From e-Invoicing and stamp duty system restructuring to SST and employment contract compliance, 2026 marks a critical turning point as Malaysian businesses move into an era of fully digitalised tax administration.

Early understanding of policy directions and timely adjustments to internal processes will be key to risk mitigation and sustainable operations.

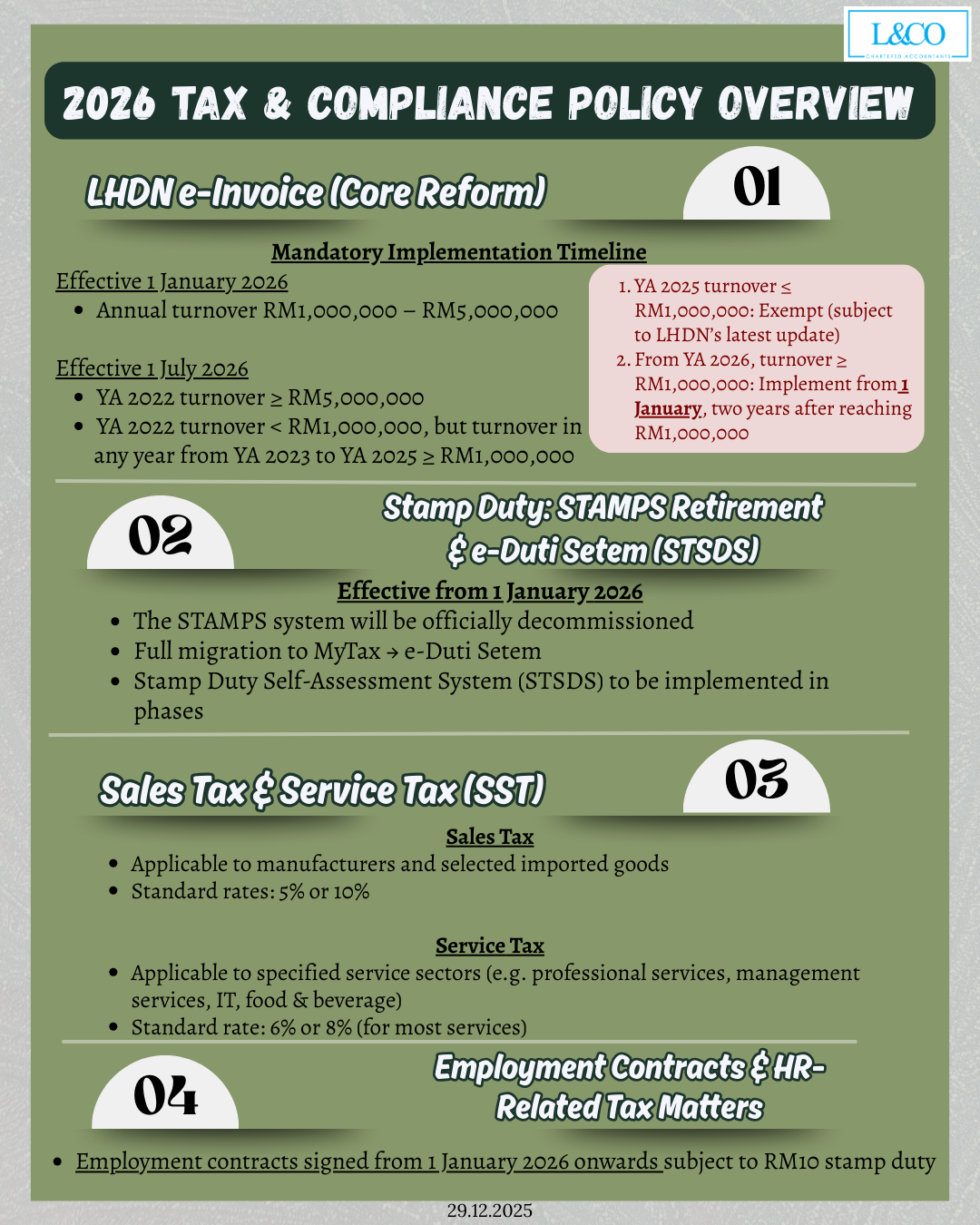

I, LHDN e-Invoice (Core Reform)

Effective 1 January 2026

- Annual turnover RM1,000,000 – RM5,000,000

Effective 1 July 2026

- YA 2022 turnover ≥ RM5,000,000

- YA 2022 turnover < RM1,000,000, but turnover in any year from YA 2023 to YA 2025 ≥ RM1,000,000

II. Stamp Duty Reform — STAMPS Decommissioning & e-Duti Setem (STSDS)

Effective from 1 January 2026

- The STAMPS system will be officially decommissioned

- Full migration to MyTax → e-Duti Setem

- Stamp Duty Self-Assessment System (STSDS) to be implemented in phases

III. Sales Tax & Service Tax (SST)

Sales Tax

- Applicable to manufacturers and selected imported goods

- Standard rates: 5% or 10%

Service Tax

- Applicable to specified service sectors (e.g. professional services, management services, IT, food & beverage)

- Standard rate: 6% or 8% (for most services)

- Higher rates apply to certain sectors, subject to prevailing regulations

IV. Employment Contracts & HR-Related Tax Matters

Employment contracts signed from 1 January 2026 onwards, subject to RM10 stamp duty

**Last Updated on 30.12.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)