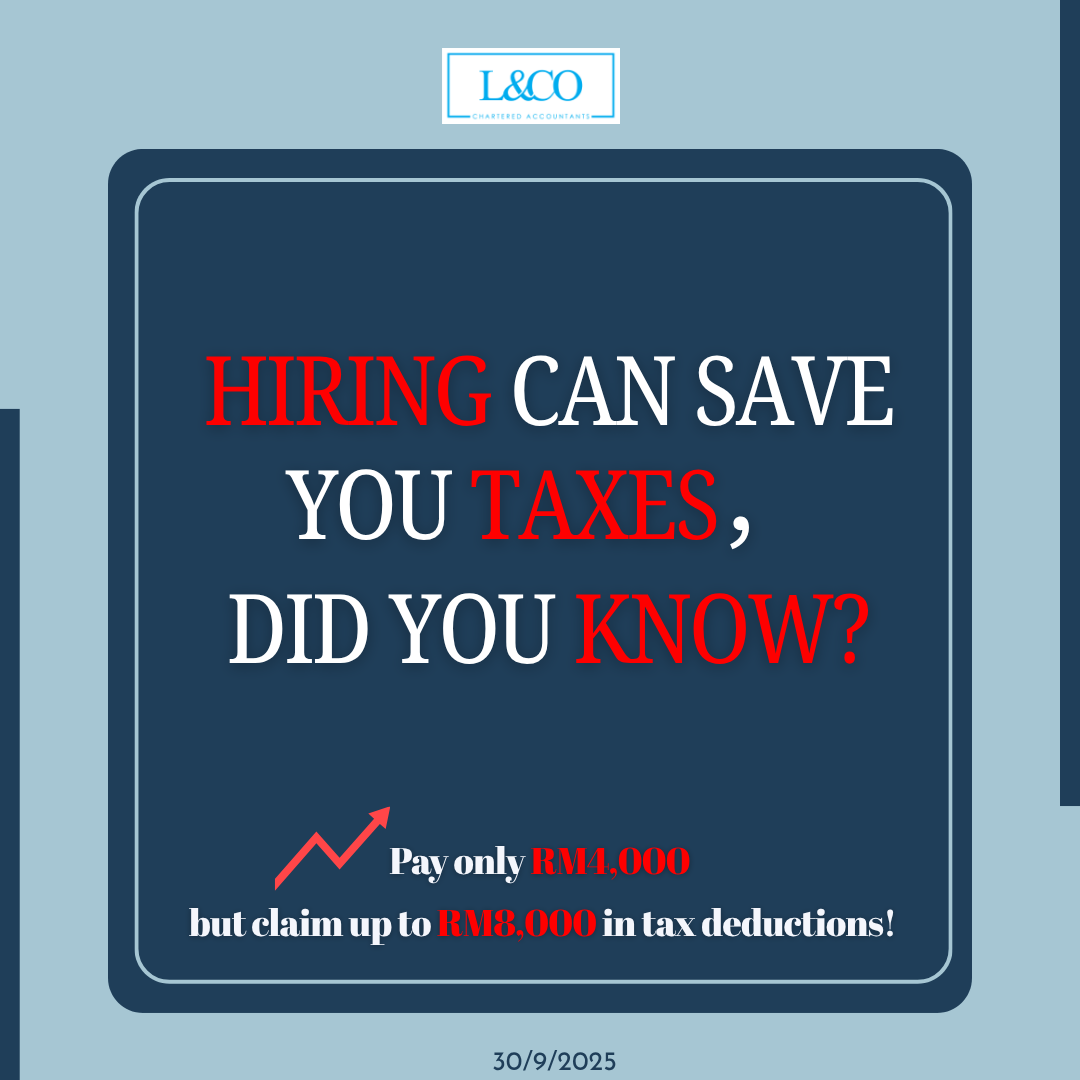

In Malaysia, hiring certain employees qualifies for a Double Deduction:

-Senior employees: aged 60+, full-time, monthly salary ≤ RM4,000

-Interns: TalentCorp MySIP certified, allowance ≥ RM500/600, internship ≥ 10 weeks

-Persons with disabilities (OKU): must hold a valid OKU card

– Incentives for seniors & interns are only extended until YA 2025.

– Remember to remind your Tax Agent during filing!

3 Common Employment Tax Incentives:

Senior Citizen:

-Hire employees aged 60 & above → enjoy double deduction

-Valid once they turn 60 (full year’s salary, no prorate)

-Must be full-time staff

-Monthly salary ≤ RM4,000Relatives not eligible

Internship:

-Employers must apply for TalentCorp certification

-Interns must be Malaysian citizens

-Internship must be before graduation & at least 10 weeks

-Enrolled in a full-time Diploma, Degree, Master’s, or Vocational programme

OKU:

**Data Updated On 30.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)