New Qualifying Criteria for Audit Exemption !!

To reduce the financial burden for carrying company audit on micro and small private companies and ensuring financial accountability.

The threshold criteria for audit exemption will be implemented via a phased approach over a period of three years.

Current Criteria

1. Dormant Companies

The company must fulfill any one of the following criteria:

– companies that have been dormant since incorporation

– dormant in the current financial year and in the immediate past financial year qualify for audit exemption.

2. Zero-Revenue Companies

Current year and immediate past two financial year

– Revenue = 0

– Total Assets ≤ RM300,000

3. Threshold-Qualified Companies

Current financial year and in the immediate past two financial years

– Revenue ≤ RM100,000

– Total Assets ≤ RM300,000

– Not more than 5 employees.

New Criteria

A private company qualifies for audit exemption if it fulfils at least 2 of the following criteria:

1. Annual Revenue

The annual revenue of the company during the current financial year and in the immediate past two financial years do not exceed RM3,000,000

2. Total Assets

The total assets of the company in the current statement of financial position and in the immediate past two financial years do not exceed RM3,000,000

3. Number of Employees

The number of employees at the end of the current financial year and in the immediate past 2 financial years do not exceed 30.

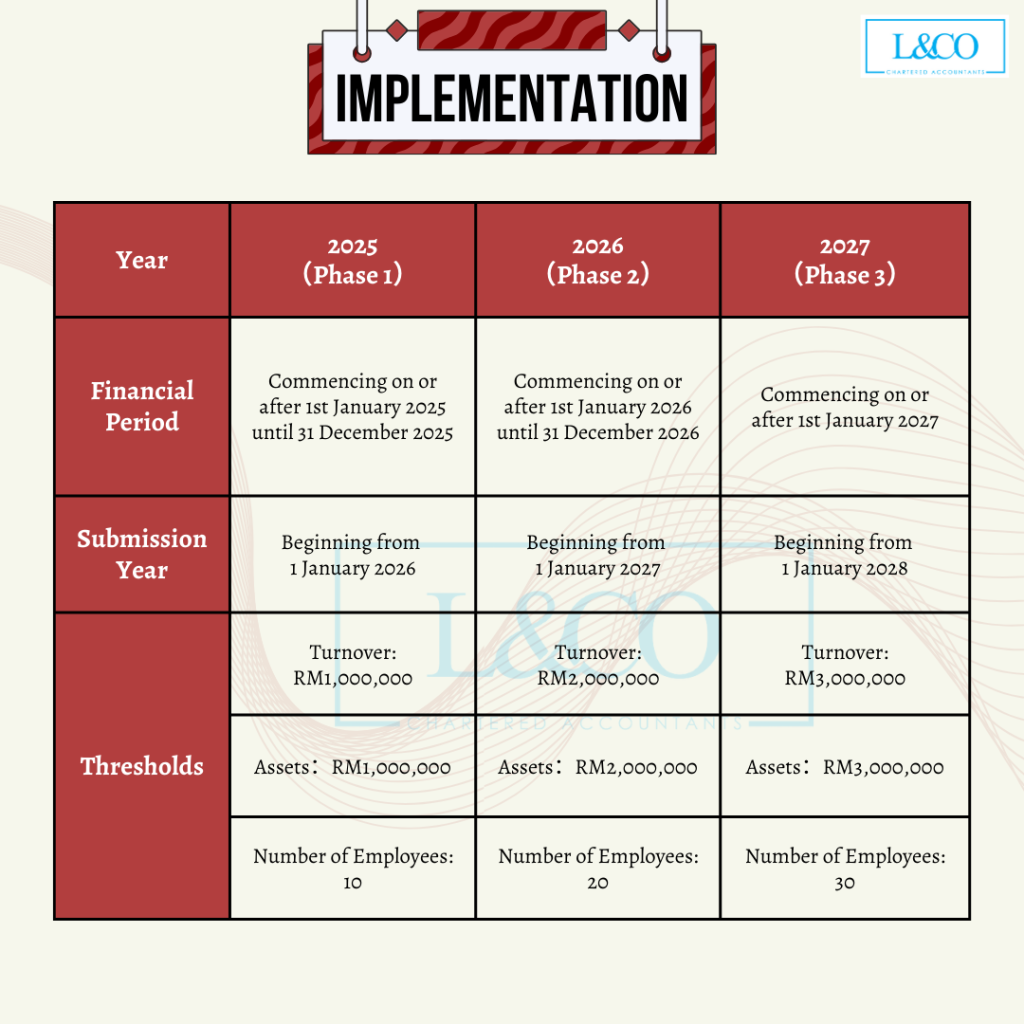

Implementation

2025(Phase 1)

Financial period:Commencing on or after 1st January 2025 until 31 December 2025

Submission year:Beginning from 1 January 2026

Thresholds:

– Turnover:RM1,000,000

– Assets:RM1,000,000

– Number of Employees:10

2026(Phase 2)

Financial period:Commencing on or after 1st January 2026 until 31 December 2026

Submission year:Beginning from 1 January 2027

Thresholds:

– Turnover:RM2,000,000

– Assets:RM2,000,000

– Number of Employees:20

2027(Phase 3)

Financial period:Commencing on or after 1st January 2027

Submission year:Beginning from 1 January 2028

Thresholds:

– Turnover:RM3,000,000

– Assets:RM3,000,000

– Number of Employees:30

OTHER CONDITIONS

- Companies which are dormant since the time of incorporation, and companies which are dormant during the current and immediate past financial year continue to be exempted from audit requirement.

- The exemption from audit under this Practice Directive will not be applicable to:

– an exempt private company which has opted to lodge a certificate relating to its status as an exempt private company to the Registrar pursuant to section 260 of the CA 2016;

– a public company including listed company and a private company that is a subsidiary of a public company

– a foreign company. - Where a company ceases to be qualified for audit exemption, it shall thereupon cease to be exempted but the company shall remain exempted in relation to the accounts for the financial years in which it qualifies.

FAQ: PART Q – AUDIT EXEMPTION (16.12.2024)

Supporting Document: PRACTICE-DIRECTIVE-10-2024

(201706002678 & AF 002133)

(201706002678 & AF 002133)