Establishment requirements, benefits, and compliance obligations—all in one!

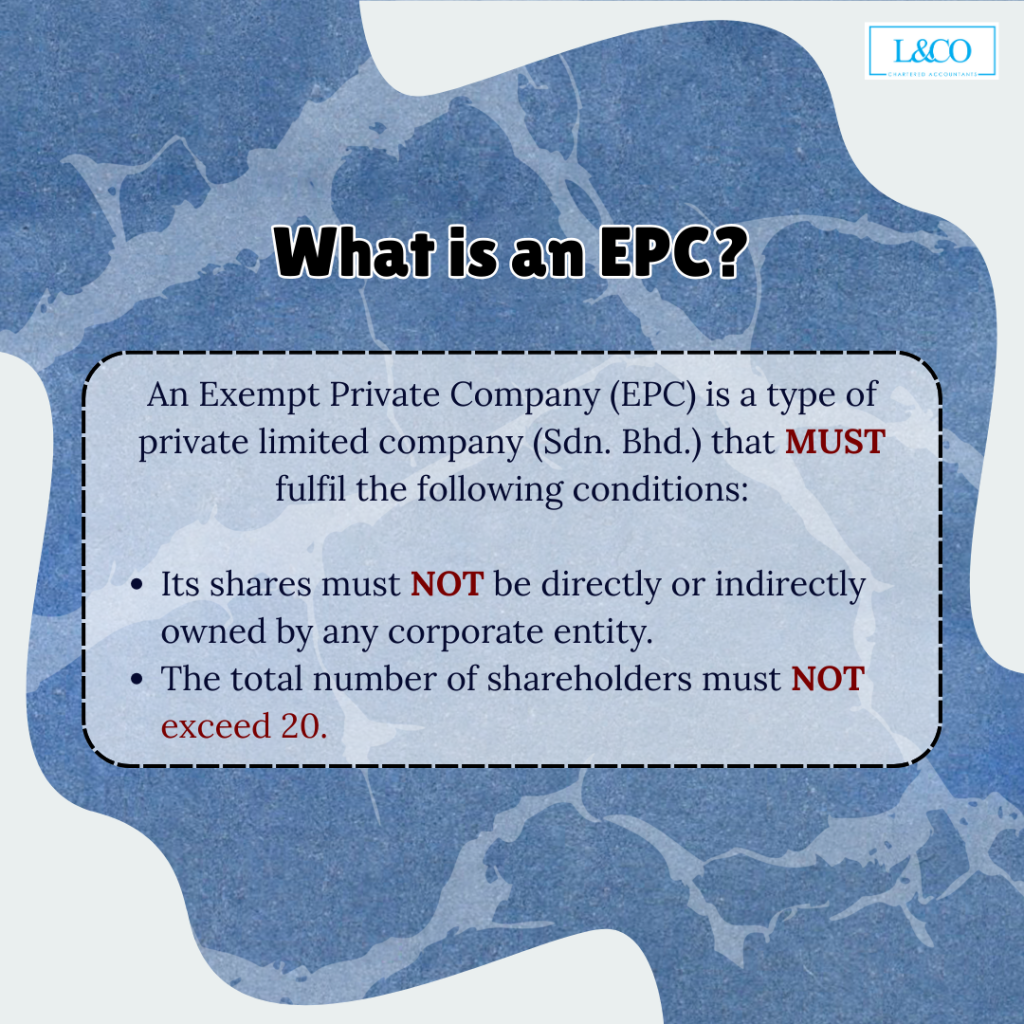

What is an Exempt Private Company (EPC)?

An Exempt Private Company (EPC) is a type of private limited company (Sdn. Bhd.) that must fulfil the following conditions:

- Its shares must not be directly or indirectly owned by any corporate entity.

- The total number of shareholders must not exceed 20.

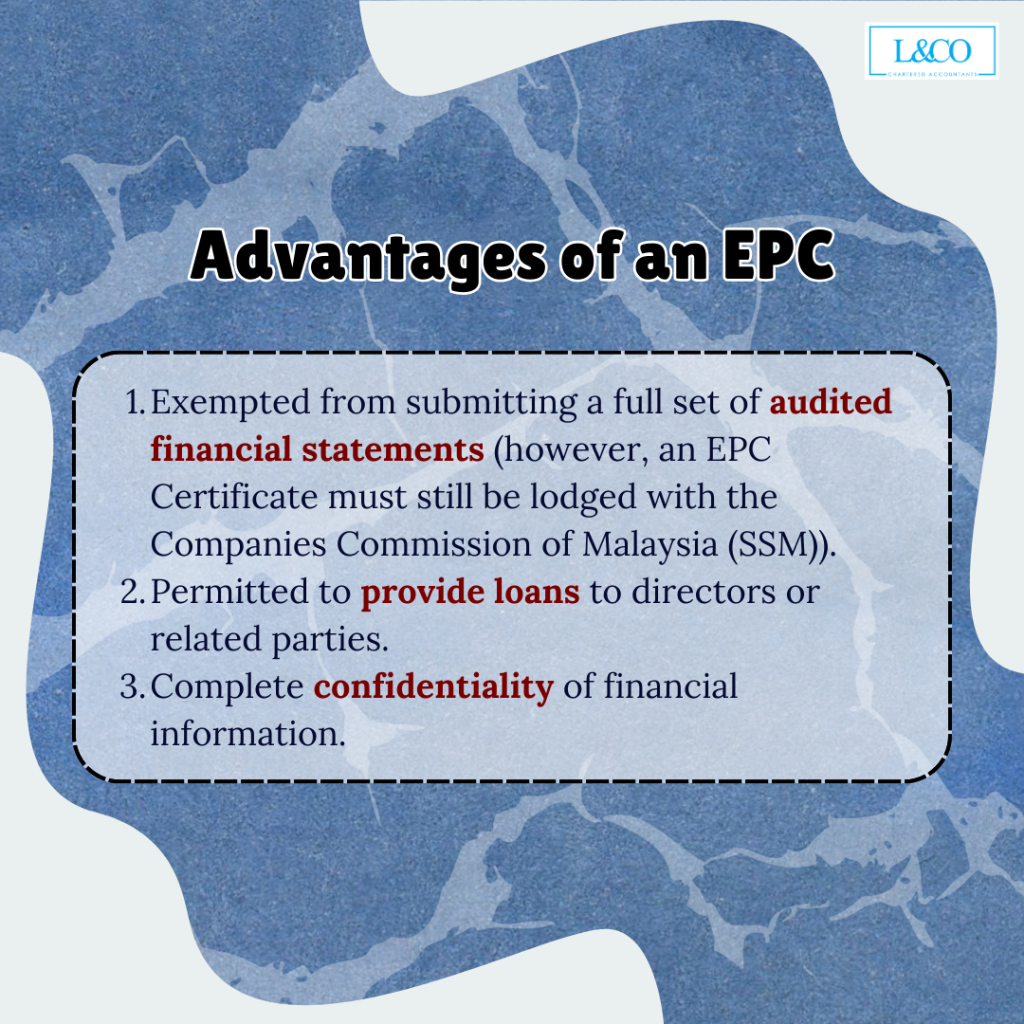

Advantages of an Exempt Private Company (EPC):

- Exempted from submitting a full set of audited financial statements (however, an EPC Certificate must still be lodged with the Companies Commission of Malaysia (SSM)).

- Permitted to provide loans to directors or related parties.

- Complete confidentiality of financial information.

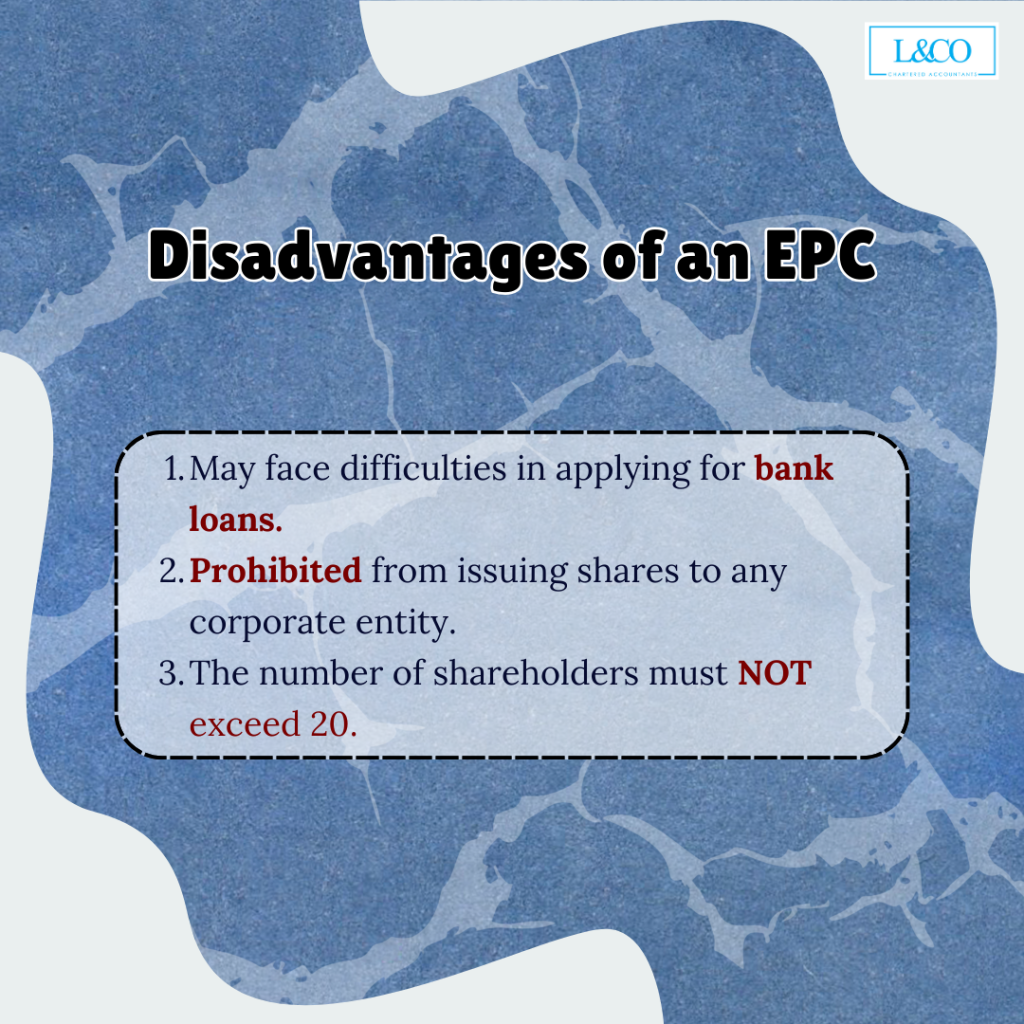

Disadvantages of an Exempt Private Company (EPC):

- May face difficulties in applying bank loans.

- Prohibited from issuing shares to any corporate entity.

- The number of shareholders must not exceed 20.

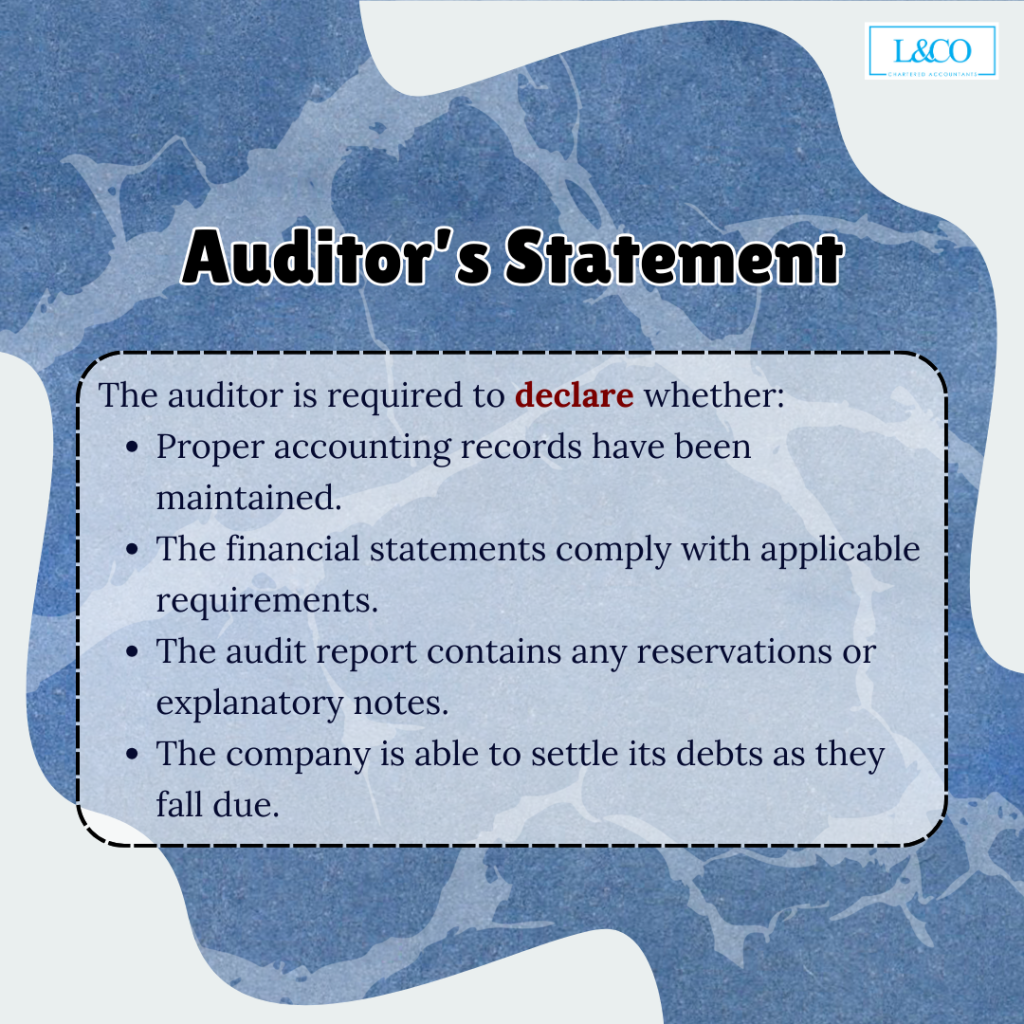

Auditor’s Statement

The auditor is required to declare whether:

- Proper accounting records have been maintained.

- The financial statements comply with applicable requirements.

- The audit report contains any reservations or explanatory notes.

- The company is able to settle its debts as they fall due.

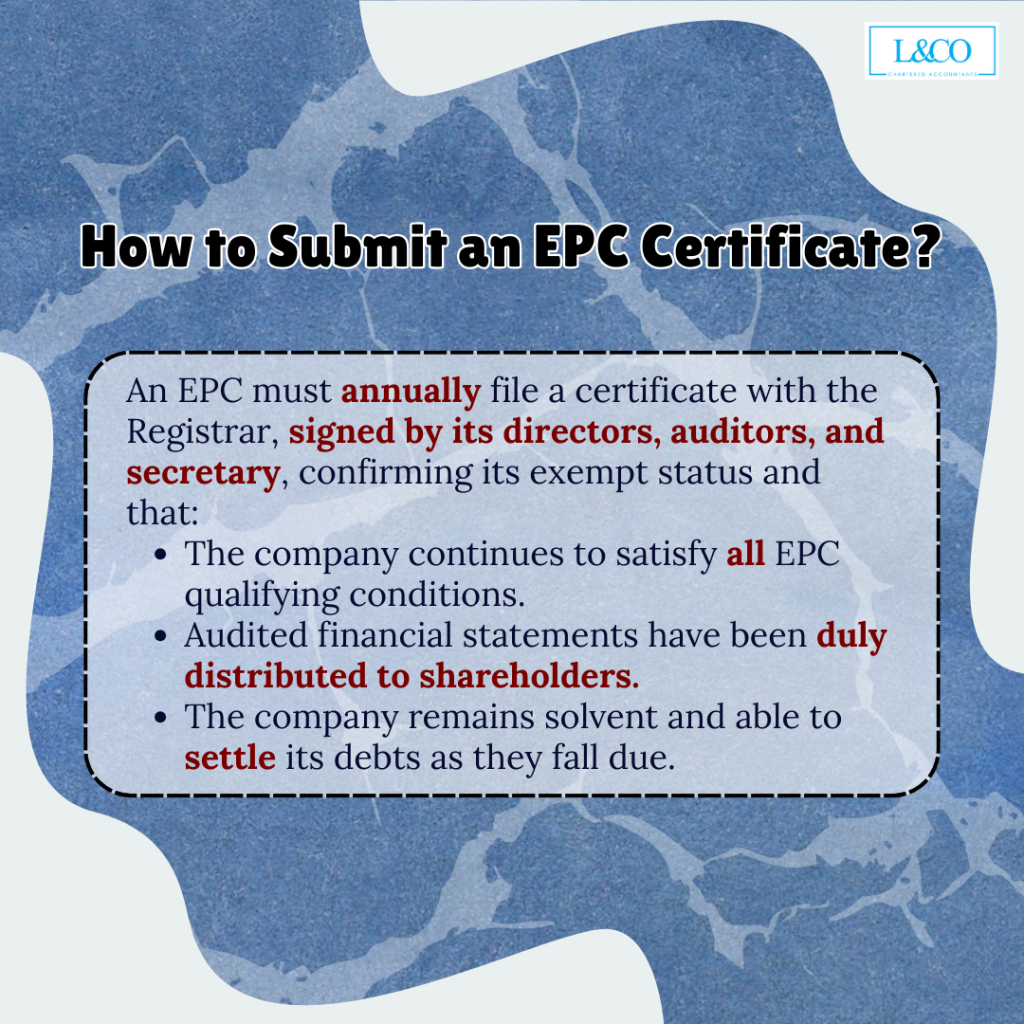

How to Submit an Exempt Private Company Certificate?

An EPC must annually file a certificate with the Registrar, signed by its directors, auditors, and secretary, confirming its exempt status and that:

- The company continues to satisfy all EPC qualifying conditions.

- Audited financial statements have been duly distributed to shareholders.

- The company remains solvent and able to settle its debts as they fall due.

**Last Updated on 22.08.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)