Key regulatory shifts that will directly impact how businesses manage tax reporting, compliance processes and risk exposure in 2026. Early understanding and preparation are essential to avoid penalties, delays and operational disruptions.

Kay Highlights

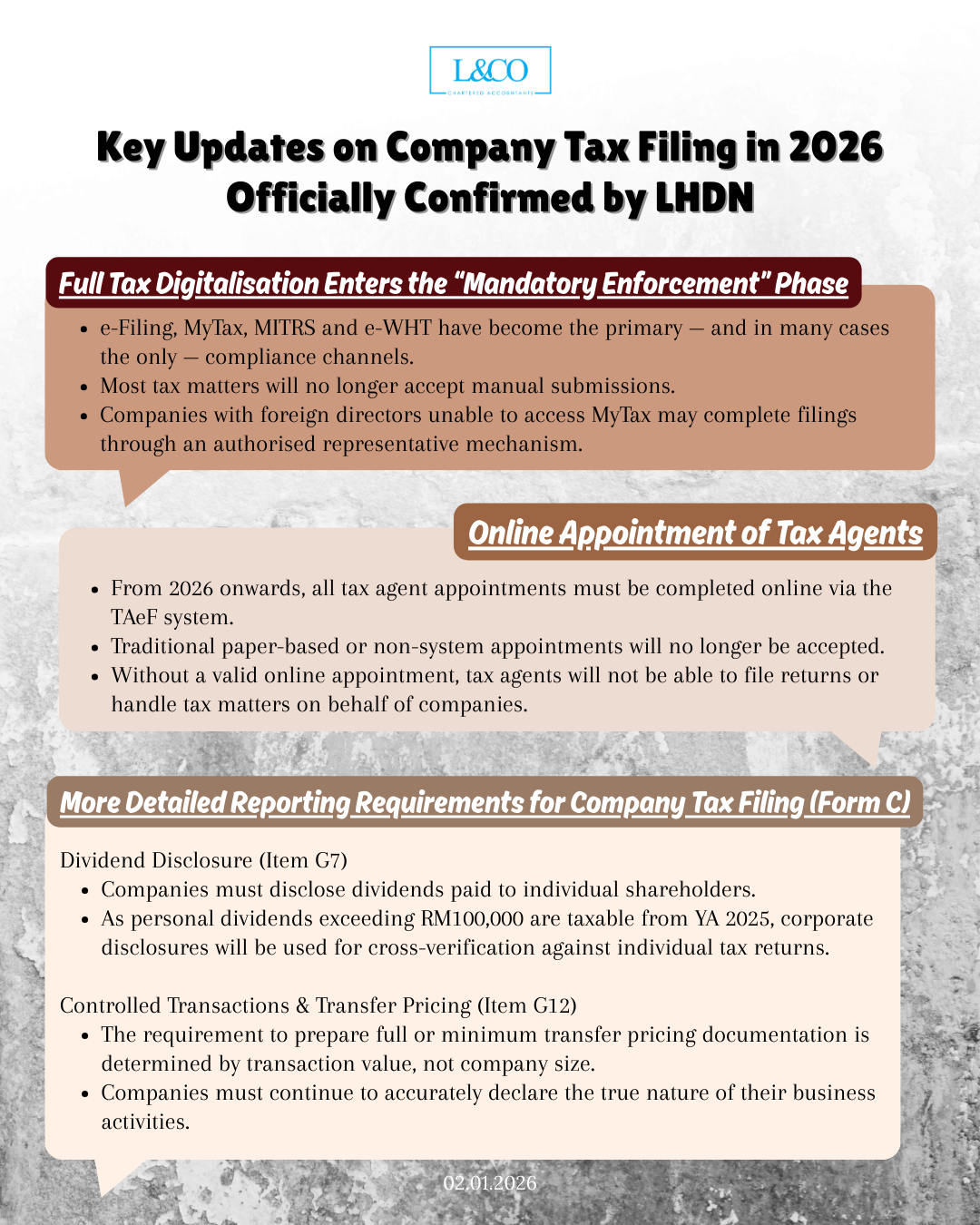

I, Full Tax Digitalisation Enters the “Mandatory Enforcement” Phase

- e-Filing, MyTax, MITRS and e-WHT have become the primary — and in many cases the only — compliance channels.

- Most tax matters will no longer accept manual submissions.

- Companies with foreign directors unable to access MyTax may complete filings through an authorised representative mechanism.

II, Online Appointment of Tax Agent (TAeF)

- From 2026 onwards, all tax agent appointments must be completed online via the TAeF system.

- Traditional paper-based or non-system appointments will no longer be accepted.

- Without a valid online appointment, tax agents will not be able to file returns or handle tax matters on behalf of companies.

III, More Detailed Reporting Requirements for Company Tax Filing (Form C)

Dividend Disclosure (Item G7)

- Companies must disclose dividends paid to individual shareholders.As personal dividends exceeding RM100,000 are taxable from YA 2025, corporate disclosures will be used for cross-verification against individual tax returns.

Controlled Transactions & Transfer Pricing (Item G12)

- The requirement to prepare full or minimum transfer pricing documentation is determined by transaction value, not company size.

- Companies must continue to accurately declare the true nature of their business activities.

IV, Capital Gains Tax (CGT): Tax Exempt ≠ No Reporting

Special attention is required for corporate restructurings and share transactions.

- Even where CGT exemptions apply (e.g. group restructurings or IPO-related restructurings):

- e-CKM submission is still required, and

- H3a / H3b must be correctly selected in Form C.

**HASiL has clearly stated that there is no “Exempted / Not Applicable” option.

V, Online Submission of Tax Appeals (e-Rayuan)

- Currently, taxpayers may submit tax appeals online via the e-Rayuan system, including Form Q and Form N, applicable to large taxpayers and Kuala Lumpur branches.

- From 2026 onwards, this online appeal mechanism will be progressively expanded to: All taxpayers and all tax types, including RPGT and withholding tax, are to be significantly enhanced efficiency and accessibility in dispute resolution.

VI, Company Cessation & Tax Clearance: Do Not “Close SSM Only”

- A company struck off by SSM may still face penalties if its tax file is not closed.

- HASiL confirms only filings up to the cessation year are required; wrong penalties will be withdrawn and excess tax refunded.

VII, MITRS Document Submission: Temporary Dual Preparation Required

Even if detailed figures are already included in the tax computation, the following must still be uploaded separately via MITRS:

- Audited financial statements

- Directors’ report

- Detailed profit and loss schedules

**Companies should allocate additional time and manpower to meet the heightened documentation and compliance requirements

**Last Updated on 07.01.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)