The Royal Malaysian Customs Department (JKDM) has issued General Ruling No. 1/2026, providing critical clarification on Sales Tax refund eligibility for exported goods. Effective from [...]

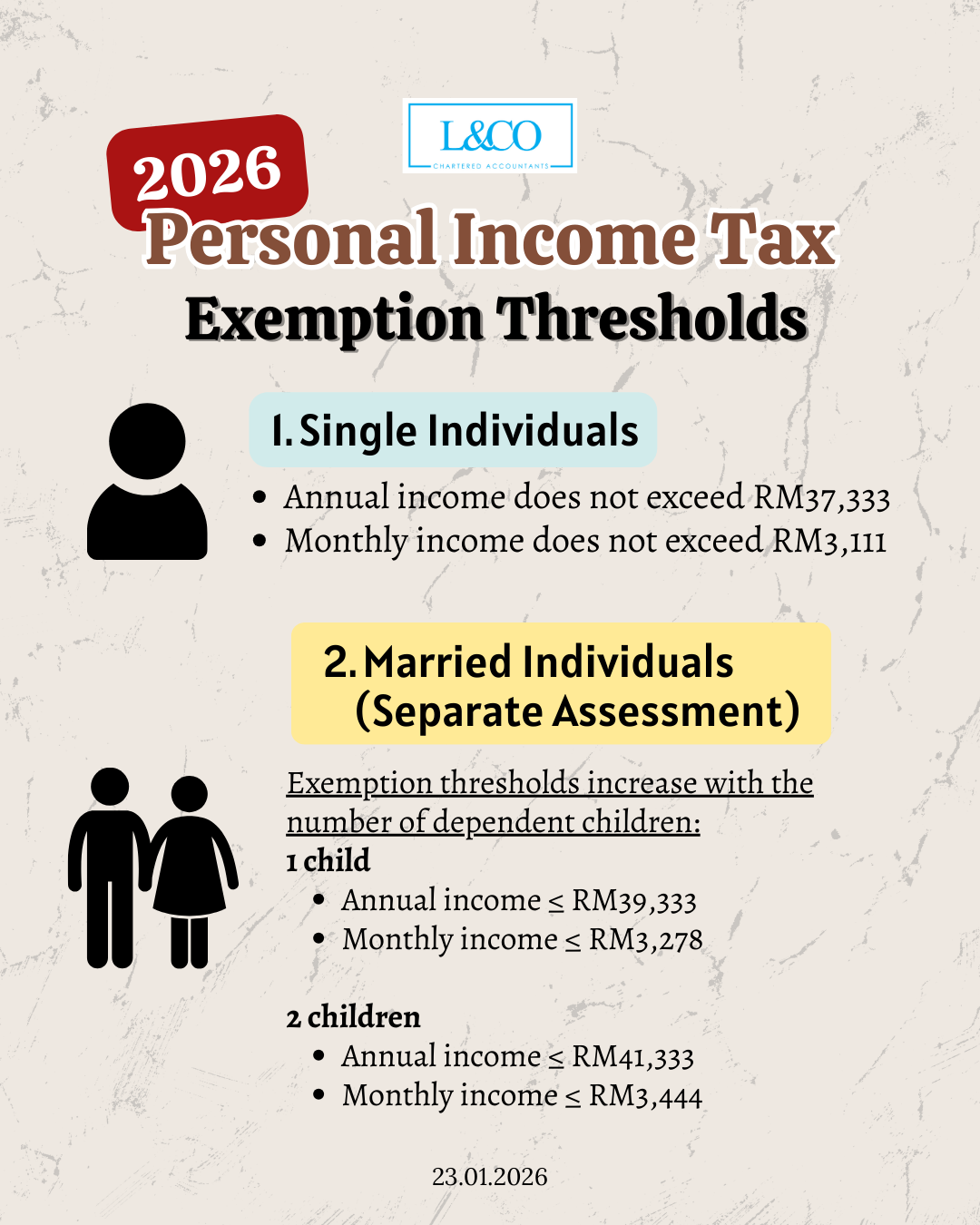

According to information published by the Inland Revenue Board of Malaysia (LHDN), individuals whose annual income falls below certain thresholds may not be required to [...]

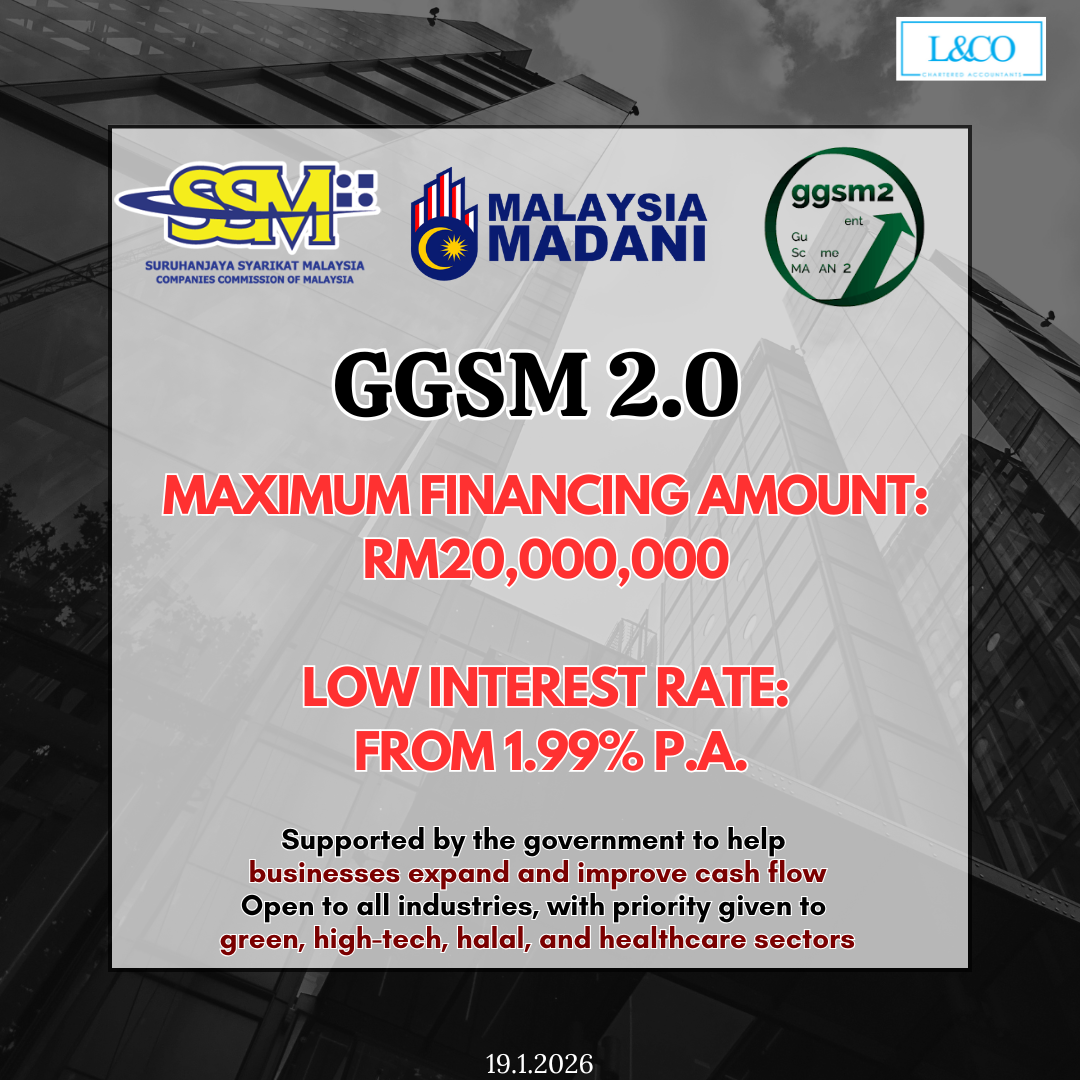

The GGSM 2.0 (Government Guarantee Scheme MADANI 2) is a government-backed financing initiative designed to help Malaysian SMEs access larger loan amounts, favorable terms, and [...]

A Beneficial Owner (BO) is not merely a nominee or registered shareholder, but the individual who ultimately owns or exercises direct or indirect control over [...]

Effective from 1 March, the Malaysian government has officially opened applications for the Internship Placement Matching Grant. Under this programme, eligible SMEs and start-ups may [...]

Attention Malaysian Employees and Self-Employed Individuals! The Employees Provident Fund (EPF/KWSP) has announced significant reforms effective January 1, 2026, aiming to secure long-term retirement funds. [...]

Effective 2026, any vehicle entering Labuan or Langkawi with a value exceeding RM300,000 will be required to pay Sales Tax Key Highlights From 2026, sales [...]

To assist companies in developing local talent and improve internship-to-employment pathways, the Malaysian Government, through TalentCorp, has launched the LiKES (Internship Placement Matching Grant for [...]

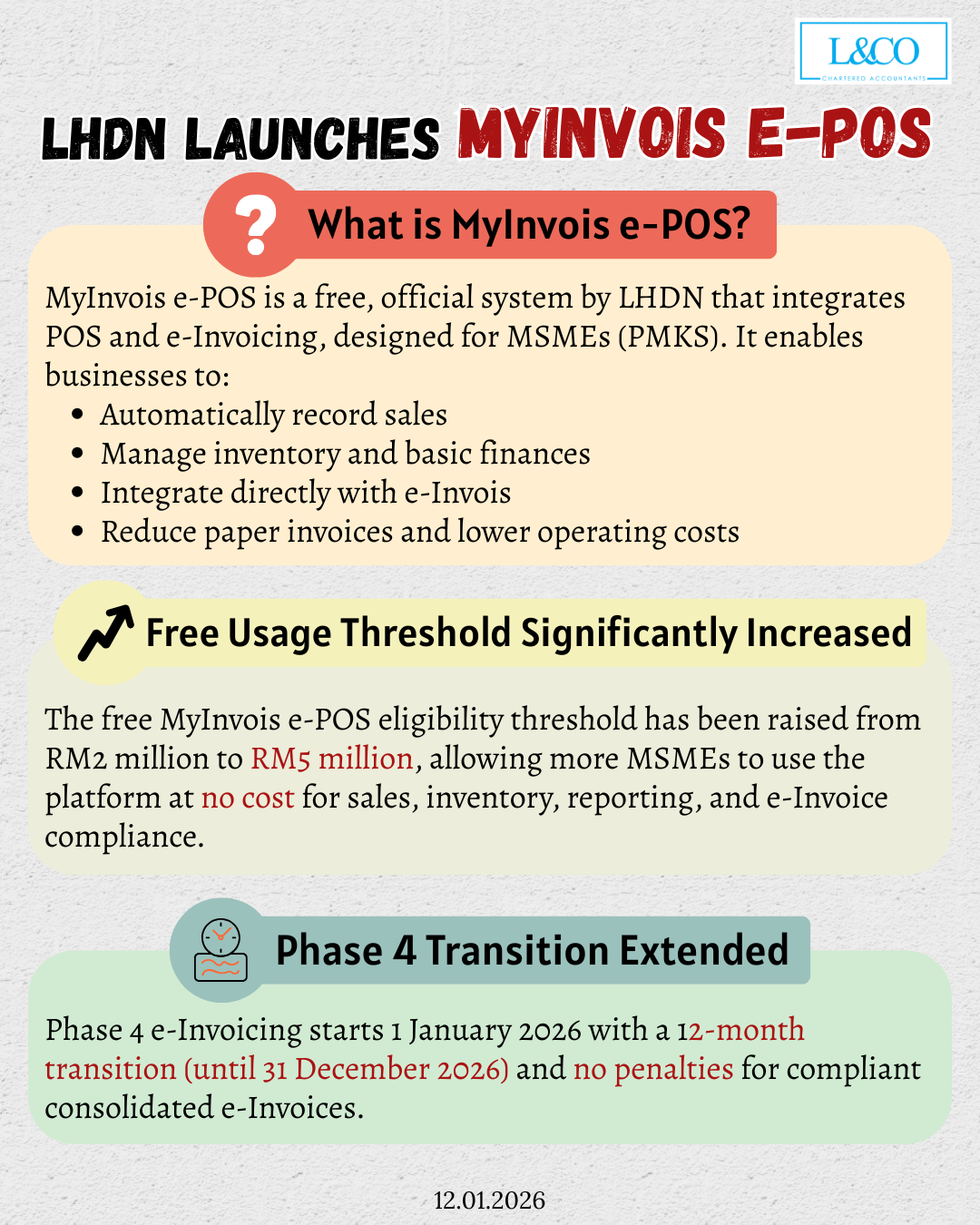

To support SMEs in accelerating digital transformation, LHDN has introduced the official MyInvois e-POS platform—enabling seamless e-Invoicing compliance while helping businesses integrate sales, inventory, and [...]

The Inland Revenue Board of Malaysia (LHDN) has announced a penalty waiver on CP500 instalment tax payments for the Year of Assessment (YA) 2026.However, the [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)