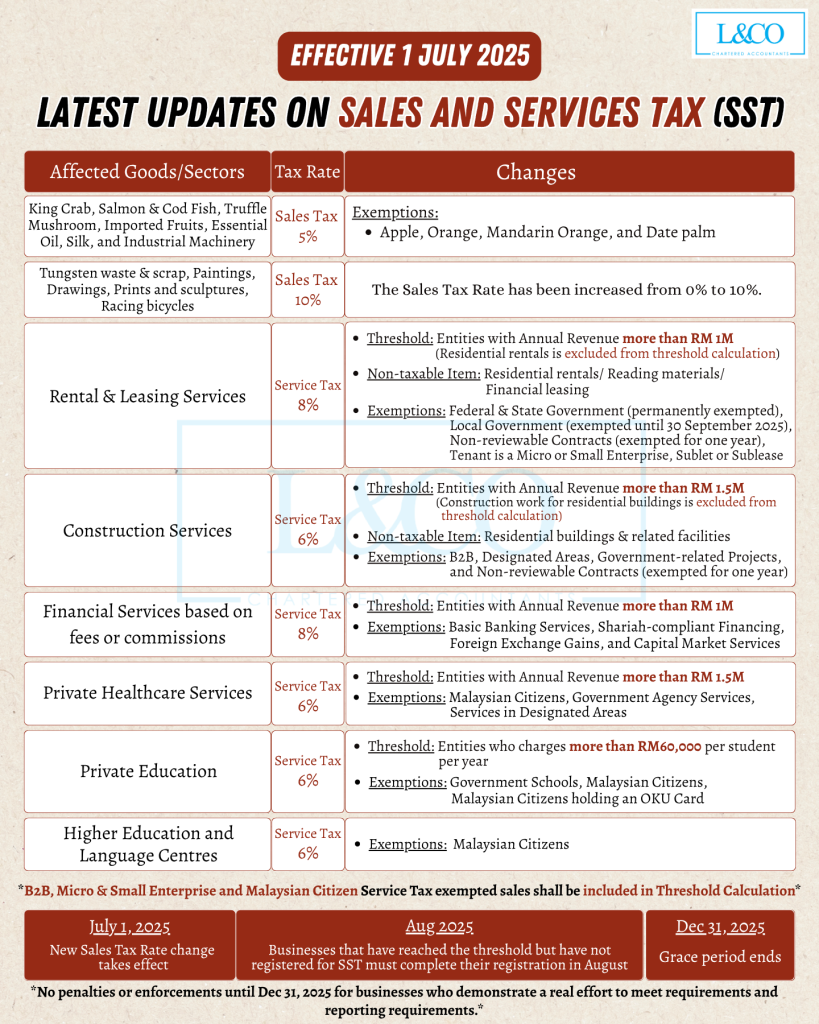

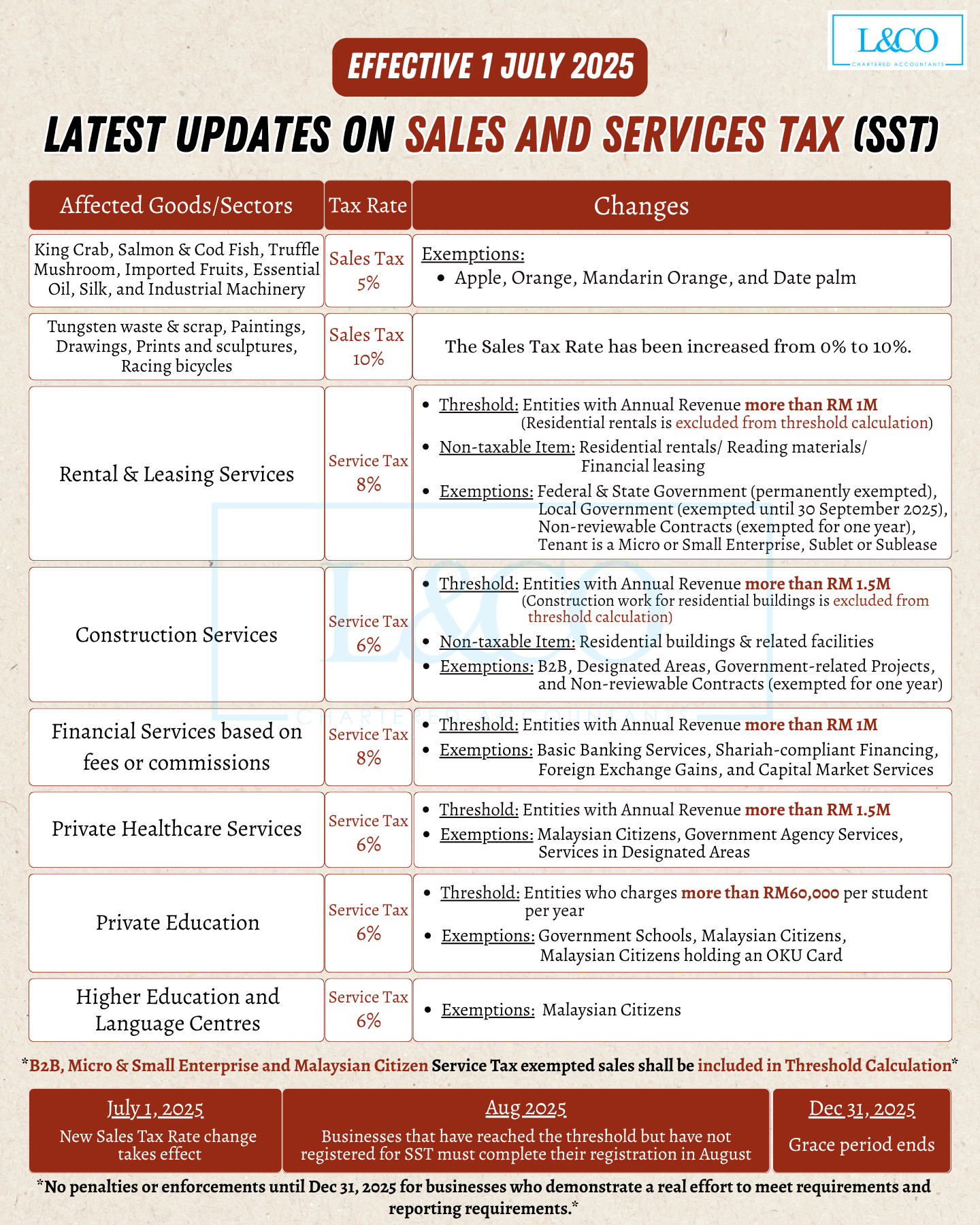

Effective from 1 July 2025. Wide-ranging impact across financial, leasing, construction, and other service sectors!

Key Highlight – Beauty services are now exempted from Service Tax!

Take note of new income thresholds, rate adjustments, and updated filing requirements!

All key points summarized in one image – save and share now!

1. King Crab, Salmon & Cod Fish, Truffle Mushroom, Imported Fruits, Essential Oil, Silk, and Industrial Machinery

- Sales Tax: 5%

- Exemptions: Apple, Orange, Mandarin Orange, and Date palm

2. Tungsten waste & scrap, Paintings, Drawings, Prints and sculptures, Racing bicycles

- The Sales Tax Rate has been increased from 0% to 10%.

3. Rental & Leasing Services

- Service Tax: 8%

- Threshold: Entities with Annual Revenue more than RM 1M

(Residential rentals is excluded from threshold calculation) - Non-taxable Item: Residential rentals/ Reading materials/ Financial leasing

- Exemptions: Federal & State Government (permanently exempted),

Local Government (exempted until 30 September 2025), Non-reviewable Contracts (exempted for one year), Tenant is a Micro or Small Enterprise, Sublet or Sublease

4. Construction Services

- Service Tax: 6%

- Threshold: Entities with Annual Revenue more than RM 1.5M

(Construction work for residential buildings is excluded from

threshold calculation) - Non-taxable Item: Residential buildings & related facilities

- Exemptions: B2B, Designated Areas, Government-related Projects,

and Non-reviewable Contracts (exempted for one year)

5. Financial Services based on fees or commissions

- Services Tax: 8%

- Threshold: Entities with Annual Revenue more than RM 1M

- Exemptions: Basic Banking Services, Shariah-compliant Financing,

Foreign Exchange Gains, and Capital Market Services

6. Private Healthcare Services

- Service Tax: 6%

- Threshold: Entities with Annual Revenue more than RM 1.5M

- Exemptions: Malaysian Citizens, Government Agency Services, Services in Designated Areas

7. Private Education

- Services Tax: 6%

- Threshold: Entities who charges more than RM60,000 per student

per year - Exemptions: Government Schools, Malaysian Citizens, Malaysian Citizens holding an OKU Card

8. Higher Education and Language Centres

- Services Tax: 6%

- Exemptions: Malaysian Citizens

Important Dates

1. July 1, 2025

- New Sales Tax Rate change takes effect

2. Aug 2025

- Businesses that have reached the threshold but have not registered for SST must complete their registration in August

3. Dec 31, 2025

- Grace period ends

Important Notes

- B2B, Micro & Small Enterprise and Malaysian Citizen Service Tax exempted sales shall be included in Threshold Calculation

- No penalties or enforcements until Dec 31, 2025 for businesses who demonstrate a real effort to meet requirements and reporting requirements.

**Lastest Updates on 03.07.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)