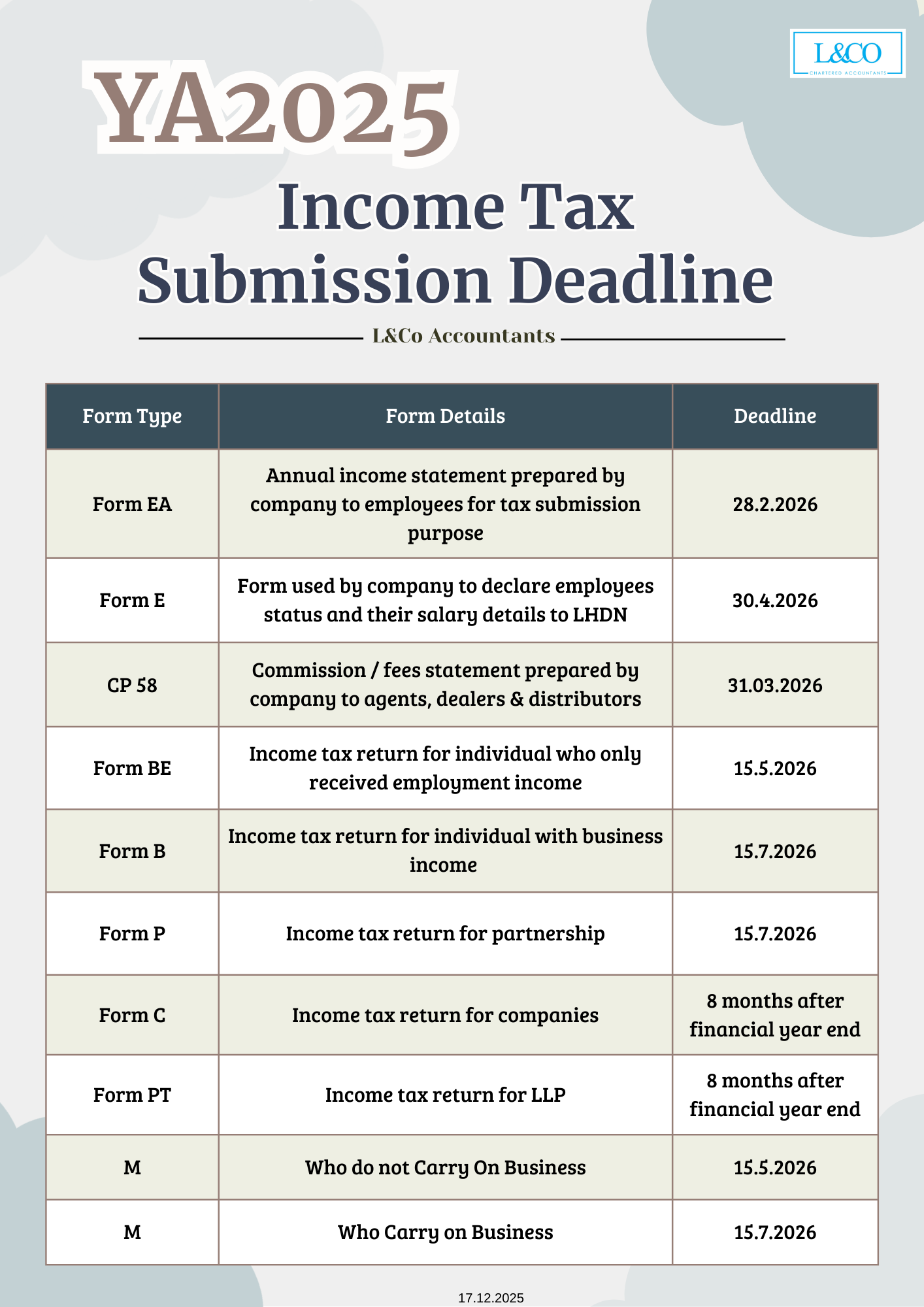

Below are the deadlines for YA 2025 (to be submitted in 2026) covering individual taxpayers, employers, and businesses. Please check the applicable deadlines based on your situation to avoid late submission penalties.

Form EA

- Employee annual income statement provided by the employer

- Deadline: 28 February 2026

Form E

- Employer declaration of employees’ annual salary and benefits to LHDN

- Deadline: 30 April 2026

CP 58

- Income declaration for agents, dealers, and distributors

- Deadline: 31 March 2026

Form BE

- For employed individuals without business income

- Deadline: 15 May 2026

Form B

- For individuals with business income, freelancers, or self-employed persons

- Deadline: 15 July 2026

Form P

- For partnership businesses

- Deadline: 15 July 2026

Form M (Non-Resident)

- Without business income: 15 May 2026

- With business income: 15 July 2026

Form C

- For private limited companies (Sdn. Bhd.)

- Deadline: Within 8 months after the end of the financial year

Form PT

- For limited liability partnerships (LLP)

- Deadline: Within 8 months after the end of the financial year

- Confirm the type of tax form applicable to you

- Prepare financial and income records in advance

- Late submission may incur penalties and interest

**Data updated on 19.12.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)