Does intercompany billing within the same group require a 6% SST? Not necessarily!

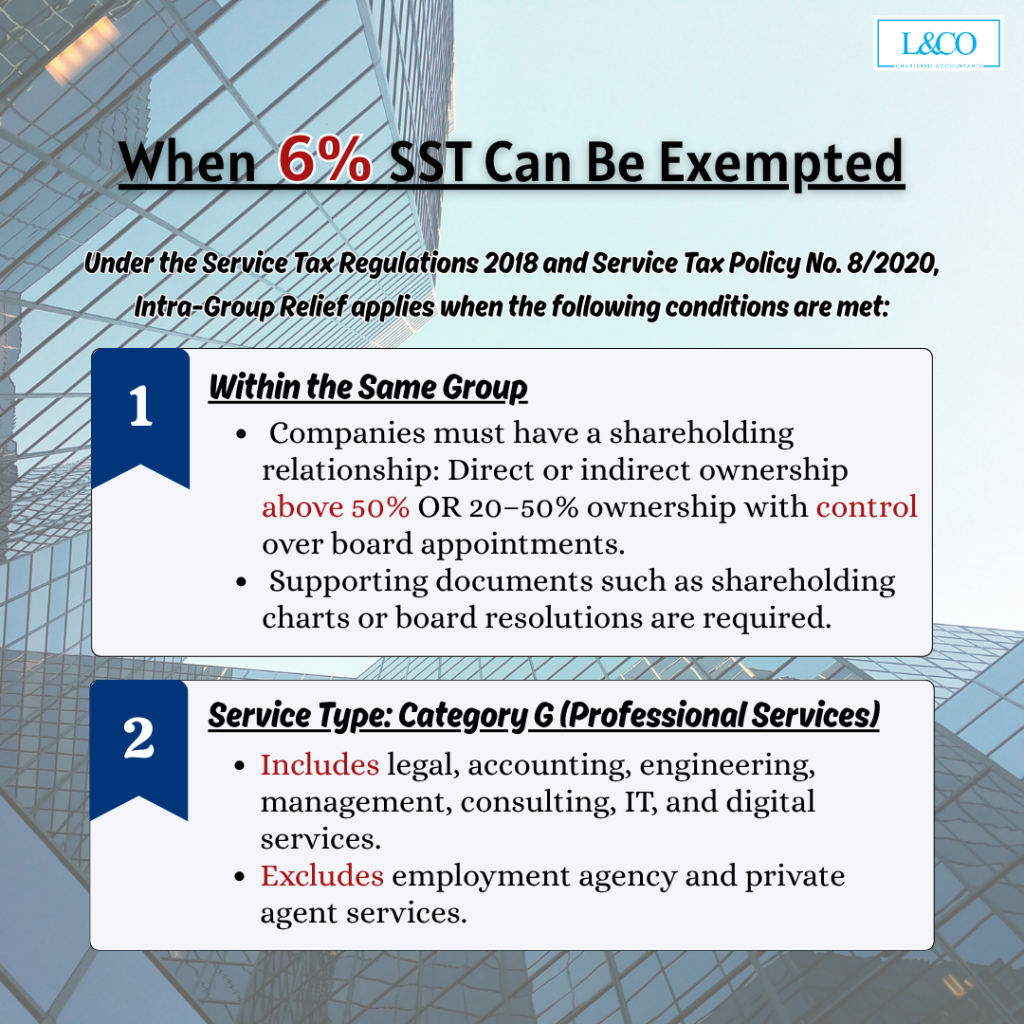

When 6% SST Can Be Exempted?

Under the Service Tax Regulations 2018 and Service Tax Policy No. 8/2020, Intra-Group Relief applies when the following conditions are met:

1. Within the Same Group

- Companies must have a shareholding relationship: Direct or indirect ownership above 50% OR 20–50% ownership with control over board appointments.

- Supporting documents such as shareholding charts or board resolutions are required.

2. Service Type: Category G (Professional Services)

- Includes legal, accounting, engineering, management, consulting, IT, and digital services.

- Excludes employment agency and private agent services.

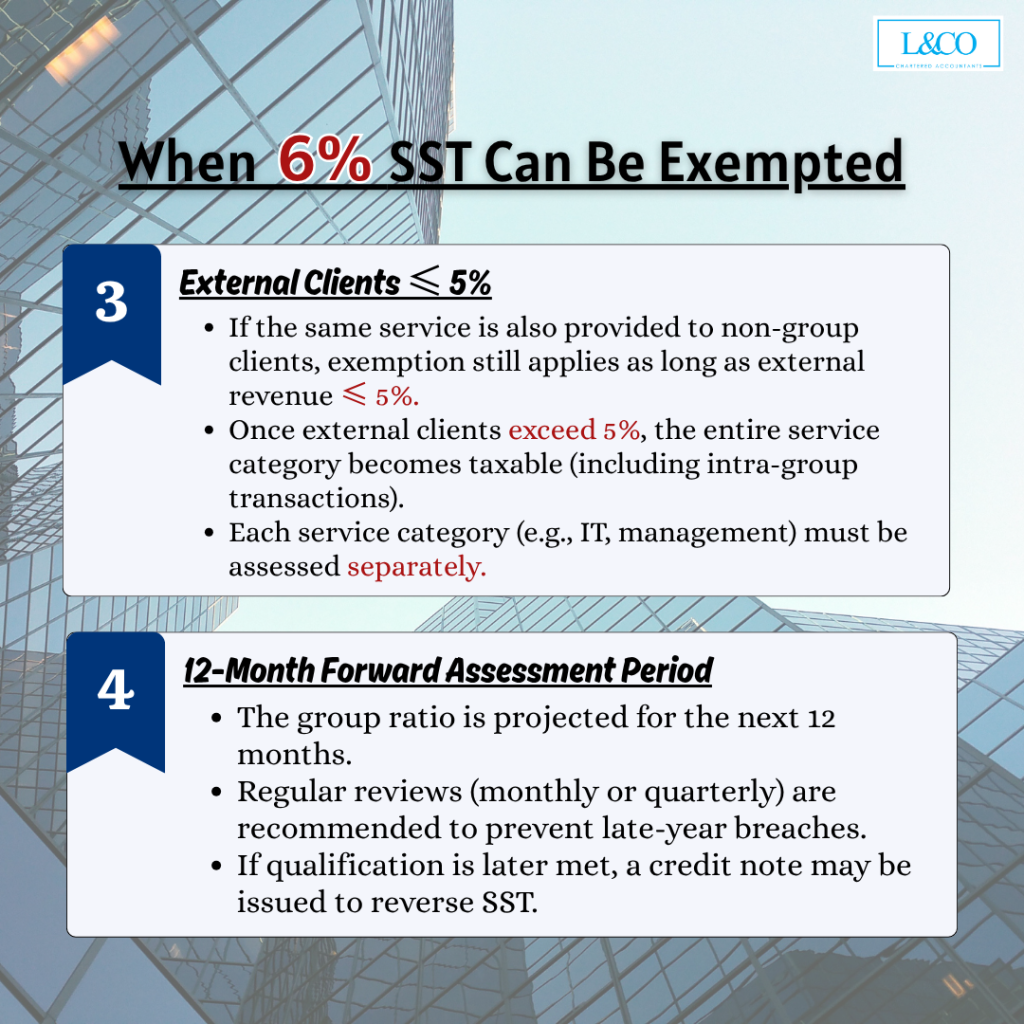

3. The “5% Rule” — External Clients ≤ 5%

- If the same service is also provided to non-group clients, exemption still applies as long as external revenue ≤ 5%.

- Once external clients exceed 5%, the entire service category becomes taxable (including intra-group transactions).

- Each service category (e.g., IT, management) must be assessed separately.

4. 12-Month Forward Assessment Period

- The group ratio is projected for the next 12 months.

- Regular reviews (monthly or quarterly) are recommended to prevent late-year breaches.

- If qualification is later met, a credit note may be issued to reverse SST.

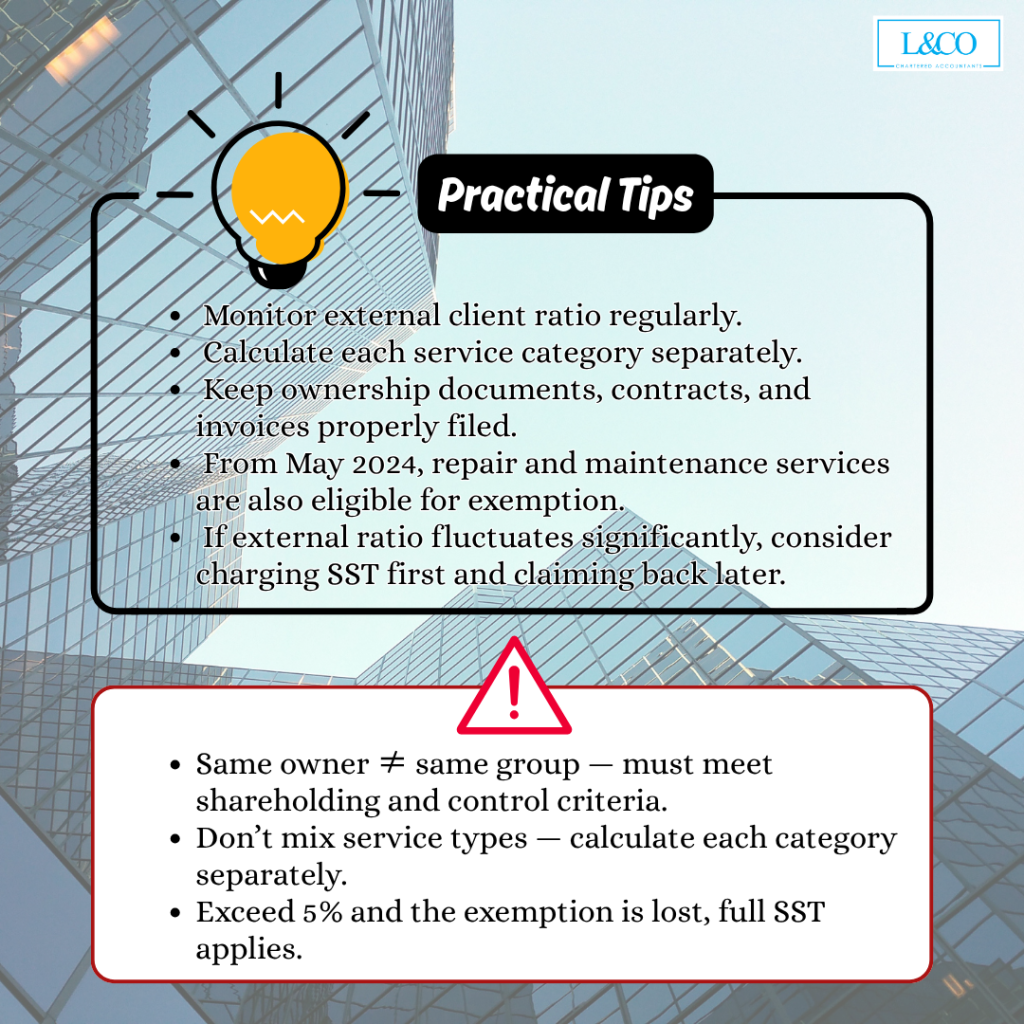

Practical Tips

- Monitor external client ratio regularly.

- Calculate each service category separately.

- Keep ownership documents, contracts, and invoices properly filed.

- From May 2024, repair and maintenance services are also eligible for exemption.

- If external ratio fluctuates significantly, consider charging SST first and claiming back later.

Common Misconceptions

- Same owner ≠ same group — must meet shareholding and control criteria.

- Don’t mix service types — calculate each category separately.

- Exceed 5% and the exemption is lost — full SST applies.

**Last Updated on 04.11.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)