FORM PK

What is Form PK?

1. According to Employment Retrenchment Notification 2004, all employers are required to report to the nearest Department of Labour before taking any of the following actions:

- Retrenchment①

- Voluntarily Separation Scheme (VSS)

- Temporary Lay-off

- Salary Reduction

2. The employer must submit the Form PK to the nearest Department of Labour at least 30 days before the above actions had been taken.

Notification to the authorities

Any employer who fails to comply with the above matter is committing an offence according to Section 63 of the Employment Act 1955 and shall be liable to a fine not exceeding RM10,000 for each offence.

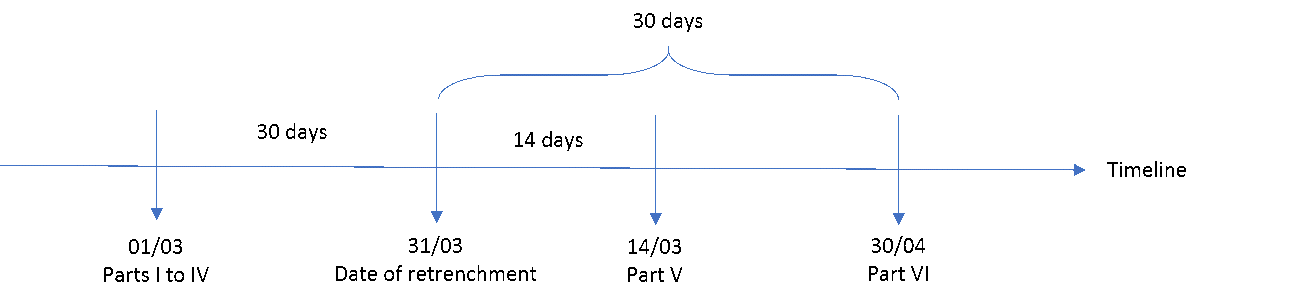

The PK Form is filed in parts and in stages. Parts I to IV must be submitted within 30 days before the retrenchment of employees. Part V must be submitted within 14 days after the date of retrenchment while Part VI must be submitted within 30 days after the date of the retrenchment exercise. Parts V and VI must be submitted if the action involves a retrenchment or voluntary separation scheme. As such, employers do not need approval from the labour office before they can conduct retrenchment exercises.

Application step

1. Download the Form PK from official website.

Link:

Western Malaysia http://jtksm.mohr.gov.my/images/pdf/Borang/Pemberhentian_Pekerja/borang_pk.pdf?fbclid=IwAR2Rd-FSuoZC3_7JcuJfnkqRThfd8fsj8B3eZ6PzbFuwN6lMijpSiQoeixU

Sabah

Sarawak

Form PK Related guide

2. Fill in the Form in Capital Letters.

i) What should you fill in?

- Part I: Company details

- Part II: Action plan to be taken

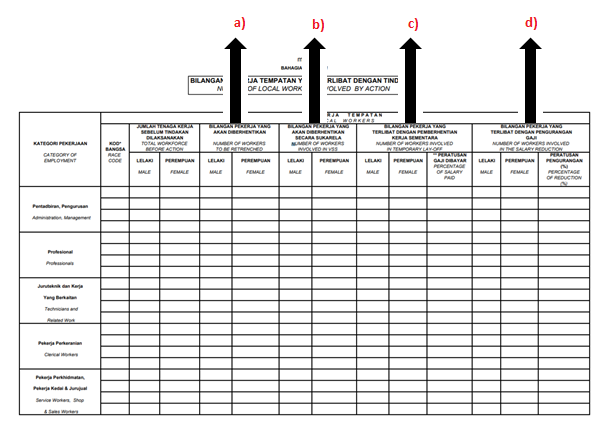

Kindly refer the following attachment

a) Number of workers plan to be retrenched

b) Number of workers plan to be involved in Voluntarily Separation Scheme

c) Number of workers plan to be involved in temporary lay-off and state the percentage (%) of salary paid

d) Number of workers plan to be involved in salary reduction and state the percentage (%) of reduction

- Part III: Chose the reasons and the cause for the action taken, state the date of action plan to be taken and any benefits payable to the involved workers.

- Part IV: Fill in the measures taken to avert action (reduction of working hours, reduction of normal working days, reduction or stoppage of overtime/work on rest day/work on public holiday).

- Part V: Particulars of benefits paid②

- Part VI: Particulars of emplacement on new jobs (Any action had been taken to help the workers in finding new job? If no, kindly put NA in this part.)

3. Email the complete form to the following email address:

① Retrenchment

What is retrenchment and redundancy?

Retrenchment means the termination ofthe contract of service as the result of redundancies that may arise due to several reasons such as the closure of the company, restructuring, reduction in operation, mergers, technological changes, takeovers, economic downturn and others.

Say in other words, redundancy is a situation where the employee or position is no longer required. Retrenchment is the action taken to terminate the employment relationship in the event of redundancy.

What measures should be taken by employers to avoid retrenchment?

When a situation of redundancy arises, the employer should first take appropriate measures as proposed under the Code of Industrial Harmony in order to avoid retrenchment: –

- Freeze the recruitment of new workers except for critical areas

- Limit overtime work

- Limit work on weekly rest days and public holidays

- Reduce weekly working days or reduce the number of shifts

- Reduce daily working hours

- Provide retraining programmes for workers*

- Identify alternative jobs and transfer workers to other divisions/jobs in the same company*

- Implementing temporary lay-off, for example in the form of temporary shut down by offering fair salary and helping to secure temporary jobs elsewhere until normal operations resume. If the employer implement a temporary lay-off, it should be reported to the Manpower Department for monitoring purposes to determine whether the workers are reemployed or offered a Voluntary Separation Scheme (VSS) or are laid off permanently in future*

- Introduce pay-cut fairly at all levels and to be implemented as the last resort after other cost-cutting measures have been implemented*

- Identify vacancies in other companies to be offered to workers who will be retrenched.

* Must be implemented with the written agreement of the workers or the trade unions representing them.

What guidelines should employers follow when selecting employees to retrench?

The Code of Conduct for Industrial Harmony (“Code”) provides guidelines on the best practice for retrenchment exercises. While not legally binding, failure to comply may be a factor that courts take into consideration in determining whether the retrenchment exercise was carried out in a fair manner.

The Code contains suggested criteria for employers to consider when selecting employees to retrench. This includes:

- Ability

- Experience

- Skill and occupation qualifications

- Age

- Family situation

- Length of service

- Status (non-citizens, casual, temporary, permanent).

A few commons industrial practice is also to retrench employees based on the: –

- FWFO principle (Foreign worker – First Out)

- LIFO principle (Last In, First Out)

Can employees challenge a retrenchment?

In the absence of a valid justification for the retrenchment exercise, the termination may amount to dismissal without just cause and excuse entitling employees to remedies such as backwages, reinstatement and/or compensation in lieu of reinstatement.

An employee who believes they have been unfairly retrenched must lodge a complaint with the Director General of Industrial Relations within 60 days from the date of the dismissal. If parties are unable to settle their dispute during the conciliation meeting ordered by the Department of Industrial Relations, the Minister of Human Resources may refer the matter to the Industrial Court for adjudication.

② Part V: Particulars of benefits paid

Workers who are retrenched are entitled to minimum termination benefits if they are covered under the Employment Act 1955 or Collective Agreements

a) Wages in lieu of notice

Workers whose services are terminated without sufficient notice, may claim payment of wages in lieu of notice (indemnity). The wages in lieu of notice should be paid not later than the last day the contract of service is terminated.

Payment in lieu of balance of annual leave, if any.

b) Retrenchment Benefits

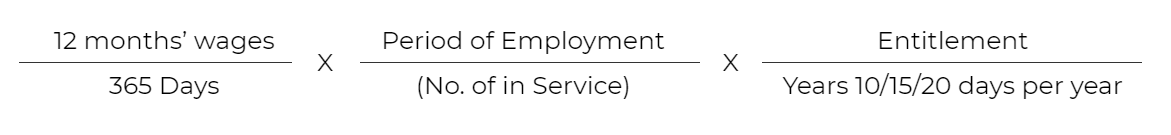

The retrenchment benefits must be paid according to the terms in the contract of service, but should not be less than the minimum rate stipulated under the Employment:

i) 10 days’ wages for every year of service if the worker has been employed for less than two years;

ii) 15 days’ wages for every year of service if the worker has been employed for two years or more but less than five years; or

iii) 20 days’ wages for every year of service if the worker has been employed for five years or more.

and pro-rata for an incomplete year, calculated to the nearest month.

The workers are entitled to receive written details of the amount of termination benefits and the method of calculation used.

The termination benefits should be paid not later than 7 days from the date the service of the worker is terminated.

An employee who is not covered by the Employment Act 1955 is only entitled to termination benefits if it is provided in his employment contract. If the contract is silent, then it is up to the employer whether to pay termination benefits, and how much to pay.

Employers who are carrying out a retrenchment due to serious financial difficulties may also be excused from paying retrenchment benefits.

Frequency Asked Question

No, EIS is financial assistant for those employees who were retrenched by company because of financial problem. Only company that has submitted Form PK is eligible to apply for the EIS financial assistant. However, company may apply for wages subsidy programme (WSP) for those employees.

Yes, if this action has an agreement between employer and employee in written, and the conversation need to be saved as evidence.

All employers are required to pay full salary on current status, therefore submitting Form PK will not help on it, however it does help if the restriction order period extended. Employers who have submitted Form PK have the right to ask their employees for salary reduction.

Form PK is for those companies that facing financial difficulties to negotiate/adjust their employees’ remuneration. We suggest you resume their payroll if possible.

Form PK is the form to inform labour office that your company is facing financial difficulties and going to negotiate/adjust your payroll. We advise you to submit it because you cannot negotiate/adjust your payroll immediately when you faced financial difficulties under existing law. You can adjust the payroll back to normal anytime if you think salary reduction is not necessary.

There are 4 situations (retrenchment, temporarily lay-off, voluntarily separation scheme (vss) or salary reduction) that apply on Form PK. When you are requesting your staff to take unpaid leave/salary reduction during this period, Form PK shall be submitted 30 days before it effective.

Yes. You need to report to the Department of Labour if the termination is caused by the termination of the contract of service resulting from the closure of office or excessive employee. Excessive employee situations may arise due to a number of reasons such as restructuring of companies, reduction of production, merger of companies, changes in technology, acquisition of companies and others. This does not include termination of service contracts due to disciplinary action and dismissal of employees.

Reports can be made through the Notice of Termination of Employment 2004 (Form PK with the Appendix) which is available free of charge from any branch of the Department of Labour throughout Peninsular Malaysia or can be downloaded from the Department’s website.

Yes. Notice of Termination of Employment 2004 (Form PK) was gazetted as PU (B) 430/2004 on November 11, 2004 and to any employer who fails to comply with this requirement commits an offense under section 63 of the Employment Act 1955, and if convicted is liable to a fine not exceeding RM10,000 for each offence.

The Code of Conduct for Industrial Harmony has suggested several steps that can be taken to avoid termination. These steps can be found in the Guidelines on Retrenchment Management. The guidelines have also outlined the procedure for implementing a retrenchment action.

Compensation or termination benefits may be claimed if terminated workers are protected under the Employment Act 1955 or the Collective Agreement. Generally, the employee is entitled to claim statutory benefits such as notice of salary, termination benefits, annual leave pay and balance of pay (if any). Employees involved in the termination can contact the nearest Department of Labour for detailed information. Further information can also be found in the Guidelines on Retrenchment Management.

Payment of termination benefits shall be in accordance with the contract of service, but shall not be less than the rate prescribed under the Employment (Termination and Retirement Benefits) Regulations 1980, of the Employment Act 1955: –

(a) 10 days’ wages for every year of service if the worker has served less than 2 years;

(b) 15 days’ wages for every year of service if the worker has served 2 years but less than 5 years; or

(c) 20 days’ wages for every year of service if the worker has served 5 years or more,

And is calculated proactively over an incomplete period of one year, almost exactly once a month. The formulas set out under the Employment (Termination and Retirement Benefits) Regulations 1980 are as follows:

The workers have the rights to receive the written details of the amount of termination benefit and how it is calculated. Termination benefits must be paid no later than 7 days from the date of termination of employment.

Voluntary Separation Scheme (VSS) means that employers intend to reduce their workforce but by inviting workers to quit voluntarily. Employees will usually be offered a termination benefit or better compensation than legal provisions. However, the decision to grant voluntary termination of the contract depends on the employer.

The employer may do so and this action is considered as temporary lay-off or lay-off. However, some conditions must be complied with by the employer. Pursuant to Regulation 5 (1) of the Employment (Retirement and Retirement Benefits) Regulations 1980, an act of temporary lay-off or lay-off occurs when an employer fails to provide employment or pay at least 12 ordinary working days within 4 weeks in a row. In either case, the employer must pay the employee’s retrenchment benefits. However, if the employer does not return to work and the service contract is terminated or not renewed, then the employer must pay the termination benefit. Temporary lay-off or lay-off shall not occur if the employer does not meet the requirements under Rule 5 (1).

According to the case M/s. Viking Askim against the National Union of Employees in Rubber Products & Anor Manufacturing Companies. [1991] 3 CLJ (Rep) 195, Rule 5 (1), (The Employment Retirement and Retirement Benefits Regulations 1980), it does not apply to monthly paid workers because their remuneration under the service contract is not based on the type of employment provided.

Yes. The court has ruled that monthly paid workers are entitled to full pay. Employers are required to pay wages based on service contracts for workers who are paid monthly wages.

Workers who are eligible for temporary lay-off or lay-off are paid hourly, daily, task-piece or piece rate workers.

Pursuant to Regulation 5 (1) of the Employment (Retirement and Employment Benefits) Regulations 1980, holidays, general leave, sick leave, maternity leave, annual leave, leave permitted under written law and any such leave applied for and approved by the employer, should not be considered as temporary lay-off or lay-off.

(201706002678 & AF 002133)

(201706002678 & AF 002133)