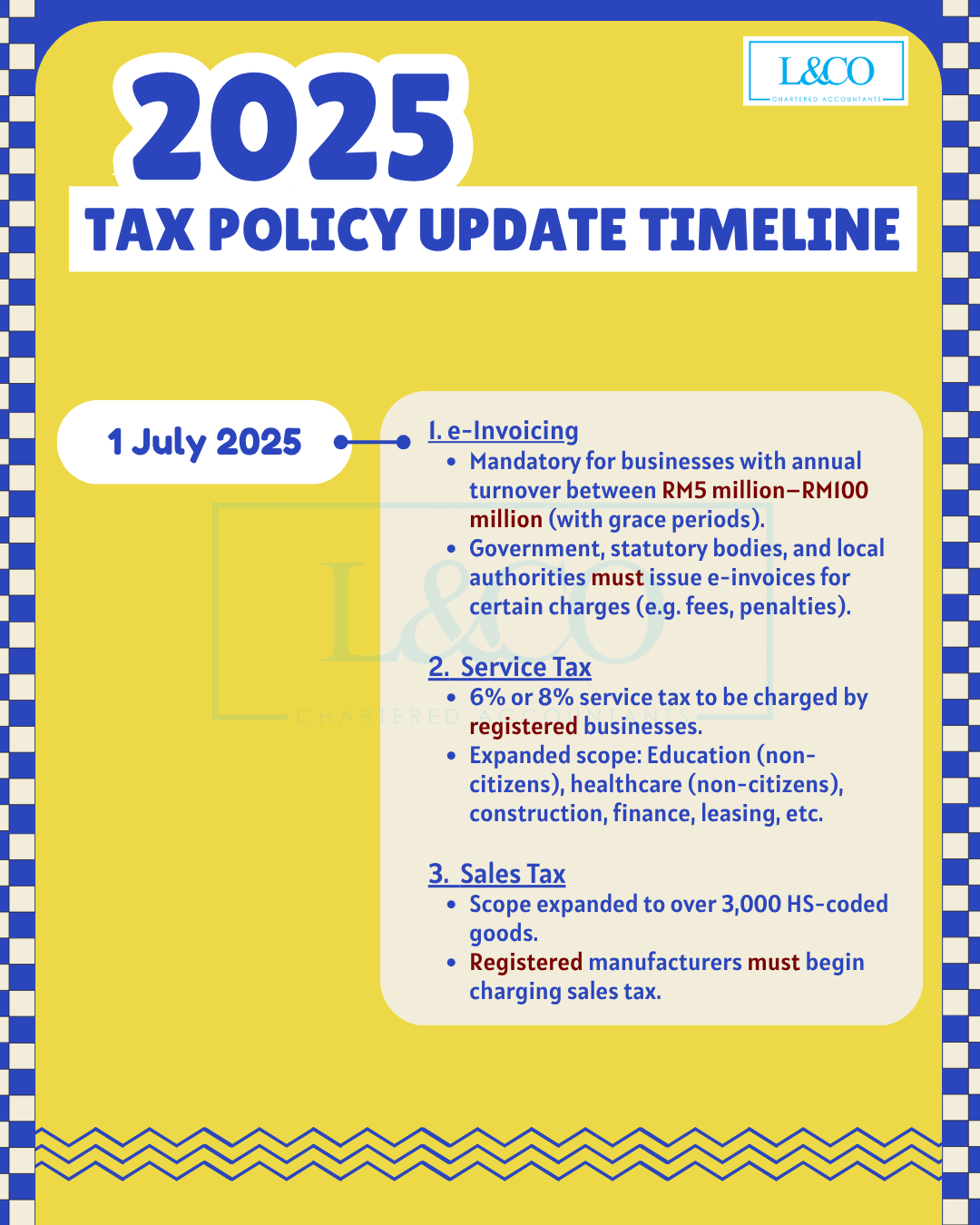

A series of tax and compliance policies will roll out in the second half of 2025!

This includes major changes in e-Invoicing, Service Tax, Sales Tax, EPF, and Stamp Duty.

Use this timeline to prepare ahead, stay compliant, and operate with confidence.

1 July 2025

- E-Invoicing: Mandatory for businesses with annual turnover above RM5 million, applies to government fees/charges too

- Service Tax: 6% or 8% tax to be charged by registered businesses, scope expanded to non-citizen education, healthcare, construction, etc.

- Sales Tax: Over 3,000 taxable goods, registered manufacturers must begin charging sales tax

1 August 2025

- Unregistered service providers/manufacturers exceeding the threshold must register for SST

1 September 2025

- Newly registered businesses begin charging Service Tax/Sales Tax

1 October 2025

- Employers must contribute an additional 2% EPF for foreign employees

31 December 2025

- Final date to rectify SST compliance gaps without penalty (tax still payable)

- Last day to stamp employment contracts for 2026 tax assessment

**Last Updated on 09.07.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)