In Malaysia, stamp duty is a tax imposed on specific legal instruments.

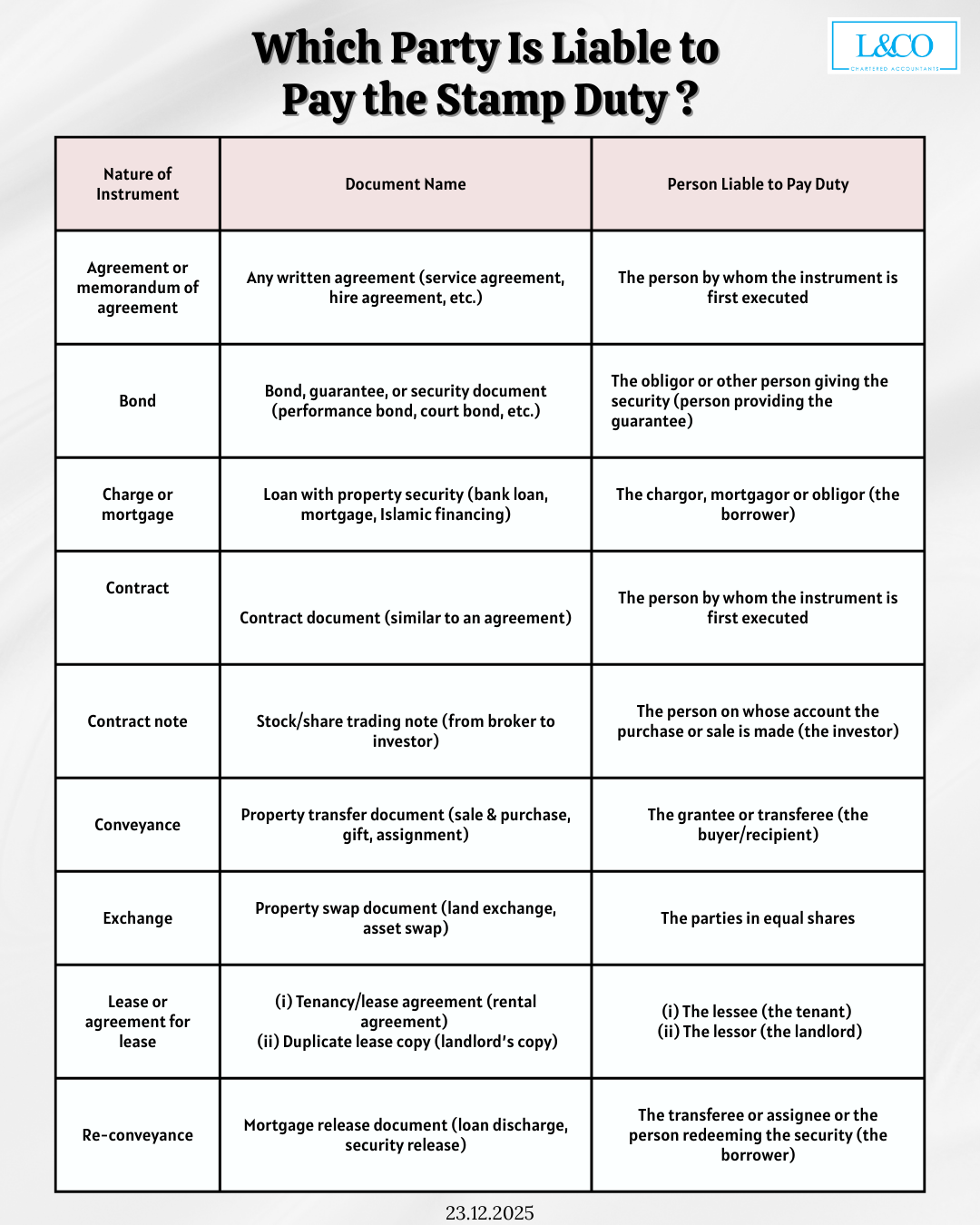

Under the Third Schedule of the Stamp Act, the responsibility to pay stamp duty varies depending on the type of document and the parties involved.

Who Is Required to Pay Stamp Duty?

In general:

- Agreements and contracts:

Stamp duty is payable by the person who first executes the instrument. - Property transfer documents:

Stamp duty is payable by the buyer or transferee. - Tenancy and lease documents:

The tenant is responsible for stamp duty on the original tenancy agreement, while the landlord is responsible for the duplicate copy. - Mortgages, charges, and loan documents:

Stamp duty is payable by the borrower.

Where an instrument is not listed under the Third Schedule, pursuant to Section 33(b) of the Stamp Act, stamp duty shall be borne by the person who prepares or executes the instrument.

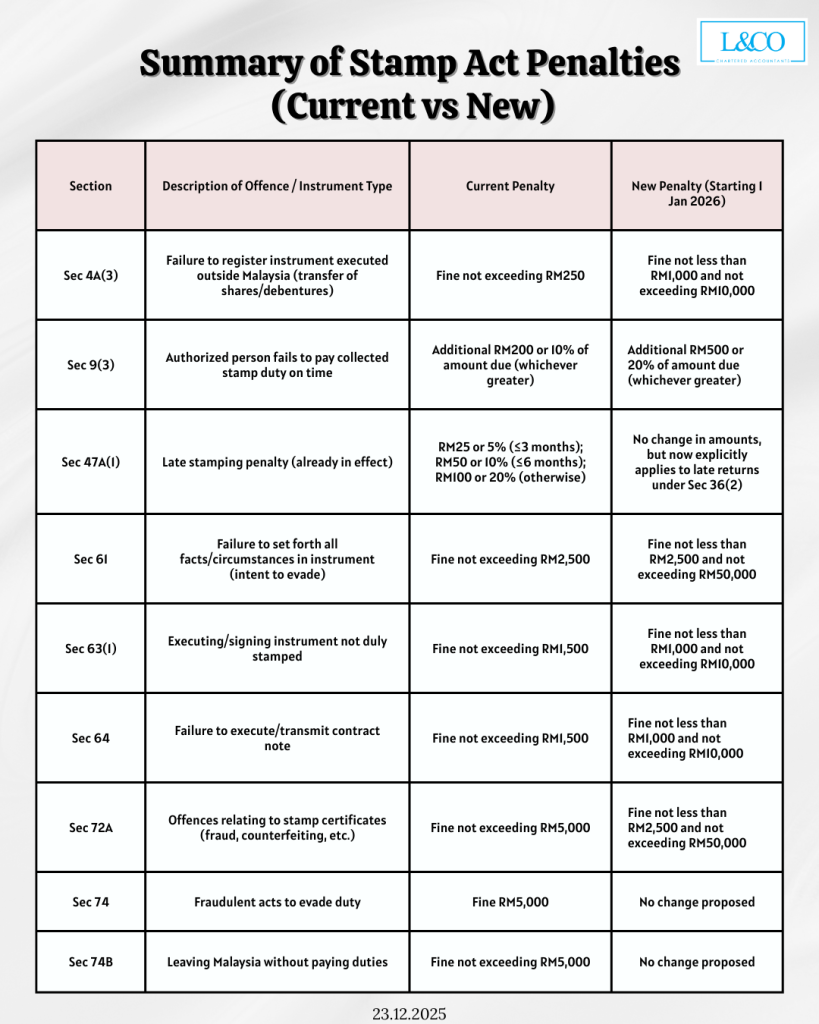

Penalties for Non-Compliance (Updated Under the Tax Bill 2025)

The Tax Bill 2025 introduces revisions to penalties for various stamp duty offences, which will take effect from 1 January 2026.

Under the revised provisions, certain penalties will be significantly increased, with fines of up to RM50,000, to strengthen enforcement and improve compliance.

Accordingly, businesses and individuals are advised to confirm the following before signing any document subject to stamp duty:

- Whether stamp duty is payable

- Which party is responsible for payment

- Whether stamping is completed within the prescribed timeframeThis is to avoid unnecessary legal and financial risks.

**Data updated on 26.12.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)