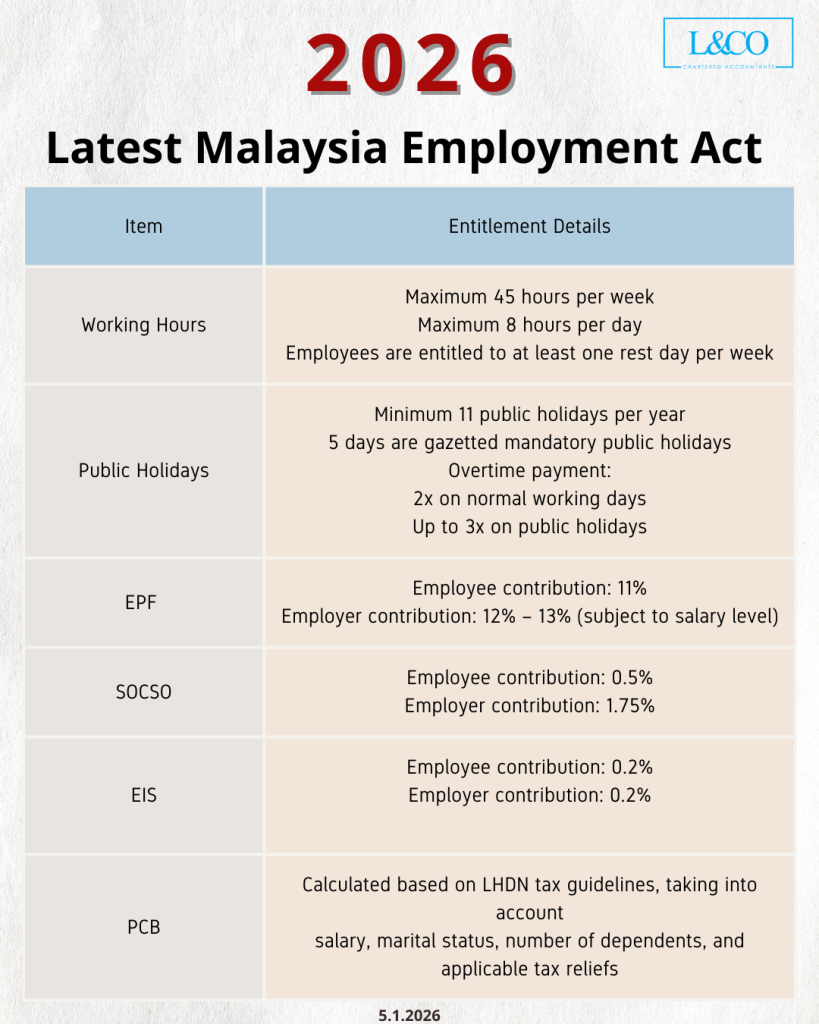

As Malaysia moves into 2026, employment regulations continue to evolve to strengthen employee protection while ensuring fair and compliant business operations.

Below is a clear and practical summary of key Employment Act 1955 requirements applicable in 2026, covering working hours, employee entitlements, statutory contributions, and minimum wage obligations.

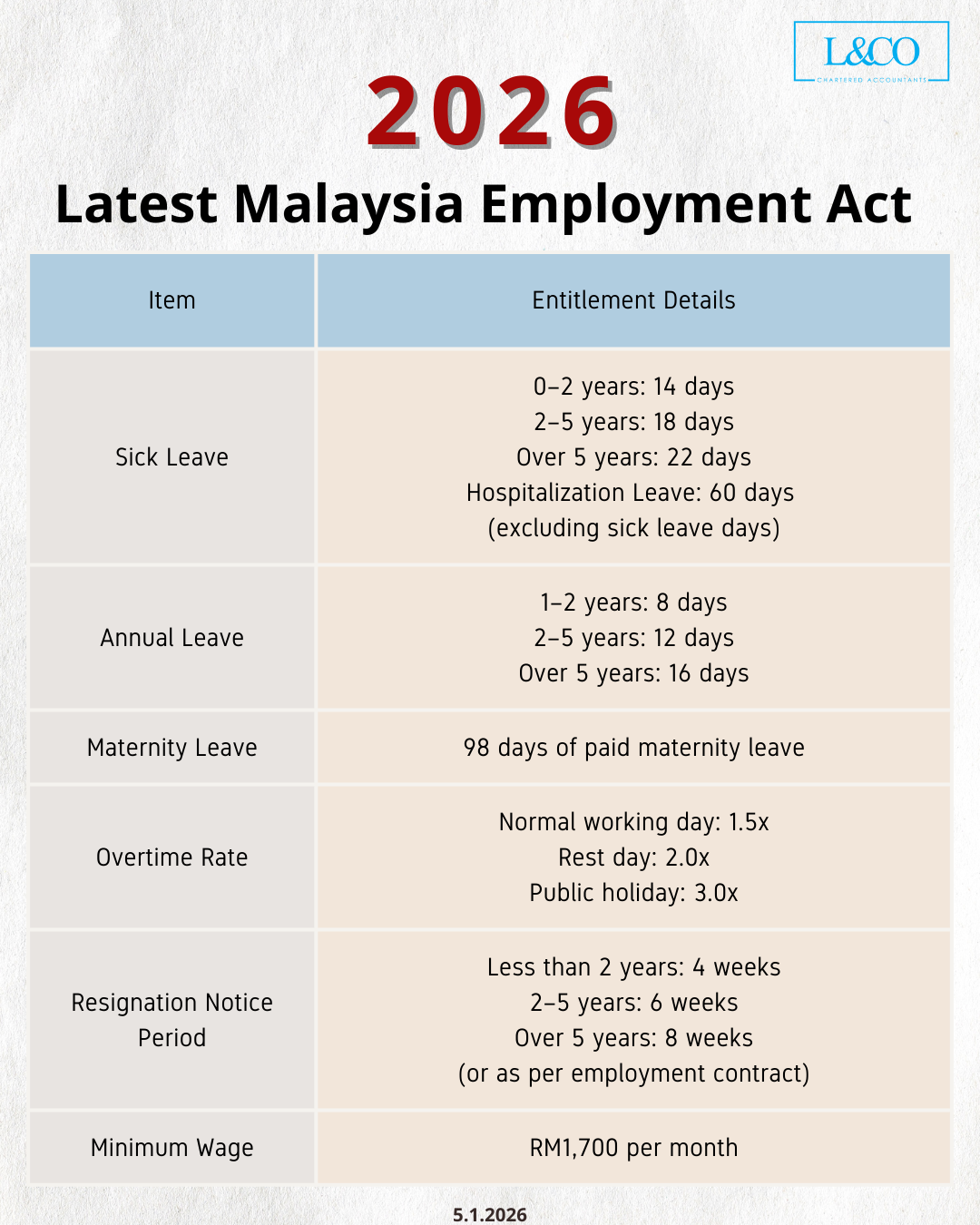

Employee Leave Entitlements

1.Sick Leave

- 0 – 2 years of service: 14 days

- 2 – 5 years of service: 18 days

- More than 5 years of service: 22 days

- Hospitalization leave: 60 days (not inclusive of sick leave)

2.Annual Leave

- 1 – 2 years of service: 8 days

- 2 – 5 years of service: 12 days

- More than 5 years of service: 16 days

3.Maternity Leave

- 98 days of paid maternity leave

4. Public Holidays

- Minimum of 11 paid public holidays per year

- 5 days are compulsory public holidays

- Work on Public Holidays

- Rest day work: 2 times the normal rate

- Work on a public holiday: up to 3 times the normal wage

5. Overtime Rates

- Normal working day: 1.5x

- Rest day: 2.0x

- Public holiday: 3.0x

6. Resignation Notice Period

Employees are required to observe the following minimum notice periods (unless otherwise stated in the employment contract):

- Less than 2 years of service: 4 weeks

- 2 – 5 years of service: 6 weeks

- More than 5 years of service: 8 weeks

7. Minimum Wage

- Minimum wage: RM1,700 per month

8.Working Hours

Under the Employment Act:

- Maximum 45 working hours per week

- Maximum 8 working hours per day

- Employees are entitled to at least 1 rest day per week

Any work beyond statutory hours must be compensated in accordance with overtime regulations.

9. Statutory Contributions

Employees Provident Fund (EPF)

- Employee contribution: 11%

- Employer contribution: 12% – 13% (subject to salary level)

SOCSO (Social Security Organisation)

- Employee contribution: 0.5%

- Employer contribution: 1.75%

EIS (Employment Insurance System)

- Employee contribution: 0.2%

- Employer contribution: 0.2%

PCB

Calculated based on LHDN tax guidelines, taking into account salary, marital status, number of dependents, and applicable tax reliefs

**data updated on 5.1.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)