Do not let outstanding tax issues prevent you from leaving the country.

Before your trip, it is strongly advisable to check your tax and travel restriction status to avoid any disruption at the airport.

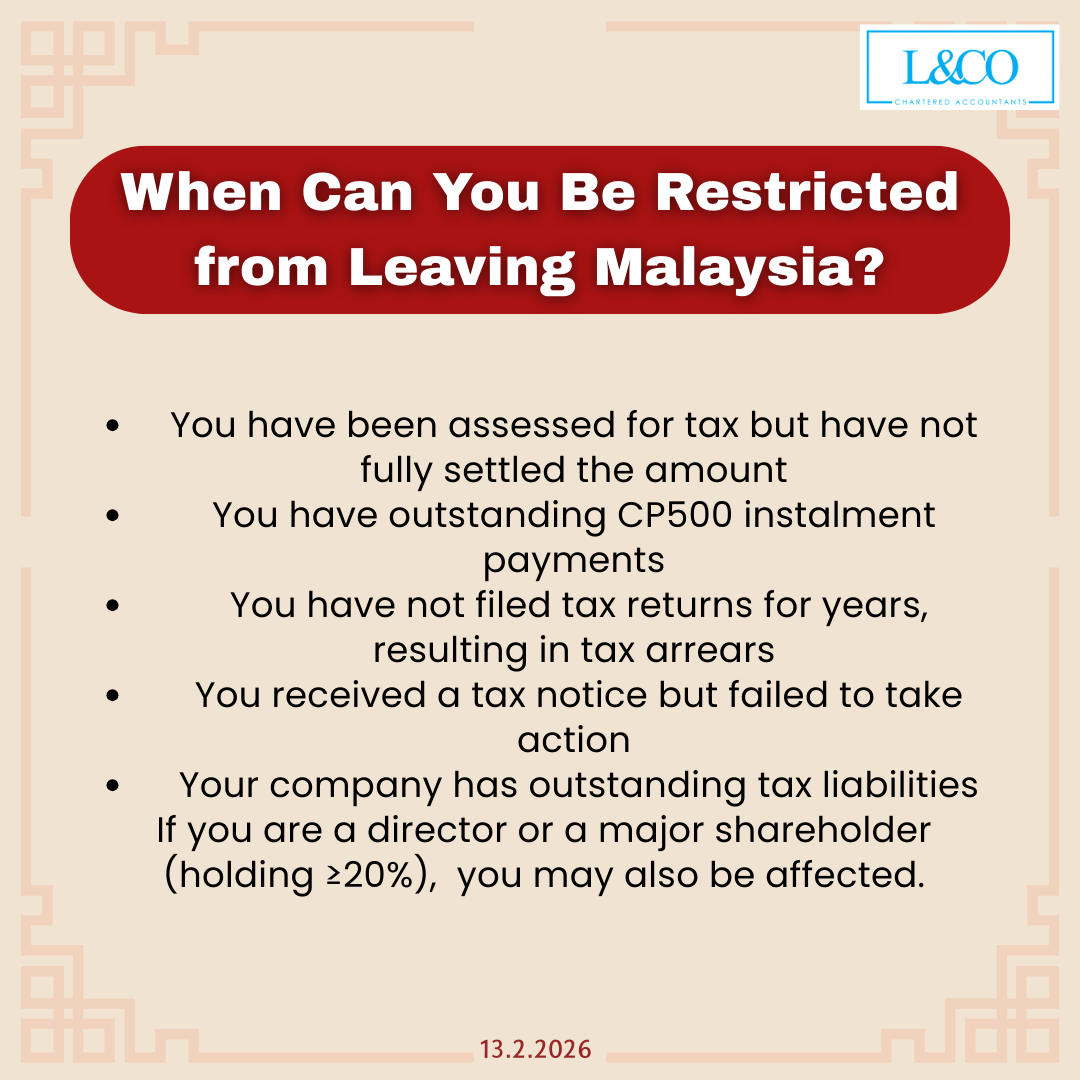

In What Situations Could You Be Restricted from Leaving Malaysia?

You may be subject to a travel restriction if any of the following apply:

1. Assessed but Unpaid Taxes

You have received a Notice of Assessment but have not settled the outstanding tax within the stipulated period.

2. Outstanding CP500 Instalments

Failure to pay CP500 tax instalments as scheduled.

3. Failure to File Tax Returns for Several Years

Non-submission of tax returns may result in estimated assessments and accumulated tax arrears.

4. Ignoring Tax Notices

Tax notices or penalty letters received but left unattended.

5. Company Tax Arrears Affecting Directors or Major Shareholders

If a company has outstanding tax liabilities, directors or shareholders holding 20% or more shares may also be affected by travel restrictions.

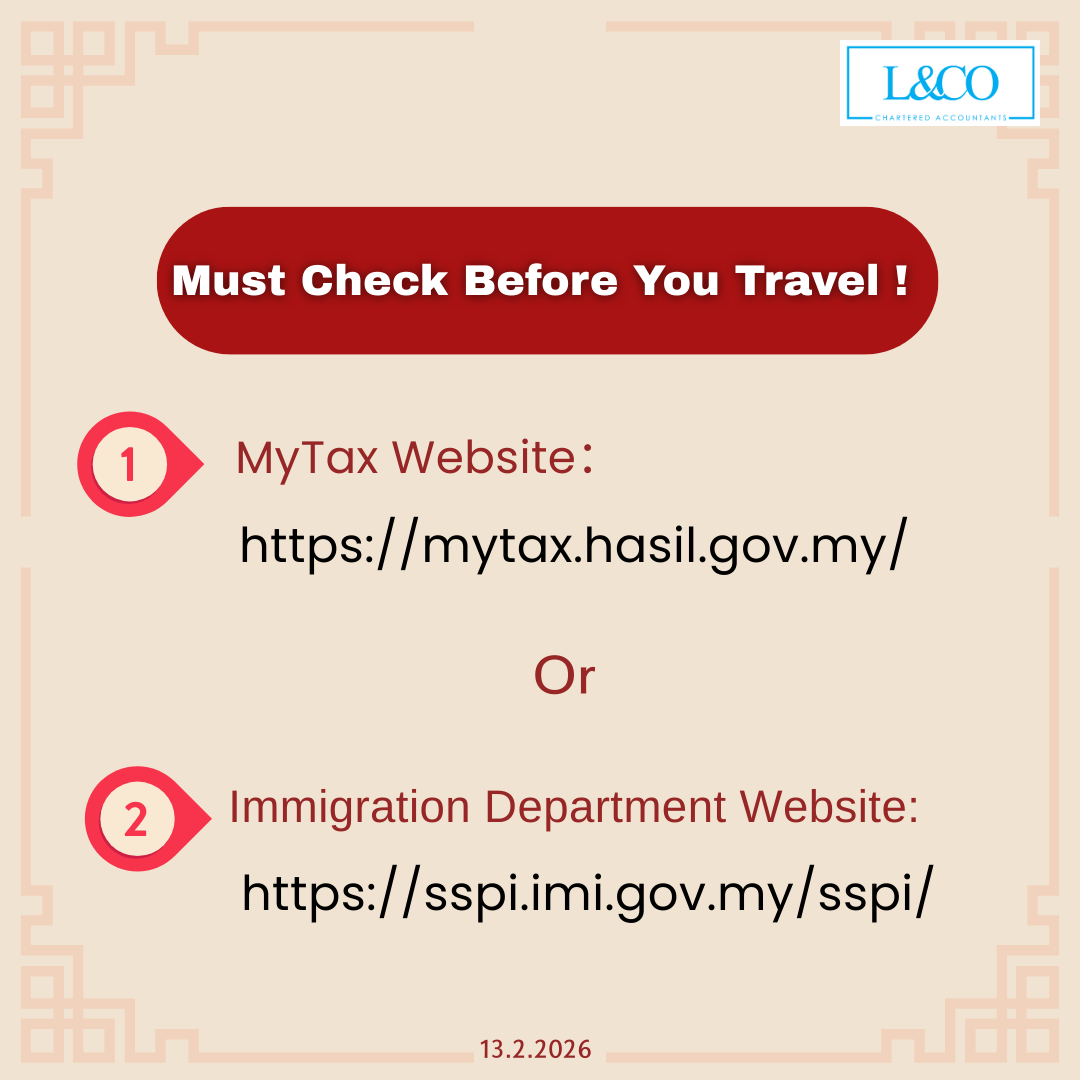

Check Before You Travel

It is recommended to verify your travel status prior to departure.

Method 1: Check via MyTax Portal

https://mytax.hasil.gov.my/

Log in to your MyTax account to review any outstanding tax balances or related restrictions.

Method 2: Check via Immigration Department (SSPI System)

https://sspi.imi.gov.my/sspi/

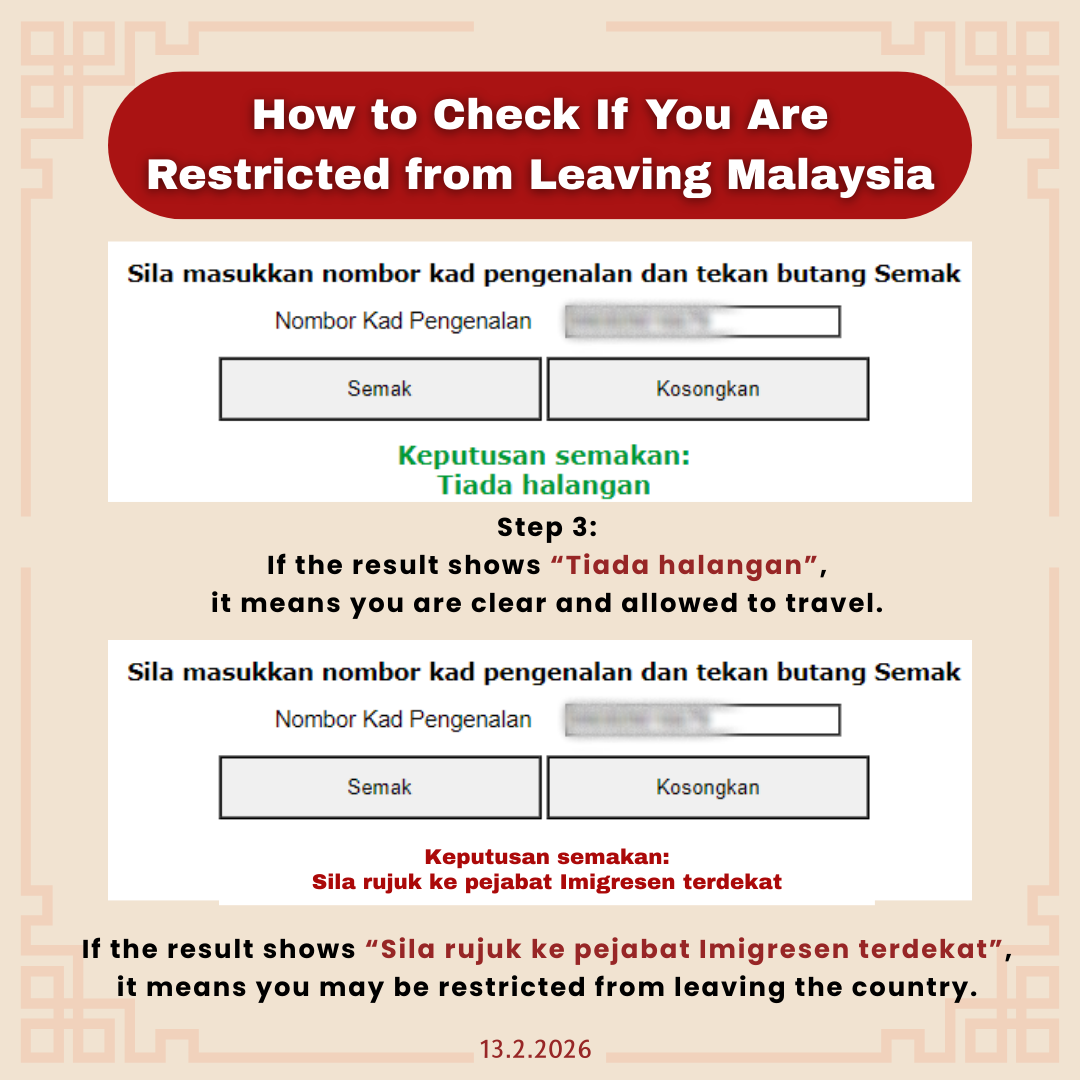

Steps to Check:

Step 1: Visit the official Immigration Department website (sspi.imi.gov.my)

Step 2: Enter your 12-digit Identity Card (IC) number

Step 3: Click “SEMAK” to proceed

Understanding the Results

If the result shows: “Tiada halangan”

This means there is no travel restriction. You may proceed with your travel plans.

If the result shows: “Sila rujuk ke pejabat Imigresen terdekat”

This may indicate a travel restriction. You are advised to visit the nearest Immigration Office for clarification and further action.

(201706002678 & AF 002133)

(201706002678 & AF 002133)