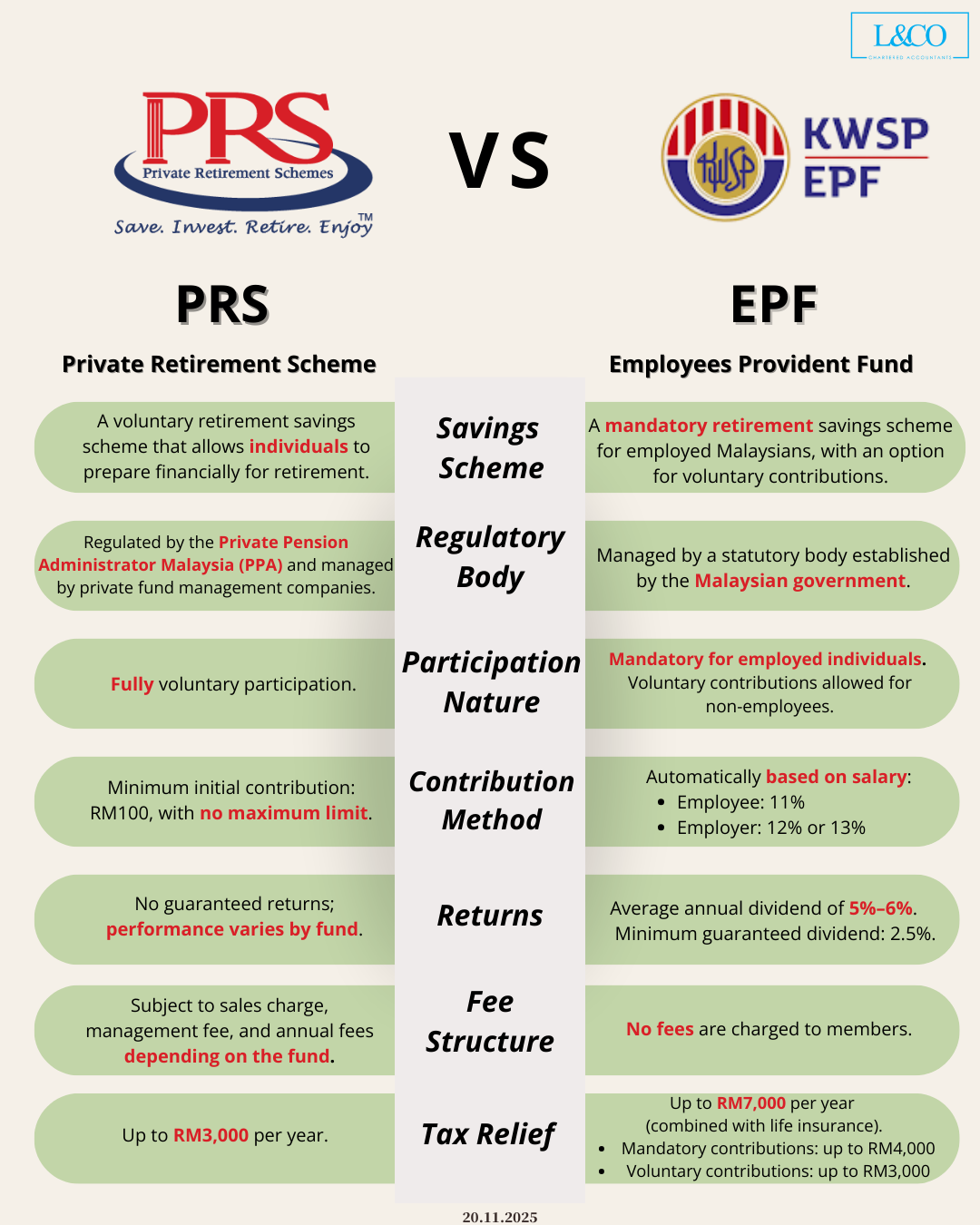

In Malaysia, the primary tools for retirement savings are the Employees’ Provident Fund (EPF) and the Private Retirement Scheme (PRS). While both aim to secure financial stability in retirement, they differ significantly in terms of nature, participation, investment returns, and tax benefits. The following is a detailed comparison for your reference:

EPF: A mandatory retirement savings plan designed to provide stable retirement security.

PRS: A voluntary retirement savings plan with flexible investment options to meet diverse individual retirement planning needs.

EPF :Primarily for salaried employees, with contributions from both employer and employee.

PRS:Open to anyone wishing to save for retirement, including self-employed individuals and voluntary contributors.

EPF: Regulated by the Employees’ Provident Fund (KWSP/EPF).

PRS: Regulated by the Securities Commission (SC), offering diversified investment options.

EPF: Contributions are made monthly at a fixed rate by both employer and employee.

PRS:Contributions are flexible in amount and frequency, adjustable according to personal financial situation.

EPF:Provides stable returns with low risk.

PRS:Returns depend on the chosen funds; higher risk may offer higher potential returns.

EPF:Employee contributions are eligible for personal income tax relief.

PRS:Voluntary contributions can qualify for tax relief of up to RM3,000 per year.

EPF:No additional management fees.

PRS:Management fees vary depending on the fund and product; cost structure should be considered.

EPF: Suitable for individuals seeking stable retirement security; serves as the foundation of long-term savings.

PRS: Suitable for those seeking flexible investment options, early retirement planning, or additional tax benefits.

A combined approach is recommended: use EPF as the foundation for retirement savings while leveraging PRS for flexible investment and tax optimization, resulting in a more comprehensive retirement plan.

**Data updated on 20.11.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)