LHDN just released new guidelines again!

Still confused about Malaysia’s e-Invoice rollout? This comprehensive FAQ guide highlights the latest key updates from LHDN.

We’ve also compiled the most common questions with clear, complete, and up-to-date explanations. Read on to get the full picture👇

FAQs

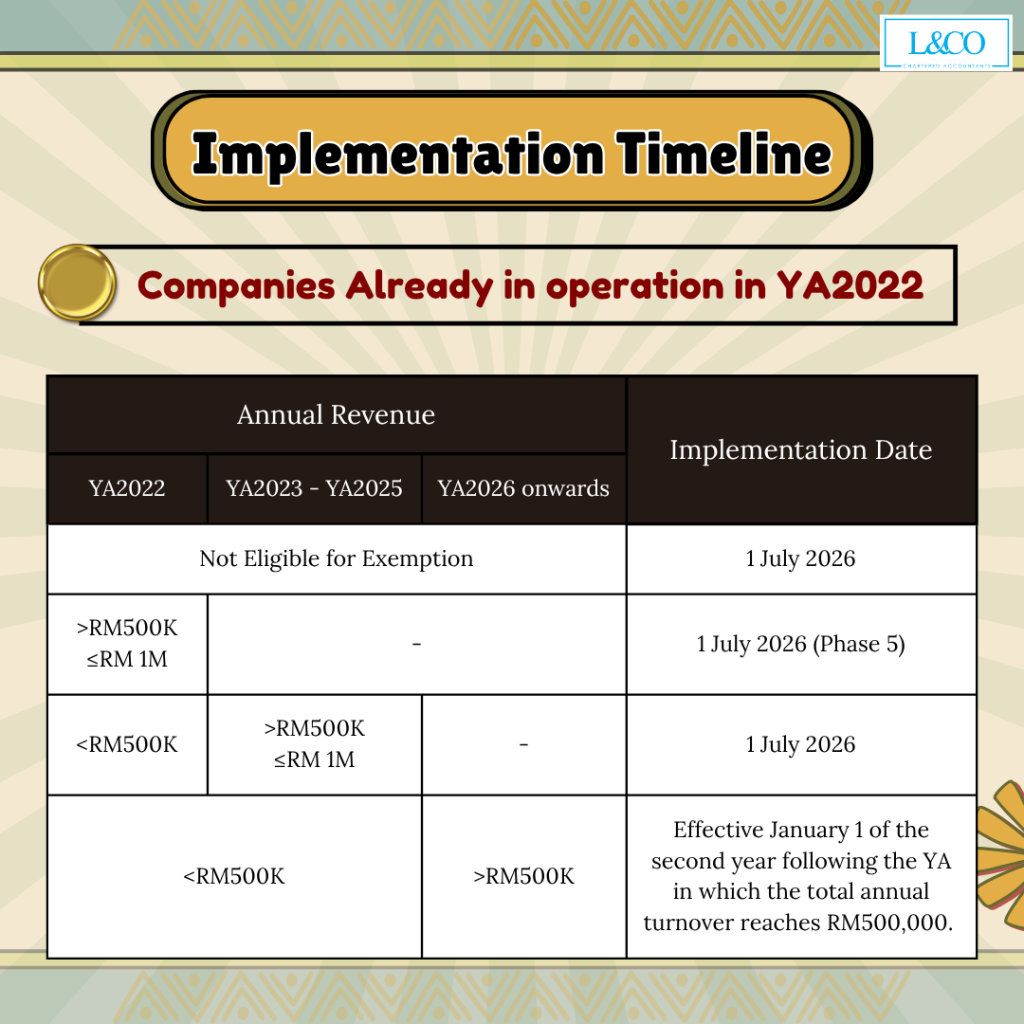

1. For companies operating since YA 2022:

✅ If not exempted, e-Invoice must be implemented starting 1 July 2026

✅ If YA2022 revenue is between RM500k–RM1mil, falls under Phase 5 (starts 1 July 2026)

✅ If YA2022 revenue is below RM500k:

- If revenue exceeds RM500k in YA2023–YA2025, e-Invoice starts 1 July 2026

- If revenue only exceeds RM500k in YA2026 or later, implementation begins 1 Jan of the second year after hitting the threshold

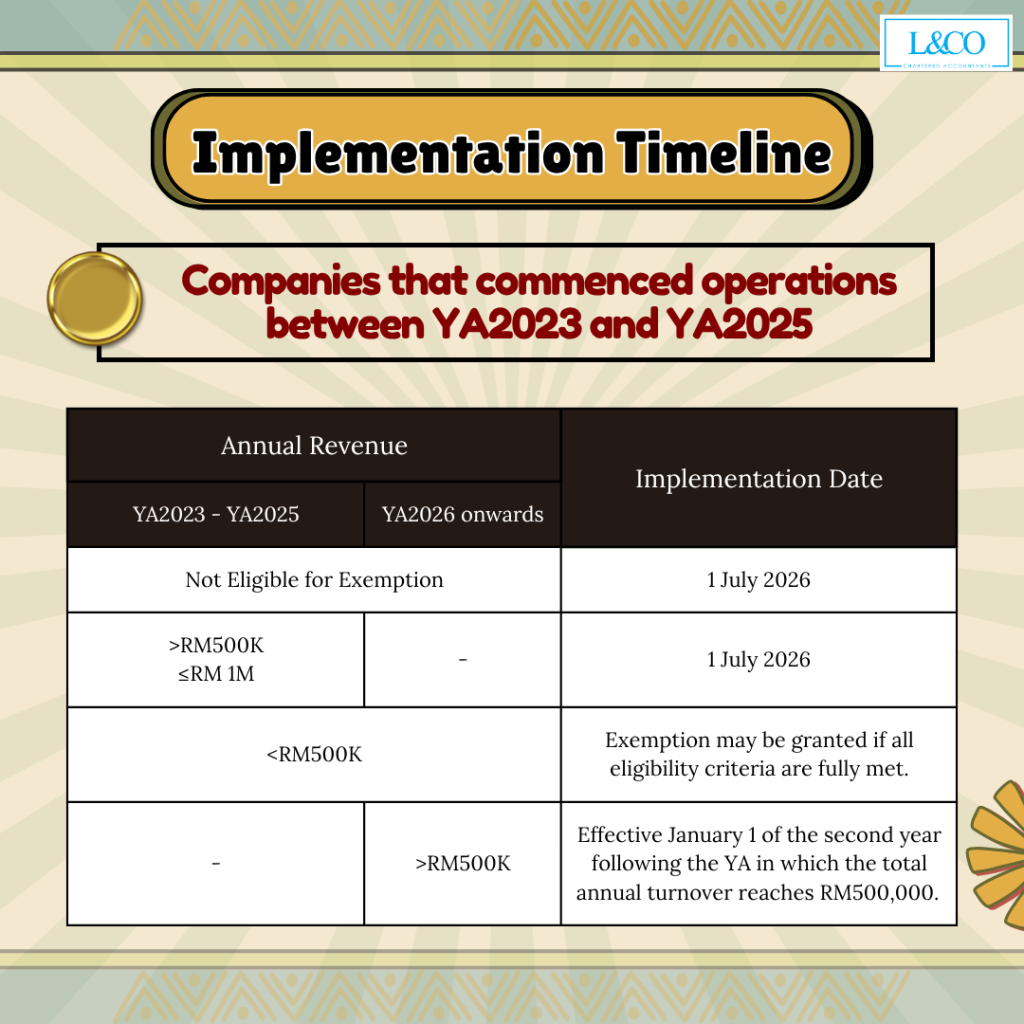

2. For companies starting operations in YA2023–YA2025:

✅ Revenue > RM500k: Must implement e-Invoice by 1 July 2026

✅ Revenue < RM500k & fully meets exemption criteria: The taxpayer is fully exempted from implementing e-Invoice.

✅ If threshold is crossed in YA2026 or later: Implement from 1 Jan of the second year after the threshold year

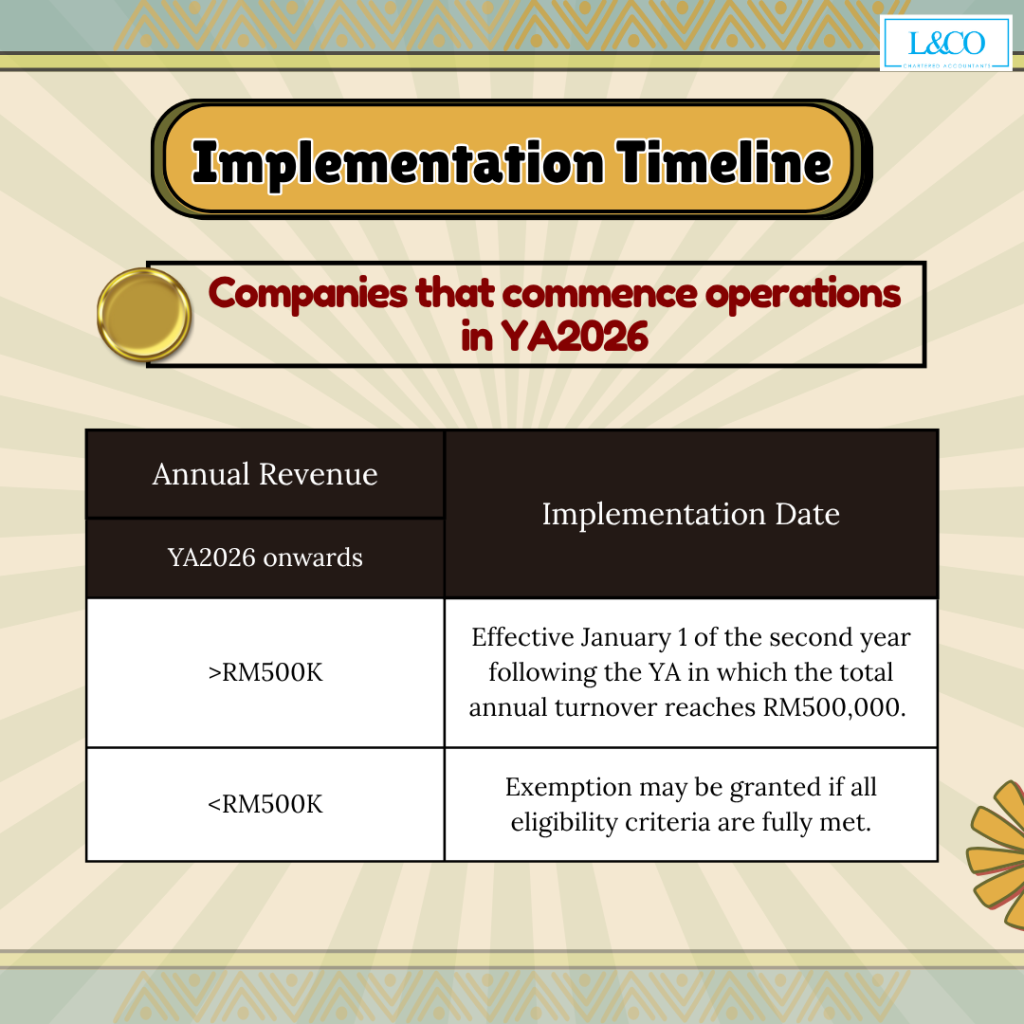

3. For companies starting operations in YA2026:

✅ Revenue ≥ RM500k: Implement from 1 Jan 2028

✅ Revenue < RM500k: Exempt from e-Invoice requirement

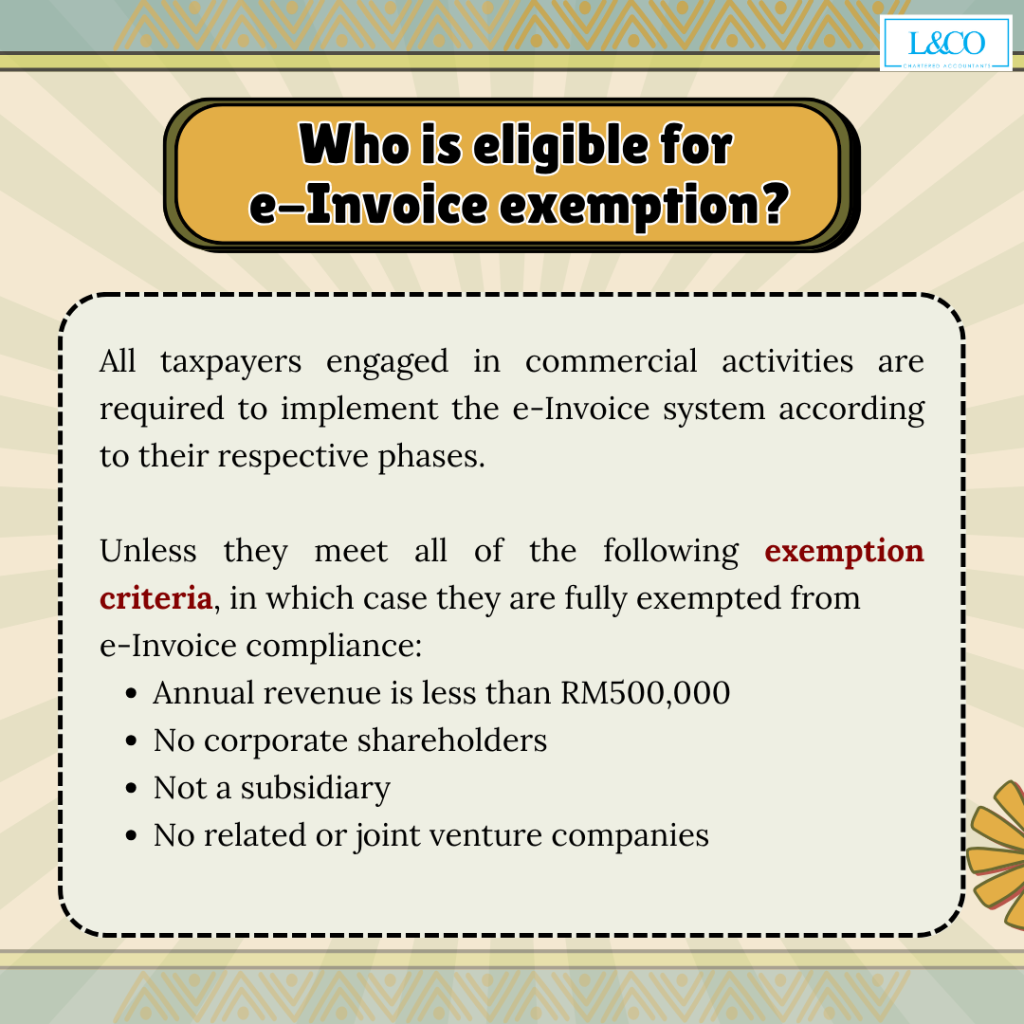

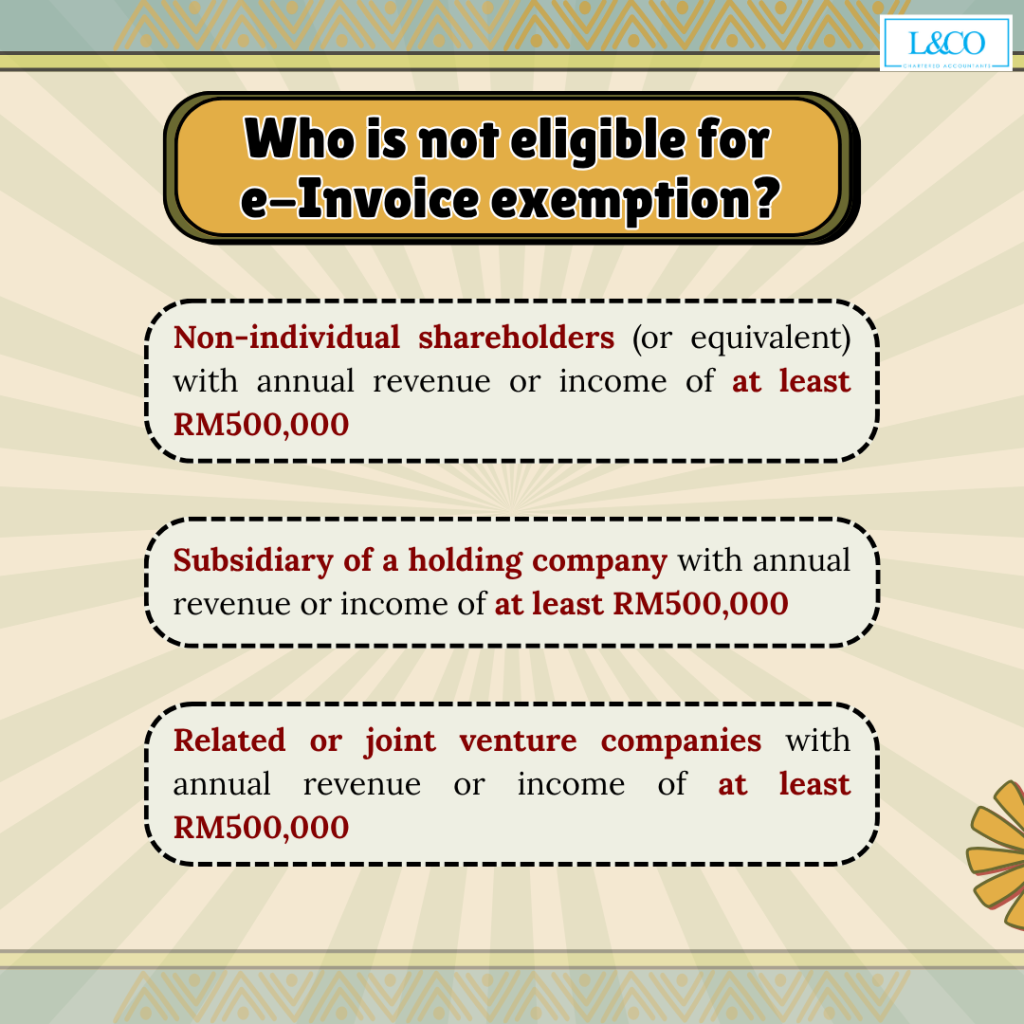

All business taxpayers must comply unless fully exempt, including from self-billed e-Invoice, if all the following are met:

- Annual revenue < RM500,000

- No corporate shareholders

- Not a subsidiary

- No related or associate companies

- Has non-individual shareholders with revenue ≥ RM500,000

- Is a subsidiary of a company with revenue ≥ RM500,000

- Has related/associate companies with revenue ≥ RM500,000

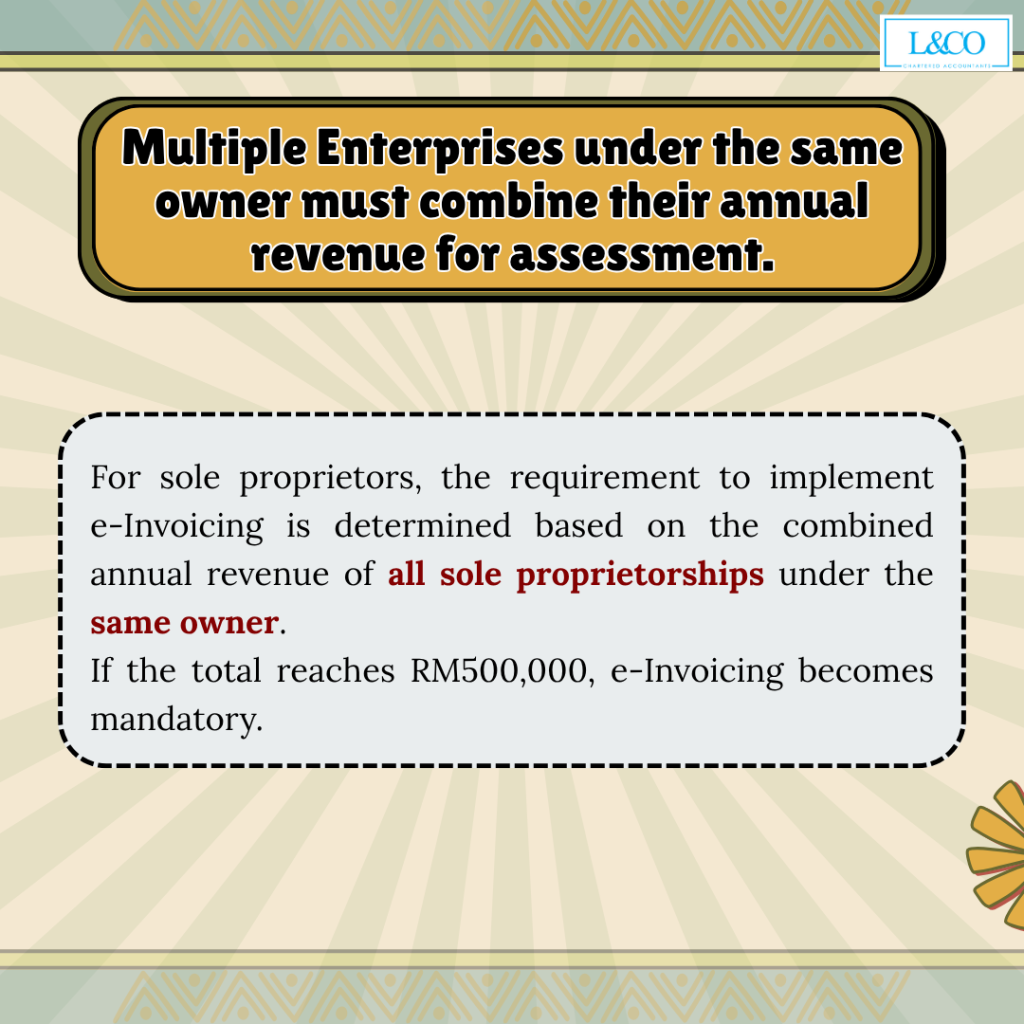

- For sole proprietors, the requirement to implement e-Invoicing is determined based on the combined annual revenue of all sole proprietorships under the same owner.

- If the total reaches RM500,000, e-Invoicing becomes mandatory.

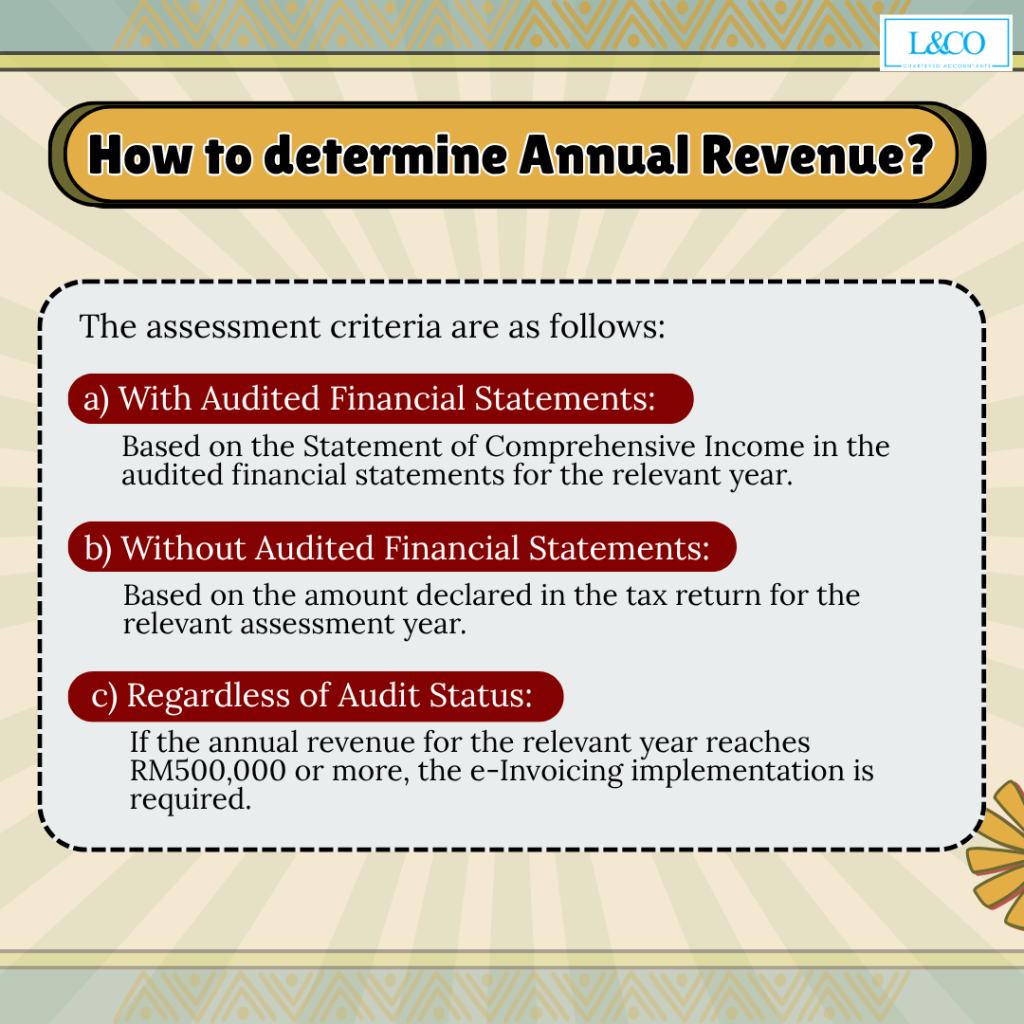

- With audited accounts: Use revenue from the Statement of Comprehensive Income

- Without audited accounts: Use declared income in tax return for the relevant YA

- Regardless of audit status: If revenue ≥ RM500,000, e-Invoice applies

**Latest Updates on 17.06.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)