The Royal Malaysian Customs Department (JKDM) has issued General Ruling No. 1/2026, providing critical clarification on Sales Tax refund eligibility for exported goods. Effective from [...]

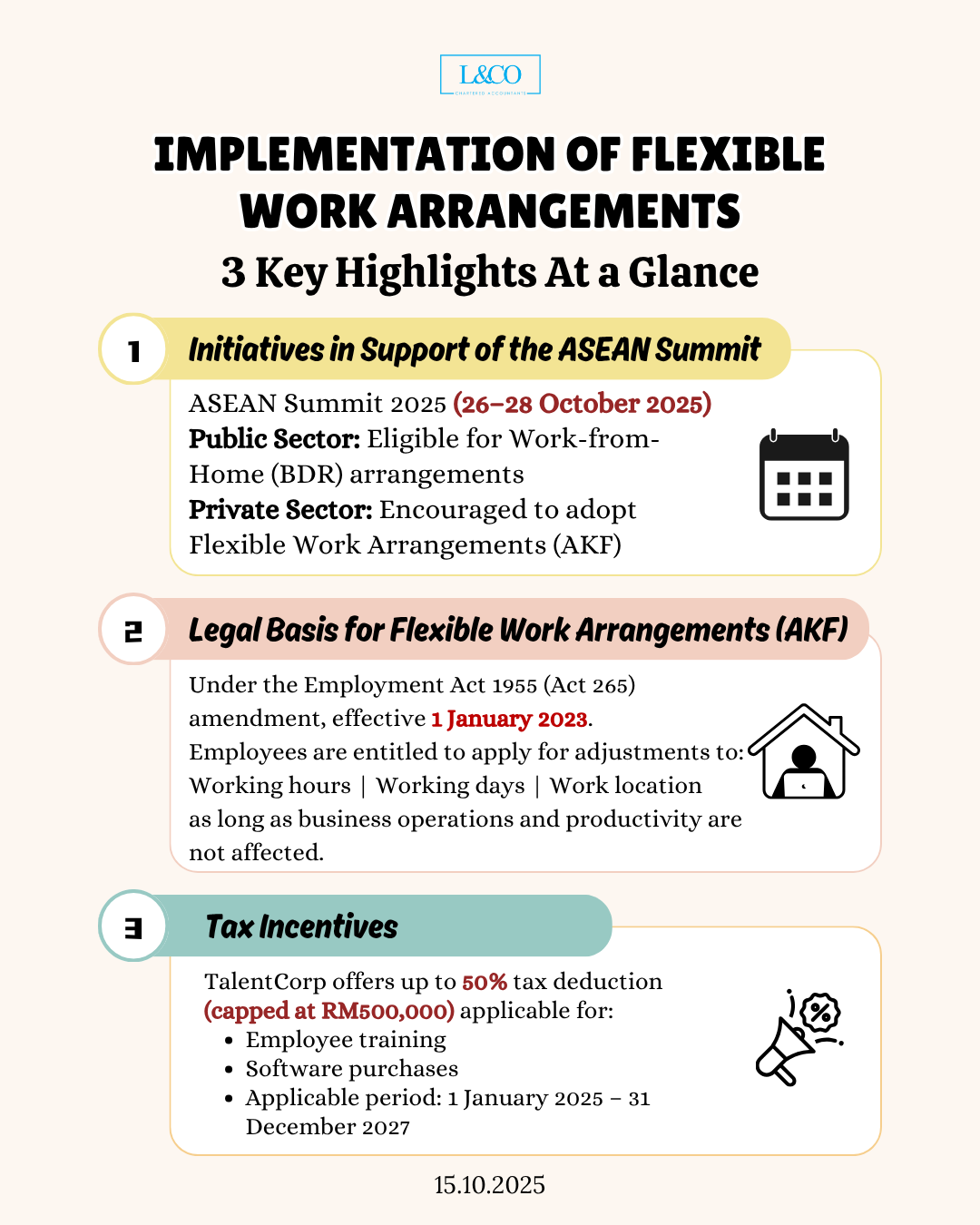

Malaysia has officially implemented the Flexible Work Arrangement (AKF).Both public servants and private sector employees can now adopt flexible hours, locations, and work-from-home options. Want [...]

As Malaysia transitions towards nationwide e-Invoice implementation in 2024/25, the Inland Revenue Board of Malaysia (IRBM) has outlined specific categories of income and expenses that [...]

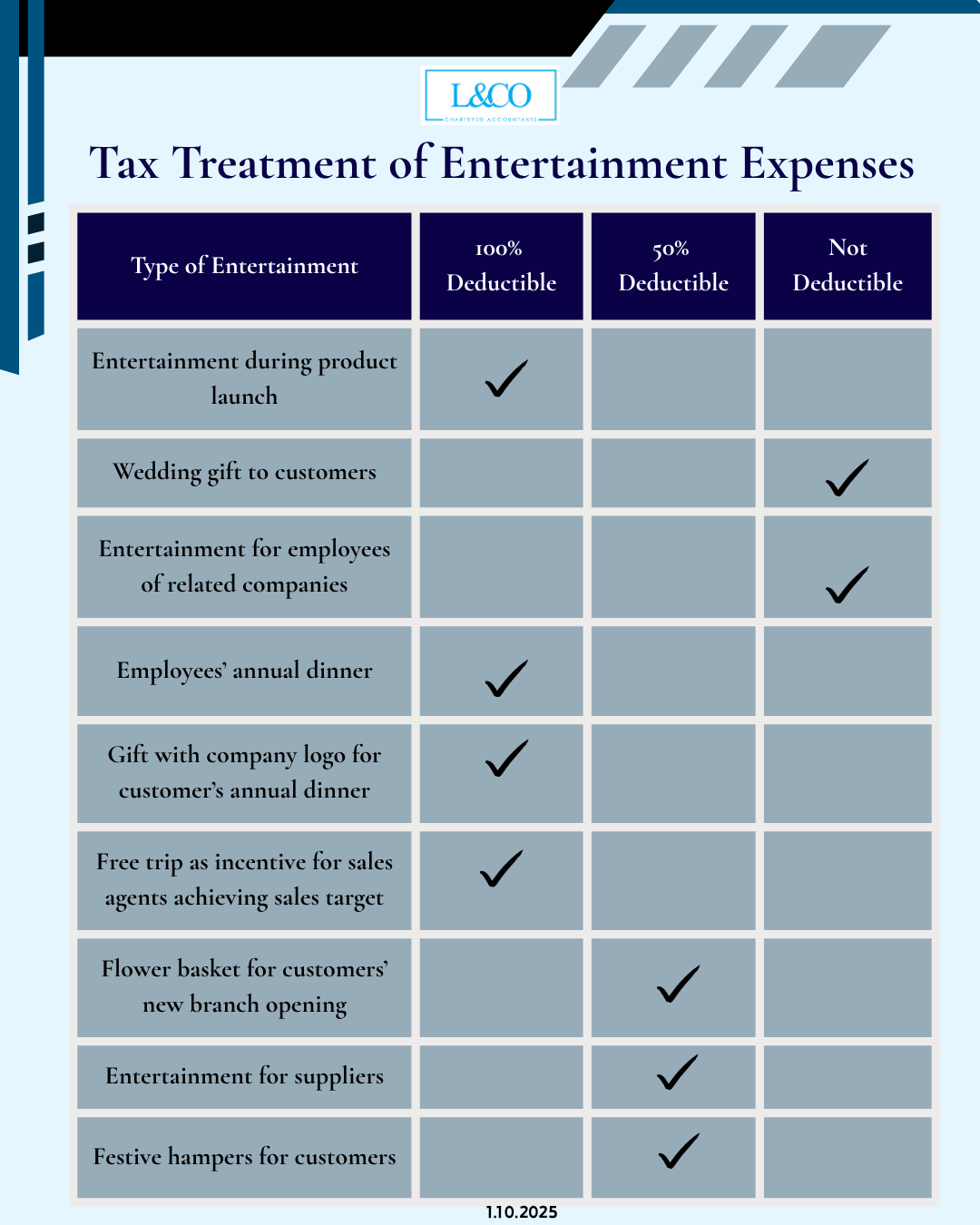

According to Income Tax Act 1967, Section 39(1)(l) and LHDN Public Ruling No. 3/2008 & 4/2015: Not all entertainment expenses are deductible. -In general, entertainment [...]

In Malaysia, hiring certain employees qualifies for a Double Deduction: -Senior employees: aged 60+, full-time, monthly salary ≤ RM4,000 -Interns: TalentCorp MySIP certified, allowance ≥ [...]

Scammers are now spoofing phone numbers and staying silent when you answer. The moment you speak, AI needs only 5 seconds of your voice to [...]

【With Brickz.my, explore property data across Malaysia to make informed and assured decisions.】 In property investment and home-buying decisions, information transparency is crucial. Today, buyers [...]

A comprehensive guide outlining e-invoicing requirements for both local and overseas expenses, clearly distinguishing between different supplier types and invoicing obligations to help employees process [...]

Starting 1 July 2025, certain construction-related services will be subject to Service Tax (SST) in Malaysia ! If you're a contractor, renovation company, or involved [...]

[MYTAX] HOW TO APPOINT EMPLOYEES AS MYTAX REPRESENTATIVE By doing so, employees will also be able to manage their company tax accounts and will not [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)