Refundable or non-refundable? The handling method makes all the difference!

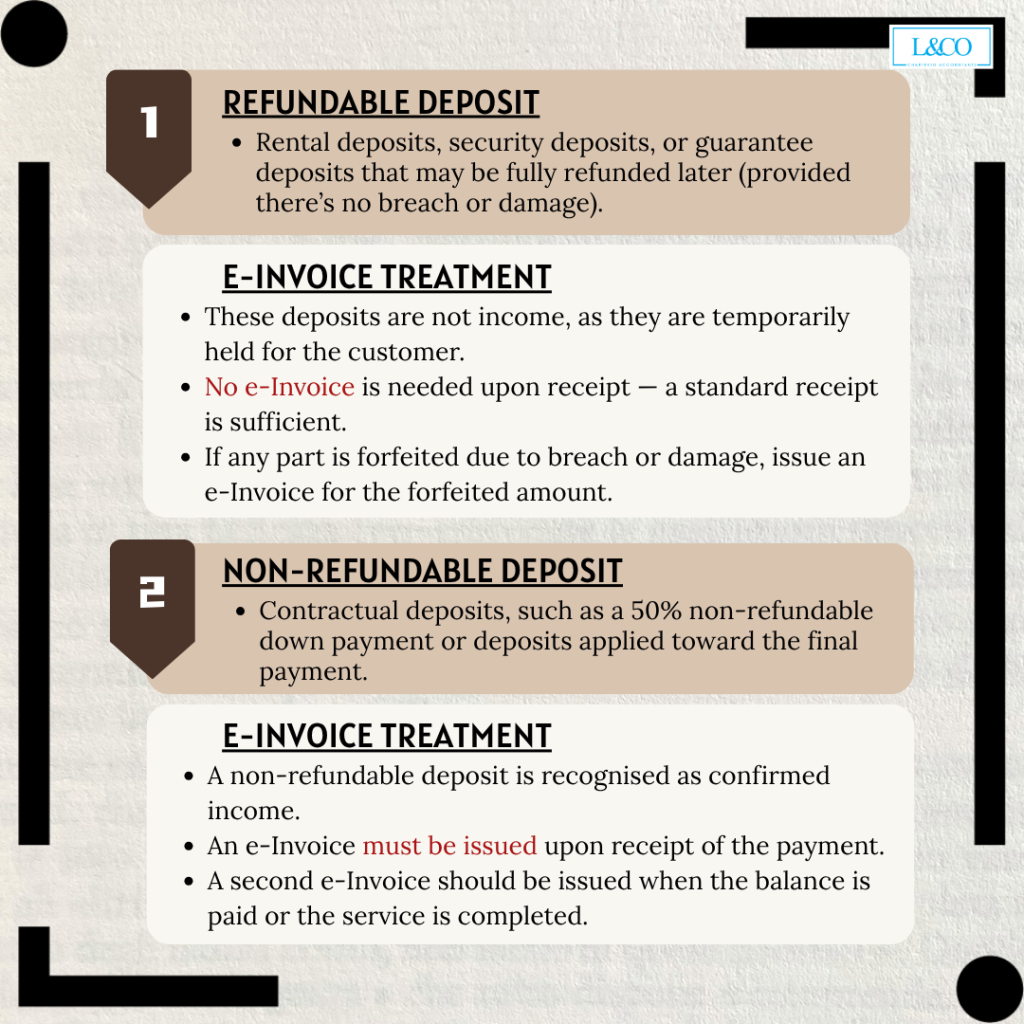

Refundable Deposit

- Examples: rental deposits, security deposits, or guarantee deposits that may be fully refunded later (provided there’s no breach or damage).

e-Invoice Treatment:

- These deposits are not income, as they are temporarily held for the customer.

- No e-Invoice is needed upon receipt — a standard receipt is sufficient.

- If any part is forfeited due to breach or damage, issue an e-Invoice for the forfeited amount.

Non-Refundable Deposit

- Examples: Contractual deposits, such as a 50% non-refundable down payment or deposits applied toward the final payment.

e-Invoice Treatment:

- A non-refundable deposit is recognized as confirmed income.

- An e-Invoice must be issued upon receipt of the payment.

- A second e-Invoice should be issued when the balance is paid or the service is completed.

Example:

- e-Invoice 1: Deposit 50% (issued upon payment)

- e-Invoice 2: Balance 50% (issued upon completion or delivery)

**Note: An Official Receipt serves only as a payment acknowledgement and cannot replace an e-Invoice.

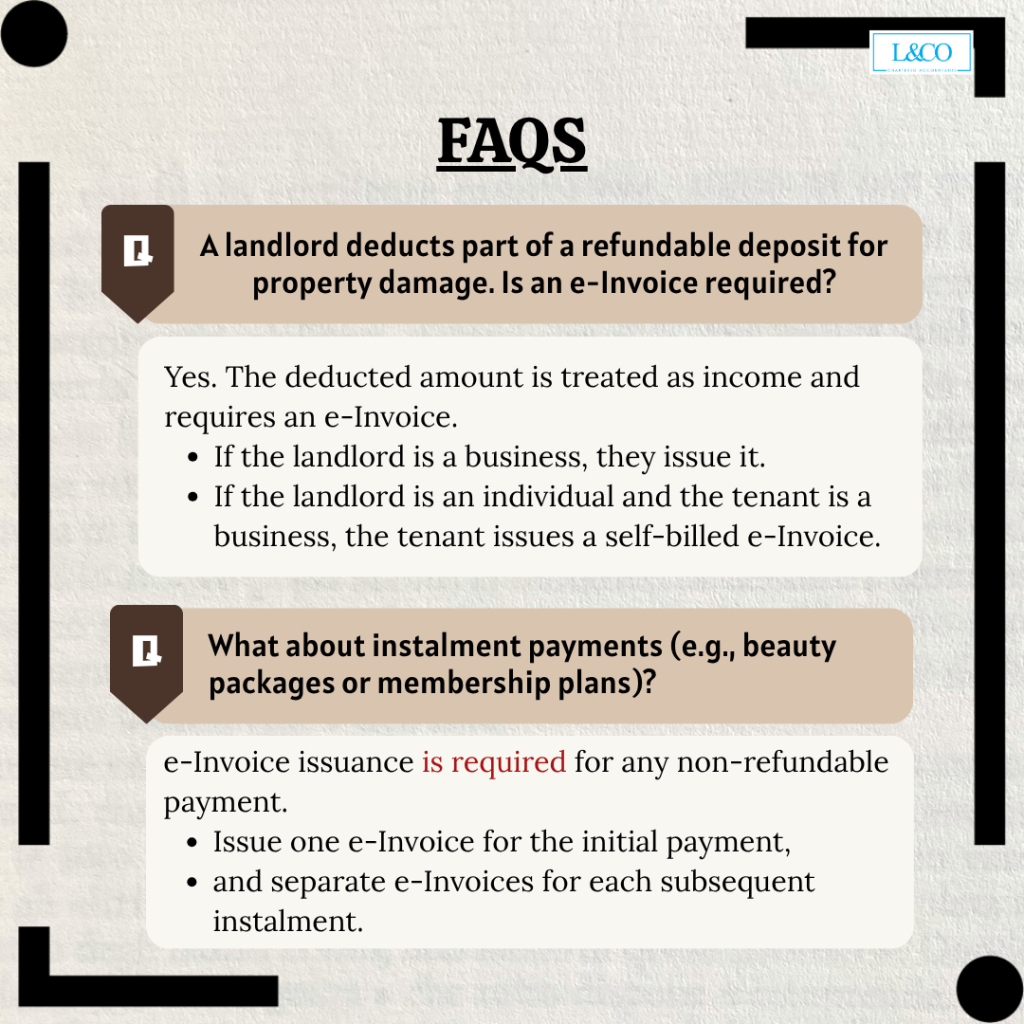

FAQs

Q: A landlord deducts part of a refundable deposit for property damage. Is an e-Invoice required?

A: Yes. The deducted amount is treated as income and requires an e-Invoice.

- If the landlord is a business, they issue it.

- If the landlord is an individual and the tenant is a business, the tenant issues a self-billed e-Invoice.

Q: What about instalment payments (e.g., beauty packages or membership plans)?

A: e-Invoice issuance is required for any non-refundable payment.

- Issue one e-Invoice for the initial payment,

- and separate e-Invoices for each subsequent instalment.

**Last Updated on 17.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)