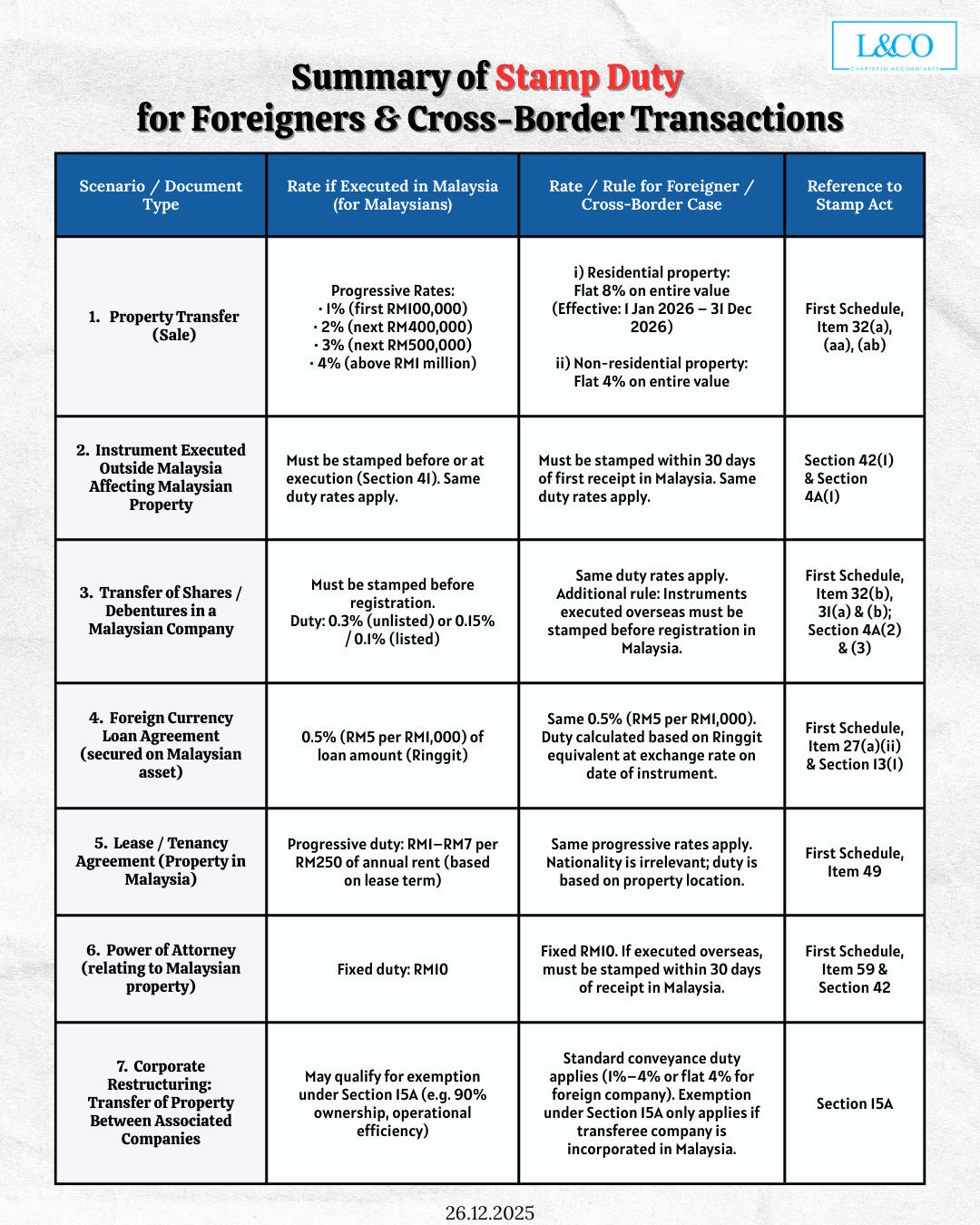

When dealing with foreign investments, cross-border transactions, or documents signed overseas,

the focus of stamp duty is not just on the rate itself. More importantly, it concerns:

whether the document is legally effective, compliant, and whether it may trigger penalties.

With regulations tightening in recent years, both companies and individuals must exercise extra caution in handling cross-border transactions.

Any document signed overseas but involving Malaysian assets or interests must be stamped before it acquires legal effect in Malaysia.

Consequences of unstamped documents:

- Cannot serve as legal evidence

- Cannot be used for registration or enforcement

- May render the transaction invalid

From 1 January 2026, penalties for overseas-signed but unstamped share transfer documents will increase:

From RM250 ➡ To RM1,000 – RM10,000

This will have a significant impact on cross-border investments and equity restructuring.

Permanent Residents (PR) are not considered foreigners

➡ Eligible for progressive stamp duty rates on local real estate

Foreigners

➡ Subject to fixed rates (e.g. 8% for residential property)

Incorrect residency determination may result in significant tax differences.

The stamping period for overseas-signed documents:

Starts from the date the document first enters Malaysia

Not the signing date

Recommended to keep:

- Courier records

- Email receipt timestamps

- Document delivery confirmations

These serve as compliance evidence.

Stamp duty must be calculated:

Using the exchange rate on the signing date

Not on the payment date

Not on the posting date

Cross-border transactions ≠ ordinary transactions

Overseas-signed documents ≠ can be delayed

Residency, timing, and exchange rate all impact tax outcomes

Errors in any step may result in:

- Increased penalties

- Document invalidity

- Transaction delays or rejection

**Data updated on 29/12/2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)