Attention Malaysian Employees and Self-Employed Individuals!

The Employees Provident Fund (EPF/KWSP) has announced significant reforms effective January 1, 2026, aiming to secure long-term retirement funds. These changes directly affect withdrawals, investments, and government-matched contributions.

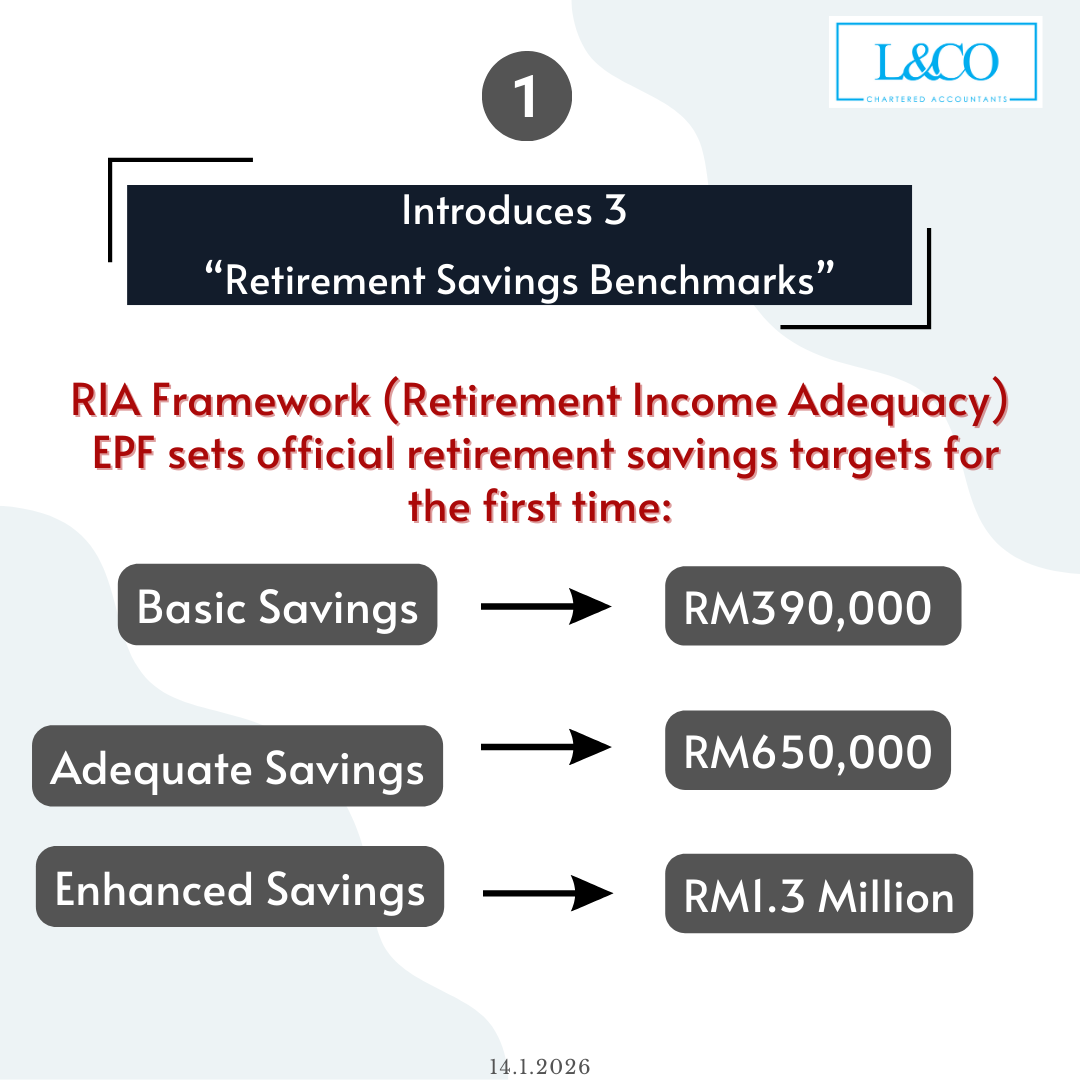

1️. Three Retirement Income Thresholds (RIA Framework)

EPF introduces new Retirement Income Adequacy indicators to help members assess their savings:

- Basic Savings: RM390,000

- Adequate Savings: RM650,000

- Enhanced Savings: RM1,300,000

Note: These thresholds also determine eligibility for investment options.

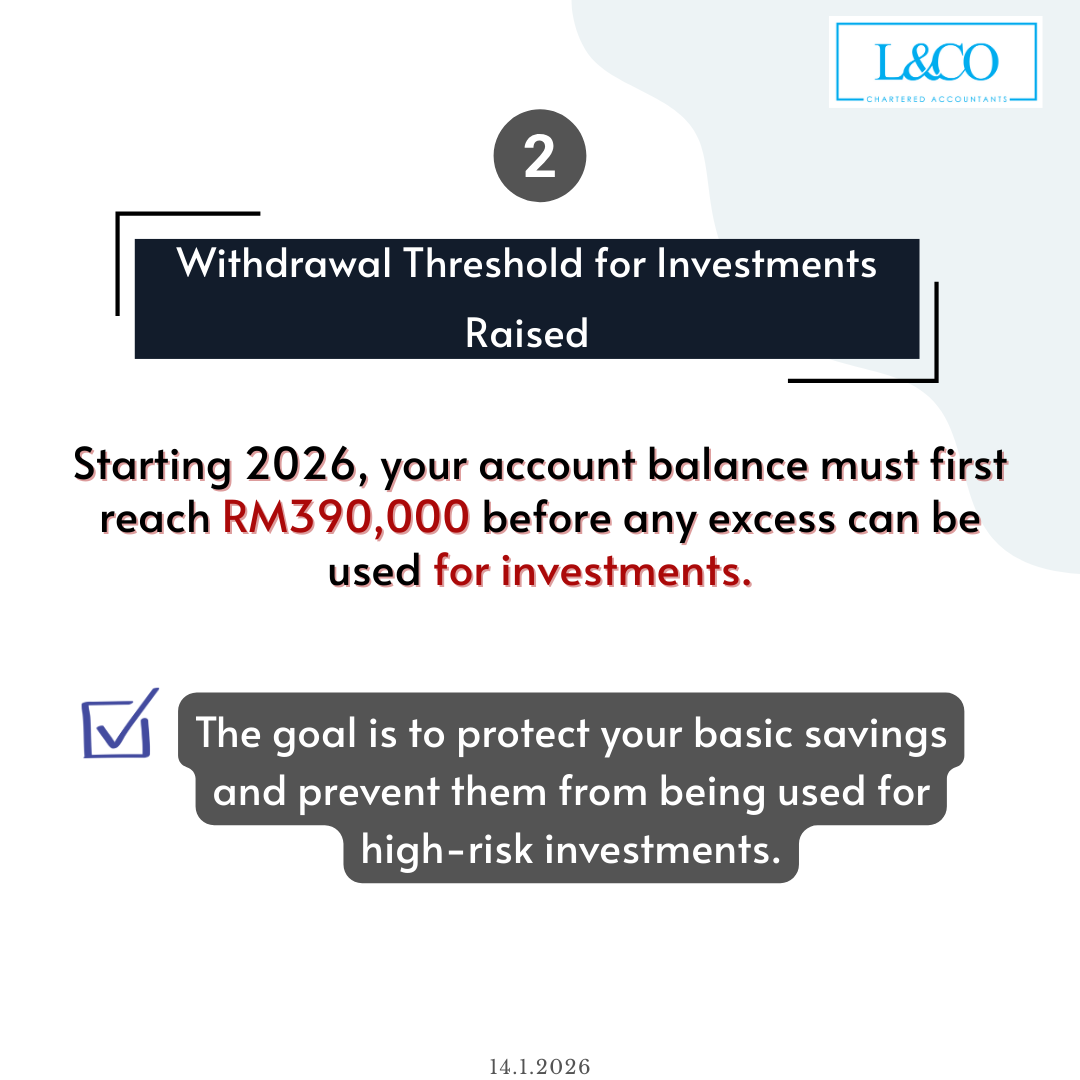

2️. Higher Investment Thresholds

From 2026 onwards, EPF members must maintain at least RM390,000 (Basic Savings) in their account before investing in unit trusts.

Purpose: To protect retirement funds and prevent risky investments.

3️. E-Hailing / P-Hailing Benefits: i-Saraan Plus

Exclusive for gig economy drivers:

- Government matching up to RM600/year

- Lifetime maximum RM6,000

- Automatic registration via platform for easier access

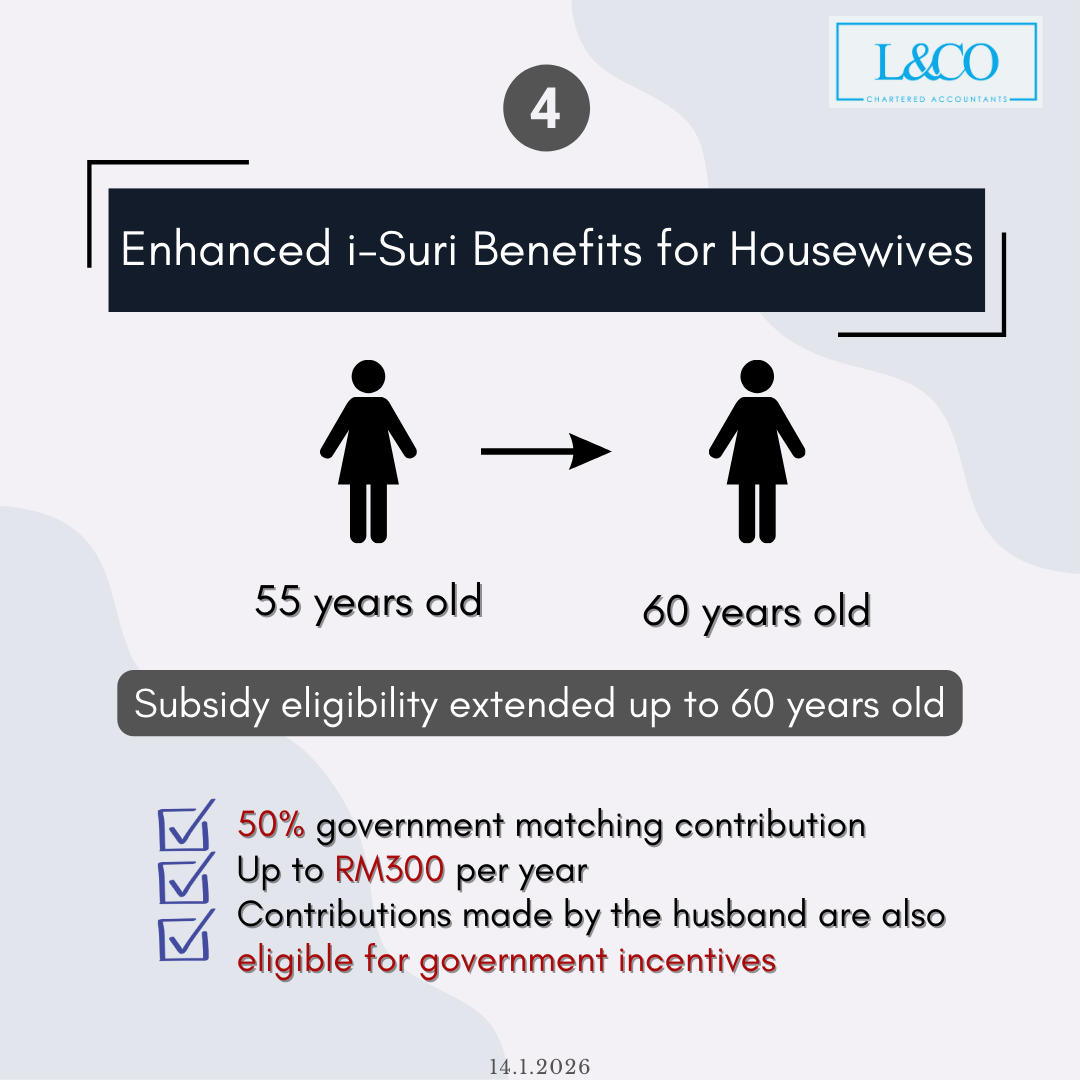

4️. Housewives i-Suri Extended to Age 60

- Government contribution 50%, max RM300/year

- Age limit increased from 55 to 60

- Applies to female members contributing for their family

5️. Hajj Withdrawal Expansion

- Withdrawal limit increased from RM3,000 to RM10,000

- No more Tabung Haji balance verification, simpler process

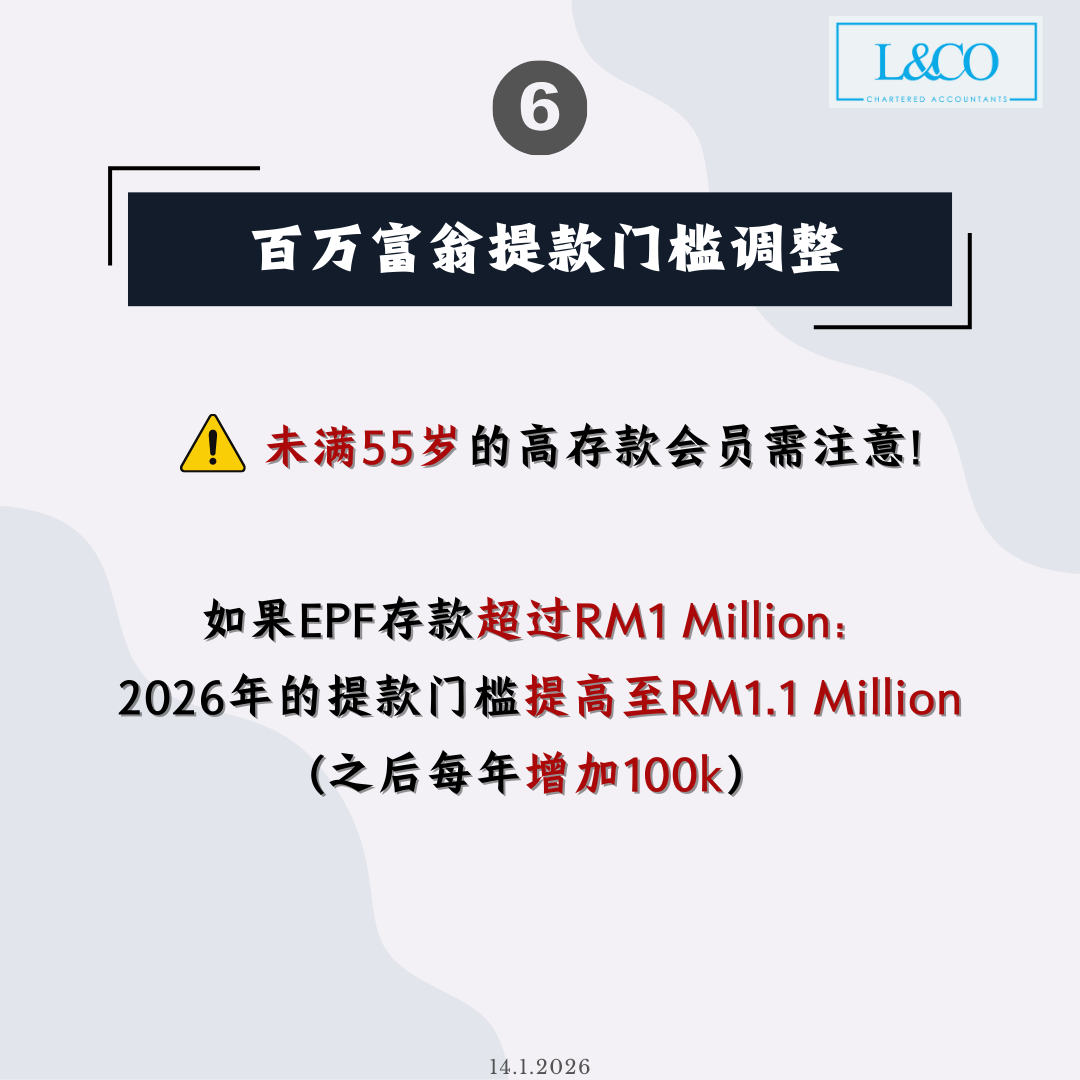

6️. Millionaire Members’ Withdrawal Threshold Adjusted

- Members under 55 with savings above RM1,000,000 will have a withdrawal threshold of RM1,100,000 in 2026

- Threshold increases by RM100,000 annually thereafter

- Encourages funds to remain invested and earn interest for long-term retirement security

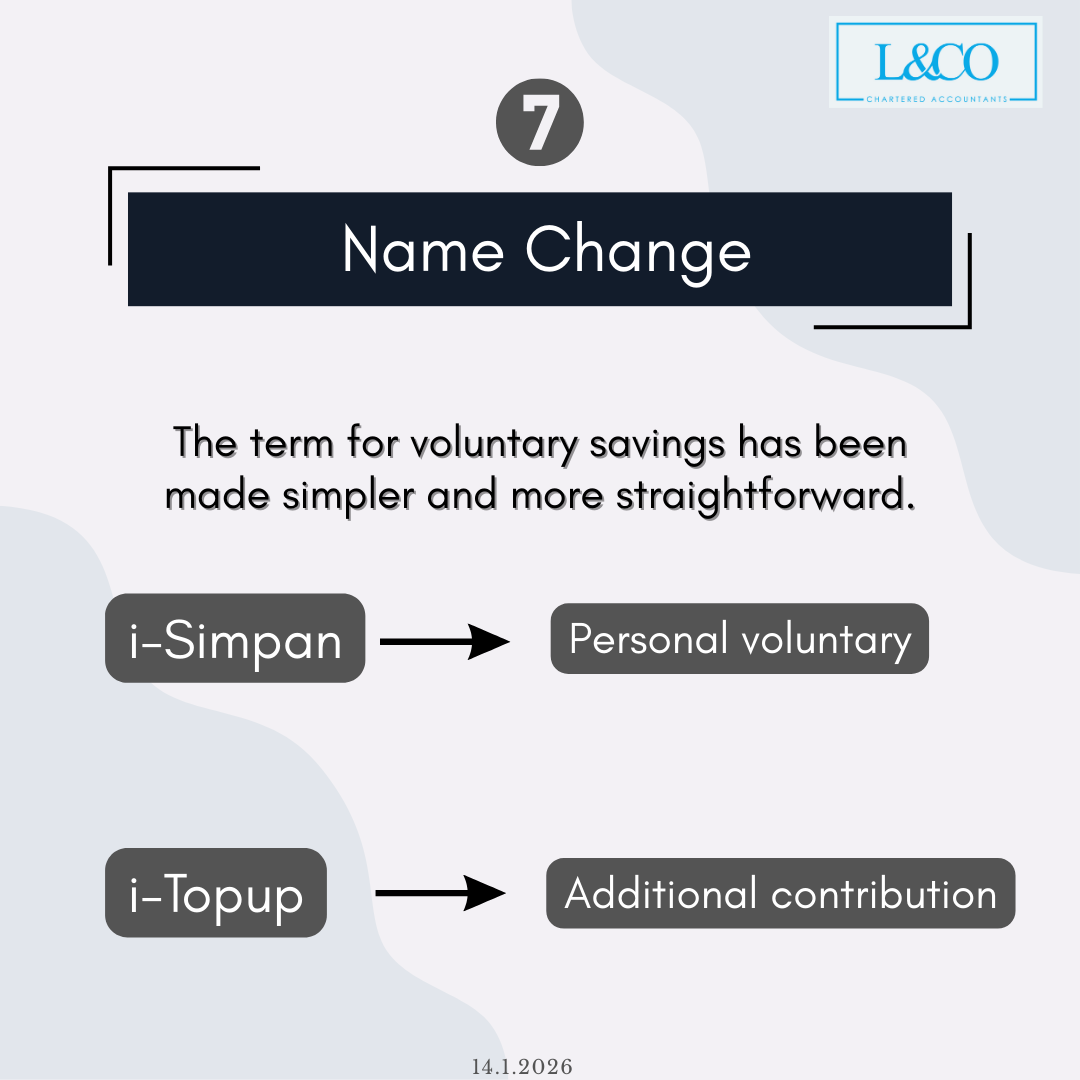

7️. Voluntary Savings Renamed

- i-Simpan: Personal Voluntary Contribution

- i-Topup: Additional Contribution

- Clearer names for better understanding and management

Conclusion

The 2026 KWSP reforms are designed to protect retirement savings. Members are encouraged to review their account balance and adjust their investment and withdrawal strategies according to the new rules.

(201706002678 & AF 002133)

(201706002678 & AF 002133)