Whether it’s domestic operations, imported services, or foreign income, each type of e-invoice has a clear submission deadline. Submitting on time helps avoid delays in tax reporting or settlement and keeps your financial management efficient

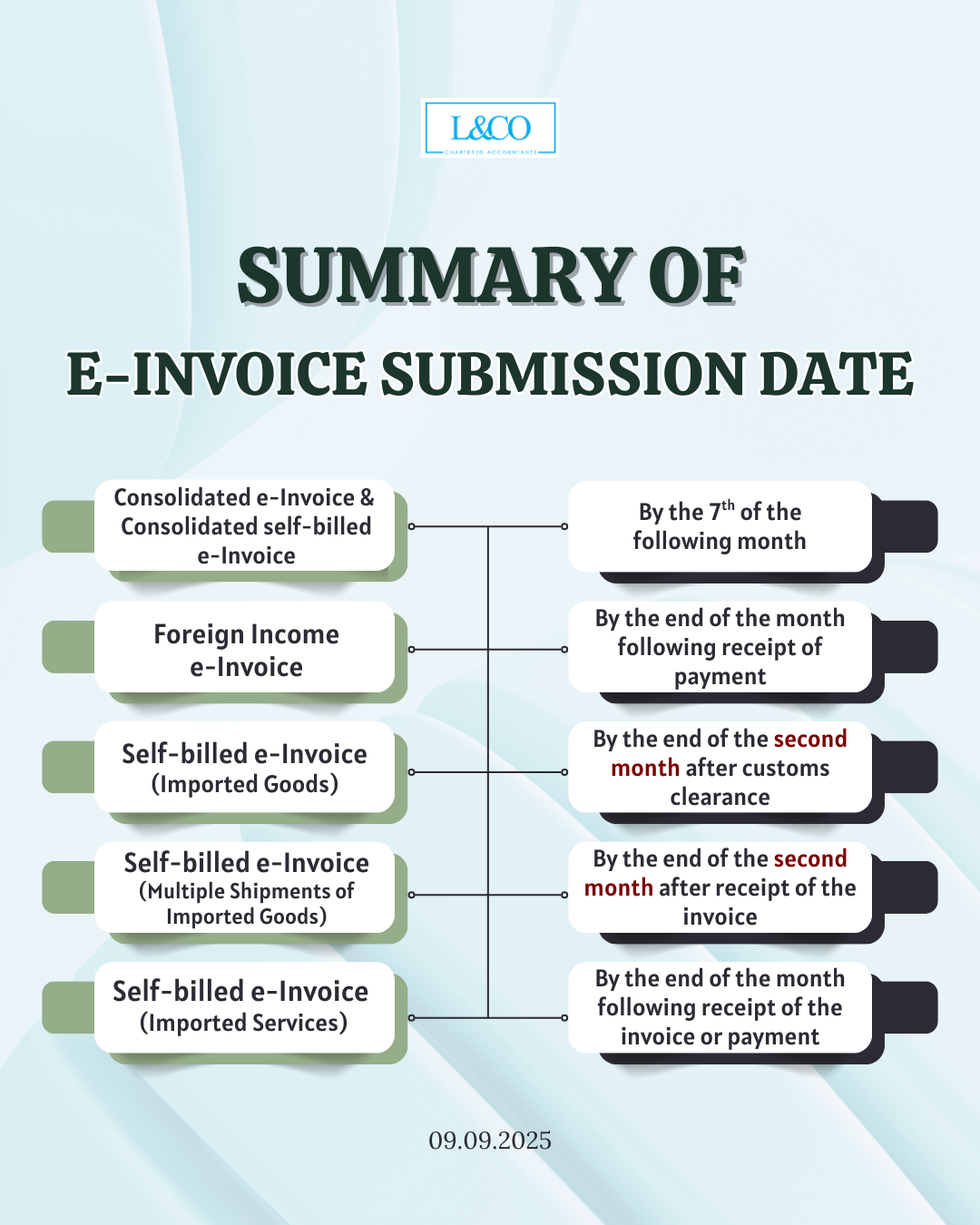

e-Invoice Submission Date:

- Consolidated e-Invoice & Consolidated Self-Billed e-Invoice: By the 7th of the following month

- Foreign Income e-Invoice: By the end of the month following receipt of payment

- Self-Billed e-Invoice (Imported Goods): By the end of the second month after customs clearance

- Self-Billed e-Invoice (Multiple Shipments of Imported Goods): By the end of the second month after receiving the invoice

- Self-Billed e-Invoice (Imported Services): By the end of the month following receipt of the invoice or payment

**Last Updated on 09.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)