Effective 15 December 2025, the Inland Revenue Board of Malaysia (LHDNM) has officially introduced the e-Invoice Compliance Audit Framework.

This is not a drill—it marks a major upgrade in e-Invoice regulatory enforcement. Business owners, finance leaders, and tax agents should take note: it’s time to refresh your compliance playbook.

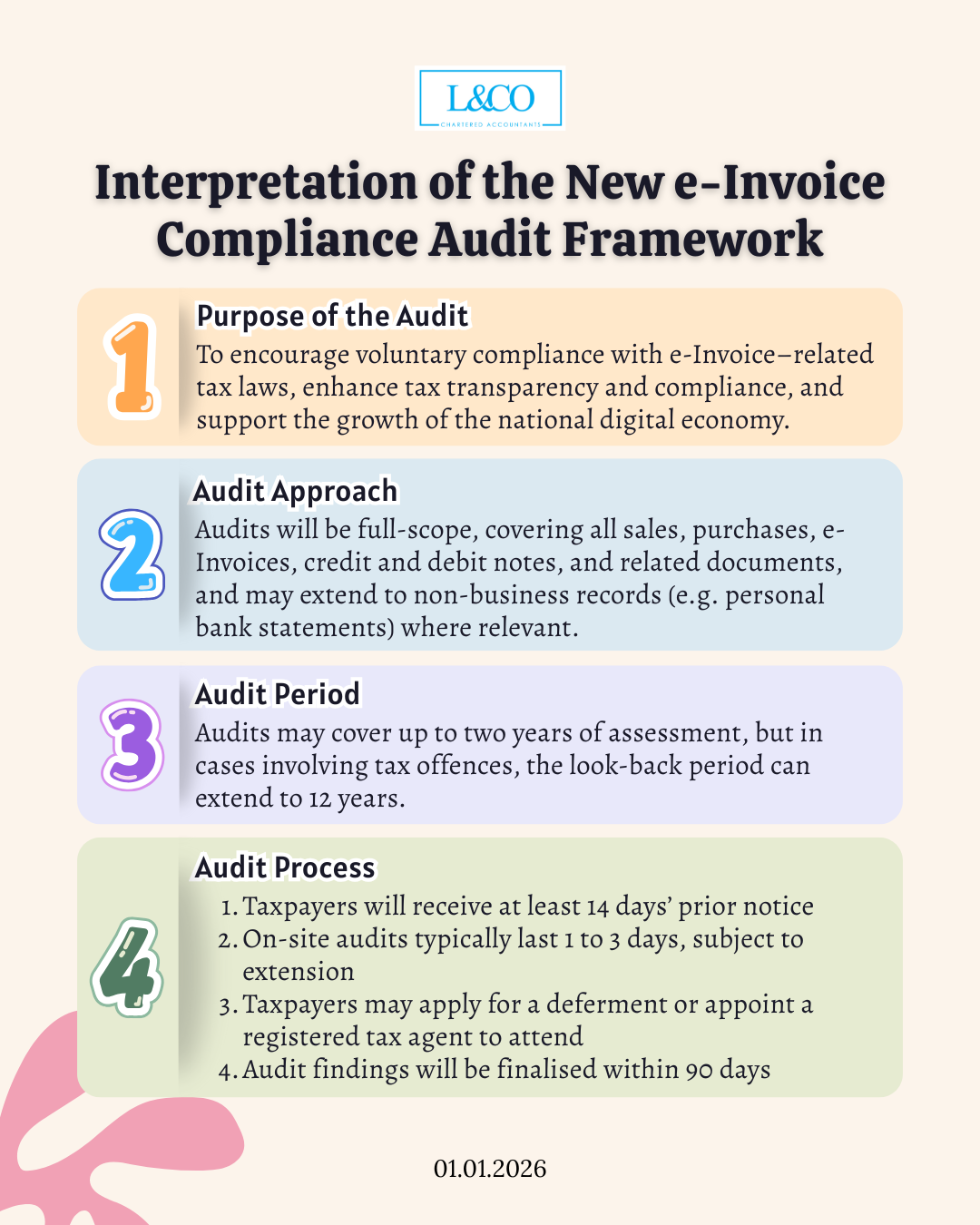

To encourage voluntary compliance with e-Invoice–related tax laws, enhance tax transparency and compliance, and support the growth of the national digital economy.

Audits will be full-scope, covering all sales, purchases, e-Invoices, credit and debit notes, and related documents, and may extend to non-business records (e.g. personal bank statements) where relevant.

Audits may cover up to two years of assessment, but in cases involving tax offences, the look-back period can extend to 12 years.

- Taxpayers will receive at least 14 days’ prior notice

- On-site audits typically last 1 to 3 days, subject to extension

- Taxpayers may apply for a deferment or appoint a registered tax agent to attend

- Audit findings will be finalised within 90 days

Taxpayers may submit a voluntary disclosure before the audit begins to rectify missing or incorrect e-Invoices, which may result in reduced penalties.

- Tax officers must uphold professional ethics, protect taxpayer information, and must not recommend tax agents or accept any benefits.

- Taxpayers must provide reasonable assistance and cooperate with the audit, and may appoint an agent or use translation services.

- Registered tax agents must be properly qualified and adhere to standards of integrity, confidentiality, and professional conduct.

Non-compliance with e-Invoice issuance or record-keeping requirements may result in fines of RM200–RM20,000 per transaction, imprisonment of up to 6 months, or both.

Taxpayers may submit an objection or appeal within 18 days of receiving the audit outcome, and may also lodge complaints regarding the conduct of tax officers.

Taxpayers must maintain proper business records, in both electronic and physical formats, in accordance with relevant LHDNM Public Rulings.

**Last Updated on 01.01.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)