With the rise of the content creation economy, more and more individuals are earning income through social media platforms.

Whether you are an influencer, blogger, KOL, virtual streamer, or even just a part-time content creator, any income earned may be subject to income tax.

This guide will help you understand the basic principles and key considerations for influencer taxation.

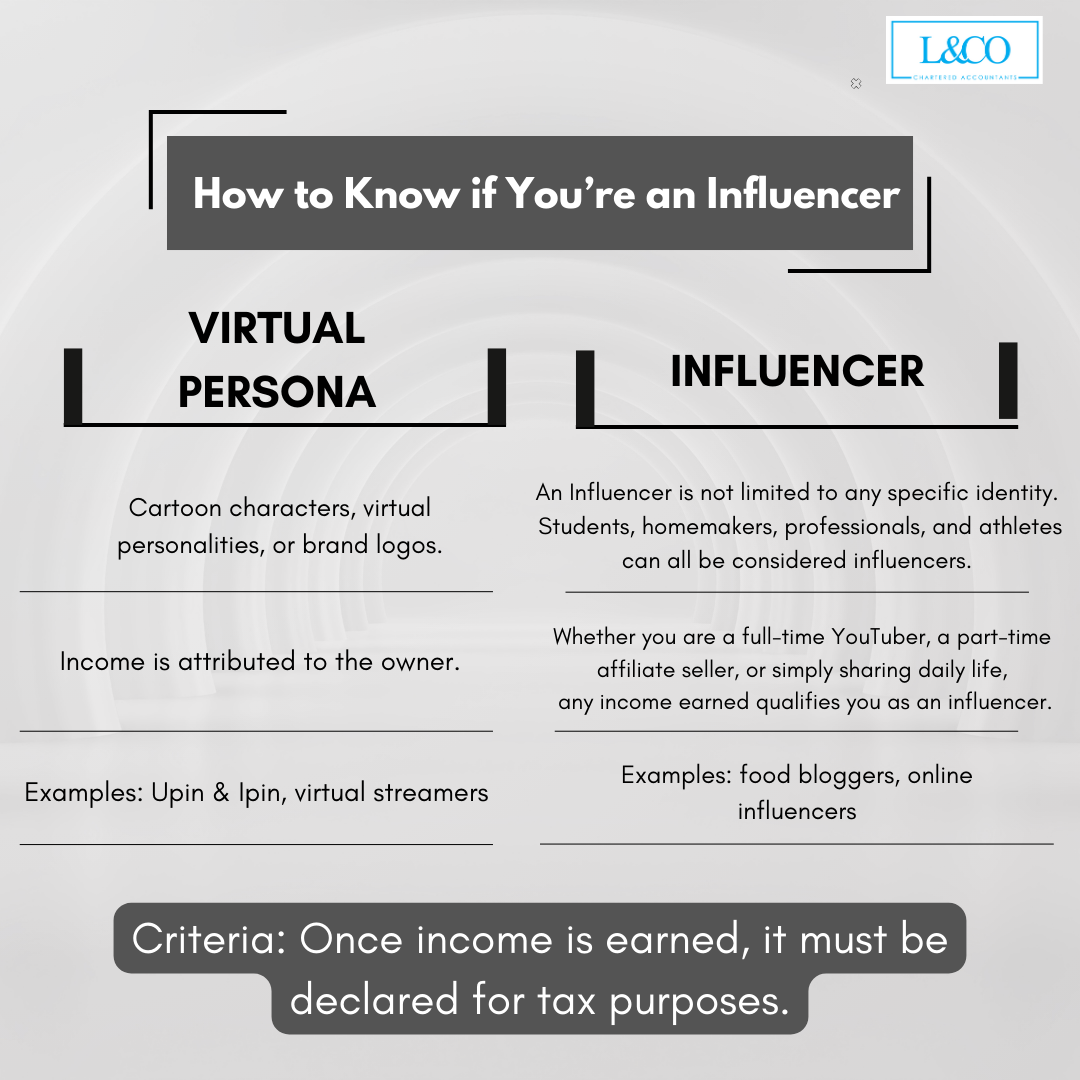

1. How to Determine if You Are an “Influencer”

- Virtual Persona / Virtual Brand

Includes cartoon characters, virtual personas, brand logos, etc.

Income generated is attributed to the individual owner.

Examples: virtual streamers, IP characters. - Individual Influencer

Influencers are not limited to a specific profession. Students, homemakers, professionals, or athletes may also fall within this category.

Whether you are a full-time YouTuber, doing part-time product promotions, or simply sharing your daily life, once you receive income, it is considered taxable.

Key determining factor: As long as there is income received, it falls within the scope of tax reporting obligations.

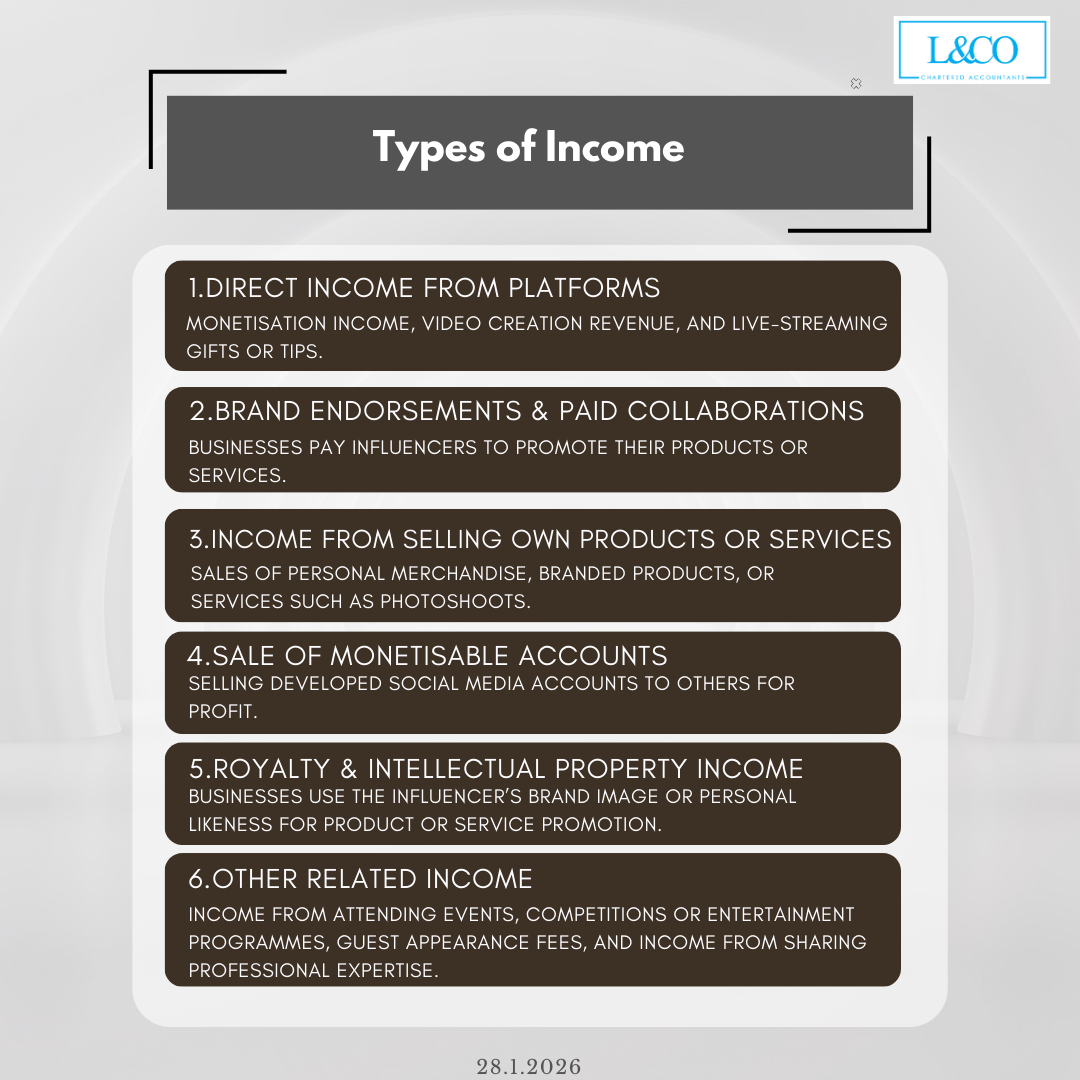

2. Common Types of Influencer Income

- Platform revenue share, live stream rewards

- Commercial endorsements, sponsored collaborations

- Sales of products or services (merchandise, photoshoots, courses, etc.)

- Sale of monetized accounts

- Copyright / image licensing income

- Appearance fees (events, judging, ribbon-cutting, etc.)

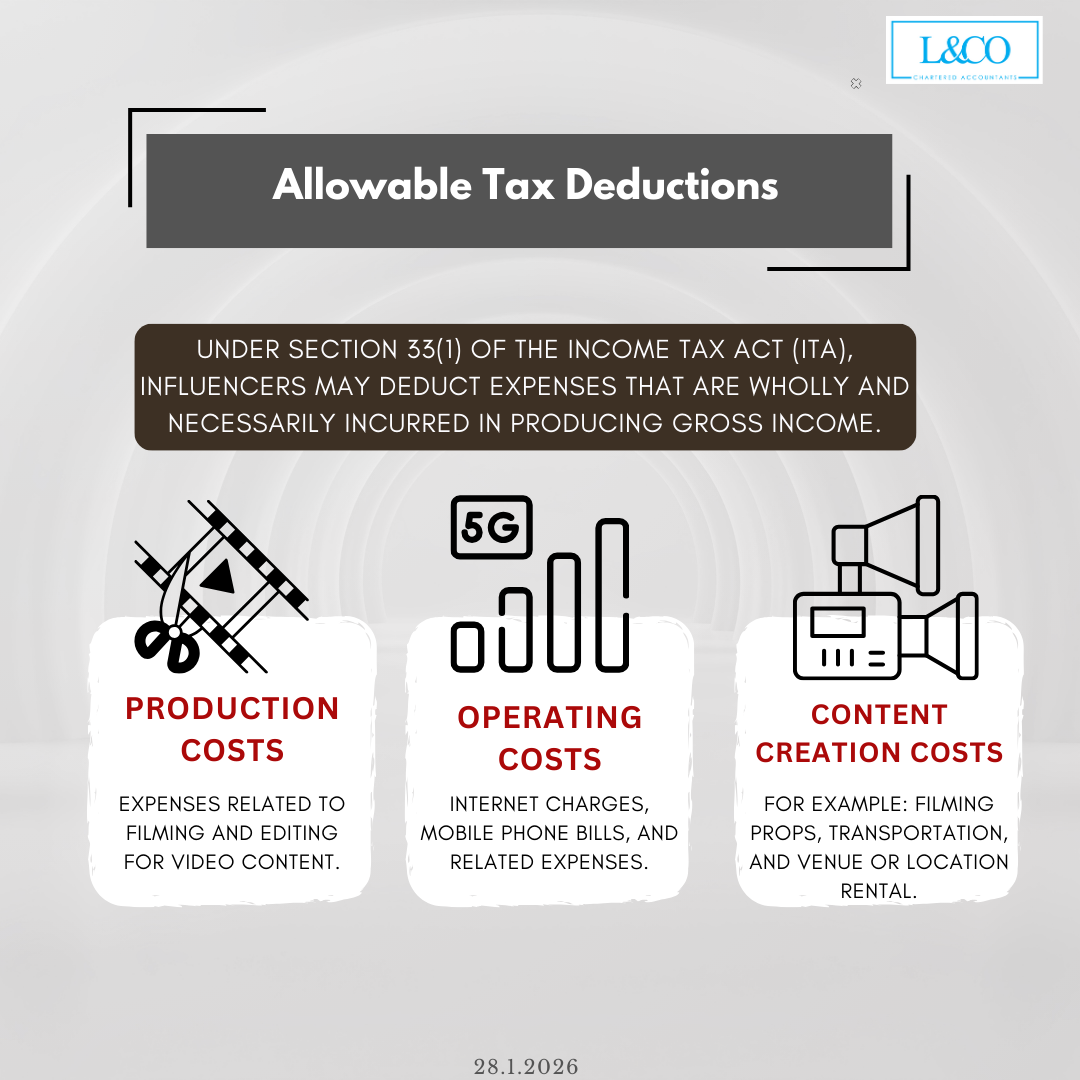

3. Tax-Deductible Expenses (ITA Section 33(1))

Influencers may deduct necessary expenses incurred to earn income, including but not limited to:

- Production costs: filming, editing, post-production

- Operating costs: internet, software subscriptions, etc.

- Content creation costs: props, set design, etc.

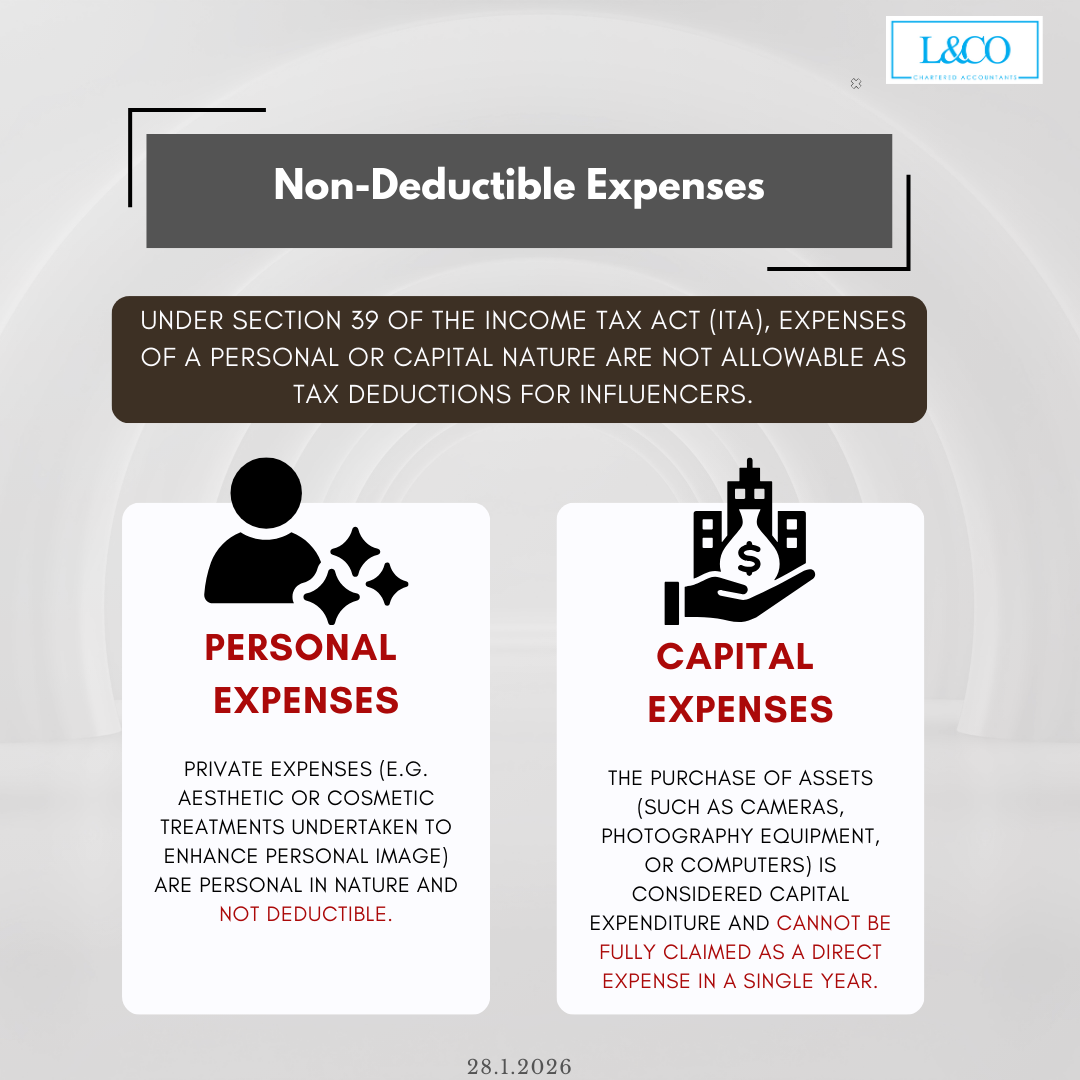

4. Non-Deductible Expenses (ITA Section 39)

The following expenses cannot be claimed as deductions:

Personal expenses

Such as cosmetic procedures, personal image enhancement, or other private expenditures.

Capital expenditures

Purchases such as cameras, computers, and other assets cannot be deducted in full at once,

but may be claimed over several years under ITA Schedule 3 (Capital Allowances).

5. Do Overseas Earnings Need to Be Reported?

Yes.

Income must be reported in Malaysia if it meets any of the following:

- Generated in Malaysia

- Originates from Malaysia

- Remitted from abroad and received in Malaysia

Even if the platform is based overseas, any income related to Malaysia must be declared.

6. Tax Responsibilities and Filing for Influencers

- All influencer income is considered business income

- Must be reported via Form B

- Full records of income and expenses must be maintained

- Individual influencers may also receive a CP500 notice, which is issued based on the tax declared in the previous year’s Form B and the estimated tax payable.

(201706002678 & AF 002133)

(201706002678 & AF 002133)