Cigarettes & Liquor Tax Increase from November

Besides this news, what else is worth paying attention to this month? Let’s take a look together!

Cigarette & Liquor Tax Increase from November

- Starting 1 November 2025, Malaysia will raise excise duties on tobacco and liquor. Cigarettes increase by RM0.02 per stick, cigars by RM40/kg, heated tobacco by RM20/kg, and liquor tax by 10%.

- The tax exemption for nicotine replacement products (sprays, lozenges) is extended to end-2027.

- Extra revenue will fund lung health and chronic disease programmes under the Health Ministry.

RON95 Unsubsidized Fuel to Float from November

- From November 2025, RON95 unsubsidised fuel will adopt a weekly floating price (currently ~RM2.60/L).

- Eligible Malaysians can still buy subsidised fuel at RM1.99/L, up to 300 L monthly.

- The move aligns fuel prices with global trends while keeping targeted subsidies.

RM500 i-Saraan Incentives Credited

- The i-Saraan scheme rewards self-employed Malaysians (under 55) who voluntarily contribute to EPF.

- The government matches 20% (up to RM500/year). Incentives are credited twice yearly; RM500 payments are now in.

- To receive the full amount, members must contribute at least RM2,500 a year.

RM400 Rebate for Energy-Efficient Appliances

- Under SEDA Malaysia’s NUR@PETRA programme, buyers of 4- or 5-star energy-efficient air-conditioners or refrigerators can claim up to RM400 rebate.

- Quota raised on 30 October 2025. Purchases must be through approved stores or platforms; check eligibility on the official site.

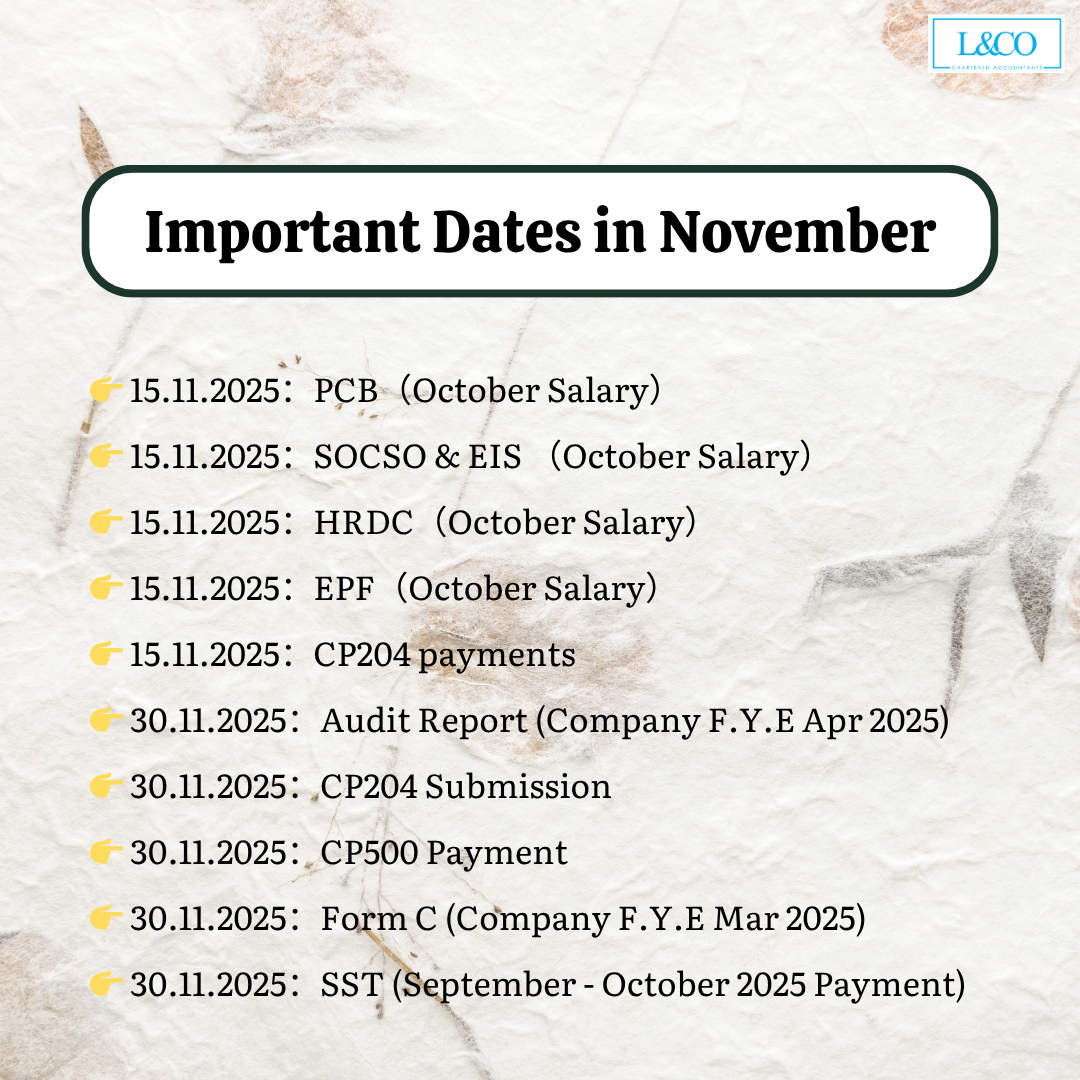

Important Dates in November

- 15.11.2025:PCB(October Salary)

- 15.11.2025:SOCSO & EIS (October Salary)

- 15.11.2025:HRDC(October Salary)

- 15.11.2025:EPF(October Salary)

- 15.11.2025:CP204 payments

- 30.11.2025:Audit Report (Company F.Y.E Apr 2025)

- 30.11.2025:CP204 Submission

- 30.11.2025:CP500 Payment

- 30.11.2025:Form C (Company F.Y.E Mar 2025)

- 30.11.2025:SST (September – October 2025 Payment)

(201706002678 & AF 002133)

(201706002678 & AF 002133)