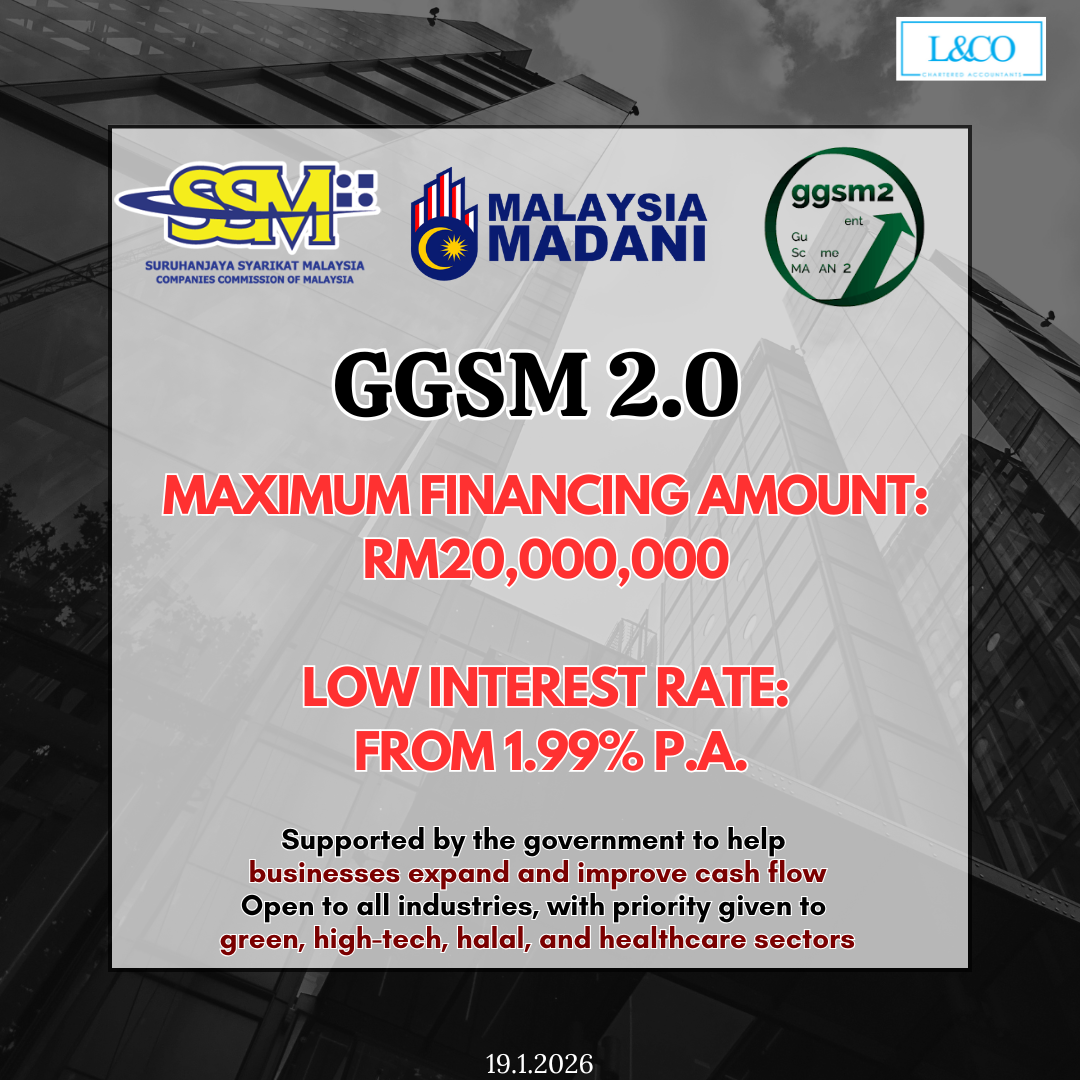

The GGSM 2.0 (Government Guarantee Scheme MADANI 2) is a government-backed financing initiative designed to help Malaysian SMEs access larger loan amounts, favorable terms, and expansion capital, enabling sustainable business growth.

Note: This scheme is open to SMEs across all economic sectors, provided they meet the eligibility criteria. However, the government gives special focus to four priority sectors:

- Green Economy

- High Technology

- Halal Industry

- Healthcare

- Maximum Financing: Up to RM20,000,000 per company (Group total up to RM50,000,000)

- Repayment Term: Up to 10 years or until 31 December 2035, whichever comes first

- Government Guarantee: Provides higher loan approval rates with guarantee coverage of up to 80%

- Usage: Can be applied for working capital and capital expenditure (CAPEX)

- Interest Rate: Starting from approximately 1.99% p.a., depending on participating banks

- Business Operation: Minimum 3 years with verified business records

- Annual Revenue: At least RM1,000,000

- Company Ownership: Malaysian-owned company with ≥51% ownership by Malaysian citizens

- Eligible Company Types: Sdn. Bhd. (Private Limited), sole proprietorship, or partnerships meeting official requirements

Compared to traditional commercial loans, GGSM 2.0 offers:

- Higher financing limits

- Stronger government-backed guarantees

- Longer repayment terms

- Lower interest rates and more flexible repayment options

This program allows businesses to expand confidently and strengthen market competitiveness without waiting for conventional bank approvals.

For full program details, official eligibility guidelines, and application instructions, please visit the SJPP official page: https://www.sjpp.com.my/schemes/government-guarantee-scheme-madani-ggsm-2

**Data updated on 19.1.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)