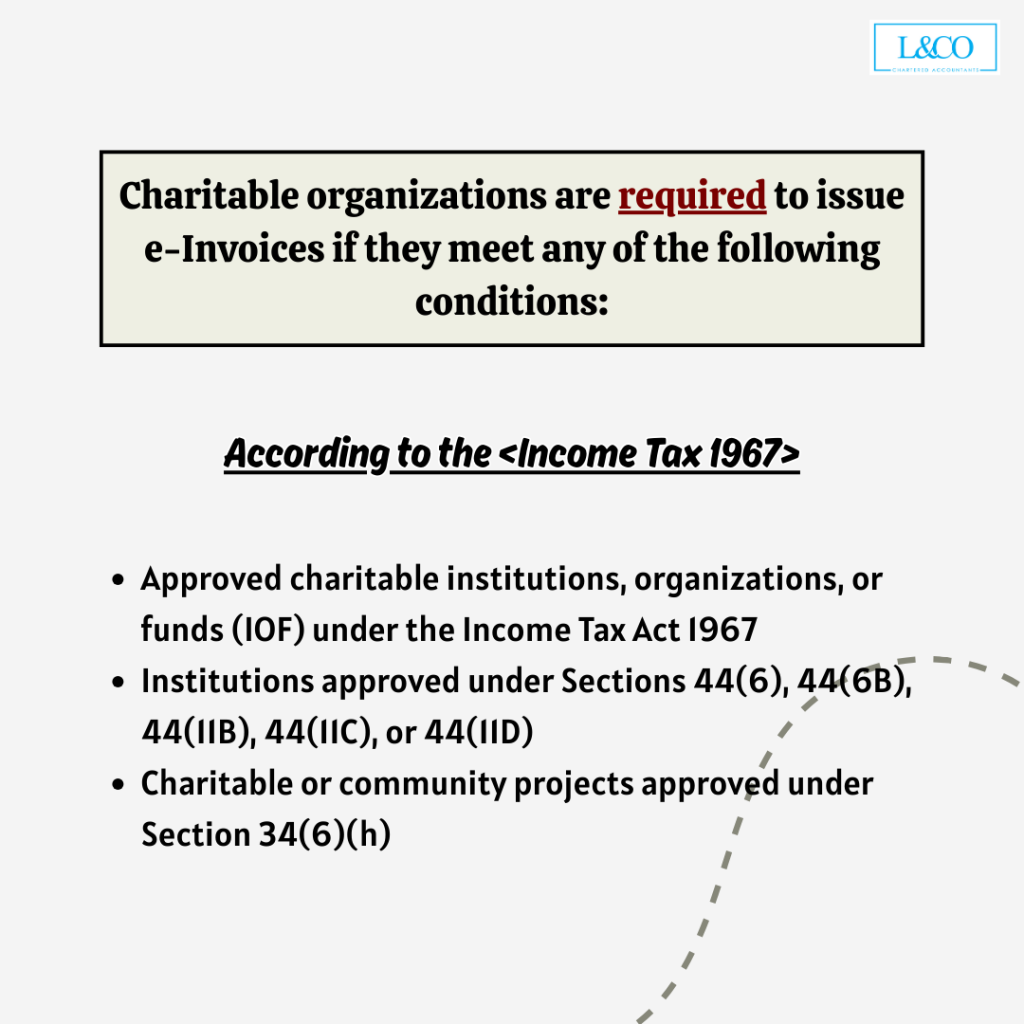

A comprehensive guide covering applicable entities, issuance procedures, exemptions, and verification methods

FAQs:

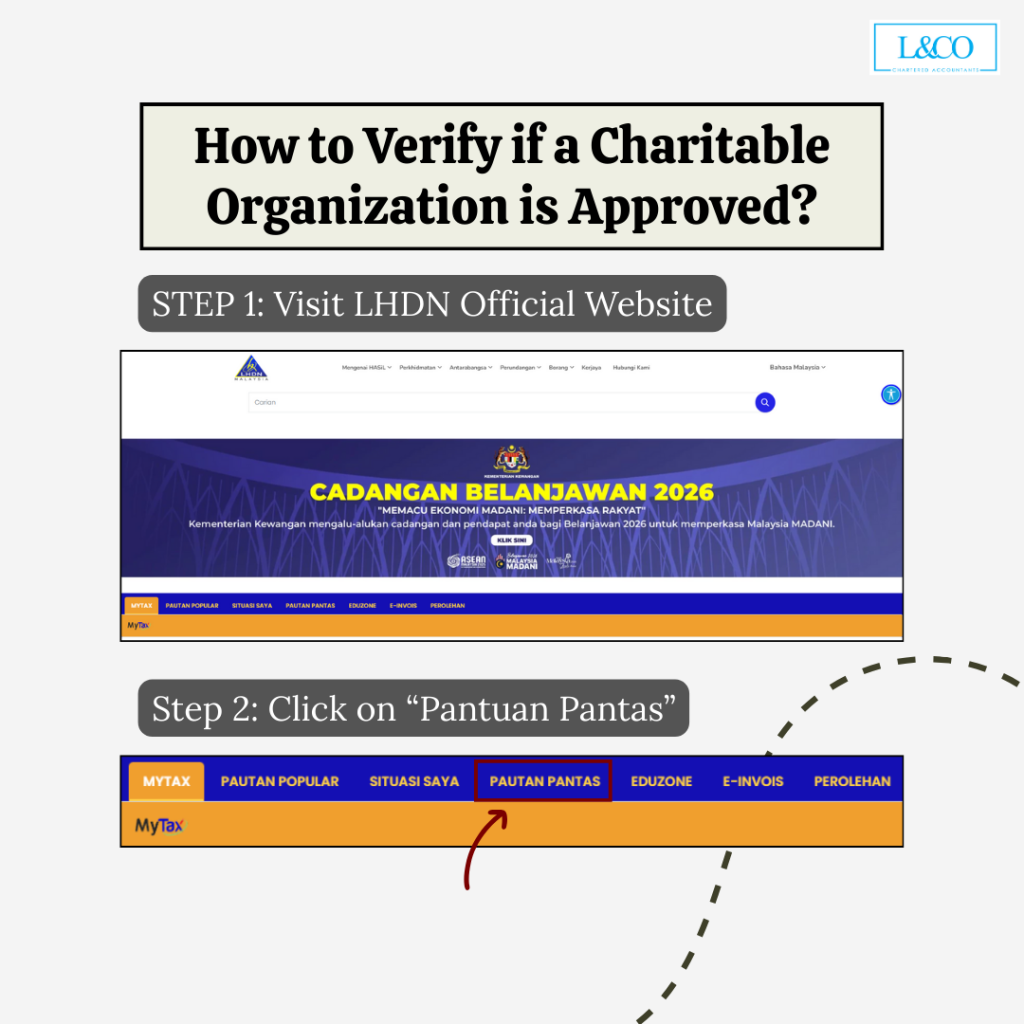

Step 1: Visit the LHDN official website

Step 2: Click on “Pautan Pantas”

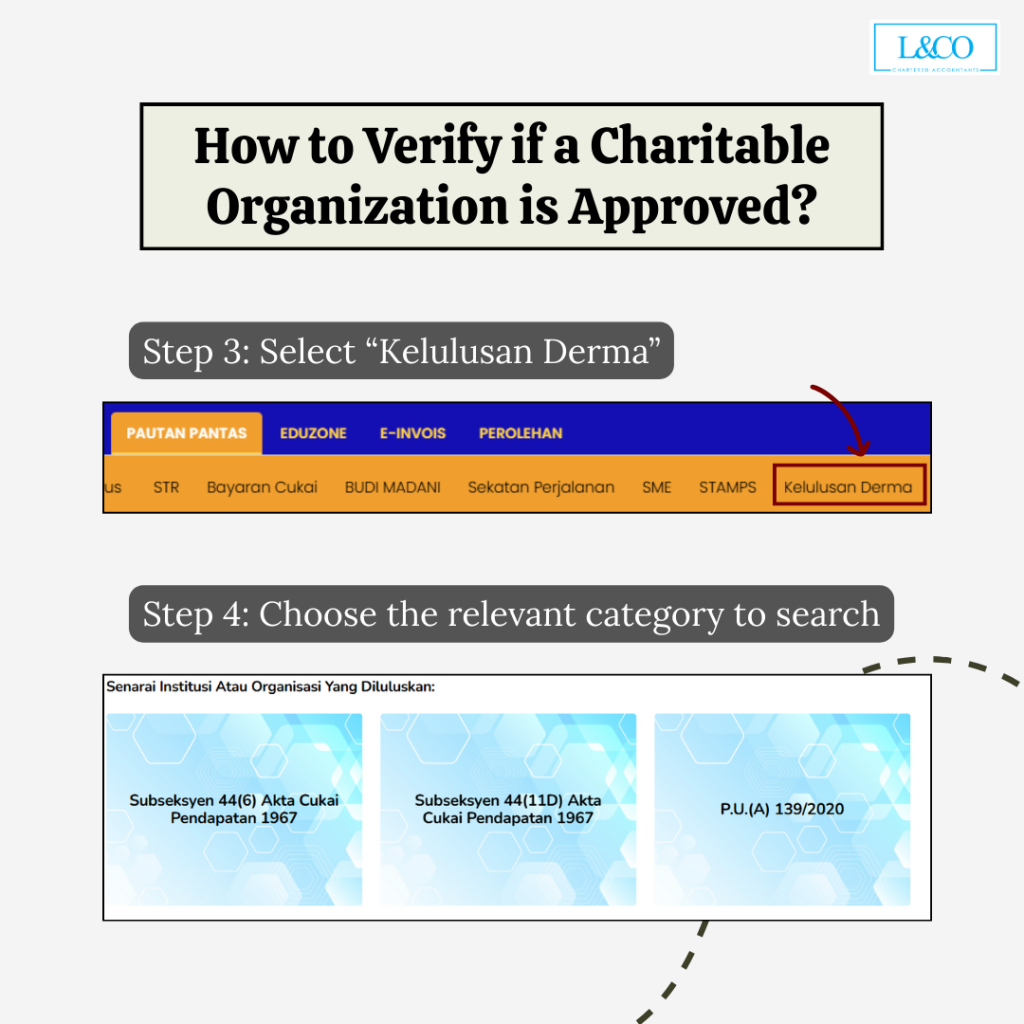

Step 3: Select “Kelulusan Derma”

Step 4: Choose the relevant category to search

**Last Updated on 03.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)