EPF Special Withdrawal Facility 2022

Reopening of Malaysia Border

Malaysia’s borders will reopen from 01.04.2022. Travellers entering Malaysia are required to comply with entry procedures and policies. Besides, travellers crossing the border by land regardless of medium of transportation are not required to apply for entry approval and undergo quarantine.

Further information: https://www.facebook.com/LANDCO.MALAYSIA/posts/1402522263529499

PerantiSiswa Keluarga Malaysia

PerantiSiswa Keluarga Malaysia (the Malaysian Family Student Device) is to help Institutions of Higher Learning (IPT) students from low-income families. Students whose family income is below RM4,850 are eligible for free mobile devices. This program will open for applications in mid-April. Students from either public or private IPT, colleges, or community colleges under the Ministry of Education would benefit from this initiative. Further details are to be announced.

Age 16 years old and above can register an EPF account

People aged 16 and above are eligible to open an EPF account and their savings are entitled to the EPF dividends even if they are not employed.

End of PTPTN Loan Discount

According to Budget 2022, 10 – 15% discount will be given to those who make PTPTN full settlement, at least 50% of their loan balance in one payment or repayment through direct debit as per schedule. This discount will end in April.

Further information: https://www.facebook.com/LANDCO.MALAYSIA/posts/1324733597975033

New Restrictions on Touch ‘n Go eWallet

Touch ‘n Go eWallet will be split into transferable and non-transferable accounts. Balances topped up by credit cards or given by the government will be considered as Non-Transferable balance; while balances topped up via online banking or Debit Card will be considered as Transferable balance. The limitation of a Non-Transferable balance is that users cannot use it for Go+, transfer these balances to other eWallets, or cash out to bank accounts. Non-Transferable balance can only be used for payment purposes.

Form BE Deadline

Taxpayers with no business income and whose income derived from other sources (rental, part-time jobs, royalties, etc.) need to file the Form BE before 30.04.2022 (E-filing deadline is 15.05.2022) .

Further information: Form BE (2)

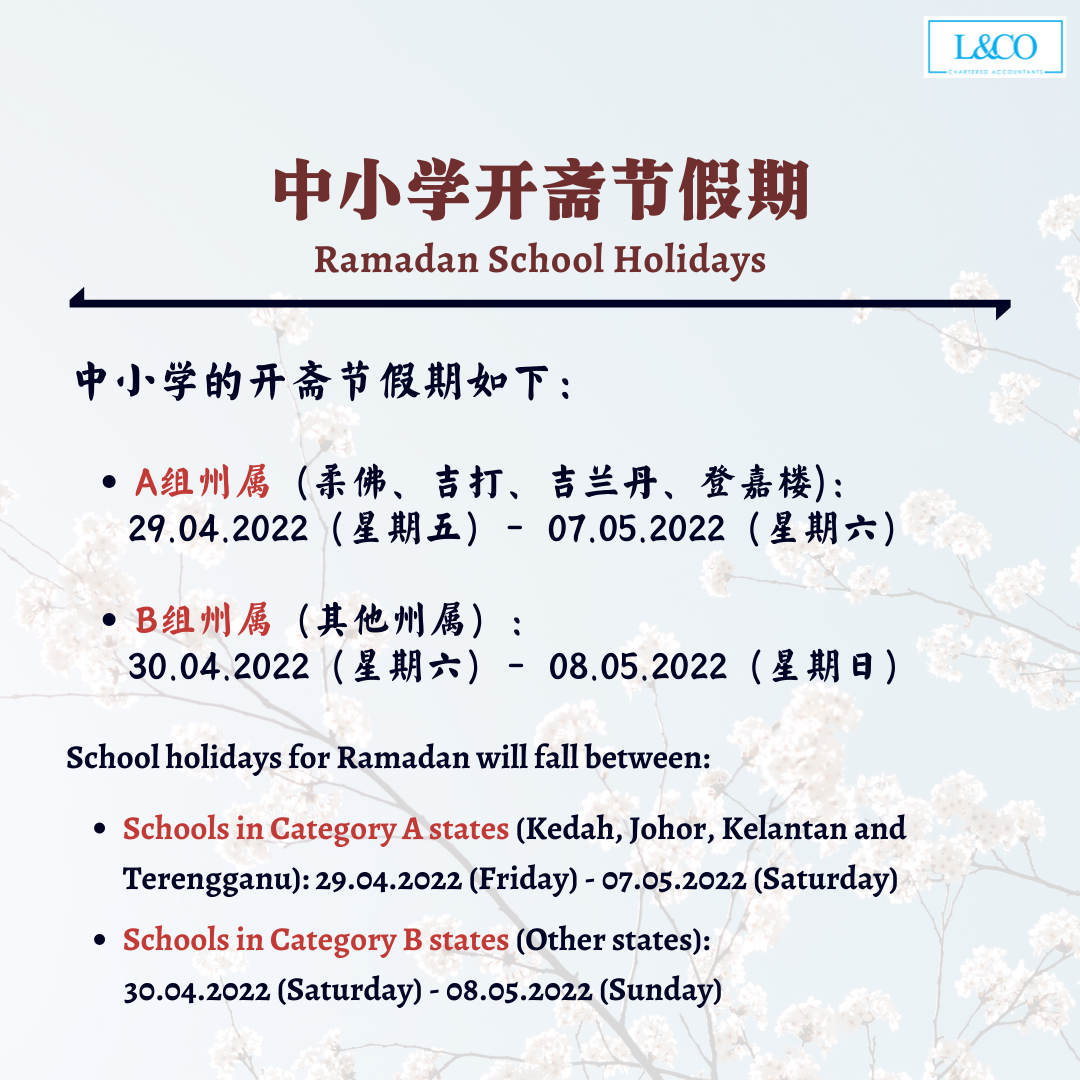

Ramadan School Holidays

- Schools in Category A states (Kedah, Johor, Kelantan and Terengganu): 29.04.2022 (Friday) – 07.05.2022 (Saturday)

- Schools in Category B states (Other states): 30.04.2022 (Saturday) – 08.05.2022 (Sunday)

Public Holidays in April

- 03.04.2022 (Sun):Awal Ramadan(Johor, Kedah & Malacca)

- 15.04.2022 (Fri):Good Friday(Sarawak & Sabah)

- 15.04.2022 (Fri):Declaration of Melaka as a Historical City(Malacca)

- 19.04.2022 (Tue):Nuzul Al-Quran Day (National except Johor, Kedah, Malacca, Negeri Sembilan, Sabah & Sarawak)

- 26.04.2022 (Tue):Birthday of the Sultan of Terengganu(Terengganu)

Submission Deadline

- 15.04.2022:PCB(March Salary)

- 15.04.2022:SOCSO & EIS (March Salary)

- 15.04.2022:HRDF(March Salary)

- 15.04.2022:EPF(March Salary)

- 15.04.2022:CP204 Payment (Exempt for Micro & SMEs until Jun 2022)

- 30.04.2022:Audited report(Company financial year ended September 2021)

- 30.04.2022:SST(Feb 2022 – Mar 2022 payment)

- 30.04.2022:CP204 Submission(Company financial year ended May 2022)

- 30.04.2022:Form C(Company financial year ended August 2021)

- 30.04.2022:Form BE

- 30.04.2022:Form E (E-Filing)

(201706002678 & AF 002133)

(201706002678 & AF 002133)