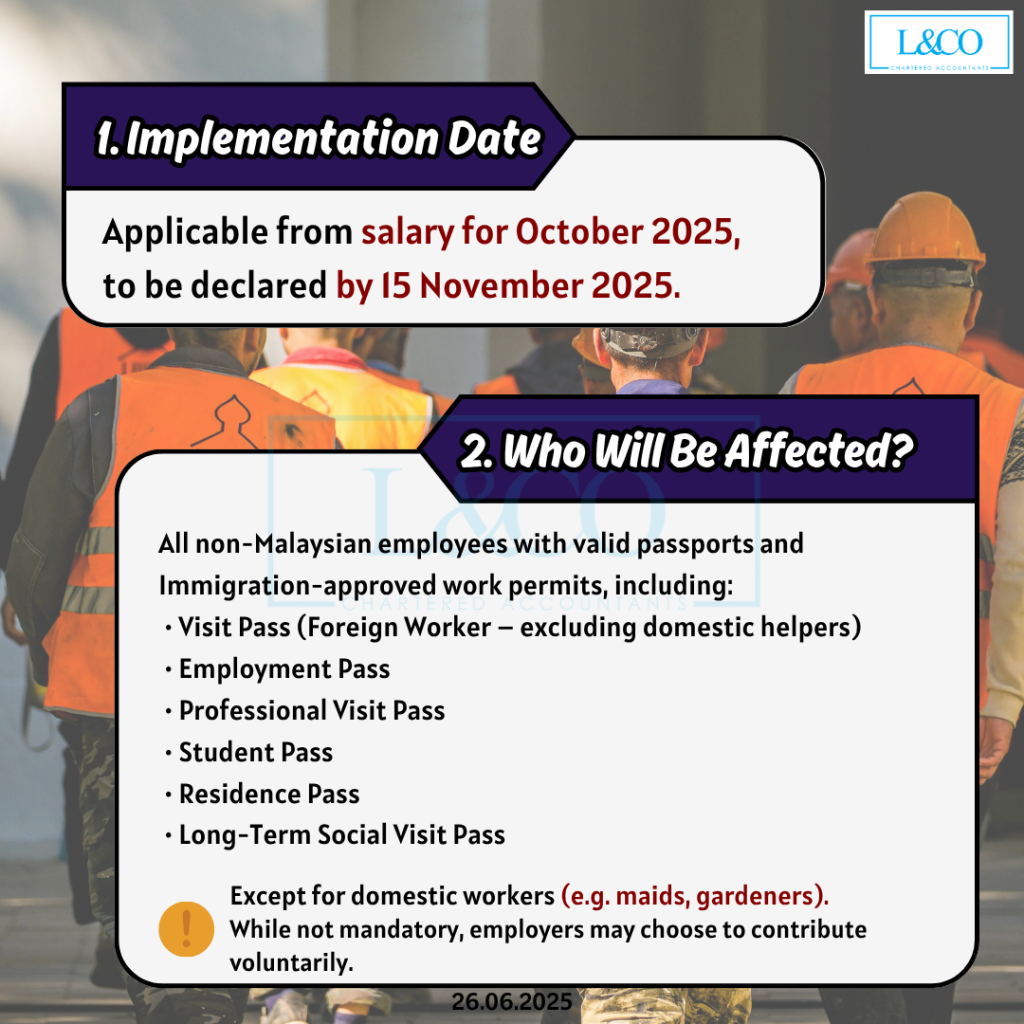

As announced by the Employees Provident Fund (EPF) of Malaysia on 25 June 2025, the Malaysian government will officially expand the scope of EPF contributions starting October 2025. Employers will be required to contribute to the EPF for all foreign employees working in Malaysia, including those holding work permits and foreign professionals.

Key Highlights of the New EPF Policy

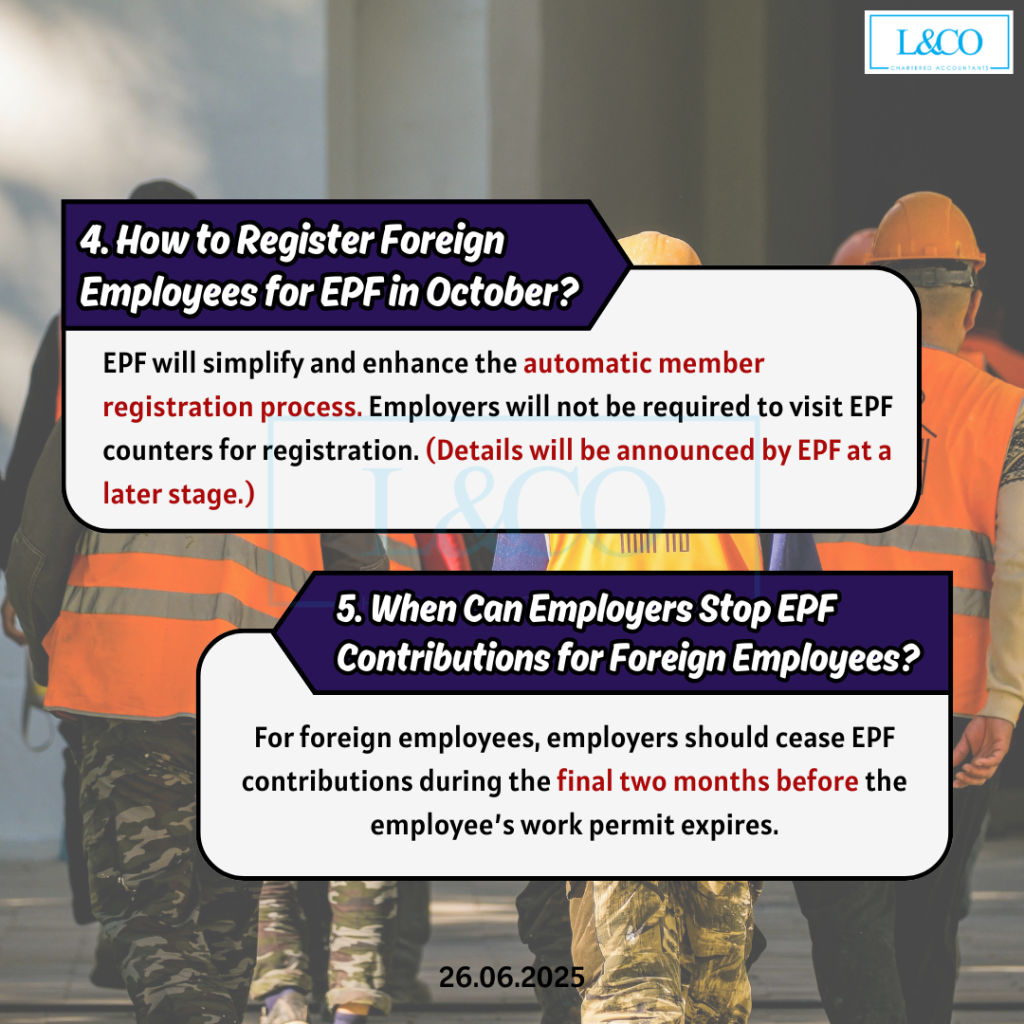

For foreign employees, employers should cease EPF contributions during the final two months before the employee’s work permit expires.

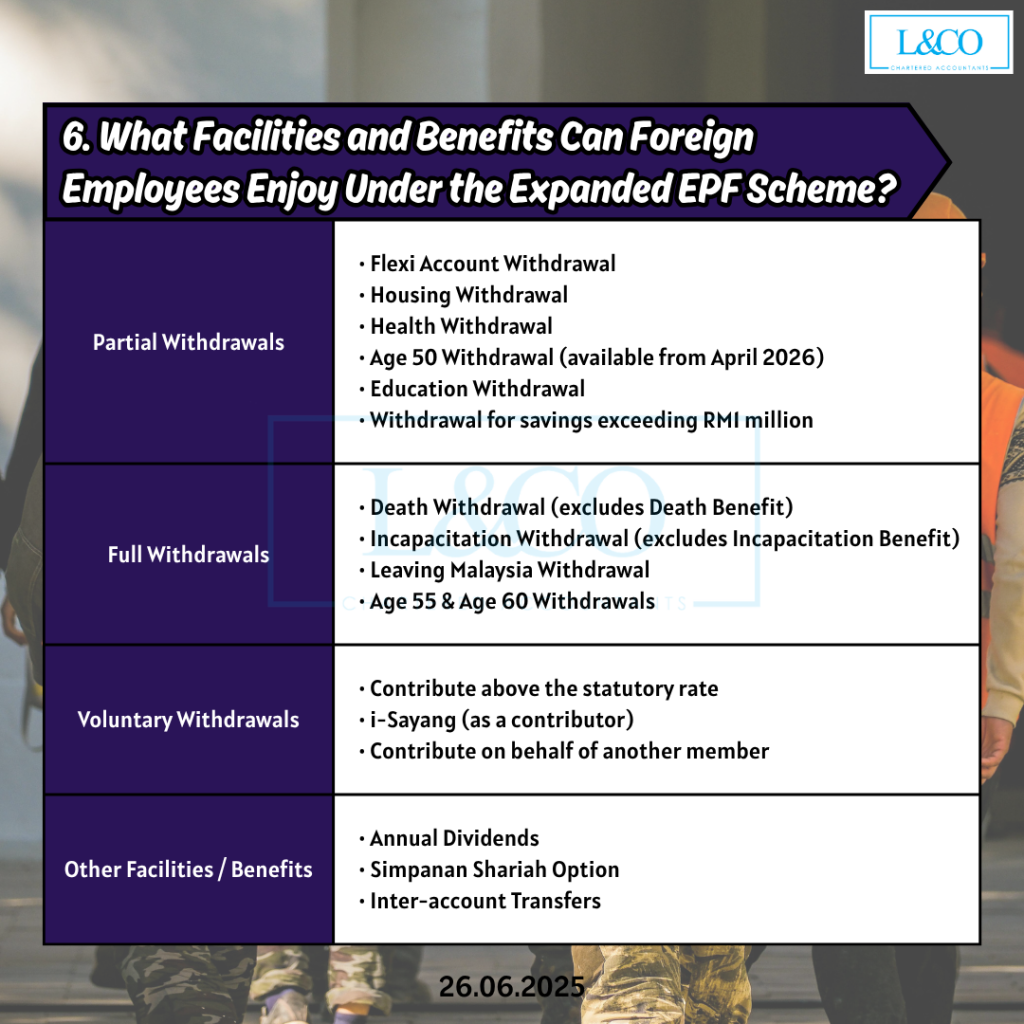

Upon contributing to EPF, foreign employees will be eligible for selected EPF facilities and benefits, subject to the terms and conditions set by EPF, including:

Partial Withdrawals

• Flexi Account Withdrawal

• Housing Withdrawal

• Health Withdrawal

• Age 50 Withdrawal (available from April 2026)

• Education Withdrawal

• Withdrawal for savings exceeding RM1 million

Full Withdrawals

• Death Withdrawal (excludes Death Benefit)

• Incapacitation Withdrawal (excludes Incapacitation Benefit)

• Leaving Malaysia Withdrawal

• Age 55 & Age 60 Withdrawals

Voluntary Withdrawals

• Contribute above the statutory rate

• i-Sayang (as a contributor)

• Contribute on behalf of another member

Other Facilities / Benefits

• Annual Dividends

• Simpanan Shariah Option

• Inter-account Transfers

**Last Updated on 26.06.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)