The Inland Revenue Board of Malaysia (LHDN) has updated its Guidelines on the Tax Treatment of Digital Currency (Second Edition, 5 December 2025).

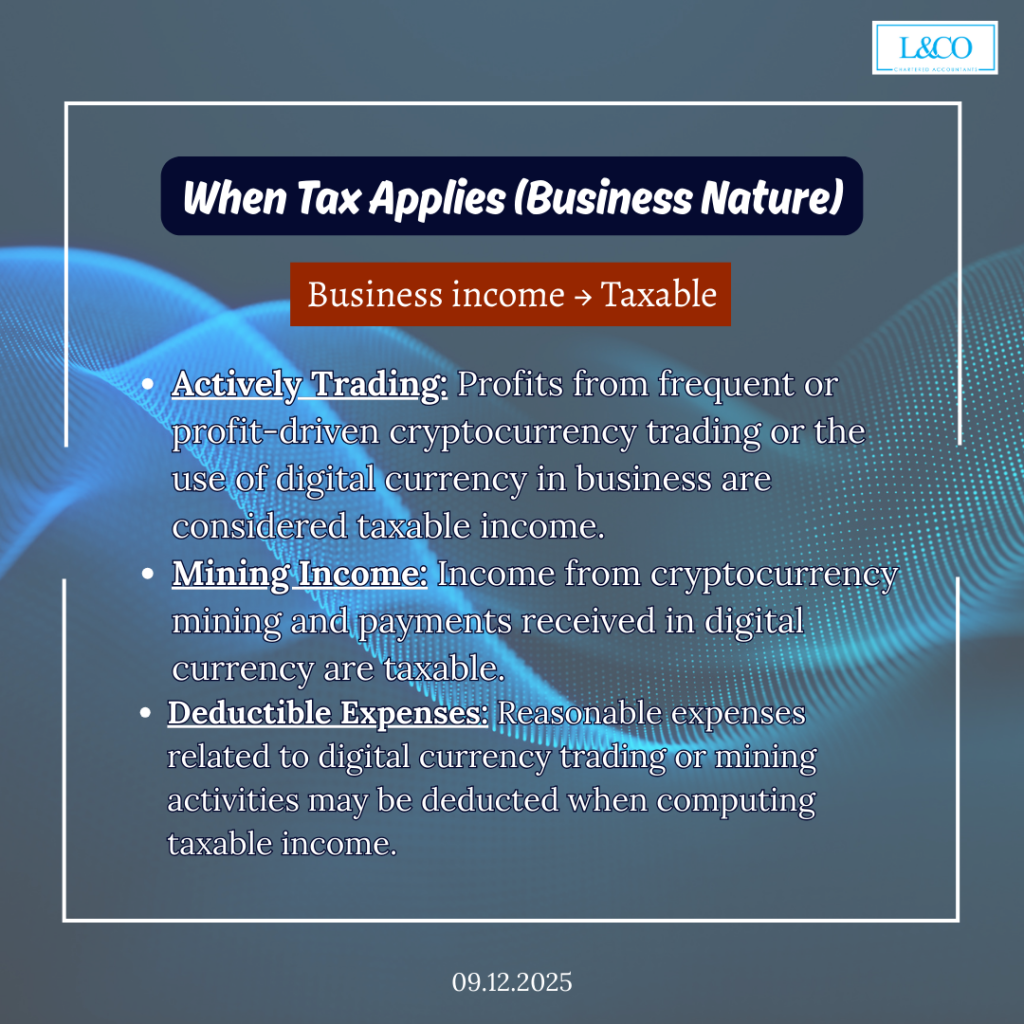

- Actively Trading: Profits from frequent or profit-driven cryptocurrency trading or the use of digital currency in business are considered taxable income.

- Mining Income: Income from cryptocurrency mining and payments received in digital currency are taxable.

- Deductible Expenses: Reasonable expenses related to digital currency trading or mining activities may be deducted when computing taxable income.

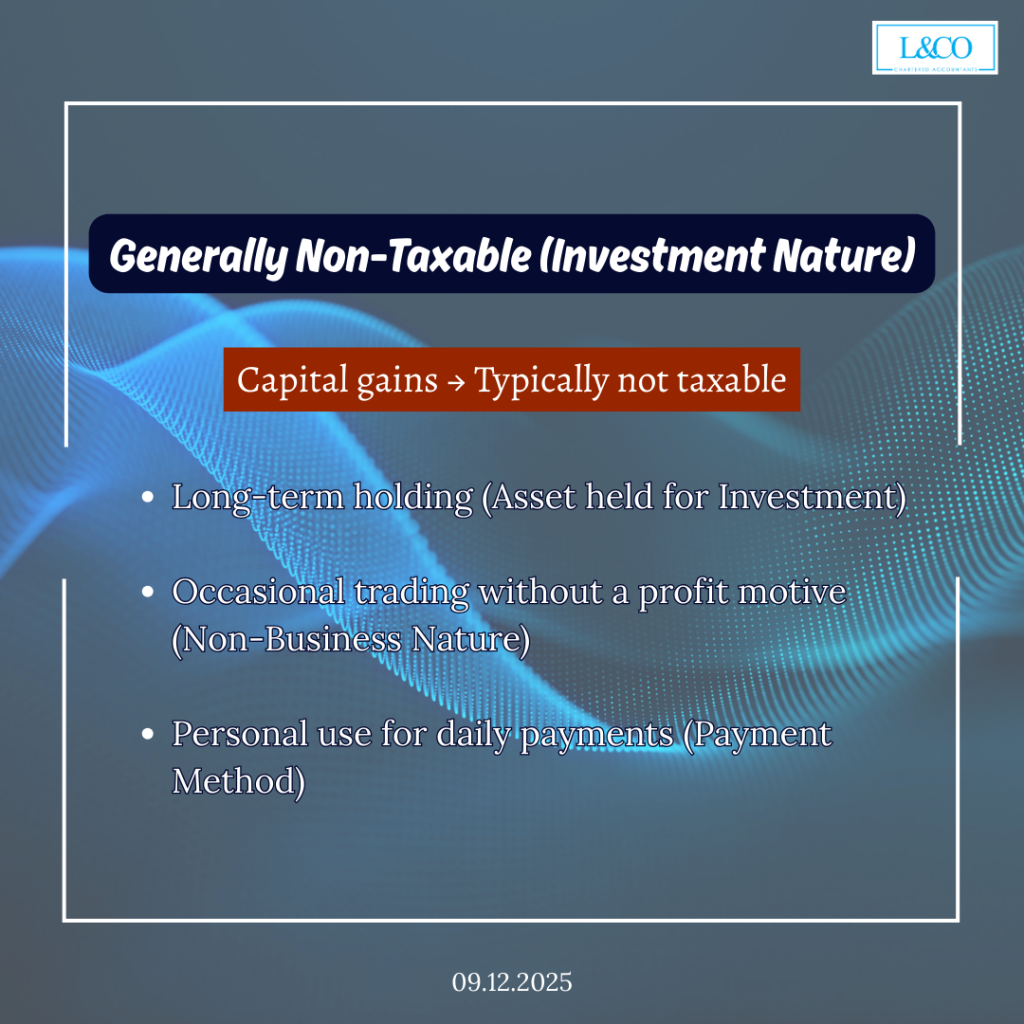

- Long-term holding (Asset held for Investment)

- Occasional trading without a profit motive (Non-Business Nature)

- Personal use for daily payments (Payment Method)

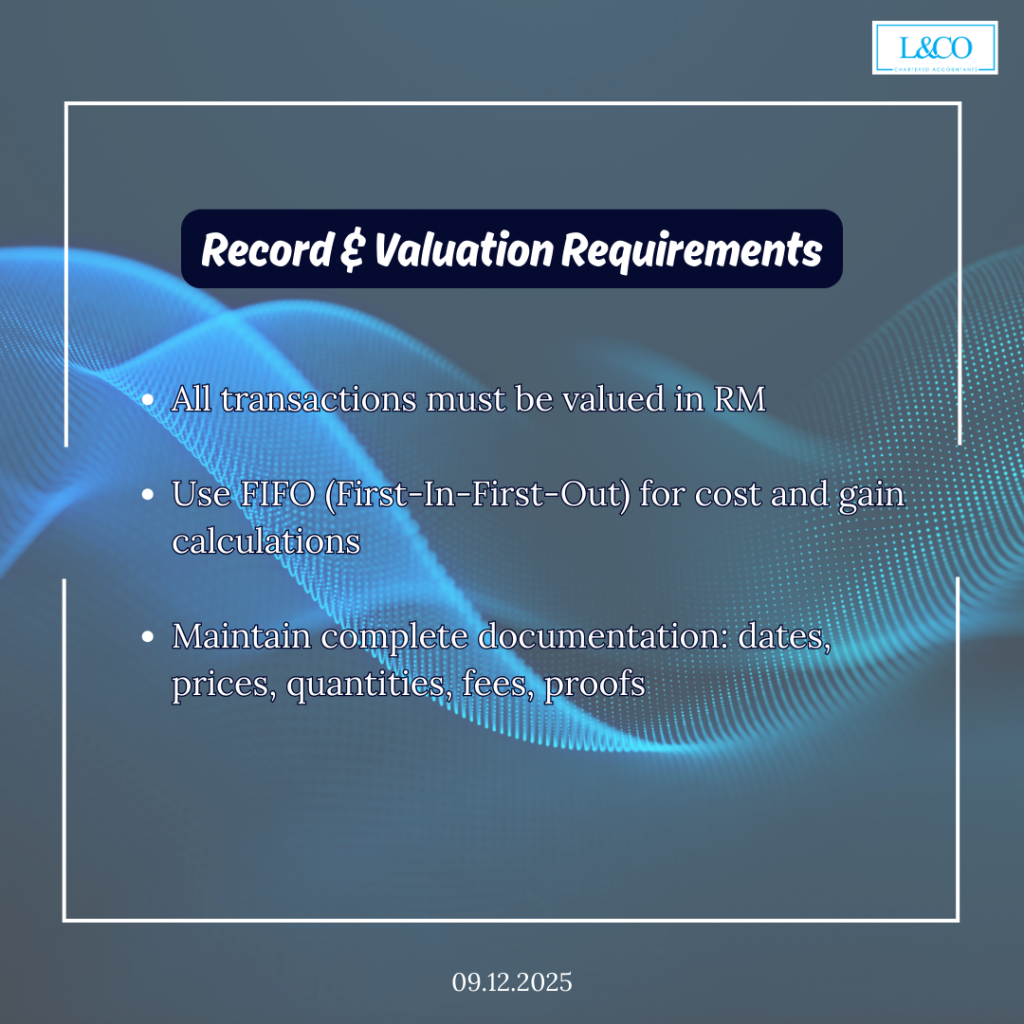

- All transactions must be valued in RM

- Use FIFO (First-In-First-Out) for cost and gain calculations

- Maintain complete documentation: dates, prices, quantities, fees, proofs

**Last Updated on 09.12.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)