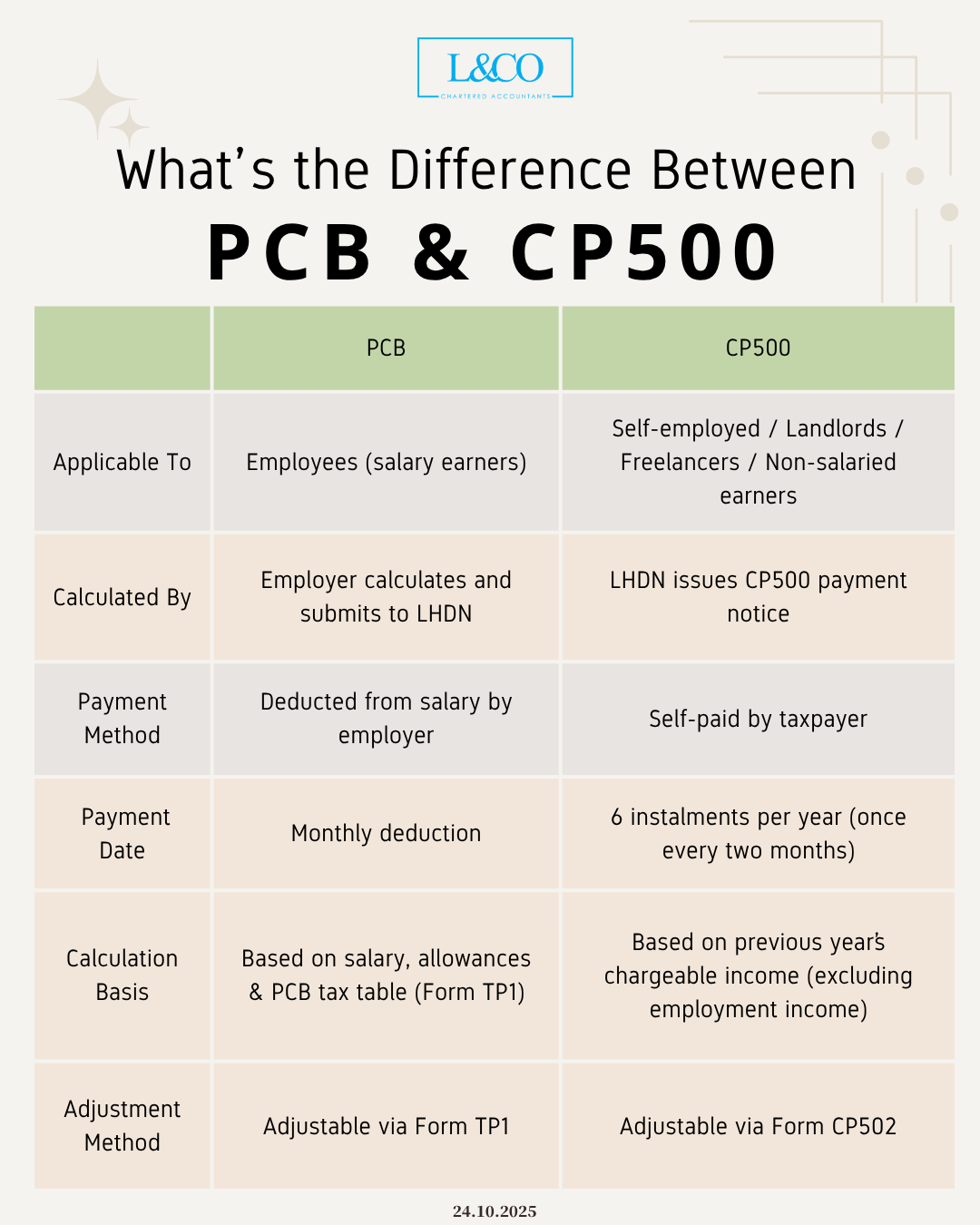

In Malaysia’s tax system, PCB (Potongan Cukai Bulanan) and CP500 (Tax Instalment Scheme) are two completely different payment mechanisms designed for different types of taxpayers.

What’s the Difference Between PCB & CP500?

PCB(Potongan Cukai Bulanan)

Applicable to salaried employees.

Employers calculate and deduct monthly tax based on the employee’s salary, allowances, and personal reliefs, then remit the amount to LHDN.

During annual tax filing, the system will automatically determine if there has been an overpayment or underpayment.

- Payment Frequency: Deducted monthly from salary

- Adjustment Method: Submit Form TP1 to update personal tax relief information

CP500(Tax Instalment Scheme)

Applicable to self-employed individuals, freelancers, landlords, and business partners — i.e., non-salaried income earners.

LHDN will issue a CP500 notice based on the previous year’s chargeable income, outlining the estimated tax payable in instalments.

- Payment Frequency: 6 instalments per year (once every two months)

- Adjustment Method: Submit Form CP502 to revise estimated tax payable

**Data updated on 24.10.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)