“Government Logic of Repayment: Owes You RM400,000, Pays Back Only RM20,000 — and Still Says You Should Be Grateful.”

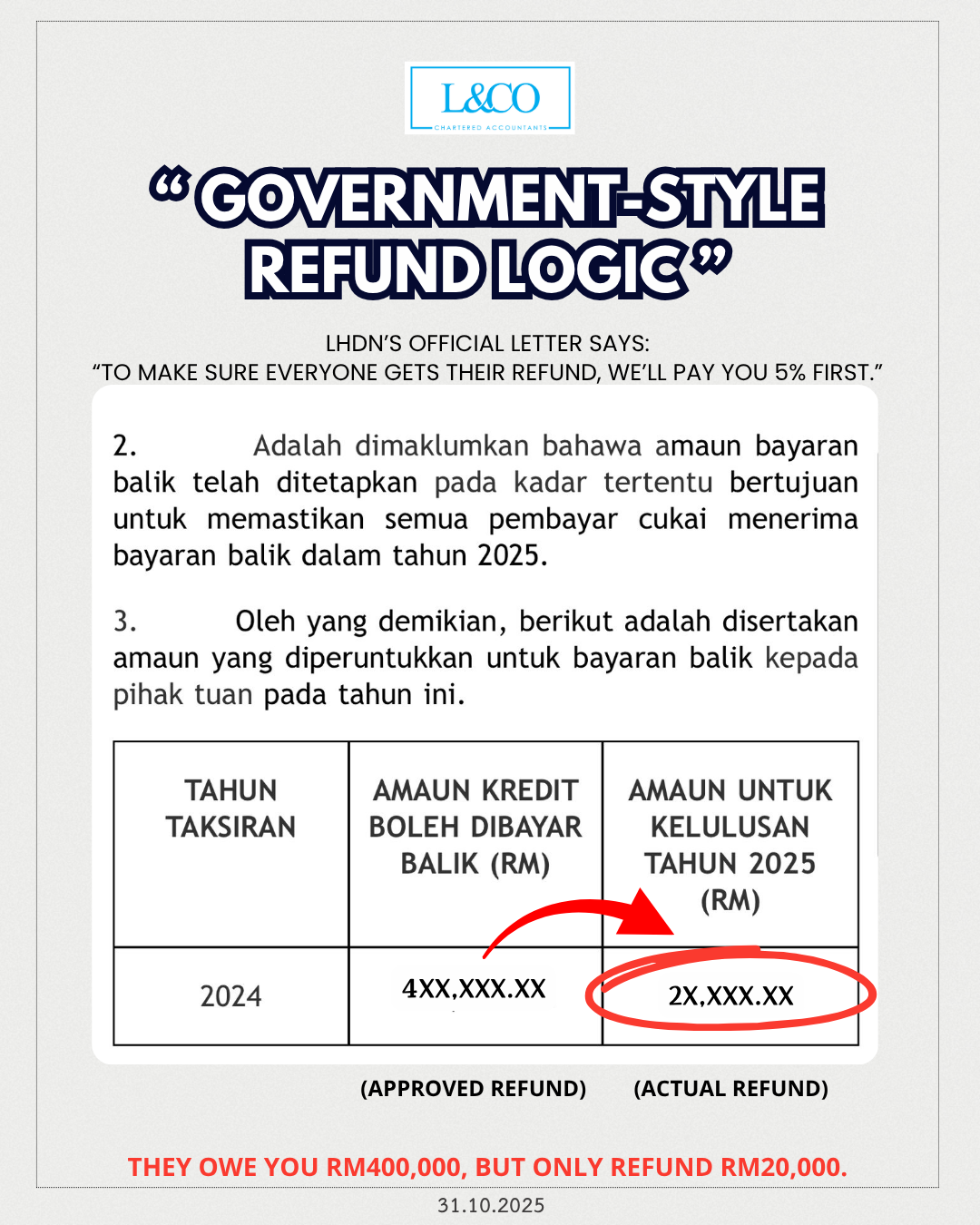

Today, a client told me that his LHDN (Inland Revenue Board of Malaysia) tax refund was approved for over RM400,000.

The amount that actually came in? RM20,000.

To make it more absurd, the official email politely said:

“To make sure everyone gets their tax refund, I’ll return 5% to you first.”

I couldn’t help but laugh.

If I owed you RM400,000, transferred only RM20,000,

and then told you “not everyone gets their money,”

you probably wouldn’t find it funny either, right?

But jokes aside, there’s something important behind this story:

According to the Malaysian Income Tax Act,

if your refund is not issued within 90 days after the filing deadline,

you are entitled to claim interest from LHDN at 2% per annum (effective rate).

This isn’t a myth or rumor —

it’s clearly written in LHDN’s official guidelines.

Many people just don’t know about it, or never exercise their rights.

So here’s the takeaway:

- Be diligent when paying taxes,

- but be even more diligent when you’re due a refund.

The tax law isn’t one-sided — it protects taxpayers too.

Don’t just sit and wait,

and don’t let “fate” decide whether you’ll get back what’s rightfully yours.

At L&Co Accountants, we always remind our clients:

“Knowing the law is your best form of protection.”

**Data updated on 31.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)