When managing corporate tax matters, HR processes, and employee income tax filings, it’s crucial to understand and correctly use the relevant forms. Below is a categorised summary of commonly used official forms, covering employer tax returns, employment procedures, employee tax filing, and company tax deduction reporting. This guide helps you navigate various submission requirements with ease and minimise compliance risks.

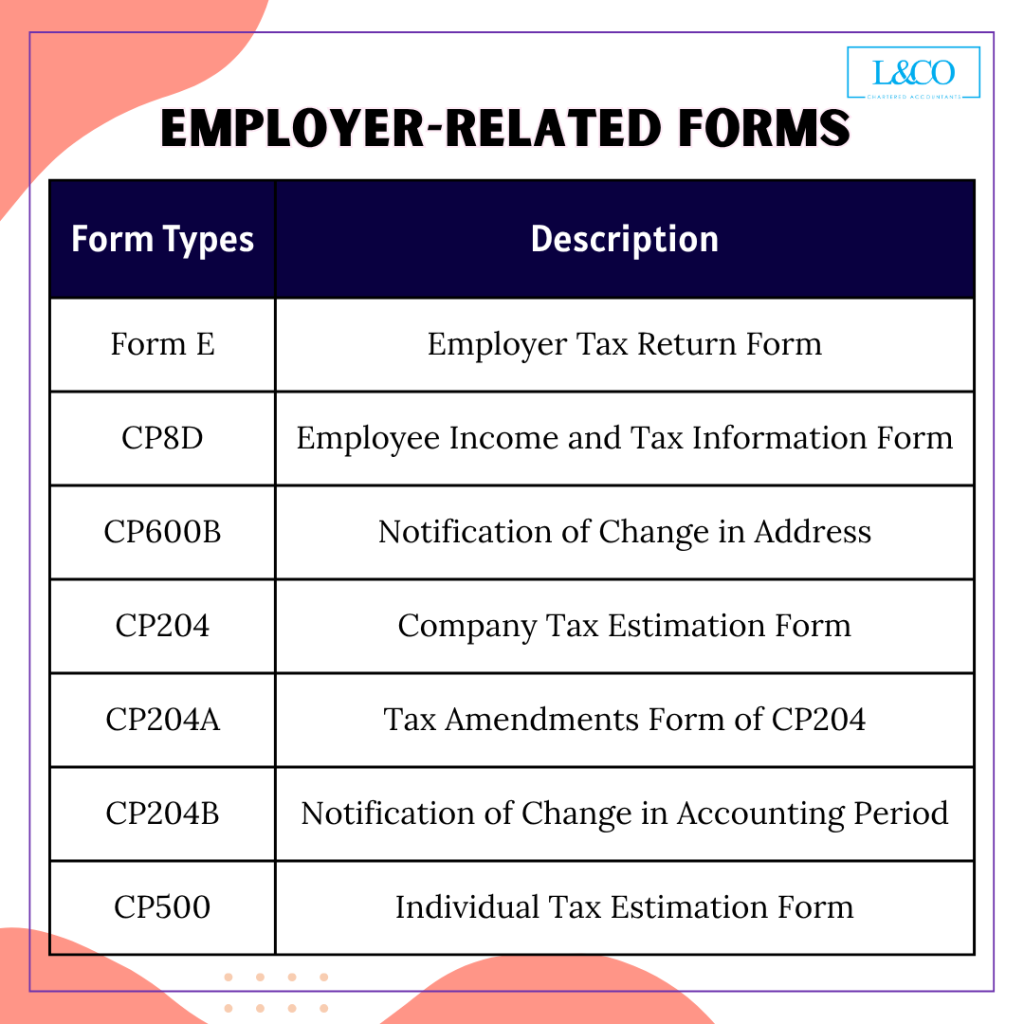

Employer-related Forms

- Form E

- CP8D

- CP600B

- CP204

- CP204A

- CP204B

- CP500

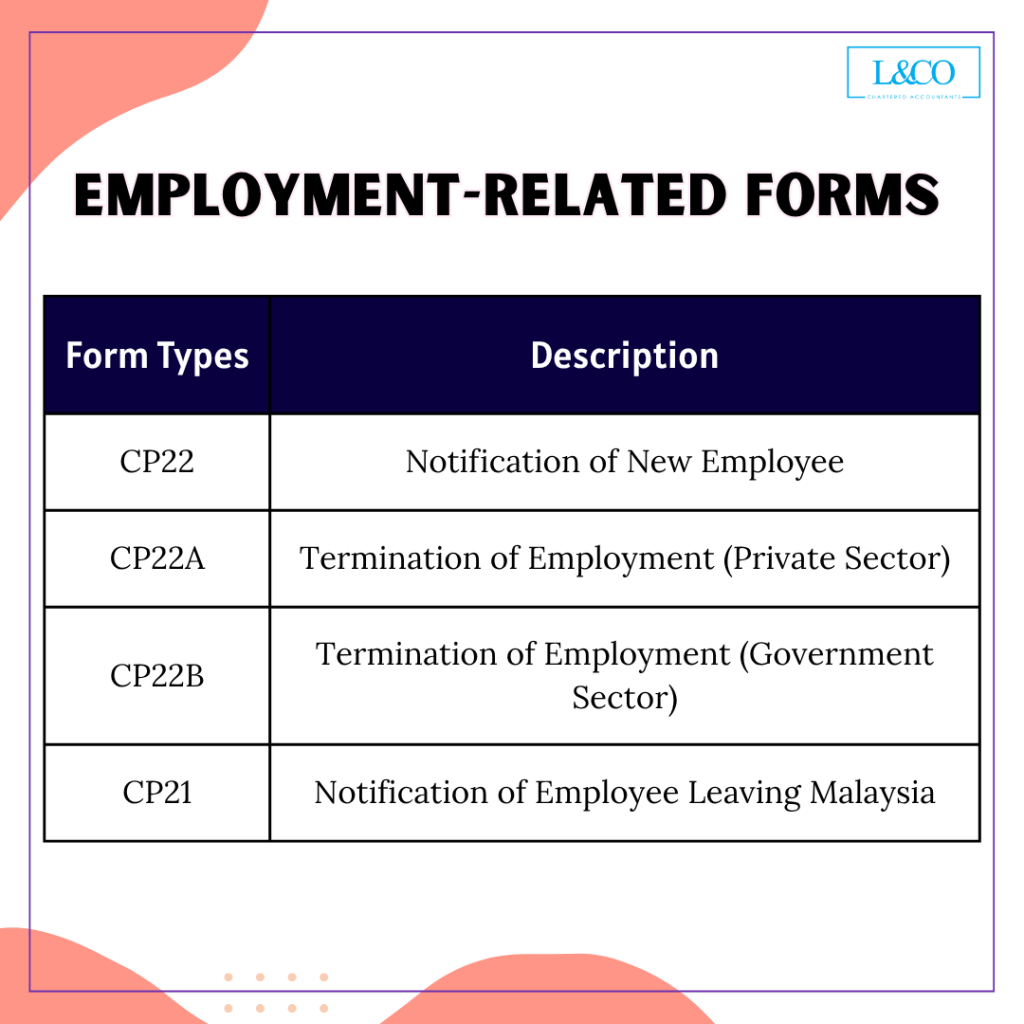

Employment-related Forms

- CP22

- CP22A

- CP22B

- CP21

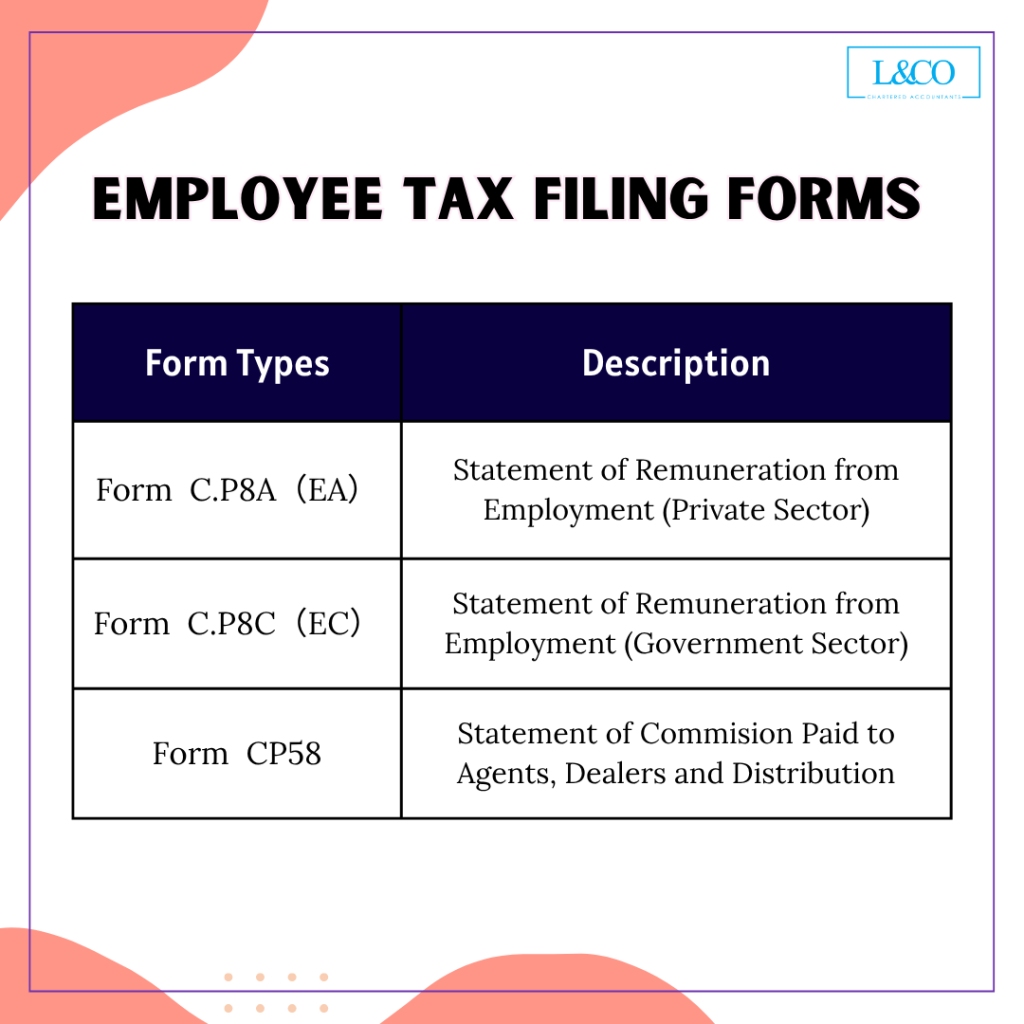

Employee Tax Filing Forms

- Form C.P8A (EA)

- Form C.P8B (EC)

- Form CP58

Company Tax Reduction Forms

- Form PCB2 [STD 2(II)]

- Form PCB/TP1

- Form PCB/TP3

**Last Updated on 07.08.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)