The Inland Revenue Board of Malaysia (IRBM) has announced that starting from September 1, the Form CP22 is mandatory to submitted through Online.

Starting from September 1, the manual submission of Form CP22 is no longer allowed. Employers are required to submit notification forms for new employees through e-CP22.

If employers fail to comply with the provision under subsection 83(2) of ITA 1967 without any reasonable excuse, upon conviction of an offence, will be liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or both.

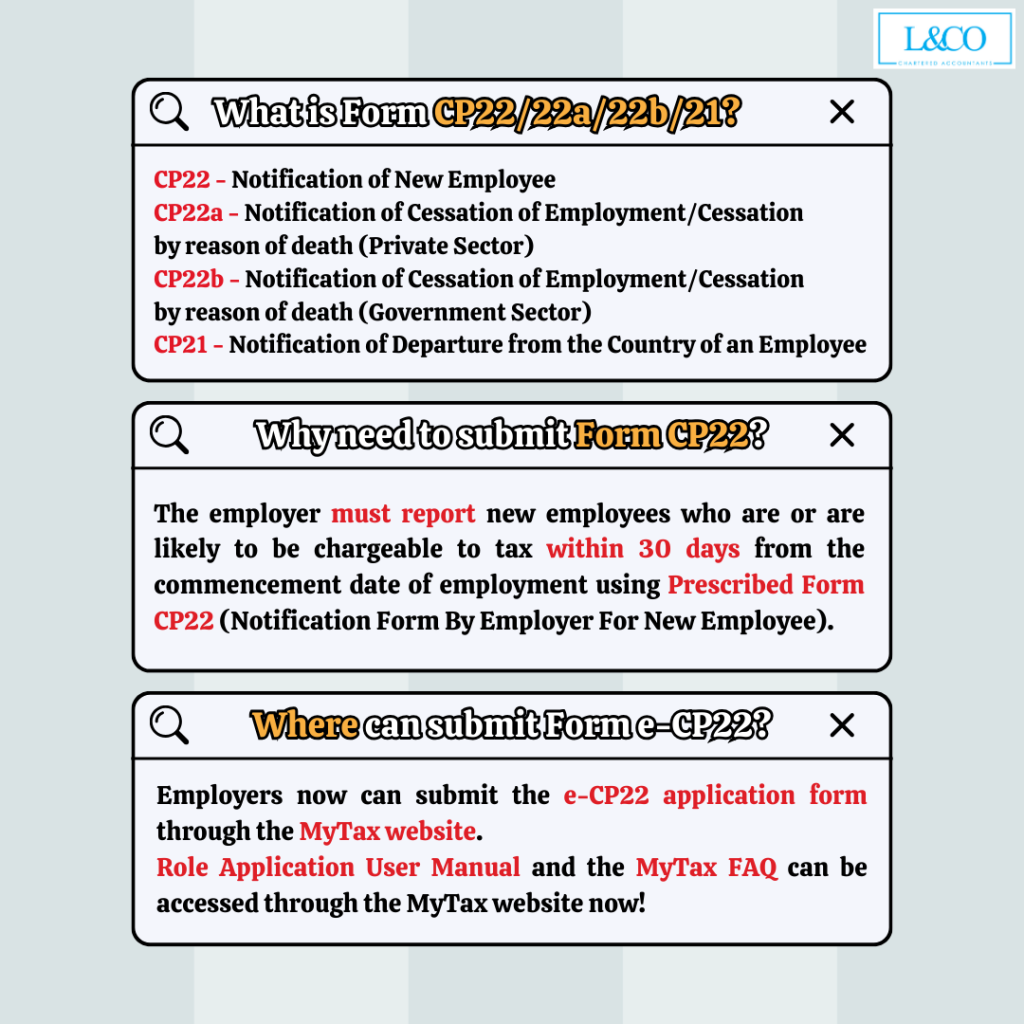

1. What is Form CP22/22a/22b/21?

CP22 – Notification of New Employee

CP22a – Notification of Cessation of Employment/Cessation by reason of death (Private Sector)

CP22b – Notification of Cessation of Employment/Cessation by reason of death (Government Sector)

CP21 – Notification of Departure from the Country of an Employee

2. Why need to submit Form CP22?

The employer must report new employees who are or are likely to be chargeable to tax within 30 days from the commencement date of employment using Prescribed Form CP22 (Notification Form By Employer For New Employee).

3. Where can submit Form e-CP22?

Employers now can submit the e-CP22 application form through the MyTax website.

Role Application User Manual and the MyTax FAQ can be accessed through the MyTax website now!

(201706002678 & AF 002133)

(201706002678 & AF 002133)