Major Policy Boost for Private Education Institutions in 2026

The Malaysian Government has officially announced: Private education institutions will enjoy a full exemption from the HRD Training Levy (HRD Levy) for the 2026 assessment [...]

Service Tax Exemptions for Construction Services

The Royal Malaysian Customs Department has issued Service Tax Policy No. 3/2025, introducing multiple exemptions and transitional arrangements for construction services. Effective immediately, the measures [...]

New Service Tax Policy on Leasing & Rental Services

Malaysia’s updated service tax framework has come into effect. Contract terms, tenant status, and group structure will directly determine tax exposure. Businesses and property owners [...]

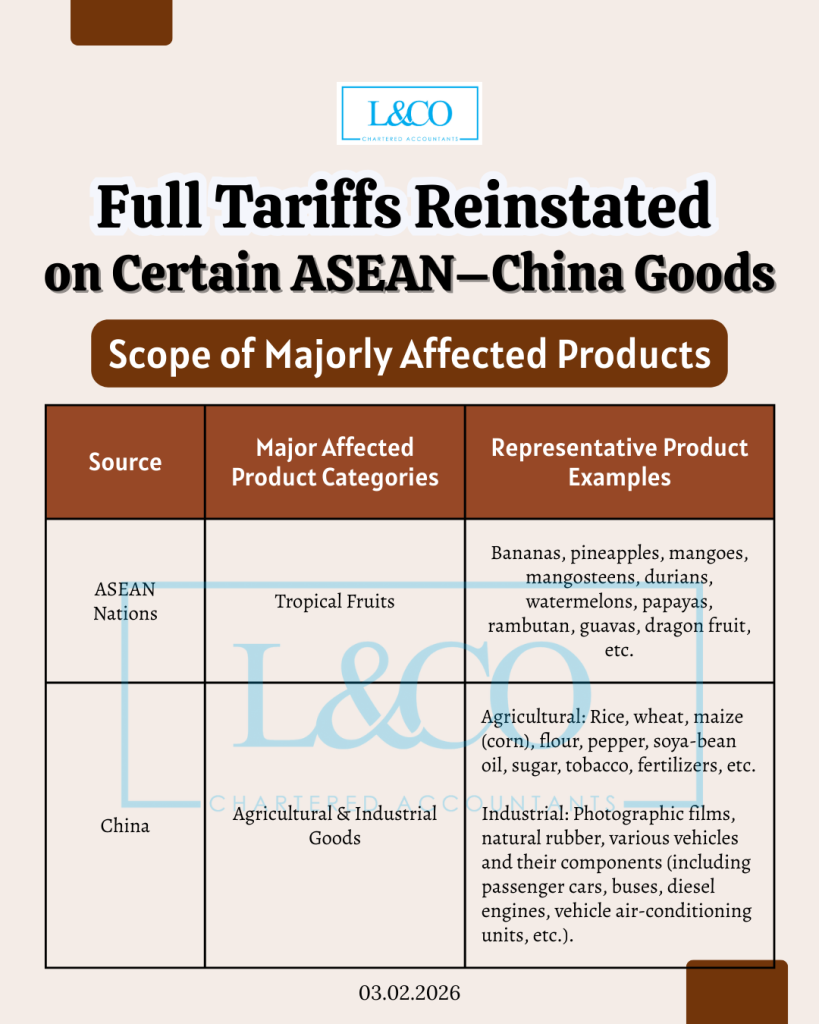

Full Tariffs Reinstated on Certain ASEAN–China Goods

The Malaysian Government has officially issued P.U. (A) 15 (2026), introducing significant revisions to the tariff concessions under the ASEAN–China Free Trade Area (ACFTA). Certain [...]

Form EA Filing Complete Guide

Form EA (C.P.8A) is an annual remuneration statement issued by employers to employees for personal income tax filing. It covers salary, benefits, tax deductions, EPF, [...]

PERKESO Late Payment Interest Rebate (FCLB)

If your company currently has PERKESO Late Payment Interest (FCLB), you may now take advantage of this initiative and apply for up to 80% rebate [...]

Proper Export Treatment to Ensure Valid SST Refunds

The Royal Malaysian Customs Department (JKDM) has issued General Ruling No. 1/2026, providing critical clarification on Sales Tax refund eligibility for exported goods. Effective from [...]

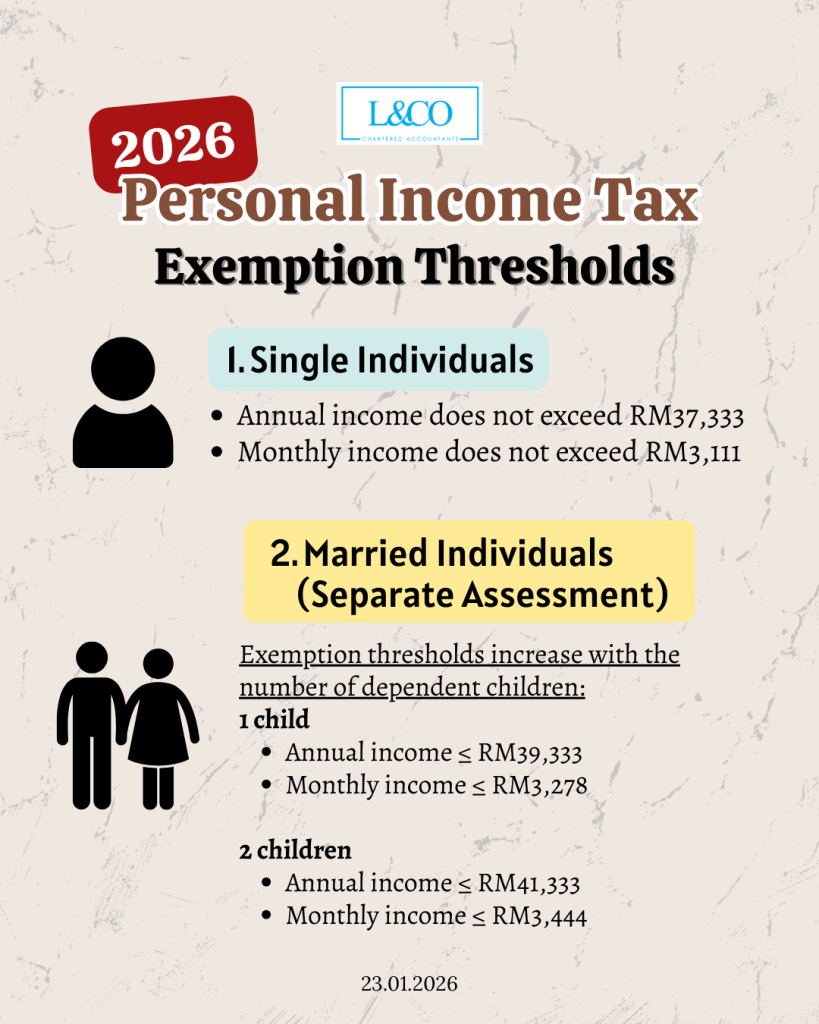

2026 Personal Income Tax Exemption Thresholds

According to information published by the Inland Revenue Board of Malaysia (LHDN), individuals whose annual income falls below certain thresholds may not be required to [...]

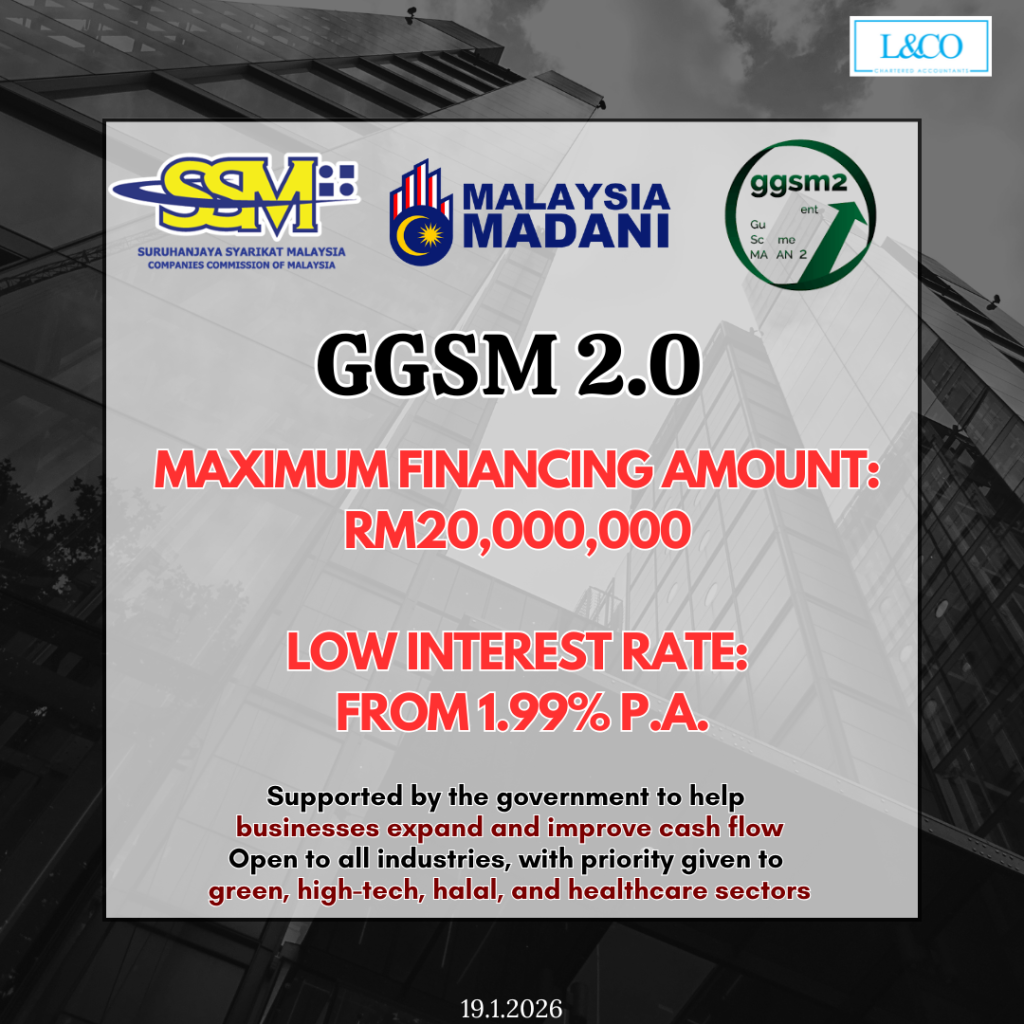

GGSM 2.0 Government-Backed Financing Scheme

The GGSM 2.0 (Government Guarantee Scheme MADANI 2) is a government-backed financing initiative designed to help Malaysian SMEs access larger loan amounts, favorable terms, and [...]

Key Beneficial Ownership (BO) Compliance Highlights

A Beneficial Owner (BO) is not merely a nominee or registered shareholder, but the individual who ultimately owns or exercises direct or indirect control over [...]

Internship Placement Matching Grant for SMEs and Start-Ups (LiKES)

Effective from 1 March, the Malaysian government has officially opened applications for the Internship Placement Matching Grant. Under this programme, eligible SMEs and start-ups may [...]

KWSP 2026 Reforms: 7 Key Changes

Attention Malaysian Employees and Self-Employed Individuals! The Employees Provident Fund (EPF/KWSP) has announced significant reforms effective January 1, 2026, aiming to secure long-term retirement funds. [...]

Malaysia 2026: New Vehicle Tax Rules for Designated Areas

Effective 2026, any vehicle entering Labuan or Langkawi with a value exceeding RM300,000 will be required to pay Sales Tax Key Highlights From 2026, sales [...]

Government Supports SMEs in Developing Local Talent: RM2,000 Grant per Intern Hired

To assist companies in developing local talent and improve internship-to-employment pathways, the Malaysian Government, through TalentCorp, has launched the LiKES (Internship Placement Matching Grant for [...]

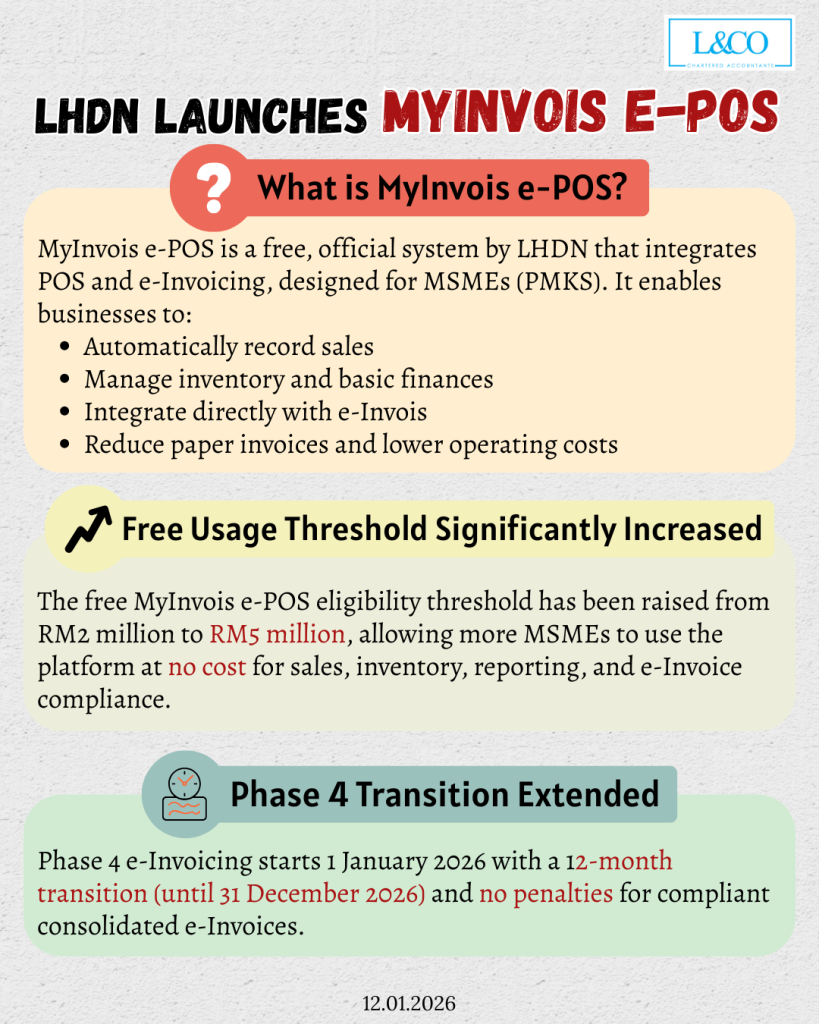

LHDN Launches MyInvois e-POS (Free Official Tool)

To support SMEs in accelerating digital transformation, LHDN has introduced the official MyInvois e-POS platform—enabling seamless e-Invoicing compliance while helping businesses integrate sales, inventory, and [...]

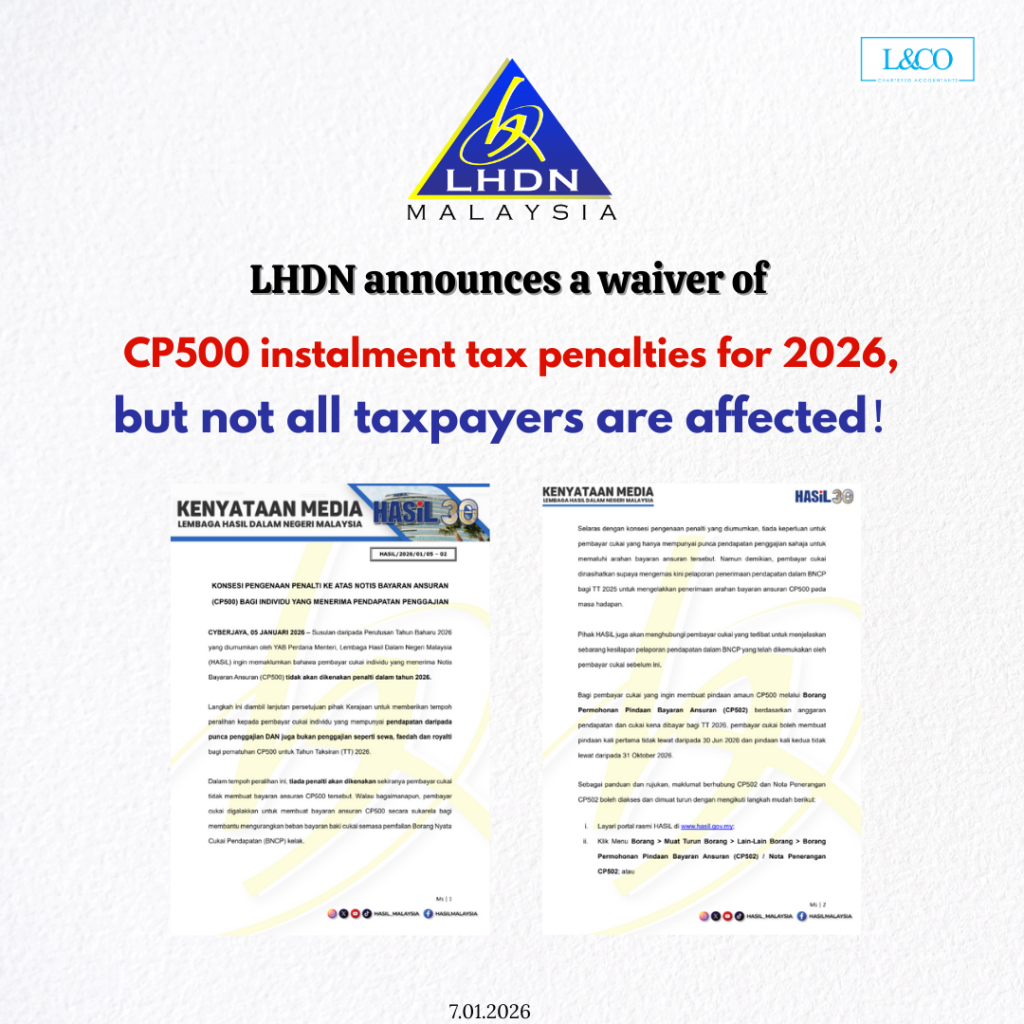

LHDN Announces CP500 Instalment Tax Penalty Waiver for Year of Assessment 2026

The Inland Revenue Board of Malaysia (LHDN) has announced a penalty waiver on CP500 instalment tax payments for the Year of Assessment (YA) 2026.However, the [...]

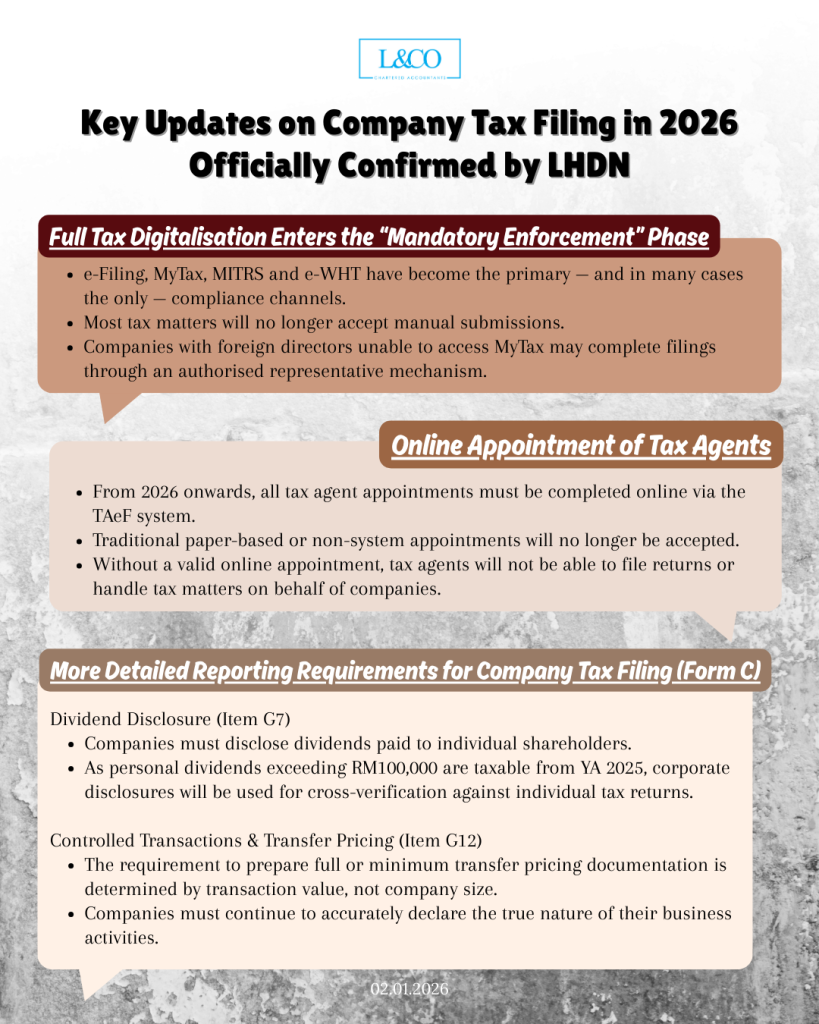

Key Updates on Company Tax Filing in 2026

Key regulatory shifts that will directly impact how businesses manage tax reporting, compliance processes and risk exposure in 2026. Early understanding and preparation are essential [...]

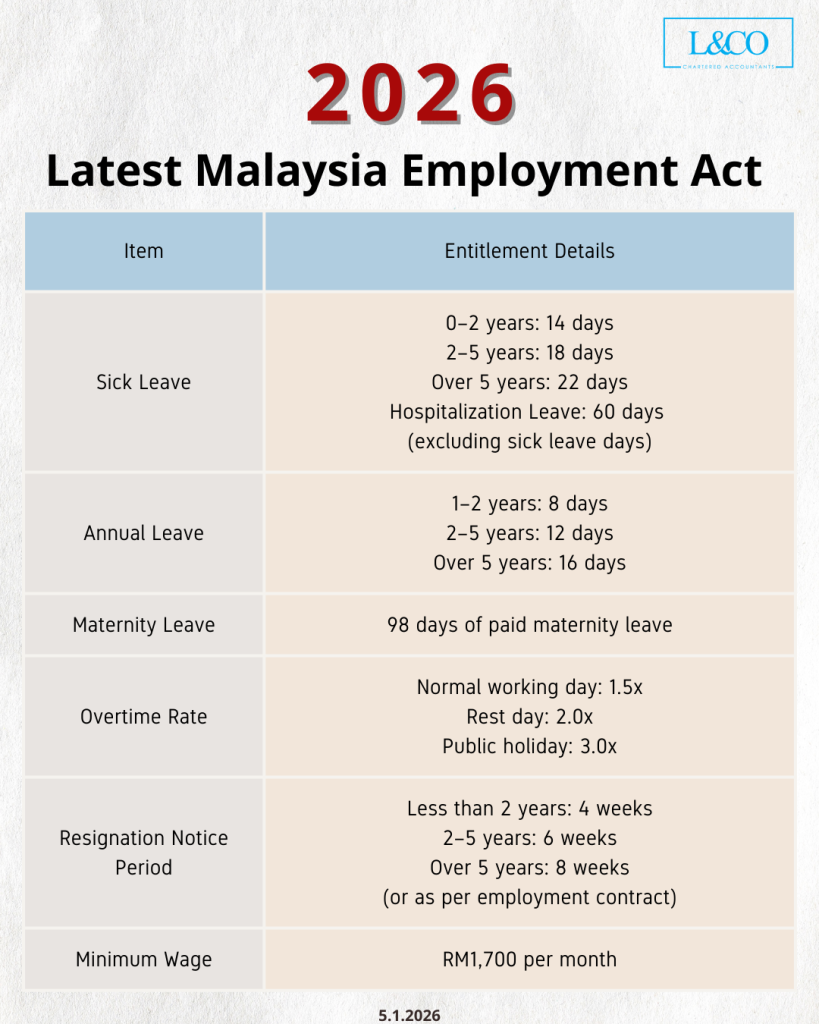

Malaysia Employment Act 2026 – Essential Guide for Employers & Employees

As Malaysia moves into 2026, employment regulations continue to evolve to strengthen employee protection while ensuring fair and compliant business operations. Below is a clear [...]

2026 Malaysia New Policies Key Highlights Summary

In line with efforts to strengthen economic resilience, enhance public well-being, and improve governance, the Government has introduced a series of new policies for 2026. [...]

SSPN Tax Relief 2025: Complete Guide

Starting from the 2025 Assessment Year (YA 2025), Malaysia’s National Education Savings Scheme (SSPN) introduces significant changes to tax relief rules. This guide combines policy [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)