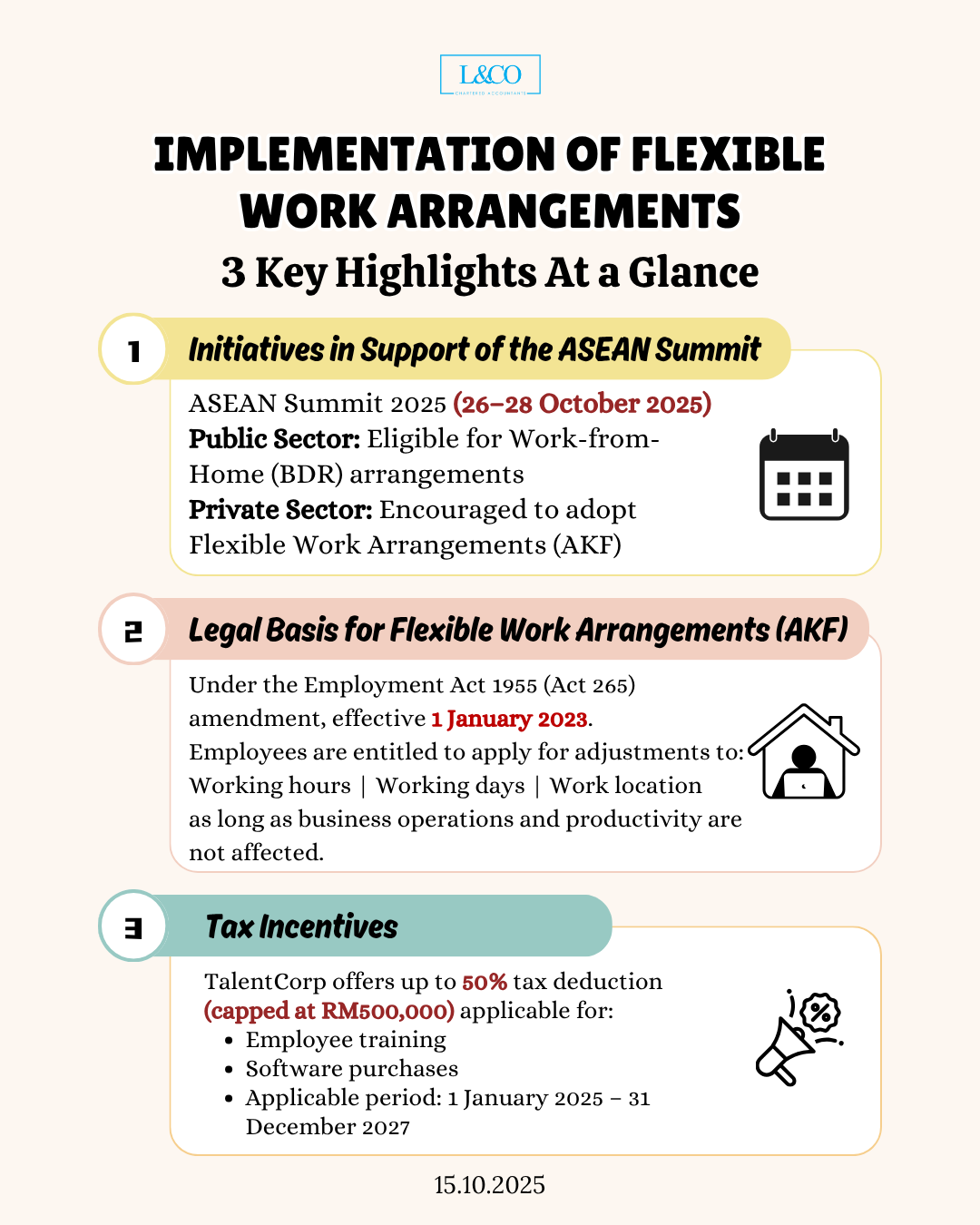

In conjunction with the ASEAN Summit 2025 (26–28 October 2025)

- Public Sector: ligible for Work-from-Home (BDR) arrangements

- Private Sector: Encouraged to adopt Flexible Work Arrangements (AKF)

Under the Employment Act 1955 (Act 265) amendment, effective 1 January 2023.

Employees are entitled to apply for adjustments to:

- Working hours

- Working days

- Work location

Provided such adjustments do not affect business operations or productivity.

TalentCorp offers up to 50% tax deduction (capped at RM500,000) for employers adopting flexible work arrangements, applicable for:

- Employee training

- Software purchases

- Applicable period: 1 January 2025 – 31 December 2027

**Last Updated on 17.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)