As Chinese companies increasingly expand overseas, outbound investment has become a common practice. However, many business owners, finance, and legal personnel are not familiar with the ODI (Outbound Direct Investment) filing process, required documents, and key considerations.

Incorrect operations may lead to funds being unable to be transferred abroad or even trigger compliance risks and administrative penalties.

This article provides a comprehensive guide on ODI filing procedures, eligibility requirements, core documents, and key considerations, helping companies ensure that their overseas investments are legal, compliant, and smooth, avoiding unnecessary pitfalls.

By reading this article, you will gain:

- A quick understanding of ODI and its applicable scenarios

- Guidance on whether your company is eligible for filing

- A checklist of required documents to avoid omissions

- Step-by-step process and precautions to reduce approval risks

ODI (Outbound Direct Investment Filing) refers to the mandatory compliance procedure that Chinese companies or individuals must complete before making overseas investments.

Purpose: Ensure that domestic funds flow overseas legally and compliantly.

Applicable scenarios include:

- Establishing a company overseas (e.g., Malaysia, Hong Kong, Singapore, Cayman Islands)

- Capital injection, mergers, acquisitions, or equity participation in overseas companies

- Remittance of domestic funds for long-term investments

Not all companies are eligible to file ODI. Main requirements include:

- Company Age: Generally must be in operation for at least 1 year

- Financial Status: Profit-making according to the latest audited financial statements

- Rationale for Investment: Overseas investment should not exceed the domestic company’s net assets

- Clean Record: No significant violations; shareholders and fund sources must be clear and explainable

In short: having money does not automatically mean you can invest. Compliance is the key.

Domestic Company Documents

- Business license

- Legal representative/shareholder ID proof

- Latest audited financial report

- Bank statements or deposit certificate

- Shareholding structure chart

- Board/Shareholder resolution

- Official statement and commitment letter

Overseas Investment Documents

- Newly established company: proposed name, articles of association, business scope

- Mergers/Acquisitions or Equity Participation: overseas company documents, asset appraisal report, due diligence files

Note: Having complete documents does not guarantee approval. Clear and logical documentation is crucial.

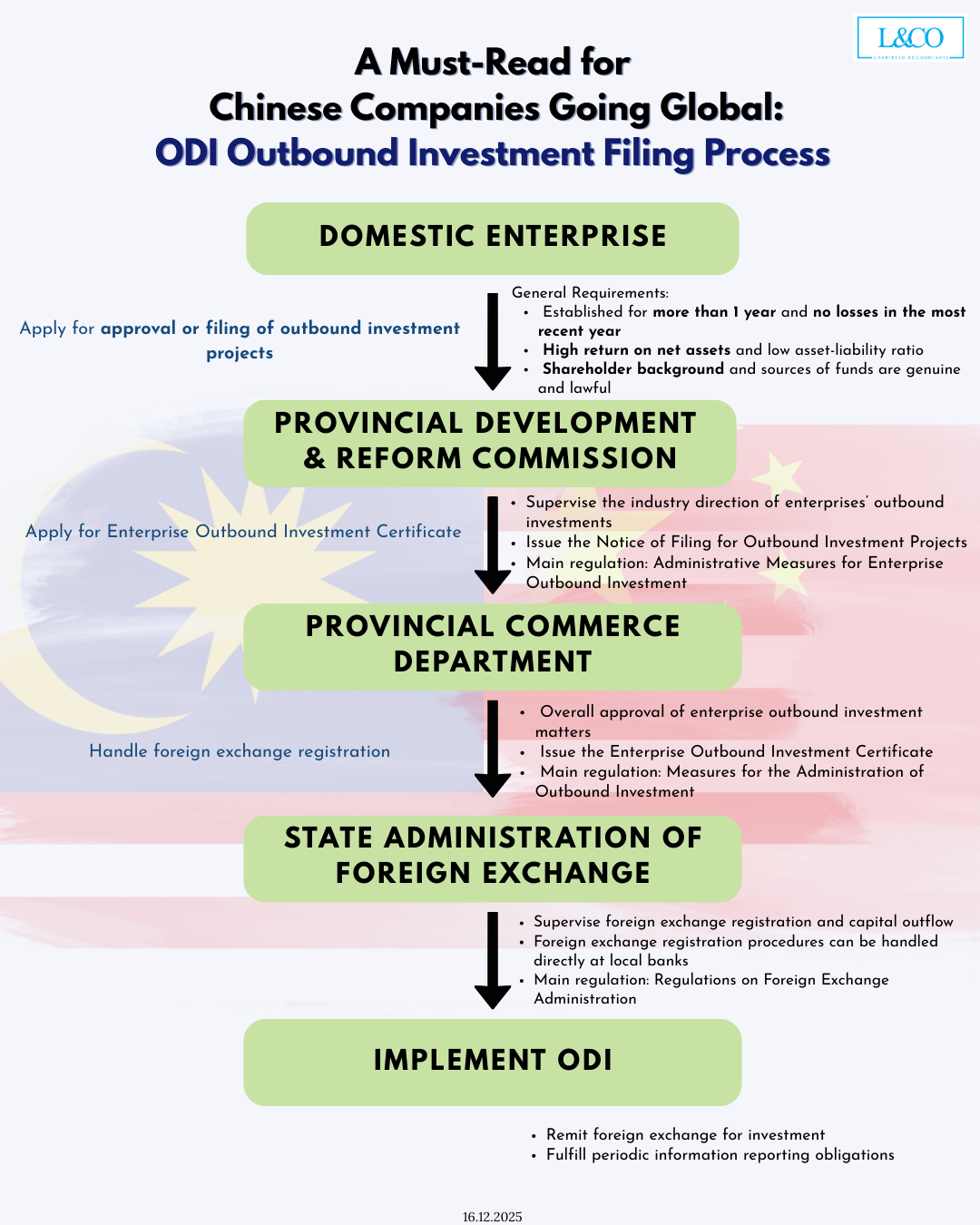

- Preliminary compliance assessment and document preparation

- Apply to the Ministry of Commerce → Obtain the “Certificate of Outbound Investment”

- File with the National Development and Reform Commission (NDRC)

- Supplement documents as requested

- Upon approval, complete foreign exchange registration and fund transfer

Entire process : takes 2–3 months

If it involves sensitive countries or sensitive industries, or the investment amount ≥ USD 300 million approval must be submitted to the Ministry of Commerce and the National Development and Reform Commission

ODI filing is not a one-time procedure. Companies must regularly update information and submit follow-up reports; otherwise, it may affect future fund transfers, reinvestments, or exit operations.

**Data updated on 18.12.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)