The Inland Revenue Board of Malaysia (LHDN) has announced a penalty waiver on CP500 instalment tax payments for the Year of Assessment (YA) 2026.However, the application of this waiver differs depending on the taxpayer’s income profile.

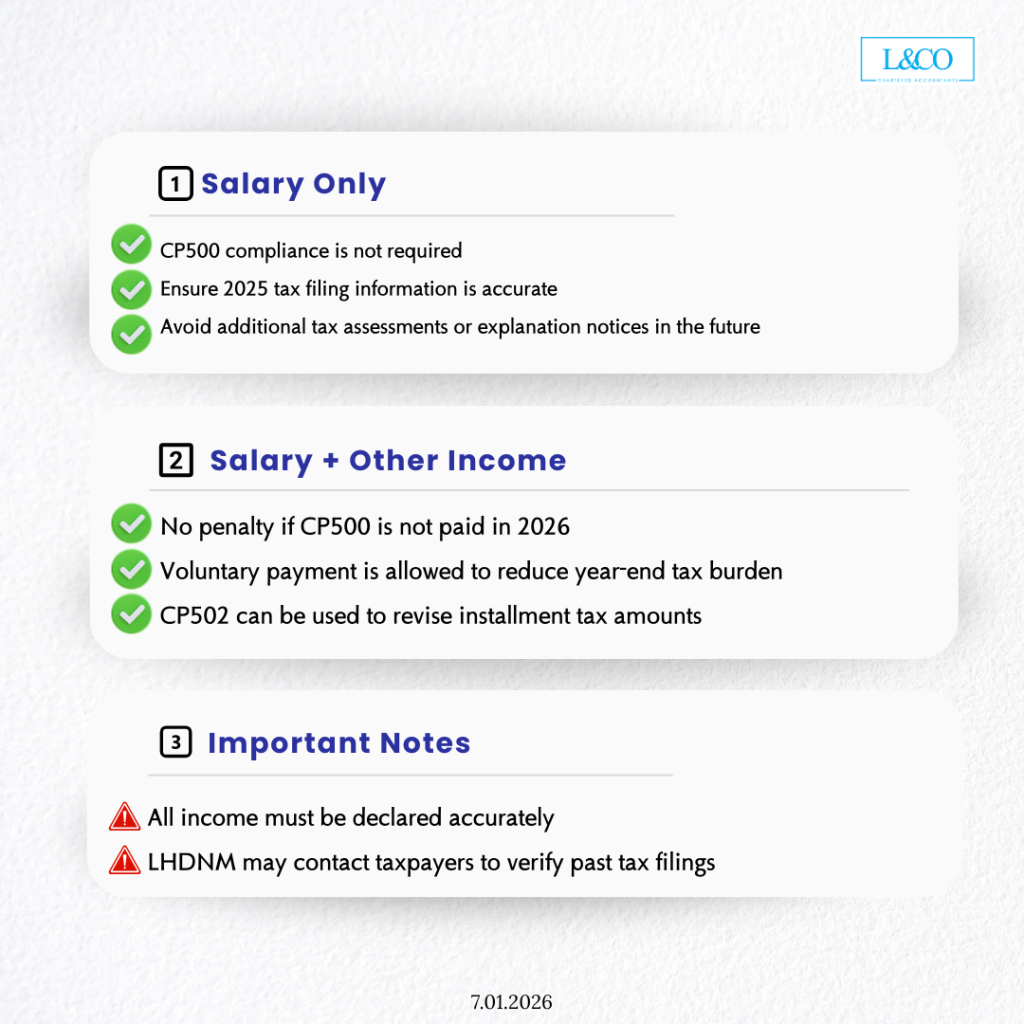

1. Taxpayers with Salary Income Only

Individuals who earn salary income only are not required to comply with CP500 instalment payments.

Taxpayers are required to:

- Ensure that YA 2025 tax return information is accurate and complete; and

- File tax returns correctly to avoid future additional tax assessments or explanation notices.

2. Taxpayers with Salary and Other Sources of Income

This category includes individuals who earn salary income in addition to other income, such as rental income, interest, freelance income, commissions, or similar sources.

For these taxpayers:

- No penalty will be imposed for non-payment of CP500 instalments in YA 2026;

- Voluntary instalment payments may be made to reduce the year-end tax liability

- Instalment amounts may be revised by submitting Form CP502.

CP502 Submission Deadlines

- 30 June 2026

- 31 October 2026

Important Compliance Notes

- All income must be declared truthfully and accurately;

- LHDN reserves the right to contact taxpayers to verify previous tax declarations if discrepancies are identified.

Key Reminder

- The CP500 penalty waiver does not exempt taxpayers from their obligation to file tax returns.

- Accurate reporting and timely submission remain the responsibility of every taxpayer.

**Data updated on 7.1.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)