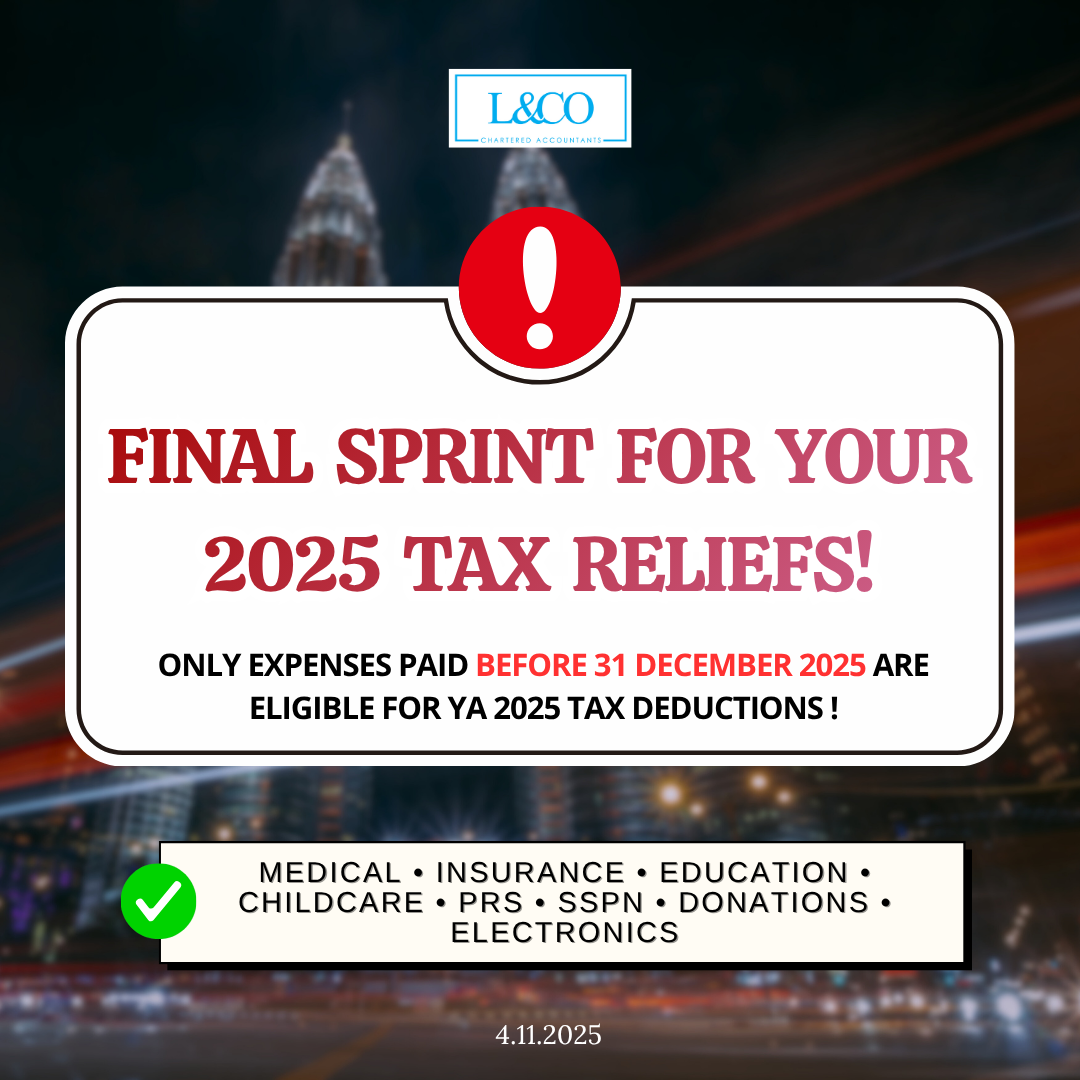

2025 is coming to an end! It’s the best time to review and maximize your personal tax reliefs before the year closes!

Final Sprint for 2025 Tax Reliefs

All eligible expenses paid by 31 December 2025 can be claimed under YA 2025 in your income tax filing.

Check through this list and make sure you’ve utilized yours

Common Tax Reliefs:

- EPF & Life Insurance (up to RM7,000)

- Medical Expenses for Self or Parents (up to RM10,000)

- Childcare, Kindergarten & Education Fees (up to RM3,000)

- PRS, SSPN Savings & Approved Donations

- Lifestyle Purchases (PCs, smartphones, sports equipment, internet, etc. – up to RM2,500)

Friendly Reminder:

- Ensure all payments are made before 31 December 2025.

- Keep all receipts and supporting documents for your tax filing.

- The earlier you plan, the more tax you can save!

**Data updated on 4.11.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)