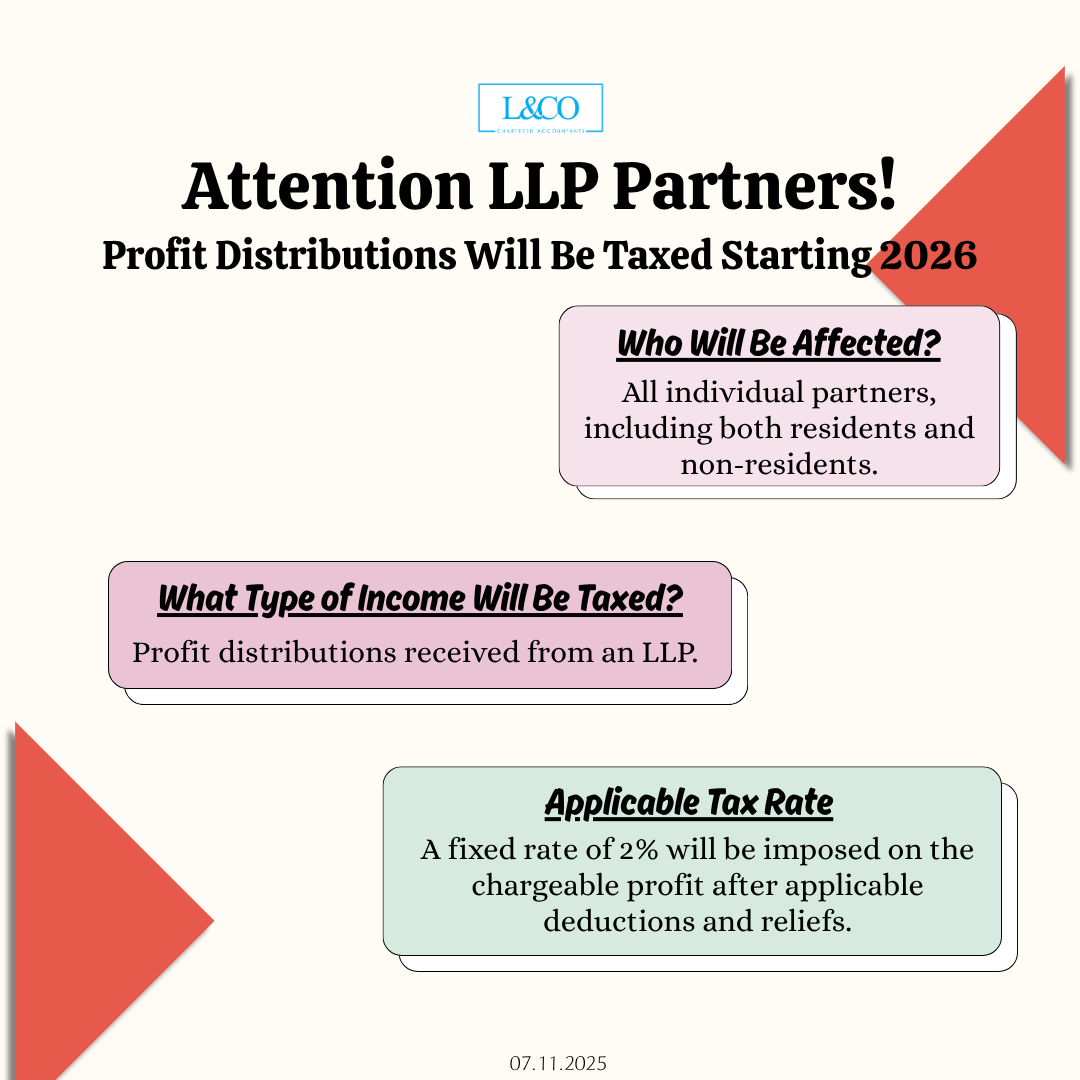

Starting from the Year of Assessment 2026, profit distributions (Profit Distribution) received from an LLP will no longer be tax-free.

All individual partners, both Malaysian residents and non-residents.

Profit distributions received from an LLP.

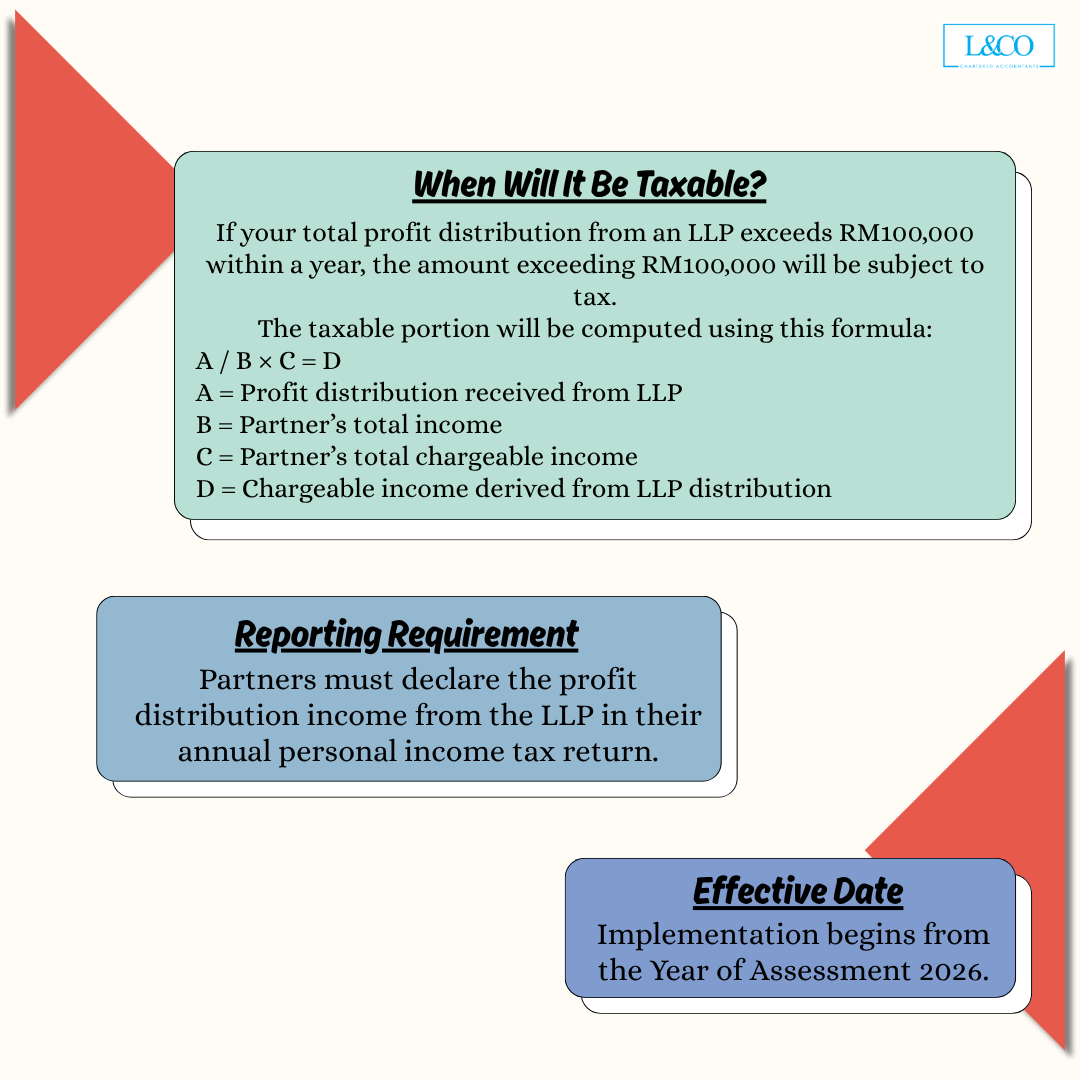

If your total profit distribution from an LLP exceeds RM100,000 within a year, the amount exceeding RM100,000 will be subject to tax.

The taxable portion will be computed using this formula:

A / B × C = D

A = Profit distribution received from LLP

B = Partner’s total income

C = Partner’s total chargeable income

D = Chargeable income derived from LLP distribution

A fixed rate of 2% will be imposed on the chargeable profit after applicable deductions and reliefs.

Partners must declare the profit distribution income from the LLP in their annual personal income tax return.

Implementation begins from the Year of Assessment 2026.

**Last Updated on 07.11.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)