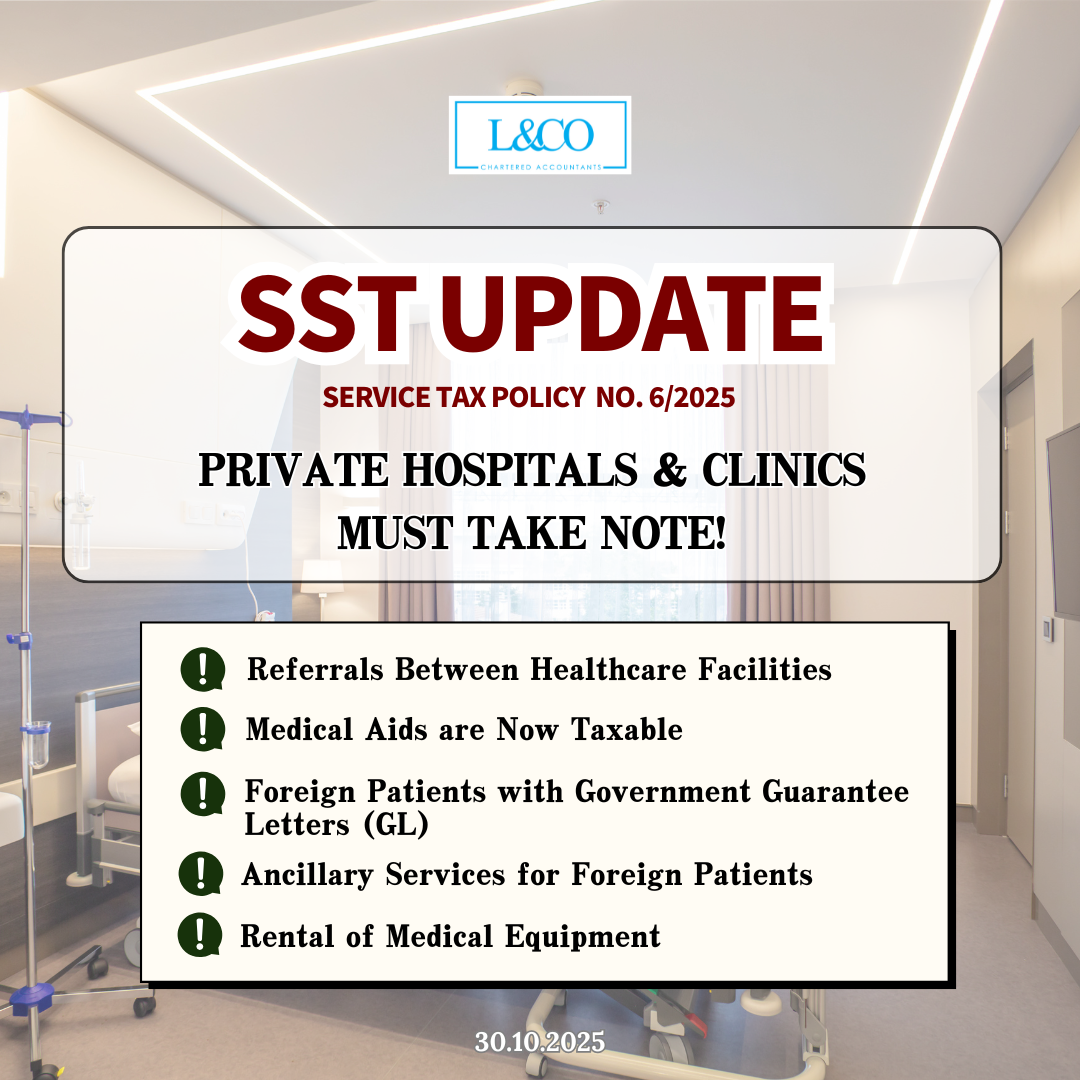

【SST Latest Update, STP No.6/2025】Attention All Private Hospitals & Clinics!

1. Referrals Between Healthcare Facilities (Hospital/Clinic)

Many clinics refer patients to other specialists or send samples to external labs.

Now, the Royal Malaysian Customs Department has made it clear — not all B2B (business-to-business) healthcare services are exempted from SST!

Examples:

Situation A:

Clinic A refers a patient to Hospital B to see a specialist, and the patient actually walks into Hospital B.

➡️ The invoice Hospital B issues to Clinic A is subject to 6% SST.

Situation B:

Clinic A only sends the patient’s blood or urine samples to Lab B for testing, and the patient does not go there personally.

➡️ This situation is NOT subject to SST.

2. Medical Aids are Subject to SST

Items such as dentures, prosthetics, hearing aids, braces, and supports — Whether billed together with treatment or separately — 💰 6% SST applies.

Make sure your invoice clearly lists:

– Medical services , Medical aids , SST amount

3. Foreign Patients with Government Guarantee Letters (GL Case)

Customs has clarified that:

SST is NOT borne by the government — it must be paid by the patient.

This means:

– The hospital invoice must clearly show SST 6%;

– Government GL payment does not include SST;

– Be sure to collect SST from the patient upon discharge.

Recommendation:

– Clearly state in your GL contract: “SST to be borne by patient.”

– Train your front desk staff to explain this clearly to avoid issues during audit.

4. Ancillary Services for Foreign Patients

Examples include:

– Luggage storage

– Caregiver or accommodation arrangements

– Parking services

👉 As long as these services are provided to foreign patients, they are subject to 6% SST.

5. Rental of Medical Equipment

If your hospital or clinic rents medical equipment to patients — such as ventilators, dialysis machines, or infusion pumps —

and it’s related to treatment, even if the patient uses it at home,

-> It is still subject to 6% SST.

Practical Implications:

-Update your billing system and invoices

-Train your staff to identify: foreign patient? walk-in?

-Revise GL agreements to include SST clauses

-Otherwise, during audit, you may face backdated SST + penalties

**Last updated on 31.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)