How to correct errors in a submitted tax return? You can still make amendments—whether it’s before or after the submission deadline! Overreported? Underreported? Missed something? [...]

Did you know? Every company in Malaysia has an “industry ID” — the MSIC Code It’s a 5-digit classification code developed by the Department of [...]

A series of tax and compliance policies will roll out in the second half of 2025! This includes major changes in e-Invoicing, Service Tax, Sales [...]

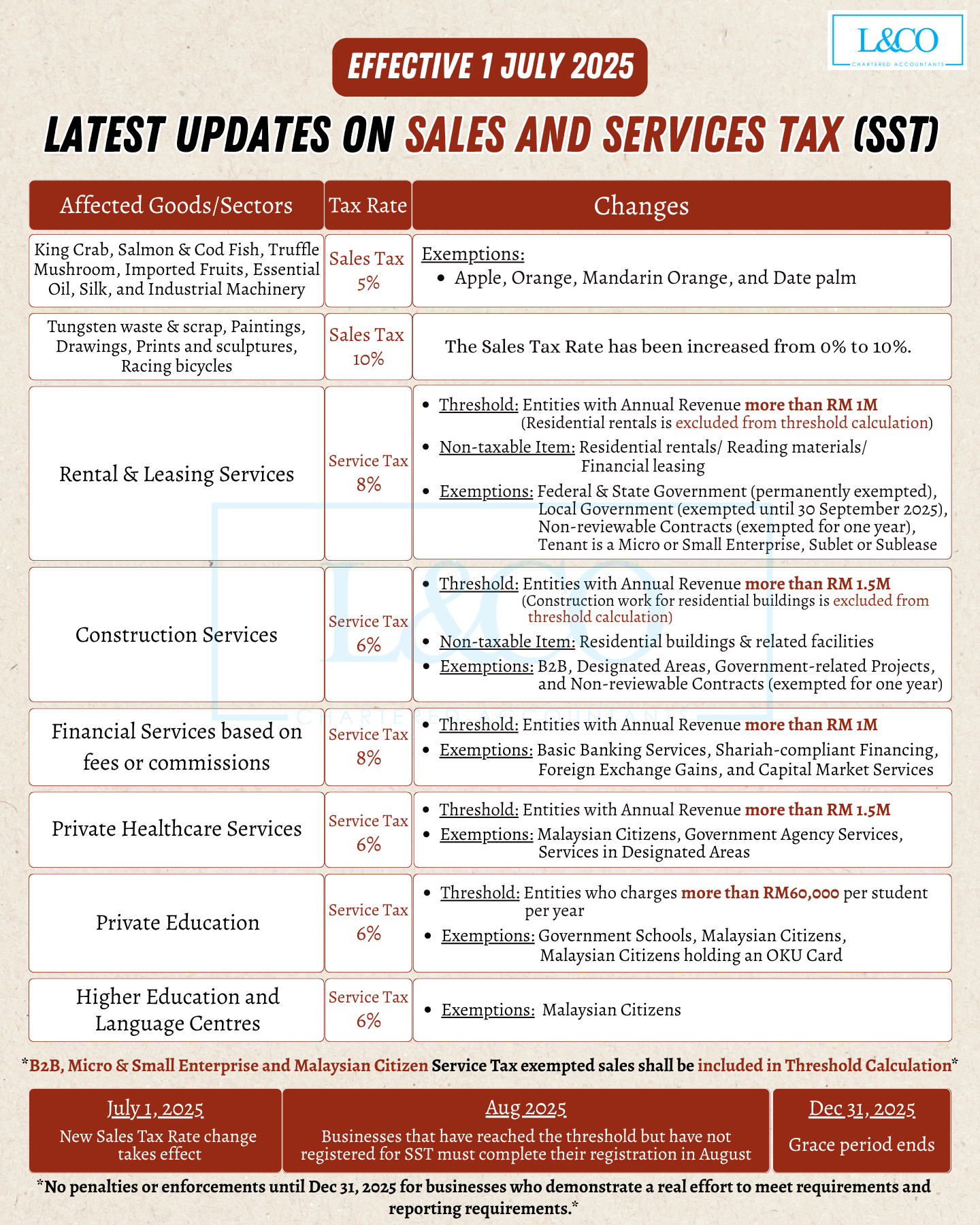

Starting from July 2025, Malaysia’s Service Tax (SST) framework has expanded significantly. Many businesses that were previously exempted may now be required to register—depending not [...]

Starting from 1 July 2025, Malaysia’s Service Tax (SST) has expanded to cover more industries and services. Many businesses—especially in services, consulting, digital, and healthcare—must [...]

Effective from 1 July 2025. Wide-ranging impact across financial, leasing, construction, and other service sectors! Key Highlight – Beauty services are now exempted from Service [...]

LHDN Official Clarification: 2% Withholding Tax under Section 107D No Longer Applies to Deceased Agents/Distributors On 30 June 2025, the Inland Revenue Board of Malaysia [...]

Recently, many hardware store owners have asked us: "Can I issue a single consolidated e-Invoice for all the cement and bricks I sell in a [...]

As announced by the Employees Provident Fund (EPF) of Malaysia on 25 June 2025, the Malaysian government will officially expand the scope of EPF contributions [...]

The Lembaga Hasil Dalam Negeri (LHDN) has officially launched the brand-new e-Ansuran system! Starting from March 5, 2025, taxpayers can apply online via the MyTax [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)