Many people think SOCSO is just a fixed monthly deduction. In reality, it includes three major protection schemes that provide critical support for employees in [...]

Still unsure when to issue an e-Invoice, consolidate transactions, or apply self-billing? This comprehensive flowchart walks you through every scenario — sales, platform transactions, reimbursements, [...]

Social Media Registration Ban for Under-16s Starting 2026 Besides this news, what else is worth paying attention to this month? Let's take a look together! [...]

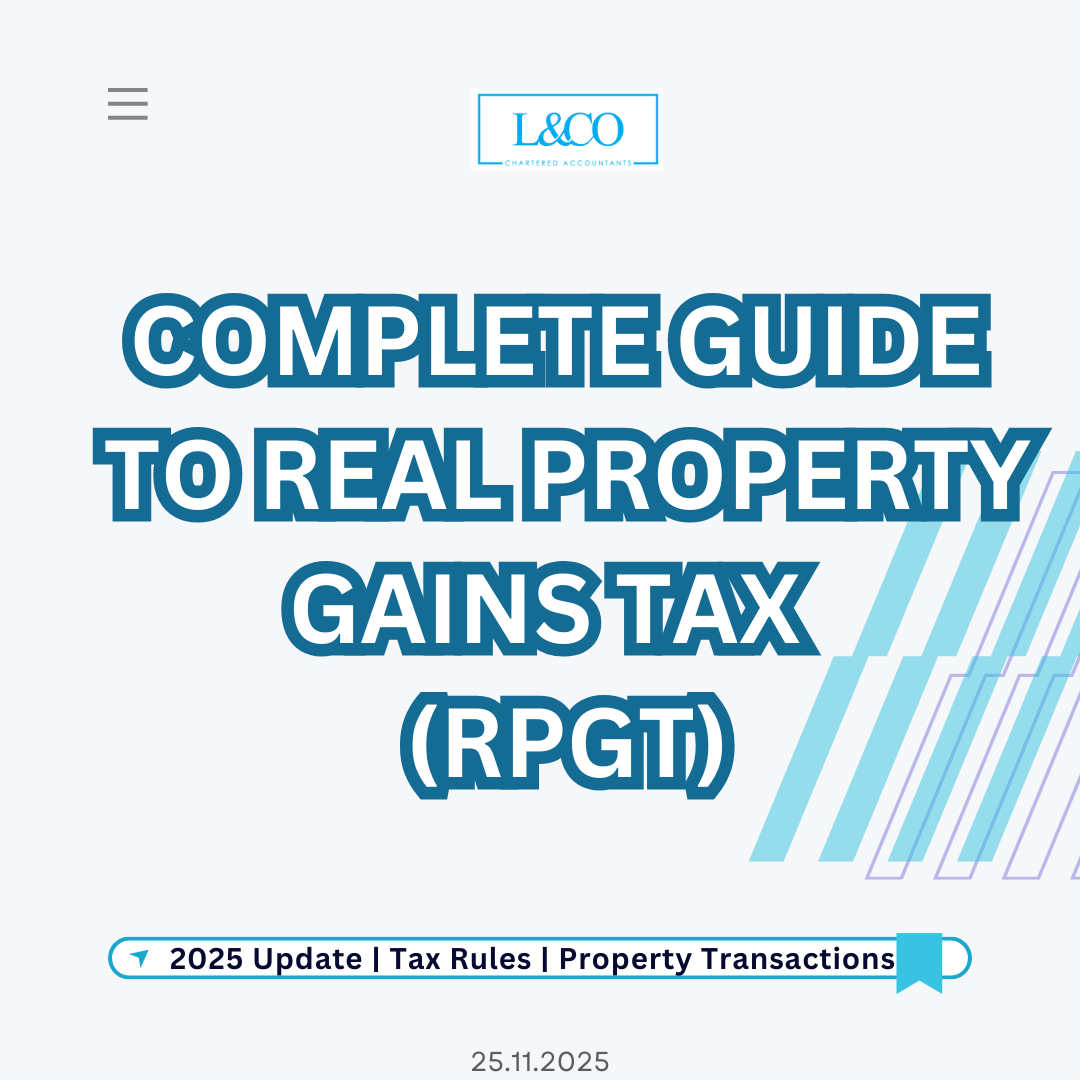

With Malaysia’s tax system continuously evolving, property-related taxation has become a critical topic for homeowners, investors, and businesses. Understanding the differences between Real Property Gains [...]

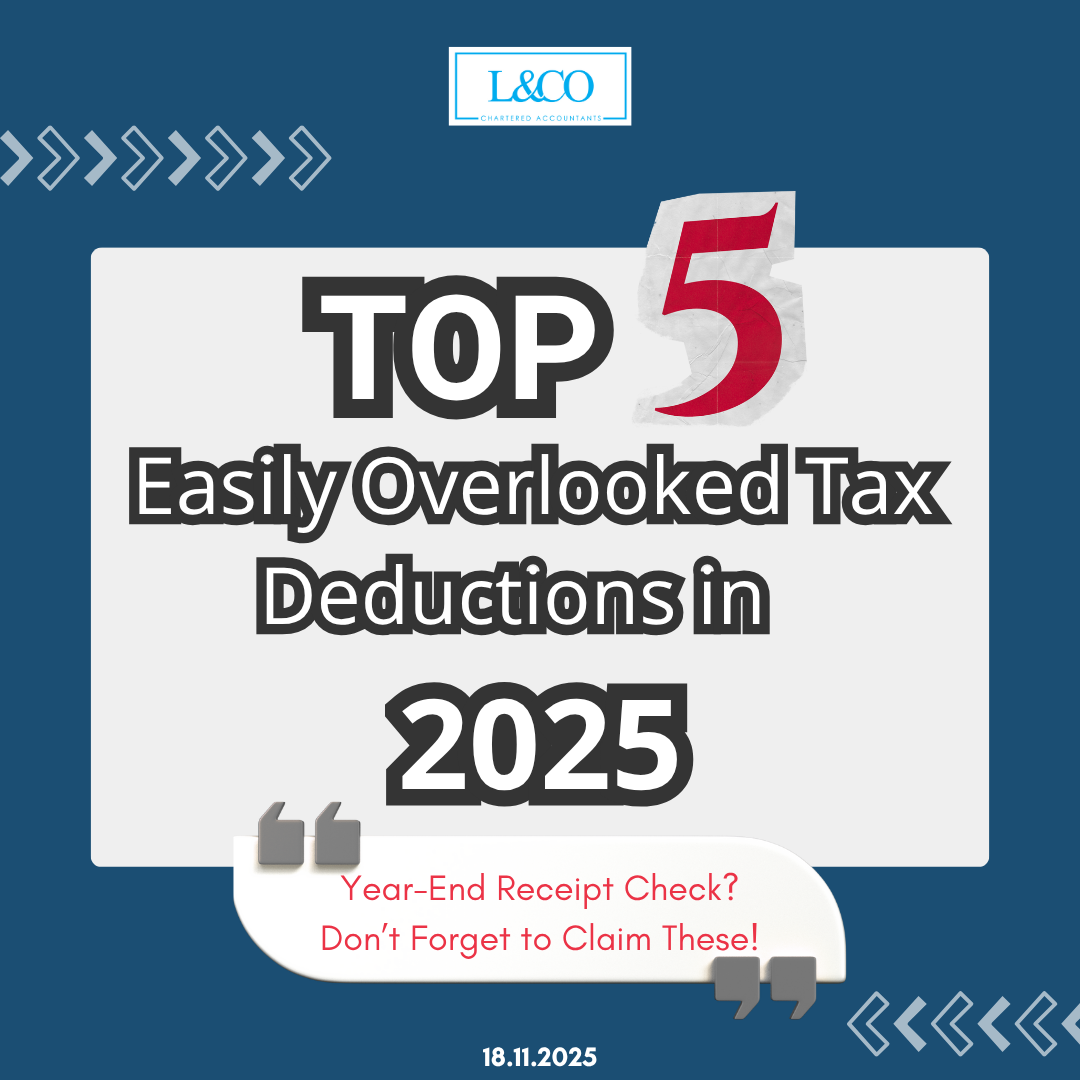

The following is a summary of commonly overlooked personal tax reliefs in Malaysia for 2025. Please ensure your eligibility before claiming, and keep all relevant [...]

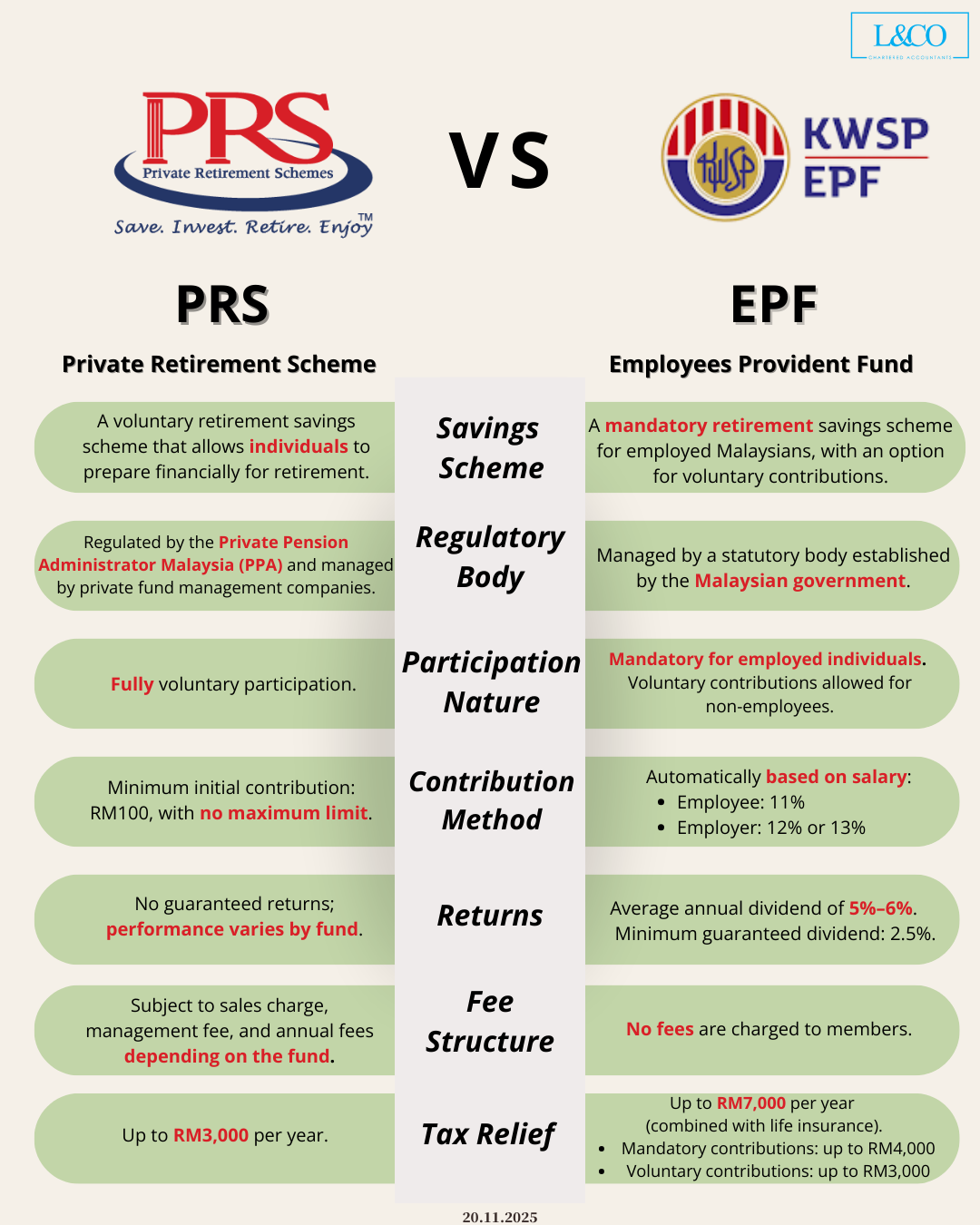

In Malaysia, the primary tools for retirement savings are the Employees’ Provident Fund (EPF) and the Private Retirement Scheme (PRS). While both aim to secure [...]

Whether your leasing service is subject to the 6% Service Tax now depends entirely on where the asset is located. Within Malaysia (≤12 nautical miles), [...]

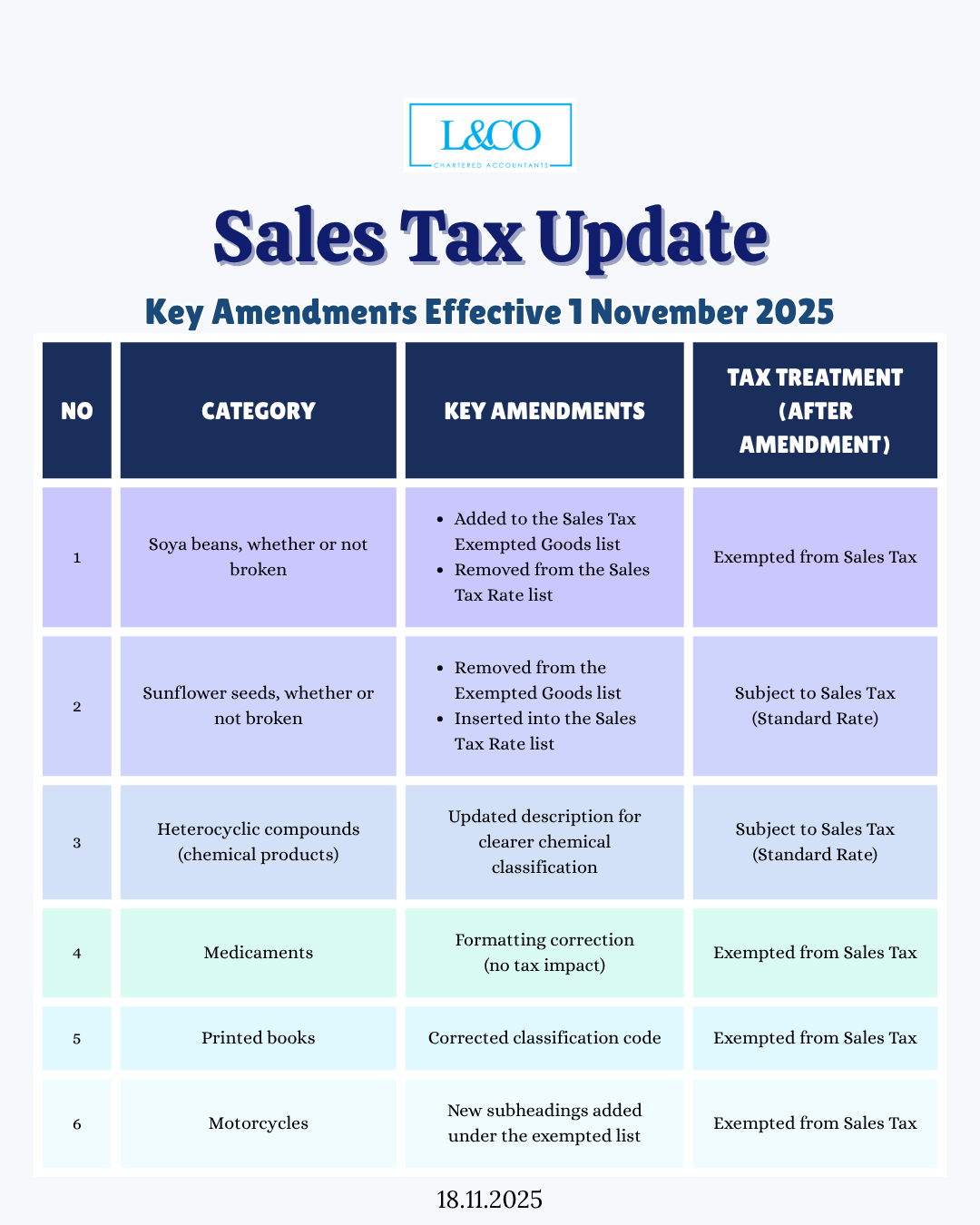

A clear summary of the latest changes to exempted and taxable items. 1. Soya Beans **Whether or not broken Key Amendments: Added to the Sales [...]

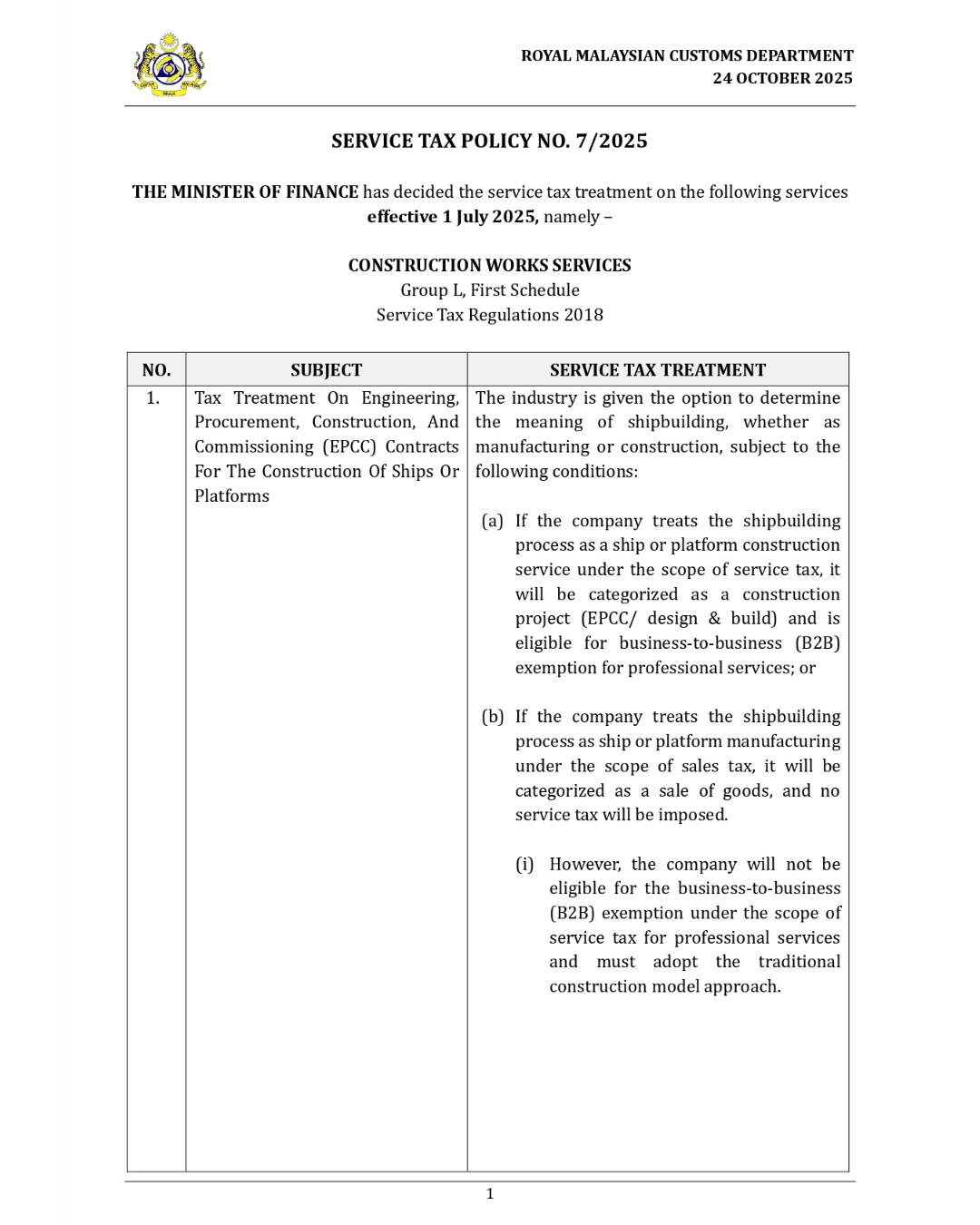

We’ve summarised the latest Service Tax Policy 7/2025 released by the Malaysian Customs, focusing specifically on construction companies, contractors, and developers. 1. EPCC Contracts (Engineering, [...]

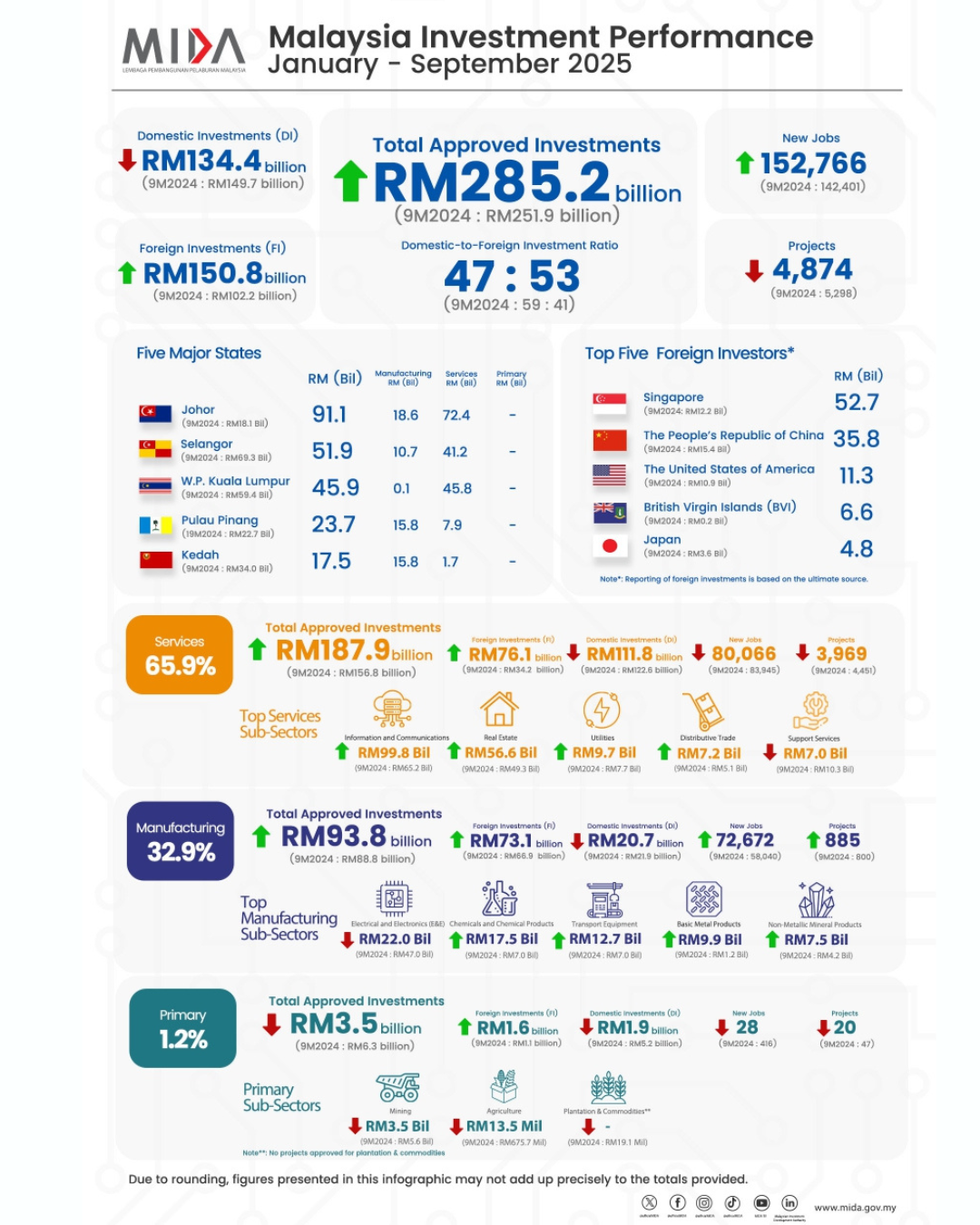

【Malaysia Approves RM285.2 Billion Investments in 9M 2025 — Up 13.2% YoY】 Johor Leads the Nation. What Does This Mean for Businesses? MIDA has just [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)