According to information published by the Inland Revenue Board of Malaysia (LHDN), individuals whose annual income falls below certain thresholds may not be required to pay personal income tax, after taking into account standard reliefs and deductions.

Key Highlights

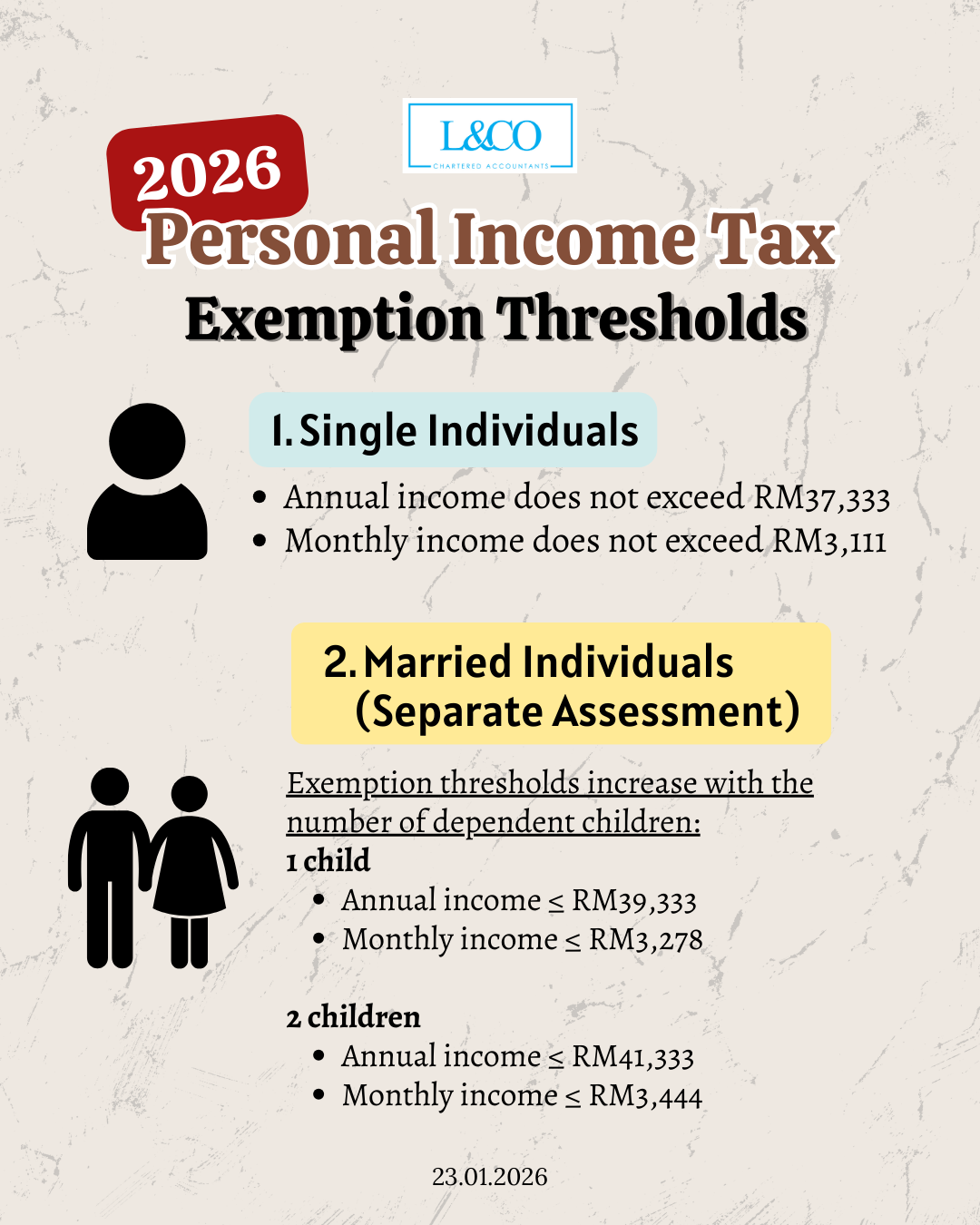

1. Single Individuals

You may qualify for an income tax exemption if your:

- Annual income does not exceed RM37,333

- Monthly income does not exceed RM3,111

2. Married Individuals (Separate Assessment)

For married taxpayers who file separately, exemption thresholds increase with the number of dependent children:

1 child

- Annual income ≤ RM39,333

- Monthly income ≤ RM3,278

2 children

- Annual income ≤ RM41,333

- Monthly income ≤ RM3,444

3. Married Couples (Joint Assessment)

For couples opting for joint assessment, the household income exemption thresholds are higher:

No children

- Annual income ≤ RM48,000

- Monthly income ≤ RM4,000

1 child

- Annual income ≤ RM50,000

- Monthly income ≤ RM4,167

2 children

- Annual income ≤ RM52,000

- Monthly income ≤ RM4,333

Gentle Reminder

These figures are estimates based on standard personal reliefs (such as the RM9,000 individual relief and child reliefs). Actual tax liability may vary depending on individual circumstances, additional deductions, and final tax filings. If your income falls within the thresholds above, you may be fully exempt from paying personal income tax for the 2026 assessment year — making it essential to understand your eligibility and plan your tax filing accordingly.

**Last Updated on 15.01.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)