Budget 2026 | Tax Policy Highlights

Good news from this year’s Budget: No new taxes introduced!

However, the government has rolled out various tax reliefs, extensions, and incentives —

benefiting individuals, SMEs, and social enterprises alike

Here’s a summary of the key highlights:

- Childcare Relief

A tax relief of RM3,000 per child aged 12 and below is available for fees paid to registered childcare or daycare centres (effective from YA 2026).

- Treatment for Disabled Children

Tax relief for the diagnosis, early intervention, and rehabilitation expenses for disabled children (aged 18 and below) is increased to RM10,000.

- Vaccination Expenses

The scope of tax relief for vaccination expenses is expanded to include all vaccines approved by the Ministry of Health (KKM).

- Insurance & Takaful

1. The RM3,000 tax relief for life insurance or takaful contributions is expanded to cover policies for children.

2. Stamp duty exemption on micro-insurance and takaful plans for individuals and MSMEs extended until 2028.

3. Perlindungan Tenang insurance products also enjoy stamp duty exemption extended for another 3 years (until 2028).

- Domestic Tourism

In conjunction with Visit Malaysia Year 2026 (VMY 2026), individuals can claim up to RM1,000 tax relief for expenses on: Entrance tickets to tourist attractions or tickets for cultural, arts, and performance events

- Lifestyle Relief

The RM2,500 lifestyle tax relief is expanded to include “food-waste shredders” as a qualifying item for sustainable living.

- AI & Cybersecurity Training

Expenditure on training programmes approved by the National Artificial Intelligence Council (NAICI) qualifies for an additional 50% tax deduction.

👉 Example: RM10,000 spent = RM15,000 deductible for tax computation.

- Green Technology (Local Use)

Businesses that adopt MyHIJAU-certified local green technology products for in-house use are eligible for 100% Green Investment Tax Allowance (GITA).

- Agriculture Incentives

New food production projects: 10-year 100% income tax exemption

Expansion projects: 5-year 100% income tax exemption

Application period extended to 31 Dec 2030

Automation tax incentives expanded to specific closed-house livestock systems

- Venture Capital

Venture capital-related tax incentives, including special tax rates and dividend exemptions, are extended for another 10 years.

- Training Sponsorships

Double deduction for training expenses of persons with disabilities (OKU) expanded to include certified caregiver training programmes.

- Speed Limiter Devices for Heavy Goods Vehicles

Qualify for Accelerated Capital Allowance (ACA) — full depreciation allowed within one year.

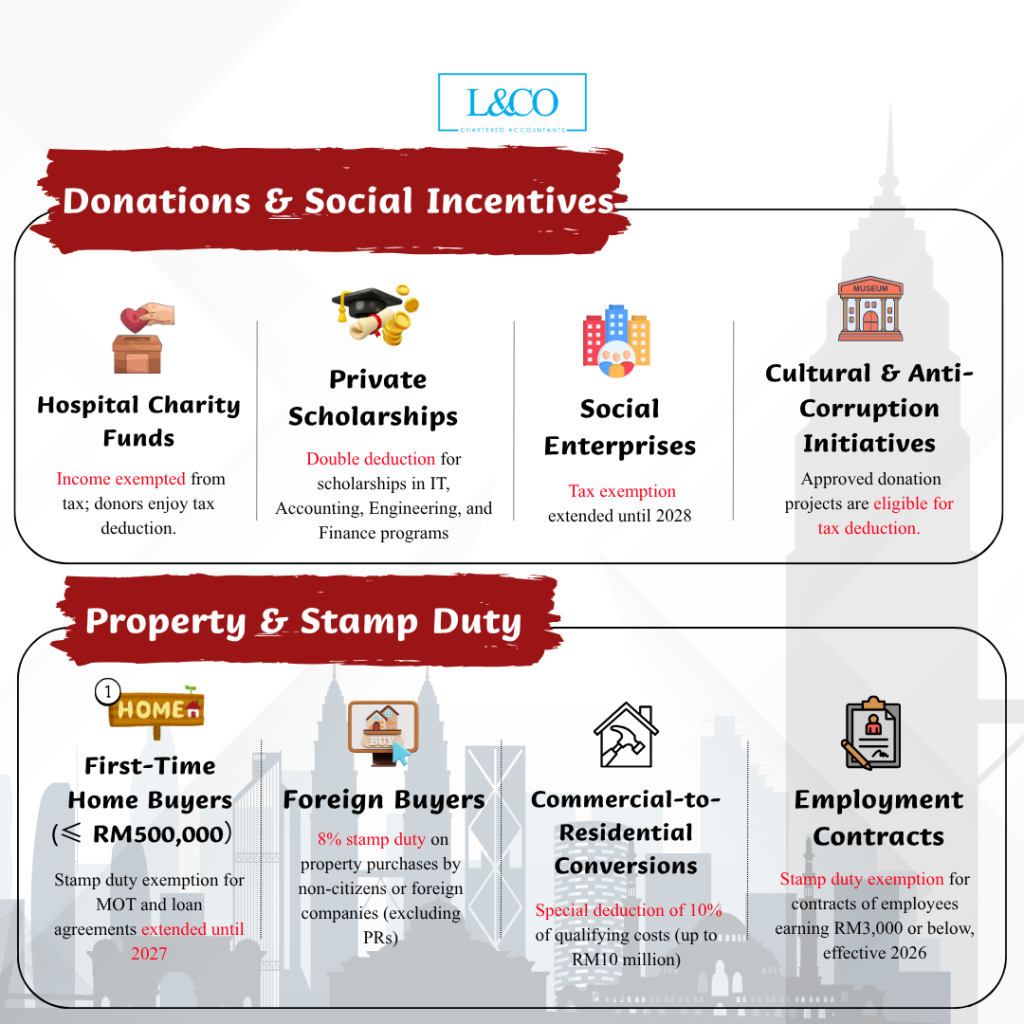

- Hospital Charity Funds – Income of approved hospital charitable funds is exempted from tax, and donors are eligible for tax deduction.

- Private Sector Scholarships:Double deduction extended to cover IT, engineering, accounting, and finance professional qualifications.

- Social Enterprises:Income tax exemption extended to 2028.

- Approved Donations: Donations to religious, cultural, museum, and community funds remain tax-deductible.

- Anti-Corruption Initiatives: Approved anti-corruption projects qualify for 10% deduction, and cash donors are also eligible for income tax deduction.

- Cultural Heritage & University Hospitals – Income of approved heritage, museum, and university hospital funds is tax-exempt, and donors qualify for deductions.

- First-Time Homebuyers (≤ RM500,000) – Full stamp duty exemption on the transfer instrument (MOT) and loan agreement extended to 31 Dec 2027.

- Foreign Buyers – Non-citizens and foreign companies purchasing residential property are subject to a fixed 8% stamp duty (excludes permanent residents).

- Commercial-to-Residential Conversions – Qualify for a special tax deduction of 10% on eligible project costs, capped at RM10 million.

- Employment Contracts – Stamp duty exemption for employment contracts of employees earning RM3,000 and below, effective 1 Jan 2026.

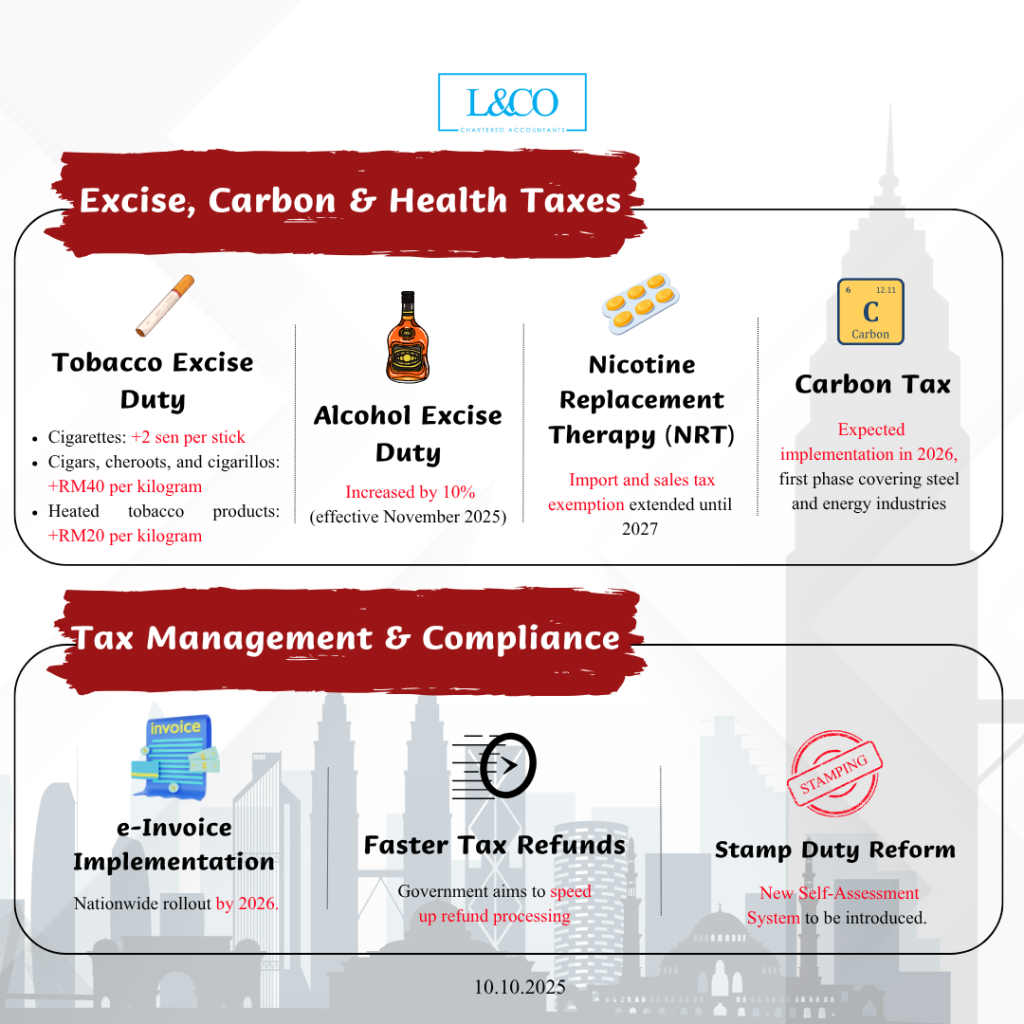

- Tobacco:

Cigarettes: +2 sen per stick

Cigars, cigarillos, cheroots: +RM40/kg

Heated tobacco: +RM20/kg

- Alcohol – Excise duty on liquor increased by 10%, effective 1 Nov 2025.

- Nicotine Replacement Therapy (sprays, lozenges) – Import and sales tax exemption extended until 31 Dec 2027.

- Carbon Tax – Expected implementation in 2026, focusing first on steel and energy industries, aligned with the National Carbon Market Policy and the upcoming Climate Change Act.

- E-Invoice – Nationwide implementation in 2026.

- Tax Refund Efficiency – The government commits to expediting refund processing.

- Stamp Duty – Transitioning to a Self-Assessment System.

📍Sources :MOF Malaysia

**Last updated on 10.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)